Automated Sentiment Analysis in CRE

Automated sentiment analysis is changing how commercial real estate (CRE) professionals analyze data. By using tools powered by natural language processing (NLP) and machine learning (ML), businesses can process online reviews, social media posts, and news articles to identify trends, tenant satisfaction, and market risks. This technology assigns sentiment scores (positive, neutral, or negative) to unstructured data, helping CRE teams make informed decisions faster.

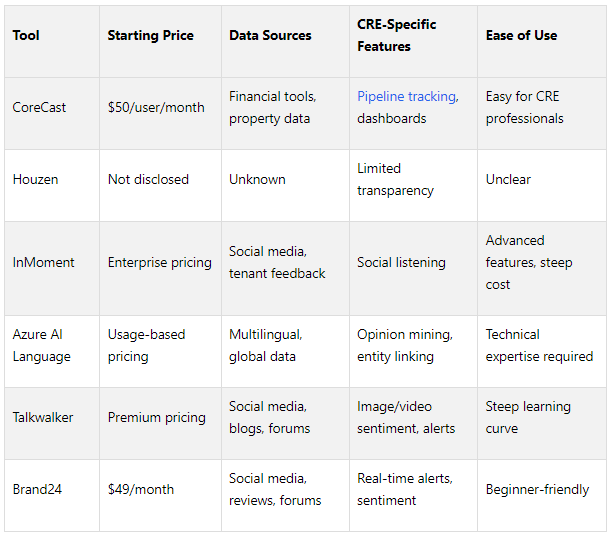

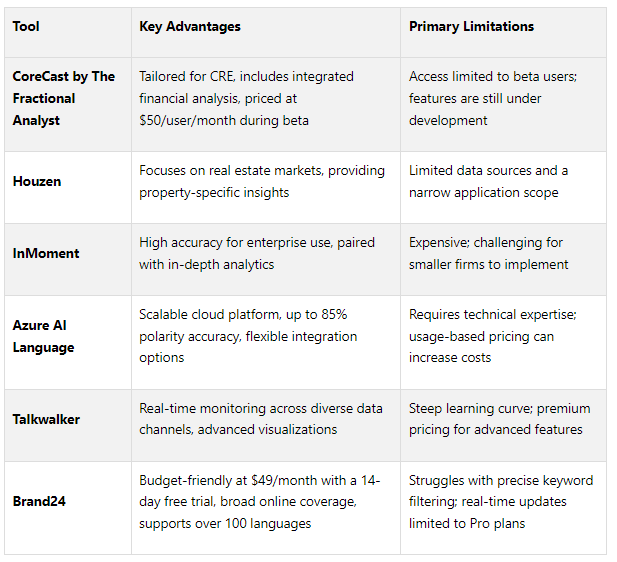

Here are six sentiment analysis tools tailored for CRE:

CoreCast by The Fractional Analyst: CRE-specific, integrates with financial tools, starting at $50/user/month (beta).

Houzen: Property-focused, limited feature transparency.

InMoment: Advanced analytics, strong social media focus, enterprise-level pricing.

Azure AI Language: Scalable, multilingual, requires technical expertise.

Talkwalker: Real-time monitoring across 150M sources, premium pricing.

Brand24: Affordable at $49/month, tracks mentions across 25M sources.

Quick Comparison:

Choose based on your budget, technical resources, and desired features. Tools like CoreCast are ideal for CRE-specific needs. Test free trials to find the best fit for your business goals.

What Are The Best Tools For Real-Time Sentiment Analysis? - Next LVL Programming

CoreCast, introduced in 2025, is a real estate intelligence platform that weaves market sentiment analysis into commercial real estate (CRE) workflows and financial reporting.

Data Sources Supported

CoreCast pulls together data from a variety of sources into one streamlined dashboard. It integrates effortlessly with existing financial and property management systems. This setup allows sentiment indicators to be processed automatically alongside operational data.

Customization and Integration

The platform's modular design makes it easy to adapt workflows to fit the needs of any organization. By leveraging large language models, CoreCast embeds sentiment insights directly into reports, adding a layer of depth to financial analysis.

“Having a tailored and precise model became the cornerstone of our capital-raising efforts. Their ability to simplify complex structures gave me & my investors the confidence to move forward.”

Real-Time Monitoring

CoreCast provides customizable, real-time dashboards that deliver sentiment insights directly to key stakeholders. The platform continuously processes data in the background, integrating alerts and updates seamlessly into established workflows.

CRE-Specific Features

The platform excels in automating tasks like underwriting, pipeline tracking, and asset reporting. By combining sentiment analysis with essential financial metrics, CoreCast adds a new dimension to CRE management. For instance, its Pipeline Tracker reduced deal slippage by 30% over two quarters.

“CoreCast transformed how we communicate portfolio performance to stakeholders. We now spend more time analyzing data, and less time assembling it.”

Pricing

CoreCast is currently in beta, with pricing starting at $50 per user per month. Once fully deployed, the rate will increase to $105 per user per month. This pricing makes it an affordable choice for mid-market firms, while still delivering enterprise-grade sentiment analysis tailored specifically for commercial real estate.

Next, we'll explore other platforms that take different approaches to automating sentiment analysis in CRE.

2. Houzen

Houzen positions itself as a property intelligence platform designed for the commercial real estate market, with an emphasis on sentiment analysis. However, the platform's publicly available information is sparse, leaving much about its methods and specific features unclear.

Data Sources Supported

Houzen does not disclose the data sources it relies on.

Customization and Integration

Details about dashboard customization, alert settings, and API capabilities are not available. To understand these functionalities, users need to consult Houzen directly.

Real-Time Monitoring

Information regarding real-time monitoring is not provided. Interested users should reach out to Houzen for clarification.

CRE-Specific Features

Houzen's offerings for commercial real estate, such as sentiment tracking or financial modeling tools, are not explicitly outlined. Those considering the platform should refer to official materials for a better understanding of its capabilities.

The next sections will cover platforms that provide more transparent and detailed feature descriptions.

3. InMoment

InMoment is a customer experience platform that goes beyond standard sentiment analysis. While it's not specifically built for commercial real estate (CRE), its advanced sentiment analysis capabilities are well-suited for the industry. With over 19 years of expertise in AI, machine learning, and natural language processing, InMoment transforms digital feedback into actionable insights.

One of its standout features is its ability to process unstructured data, which makes up nearly 90% of all information. This is especially helpful for CRE professionals who need to analyze tenant feedback, market conversations, and property-related discussions across various digital platforms.

Data Sources Supported

InMoment's sentiment analysis tools pull insights from a wide range of digital channels, with a strong focus on social media. The platform’s XI Spotlight Tool enables users to manage data collection from key platforms like Instagram, X (formerly Twitter), and Facebook. Its social listening tool also tracks brand-related discussions, providing valuable insights for decision-making. By connecting data from multiple sources, the platform uses an AI-driven sentiment engine to extract meaningful information from unstructured feedback.

Customization and Integration

The platform allows for extensive customization, making it easy to adapt to CRE-specific needs. Users can add custom entity lists for industry terms and market indicators, and InMoment offers hands-on support for fine-tuning sentiment models. Integration is seamless, thanks to out-of-the-box connectors, APIs, and ETL tools, enabling connections with systems like CRM platforms, marketing automation tools, HRIS, and call center software.

Real-Time Monitoring

InMoment offers real-time analytics, notifications, and reporting through its Active Listening feature, which captures 2.4 times more actionable feedback than traditional surveys. For CRE professionals, this means they can track immediate reactions to property developments or lease announcements. A great example of its capabilities is how Jack in the Box uses InMoment AI to analyze customer feedback. Tony Darden, the company’s Chief Operating Officer, shared:

“The use of InMoment AI will allow us to easily analyze feedback in all of its forms to receive more detailed and immediate insight from a wider variety of guest experiences.”

The platform boasts strong user satisfaction, with 92% of users recommending it. It holds a 4.8/5 rating on Gartner (based on 32 reviews) and 4.2/5 on G2 (based on 17 reviews). These real-time insights make it a valuable tool for addressing CRE-specific challenges.

CRE-Specific Features

Although InMoment doesn’t include features explicitly tailored for CRE, its sentiment analysis tools can be applied effectively in the field. For example, its social listening capabilities can help CRE professionals monitor conversations about specific properties, neighborhoods, or market trends. Quick responses to customer feedback are crucial - addressing concerns within 24–48 hours can increase retention by 8.5%. For property managers, this makes real-time monitoring an essential feature for improving tenant satisfaction and engagement.

4. Azure AI Language

Azure AI Language combines several Azure AI services - Text Analytics, QnA Maker, and LUIS - into one cloud-based natural language processing (NLP) solution tailored for CRE (Commercial Real Estate) professionals. This platform builds on advancements in automated sentiment evaluation, offering high-quality, low-latency text analysis that's particularly well-suited for processing CRE-related data.

With sentiment analysis and opinion mining capabilities, Azure AI Language provides sentiment labels like positive, negative, neutral, and mixed, along with confidence scores ranging from 0 to 1. These scores are available at both sentence and document levels. This detailed breakdown allows CRE experts to understand not just the overall market sentiment but also specific opinions tied to property features, locations, and market trends.

Data Sources Supported

Azure AI Language is designed to handle a wide range of CRE data sources. These include property reviews, market reports, tenant feedback, social media conversations, and news articles. Supporting 94 languages, it’s particularly useful for global firms or those working with multilingual tenant communities. The service processes data through REST API endpoints, which accept text input and return results in JSON format. This ensures compatibility with most existing data management systems.

Customization and Integration

The platform allows users to train custom AI models using their own datasets. For example, Custom Named Entity Recognition (NER) can identify CRE-specific terms like property types, market trends, or location names. Integration options are extensive, with Microsoft providing client libraries for popular programming languages like C#, Python, JavaScript, and Java. Additionally, detailed guides and an Azure Synapse wizard simplify deployment. For organizations prioritizing data security, a Docker container option supports on-premise deployment to keep data secure. These features make it easy to integrate Azure AI Language into existing CRE workflows.

Real-Time Monitoring

Azure AI Language excels in real-time sentiment analysis, offering low-latency processing that lets CRE professionals track market sentiment as it changes. This is particularly useful for tasks like monitoring tenant satisfaction, conducting market research, or managing financial communications. The ability to quickly react to sentiment shifts provides a competitive edge, whether in customer service or investment decision-making.

CRE-Specific Features

While not exclusively designed for CRE, Azure AI Language includes features that are highly relevant to the industry. Its opinion mining tool, for instance, identifies specific targets (like nouns or verbs) and their associated evaluations (often adjectives) within text. This is especially effective for analyzing tenant surveys or property reviews, where smaller text segments yield the best results. Additionally, the platform’s named entity recognition and entity linking capabilities help pinpoint details like specific properties, locations, or market indicators.

Through the Azure AI Foundry interface, even non-technical teams can access these advanced tools without needing to write code. This accessibility makes it easier for CRE professionals to leverage sentiment analysis across various departments. Up next, we’ll take a closer look at Talkwalker’s approach to sentiment analysis in CRE.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

5. Talkwalker

Talkwalker is a social listening and analytics platform that processes sentiment data from an impressive 150 million sources across 196 countries in 187 languages. With such a vast global reach, it’s a powerful tool for commercial real estate (CRE) firms operating in international markets or managing diverse tenant communities. Its AI-powered sentiment analysis boasts up to 90% accuracy, providing dependable insights for professionals monitoring market sentiment and brand perception. Let’s break down how Talkwalker’s features - data coverage, customization, real-time monitoring, and CRE-specific tools - support industry professionals.

Data Sources Supported

Talkwalker doesn’t just stick to social media; it casts a wide net. It monitors over 30 platforms, including Facebook, LinkedIn, and Instagram - key spaces where CRE professionals connect with clients and promote properties. Beyond social networks, it tracks blogs, forums, online news, and even broadcast media to provide a well-rounded view of market trends.

What sets Talkwalker apart is its ability to analyze first-party text data. This includes customer service emails, chats, surveys, and call center transcripts. It also dives into product, location, and app reviews, offering insights that go beyond traditional tenant communications and customer support interactions.

“Customer Data+ has the power to revolutionize the way enterprises view multiple data sources to make data-driven decisions. We’ve created an industry-leading social listening and analytics tool that allows companies to see how customers engage with them across social and the web. Customer Data+ goes a step further by using Talkwalker’s AI Engine to run analysis on a company’s first-party text data and offer a complete picture of multiple data streams.”

Customization and Integration

Talkwalker’s customization options make it highly adaptable for CRE needs. It offers tailored dashboards and reports designed to focus on specific CRE metrics. The platform integrates smoothly with tools like Hootsuite for social media management and Tableau for business intelligence. Teams can share search topics, filters, and channels through its account libraries, and custom integrations allow firms to incorporate data sources unique to their operations.

On top of that, Talkwalker provides timely alerts, ensuring users can act quickly on new insights.

Real-Time Monitoring

In the fast-paced world of CRE, staying ahead of changes is critical. Talkwalker’s real-time monitoring capabilities deliver instant alerts on crises, sentiment shifts, and trending topics tied to properties or markets. It keeps an eye on 30 social networks and 150 million websites across 239 countries and regions, making it a reliable partner for tracking dynamic market conditions.

CRE-Specific Features

Although Talkwalker isn’t built exclusively for commercial real estate, many of its features are particularly useful for the sector. For instance, it tracks over 40,000 brand logos, objects, and scenes in social images and videos, while also scanning more than 60 million new videos daily for mentions. Its sentiment analysis doesn’t stop at text - it extends to images, videos, and even podcasts in 187 languages, offering a comprehensive view of public sentiment around CRE projects.

For CRE professionals, this means they can monitor tenant sentiment on a global scale and respond quickly to market trends or public perception shifts. Whether it’s identifying emerging issues or spotting opportunities, Talkwalker equips CRE firms with the tools to stay informed and proactive.

6. Brand24

Brand24 stands out as a tool for monitoring real-time public sentiment. By tracking mentions from over 25 million sources across 154 countries and processing more than 25 billion mentions, it provides valuable insights into market sentiment and brand perception, particularly in commercial real estate (CRE). Its AI-driven analysis goes a step further by identifying emotions such as admiration, anger, and joy, offering a deeper understanding of public sentiment.

Data Sources Supported

Brand24 monitors a wide range of public sources. Its coverage includes major social media platforms like X (formerly Twitter), Facebook, Instagram, LinkedIn, TikTok, and YouTube. It also tracks content from Spotify, news articles, blogs, forums, and review platforms such as TripAdvisor and the App Store. Additionally, it keeps tabs on niche channels like Reddit and Telegram, ensuring that no relevant discussion about properties or market trends slips through the cracks.

Customization and Integration

The platform offers flexible reporting options that can easily fit into CRE workflows. Users can generate customizable PDF reports, selecting specific data such as mentions, charts, key metrics, or top influencers, and even include their own company branding for a polished presentation. Scheduled email summaries - daily or weekly - keep teams up to date, while data exports to Excel, Google Sheets, or business intelligence tools allow for more in-depth analysis. Brand24 also integrates with Slack for real-time notifications. Although it lacks a traditional API, users can automate workflows using webhooks and custom actions. These features make it easier to stay on top of real-time developments.

“This tool provides personalized reports, reliable metrics, and customer insights that help you understand the level of buzz you’re generating, whether it’s positive or negative, and what your audience is interested in.”

Real-Time Monitoring

Real-time monitoring is a key feature for responding quickly to market changes. Available with Pro plans and above, Brand24 continuously scans over 25 million online sources and delivers instant alerts for new mentions. Users can set up email notifications for negative mentions or receive real-time updates via Slack. The platform’s AI insights simplify data interpretation, helping professionals quickly identify sentiment trends. With an average rating of 4.7 out of 5 stars on Capterra, customers frequently highlight its ease of use, effective real-time tracking, and responsive customer service.

CRE-Specific Features

While Brand24 isn’t exclusively designed for commercial real estate, it offers tools that are particularly helpful for the industry. For instance, its sentiment analysis provides immediate alerts for Instagram mentions, enabling firms to quickly gauge audience reactions to their properties or developments. Pricing is structured to be accessible, starting at $49 per month for individual users and scaling to $249 for enterprise accounts. A 14-day free trial lets users test its features before committing. However, some users have pointed out difficulties in filtering generic keywords like "office space" or "retail property".

Advantages and Disadvantages

Every sentiment analysis tool offers its own set of strengths and challenges, especially when applied to commercial real estate (CRE). Understanding these trade-offs is key to selecting the right tool that aligns with your goals and budget.

Key Considerations for CRE Professionals

While the table provides a snapshot, there are deeper factors that influence each tool's fit for CRE applications.

Cost: Brand24 is the most affordable option, starting at $49/month, making it suitable for individuals or small teams. On the other hand, tools like InMoment and Talkwalker cater to enterprise-level needs and come with higher investment requirements.

Integration and Usability: Tools like Azure AI Language offer robust API integration, making them highly adaptable but requiring technical know-how. In contrast, CoreCast is designed for seamless integration with The Fractional Analyst's financial tools, streamlining workflows for CRE professionals.

Data Coverage and Monitoring: Talkwalker excels in monitoring a broad range of channels, from social media to support tickets, while Brand24 stands out with its ability to classify mentions in over 100 languages. However, Brand24’s real-time updates are restricted to Pro plans - a notable limitation in fast-moving CRE markets.

Ease of Use: User experience varies widely. Brand24 scores a 4.7 out of 5 on Capterra for ease of use, making it accessible for beginners. On the flip side, Talkwalker’s extensive features require a longer learning curve to master.

Real-Time Capabilities: For CRE professionals, staying ahead of market sentiment is critical. While Brand24 offers real-time updates only on higher-tier plans, Talkwalker provides comprehensive real-time monitoring across multiple channels.

Hybrid Algorithms: Many tools use a mix of machine learning and rule-based approaches for sentiment analysis. While this hybrid method is effective, it often requires ongoing adjustments to account for CRE-specific terms and nuances.

These nuances highlight how each platform addresses the unique demands of CRE market dynamics and financial analysis. The right choice ultimately depends on your priorities - whether it’s affordability, advanced features, or ease of integration.

Conclusion

The analysis above breaks down the strengths and weaknesses of various sentiment analysis tools for commercial real estate (CRE) applications. Selecting the right tool hinges on your specific goals, budget, and technical requirements. Each option brings unique features tailored to different aspects of CRE.

For market researchers, Talkwalker offers powerful social media monitoring and trend analysis, ideal for tracking consumer behavior and market trends. Companies working within tighter budgets might favor Brand24, which focuses on social media monitoring and brand reputation management. Larger enterprises can explore InMoment for its advanced analytics, while businesses already using Microsoft products may find Azure AI Language appealing for its seamless integration and scalable cloud capabilities.

Research suggests that advanced sentiment analysis can improve client retention rates by 33%, and the global sentiment analysis market is expected to grow to $6.12 billion by 2028.

For CRE professionals, CoreCast by The Fractional Analyst offers a tailored solution that combines financial analysis with sentiment insights. Priced at $50 per user per month during its beta phase, it addresses industry-specific needs that more general tools might overlook.

Before committing, take advantage of free trials and pilot programs to ensure the tool aligns with your CRE objectives. Clearly outline your goals, evaluate your technical resources, and confirm that the tool can grow with your business. The right sentiment analysis tool can turn raw data into actionable insights, giving you a competitive edge and enabling smarter decisions in today’s data-centric CRE environment.

FAQs

-

Automated sentiment analysis provides commercial real estate professionals with real-time insights into market sentiment and trends. By processing vast amounts of data, it highlights shifts in public perception and market demand, making it easier to base decisions on solid evidence rather than guesswork.

This tool can spotlight new opportunities in underserved markets, predict changes in property values, and fine-tune investment strategies. By minimizing dependence on gut feelings, it streamlines decision-making and helps businesses stay competitive in the market.

-

When choosing a sentiment analysis tool, professionals in commercial real estate (CRE) should prioritize tools that can handle large-scale datasets, offer fast data processing, and integrate seamlessly with existing systems. These features are crucial for managing the vast amounts of data typical in the CRE sector while ensuring smooth workflows.

It's also important to select a tool designed specifically for the real estate market. This means it should accurately detect sentiment nuances unique to CRE, providing insights that align with industry-specific needs. A straightforward, user-friendly interface and strong support during implementation can further enhance the tool's effectiveness, helping your business get the most out of its investment.

-

Real-time sentiment analysis is becoming a game-changer in commercial real estate (CRE). By tapping into tenant feedback as it happens, property managers can gain a clear understanding of tenant concerns and emotions. This insight makes it easier to address problems promptly and offer tailored services, which can significantly enhance tenant satisfaction.

Beyond tenant relationships, sentiment analysis also plays a crucial role in monitoring market trends. By processing large volumes of data instantly, it allows investors and managers to adapt their strategies on the fly. This agility helps them stay competitive and make smarter decisions. With these insights, CRE professionals are better equipped to predict market changes and boost overall performance.