Positive vs. Negative Leverage in CRE Portfolios

Leverage in commercial real estate (CRE) can either boost your returns or increase your risks, depending on how it's used. Here's the core idea:

Positive Leverage: When a property's income (cap rate) is higher than the loan's interest rate, it increases cash flow and returns.

Negative Leverage: When borrowing costs exceed property income, it reduces profitability and raises financial risks.

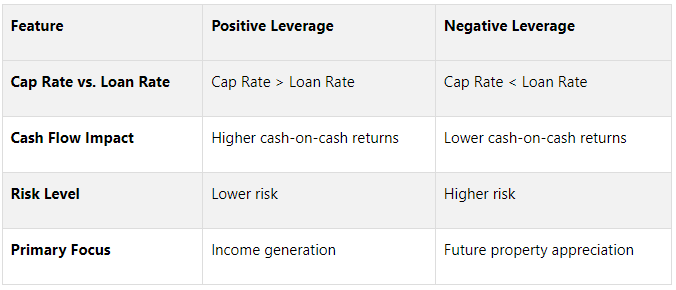

Quick Comparison:

To succeed, focus on market conditions, interest rates, and property performance. Positive leverage works best when income exceeds debt costs, while negative leverage may be viable in specific scenarios, like undervalued properties or future growth potential.

What Is Positive Leverage

Definition of Positive Leverage

Positive leverage happens when a property's capitalization rate (cap rate) exceeds the interest rate on the loan used to purchase it. In simple terms, this means the property's income is greater than the cost of borrowing.

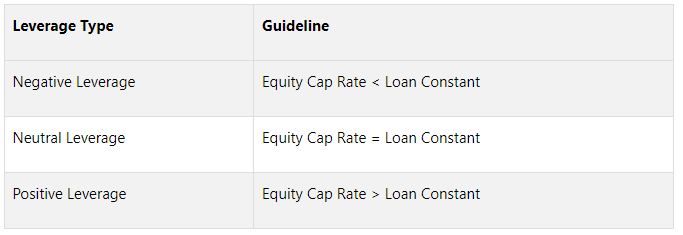

If your cash-on-cash return (equity yield) surpasses your loan constant, you've achieved positive leverage. This setup boosts net cash flow and delivers better returns compared to buying the property outright with cash.

“Positive leverage occurs when the cap rate is greater than the loan constant, so the return to the lender is lower than the cap rate, allowing the investor to capture some of that net cash flow to increase their return.”

Here’s an example: Imagine an investor buys a shopping center using a loan with a 7% interest rate, while the property's cap rate is 10%. In this case, the property's income outpaces the cost of the loan, leading to higher annual profits for the investor.

This foundation explains why positive leverage is a powerful tool for improving portfolio performance.

How Positive Leverage Helps Portfolios

Now that we’ve covered the basics, let’s look at how positive leverage can benefit an investment portfolio. When structured properly, it ensures that borrowed money costs less than the returns generated by the investment, leading to stronger equity yields.

The main advantage? Increased cash flow and higher overall returns. Positive leverage generates steady cash flow and amplifies investment returns. Over time, as debt is paid down and property values increase, equity grows, creating a compounding effect that supports long-term wealth building.

There are also tax benefits to consider. Interest payments on loans are often tax-deductible, which reduces the effective cost of borrowing. This tax shield makes positive leverage even more appealing, as it further enhances the investment’s financial performance.

Another big plus is the ability to scale investments more effectively. Positive leverage allows investors to purchase properties that would be out of reach if relying solely on cash. By using debt, investors reduce their required equity contribution, which significantly boosts equity yields.

Take industrial real estate, for instance. Leveraging investments in this sector can drive cash-on-cash returns into the 8-12% range. This illustrates how positive leverage can create attractive returns across various property types.

Best Times to Use Positive Leverage

Positive leverage is particularly beneficial when market conditions align with low interest rates and stable income streams. Low interest rate environments are ideal because they make it easier to find properties where the cap rate exceeds the loan rate, creating favorable conditions for investors.

Recent data highlights this trend. Abby Corbett, global head of investor insights at Cushman & Wakefield, noted positive leverage of 18 basis points in the retail sector. Similarly, the hotel sector has seen 16 basis points of positive leverage, while apartment and industrial sectors are in neutral to slightly positive leverage territory.

“This is a strong step forward into this next chapter of CRE.”

Properties with strong income potential are prime candidates for positive leverage. These include buildings with long-term tenants, properties in high-demand areas, or assets with opportunities to grow net operating income (NOI) through improvements or expansions.

Additionally, market recovery periods and fixed-rate financing options often provide excellent opportunities to use positive leverage. These conditions help protect against rising interest rates and offer more predictable cash flow over the loan’s duration.

The key to success lies in careful due diligence. Investors should aim to negotiate favorable loan terms that align with the property's cap rate and focus on assets where NOI growth is achievable. By doing so, they can ensure leverage works to their advantage.

What Is Negative Leverage

Definition of Negative Leverage

Negative leverage happens when the cost of borrowing exceeds the returns generated by a property's cash flow. Essentially, the interest rate on your loan is higher than the property's capitalization rate, which creates a drag on your investment's performance.

“Negative leverage happens when borrowing costs surpass investment returns, reducing profitability.”

This situation directly reduces cash-on-cash returns compared to an all-cash purchase. In simple terms, the debt you're using to finance the property ends up lowering your overall returns.

Here’s an example: Imagine a property with a 4% cap rate, but the loan you're using has an interest rate of 4.6%. In this case, you're dealing with negative leverage, and your cash-on-cash return could drop to just 2.7%. That’s a noticeable decline compared to the property’s core performance.

The rule of thumb is clear: negative leverage occurs whenever the cap rate is lower than the loan constant. This relationship determines whether the debt will boost or drag down your equity returns.

Problems with Negative Leverage

Negative leverage brings several challenges that can impact both individual investments and broader portfolios. The most immediate issue is reduced cash flow and lower returns on equity. When the cost of servicing debt outweighs the income benefits, every dollar borrowed works against your returns.

Another major concern is increased risk. Negative leverage amplifies overall portfolio risk, making it harder to manage operational issues or weather unexpected challenges. If a property underperforms, the added debt burden intensifies the pressure.

Perhaps the most dangerous aspect is the compounding effect. As debt levels rise or interest rates increase, the negative impact on equity returns can grow rapidly. This creates a scenario where the financial strain escalates over time.

For investors in this position, returns often rely more on property appreciation than on cash flow. This shifts the focus from steady income to speculation, requiring significant growth in property value to counterbalance the ongoing cash flow shortfall.

“Conceptually, negative leverage implies the cash-on-cash return (or ‘cash yield’) on a levered investment is less than a comparable investment financed using no debt (or all-cash).”

In extreme cases, negative leverage can lead to longer holding periods, diminished overall returns, or even foreclosure if the property can’t generate enough income to cover its debt obligations.

Despite these risks, there are specific scenarios where negative leverage might still make sense.

When to Consider Negative Leverage

While risky, negative leverage can be a strategic choice in certain situations, particularly in volatile markets with discounted property prices. If you can buy a property at a significant discount, the lower price might offset the temporary cash flow issues.

Another scenario is below-market rent properties. When rents are far below the current market rates, negative leverage may be acceptable initially, with the expectation that as rents rise to market levels, the leverage will shift to positive over time.

“Negative leverage can make sense when there is an opportunity in a volatile market or in a special situation where the potential reward is higher than the risk.”

It may also play a role in portfolio diversification strategies. Sometimes, investors accept lower returns on specific properties as a way to balance risk across their portfolio, treating these investments as stabilizing assets during uncertain times.

Finally, interest rate trends heavily influence decisions around negative leverage. In a rising rate environment, investors might still proceed with acquisitions under negative leverage, expecting future rate drops or improved property performance to turn the situation around.

The key to making negative leverage work is having a clear plan to transition to positive leverage during the holding period. This could involve raising rents, improving operations, or refinancing under better terms. Without this plan, negative leverage becomes a long-term liability rather than a short-term strategy.

Positive vs. Negative Leverage Comparison

Main Differences Between Positive and Negative Leverage

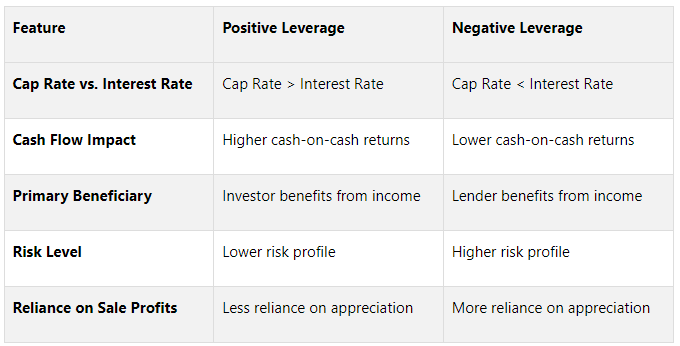

Positive leverage happens when a property's cap rate is higher than the loan's interest rate. On the flip side, negative leverage occurs when the cap rate falls below the interest rate. With positive leverage, every borrowed dollar works to boost returns. In contrast, negative leverage shifts the advantage to the lender, as they benefit more from the property's income.

“Positive leverage can enhance returns while creating growth opportunities. Negative growth, on the other hand, poses significant risks that can seriously undermine an investment’s profitability.”

In practical terms, positive leverage leads to higher cash-on-cash returns compared to an all-equity purchase. Negative leverage, however, results in lower cash-on-cash returns, and in some cases, the unleveraged return may actually outperform what’s achieved through financing.

Negative leverage comes with higher risks. Investors may face difficulties meeting debt payments, especially if property income doesn’t hold up. On the other hand, positive leverage can boost a portfolio’s performance, offering better returns. That said, over-leveraging can backfire if property values drop or rental income doesn’t meet expectations. This comparison highlights the tradeoffs between the two approaches and sets the stage for evaluating their pros and cons.

Pros and Cons of Each Approach

Positive leverage aligns well with portfolio goals by ensuring that property income comfortably exceeds debt service costs. This creates steady cash flow, enhances returns over time, and provides a cushion against operational hiccups.

Negative leverage, while riskier, has its own appeal. It requires less upfront cash, making it possible to acquire properties that might otherwise be unaffordable. This strategy can work when the purchase price is discounted enough to offset lower cash flow or yields.

“When the price paid for the asset is discounted enough to more than compensate the investor for the reduced yields or cash flow, then its use may be warranted.”

Negative leverage can also be attractive for investors banking on significant property appreciation or planning to improve operational cash flow through value-add strategies. However, it heightens overall risk and limits flexibility in managing property challenges. Investors in this scenario often rely heavily on profits from a future sale to meet their return expectations.

“Negative leverage develops when the cost of debt exceeds the operating yield produced by the property. In a negative leverage environment, the property’s cash return is lower than the debt service.”

For negative leverage to work, it’s critical to have a plan to transition to positive leverage during the holding period. Whether choosing positive or negative leverage, careful analysis is key. Stress testing assumptions and comparing leveraged versus unleveraged cash flows over the holding period can help ensure the strategy aligns with overall investment goals . This kind of analysis informs the next steps in effectively managing leverage strategies.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

How to Choose the Right Leverage Strategy

Factors to Consider When Selecting Leverage

When deciding on a leverage strategy, it’s essential to evaluate market cycles. Commercial real estate (CRE) typically moves through four phases: recovery, expansion, hypersupply, and recession. Knowing which phase the market is in can guide you toward the most effective leverage approach.

“Understanding the real estate cycle can help multifamily investors not only project the income and capital appreciation of their properties, but also use the best investment strategy to maximize returns.”

Each phase calls for a different strategy:

Recovery: Focus on acquiring undervalued properties, as improving fundamentals often support positive leverage.

Expansion: Use moderate leverage to take advantage of rising demand through development projects.

Hypersupply: Shift to a conservative approach, reducing leverage while prioritizing high-quality assets to manage risk.

Recession: Consider negative leverage for purchasing distressed properties, but only if the discount justifies the risk.

Interest rate trends also play a major role in shaping leverage decisions. For instance, with national office vacancy rates at a record 19.1% and office building values potentially dropping by 39% (around $454 billion), understanding whether rates are climbing, falling, or stabilizing is critical when structuring debt.

Your investment strategy should align with your leverage approach. Stable, high-occupancy properties (core investments) are well-suited for positive leverage. On the other hand, value-add or opportunistic projects might temporarily require negative leverage if the business plan is expected to create significant long-term value.

Once these factors are considered, implementing a strong risk management plan is key to refining your leverage strategy.

Managing Risk and Conducting Analysis

Risk management begins with thorough stress testing. Portfolio managers should simulate scenarios like rent decreases or rising interest rates to pinpoint vulnerabilities. Regular quarterly reviews of leverage ratios ensure that your capital structure adapts to changing market conditions and portfolio performance. This proactive approach helps prepare for different economic scenarios.

Understanding local market dynamics is equally important. Factors like tenant demand, competitive positioning, and broader economic conditions can influence how properties perform under varying levels of leverage, especially during uncertain times.

Financial ratios are another critical tool for analyzing leverage. Metrics that assess liquidity, profitability, and efficiency provide valuable insights into how well your leverage strategy is working. Automated financial tools can streamline these calculations, minimize errors, and allow for real-time adjustments.

As Joe McBride, Senior Director of Commercial Real Estate Data Products at Moody's Analytics, explains:

“Thinking about the office market, we’re kind of in this Bermuda triangle of uncertainty. We’ve got three major components in any analysis of an office building today that our customers are doing. First is fundamentals – What are the rents in this building? How are my tenants looking? Is office in this market sustainable in the long-term? Then we’ve got return to office - So what kind of tenants are they? Are they law firms and financial firms? Even there, that doesn’t necessarily equate to higher rents or more income for me as the borrower or the owner. And then you’ve got the major boogey-man which is interest rates.”

This uncertainty highlights the importance of detailed analysis and contingency planning when developing leverage strategies.

Using Professional Analysis and Tools

After conducting risk assessments, advanced tools can take your leverage strategy to the next level. Professional financial software is invaluable for analyzing leverage decisions effectively. These tools should integrate seamlessly with other systems, ensuring smooth data flow and providing real-time insights.

AI-enhanced modeling is becoming a game-changer, offering more precise forecasts of how leverage might perform over time. Predictive analytics can flag potential risks early, helping investors make informed decisions. For example, Gartner research shows that 66% of finance leaders see immediate benefits from generative AI in areas like budget forecasting and variance analysis.

One notable solution is The Fractional Analyst, which offers both direct and self-service tools tailored to the CRE market. Through its CoreCast platform, investors gain access to underwriting support, asset management tools, and custom financial models. Free resources like multifamily acquisition models and IRR matrices further assist in evaluating leverage scenarios.

Interactive dashboards and visualization tools simplify complex data, offering clear insights into cash flow projections, debt service coverage ratios, and sensitivity analyses. Collaboration features also allow teams to work together in real time, ensuring all perspectives are considered during decision-making.

Investing in advanced tools can significantly improve decision quality. Companies that adopt sophisticated data practices are up to eight times more likely to achieve meaningful growth. In today’s volatile market, these tools are no longer optional - they’re essential for effective leverage management.

Mastering Commercial Real Estate: Cap Rates, Interest Rates, and Positive Leverage

Conclusion

When a property's cap rate surpasses the debt interest rate, it creates positive leverage, which enhances cash-on-cash returns. On the flip side, negative leverage occurs when the debt interest rate is higher than the cap rate, reducing returns and increasing the risk of financial strain or even property loss if debt obligations become overwhelming.

This dynamic highlights the importance of careful analysis in managing leverage risks effectively. With commercial mortgage rates expected to range between 6% and 7% by mid-2024, properties with cap rates above this threshold can benefit from positive leverage. Conversely, properties with lower cap rates may face the challenges of negative leverage.

In today’s unpredictable commercial real estate market, advanced modeling and thorough analysis are more critical than ever. These tools are invaluable for stress testing and monitoring portfolios in real time, helping investors stay ahead of potential risks. By leveraging data analytics, investors can conduct predictive modeling, perform stress tests, and continuously monitor their portfolios to identify and address vulnerabilities before they escalate.

For investors looking to implement these strategies, platforms like The Fractional Analyst provide valuable support. With tools such as CoreCast, investors gain access to underwriting assistance, custom financial models, and real-time portfolio monitoring - key resources for managing leverage effectively and navigating the complexities of today’s market.

FAQs

-

The best time to apply positive leverage in commercial real estate is when the property's capitalization rate (cap rate) surpasses the loan's interest rate. In this scenario, the property's income not only covers the borrowing costs but also delivers a better return on equity.

Positive leverage works particularly well in environments with low interest rates and high rental income potential. These conditions amplify the advantages of using debt. By thoroughly evaluating these factors, investors can make strategic decisions to boost the overall performance of their portfolios.

-

To shift from negative leverage to positive leverage in commercial real estate, focus on strategies that boost cash flow while easing debt obligations. One way to achieve this is by increasing the property’s Net Operating Income (NOI). This could involve raising rents, improving occupancy rates, or cutting back on unnecessary operating costs. Negotiating a lower purchase price for the property can also reduce the debt burden and improve potential returns.

Refinancing is another powerful tool. Securing a loan with a lower interest rate or extending the loan term can significantly reduce monthly debt payments. Additionally, staying alert to interest rate fluctuations and keeping a close eye on expenses can help maintain financial stability. These steps not only improve leverage but also strengthen the overall performance of your investment portfolio.

-

Relying on property appreciation to justify negative leverage comes with its risks. If the anticipated appreciation doesn’t happen, it could result in reduced returns, difficulties meeting debt payments, and even financial stress. This strategy hinges on the assumption that market conditions will improve - something that’s never a sure thing.

To navigate these risks, it’s wise to keep debt levels manageable and ensure the property’s cap rate is higher than the cost of borrowing. Diversifying your portfolio can also help minimize the impact of market swings. On top of that, maintaining healthy cash reserves and looking into options to renegotiate loan terms can act as a safety net if things don’t go as planned.