Understanding Debt Service Coverage Ratio (DSCR)

The Debt Service Coverage Ratio (DSCR) is a simple way to measure if a property earns enough to cover its debt payments.

Here’s what you need to know:

What it is: DSCR compares a property’s annual Net Operating Income (NOI) to its total annual debt payments.

Why it matters: A DSCR above 1.0 means the property earns more than it owes. Most lenders prefer a DSCR of 1.25 or higher for commercial loans.

How to calculate it: Divide NOI by total debt payments. For example, if NOI is $120,000 and debt payments are $100,000, the DSCR is 1.20.

What’s good or bad:

Above 1.0: Income covers debt.

Below 1.0: Income falls short.

Lenders use DSCR to decide loan approvals and terms. Investors rely on it to assess cash flow and manage risks. A higher DSCR can lead to better loan terms and more financial stability.

Quick Formula:

DSCR = NOI ÷ Total Debt Service

If you want to know how DSCR impacts real estate financing, loan approvals, and property performance, keep reading for detailed explanations and examples.

How to Calculate DSCR

DSCR Formula and Steps

The formula for calculating DSCR is:

DSCR = NOI / Total Debt Service [3].

Here’s how you calculate it step by step:

Step 1: Determine the annual Net Operating Income (NOI) by subtracting operating expenses from total income.

Step 2: Add up all annual debt payments, including both principal and interest.

Step 3: Divide the NOI by the Total Debt Service.

For example, if a property has an NOI of $120,000 and total debt payments of $100,000, the DSCR would be 1.20. To better understand this calculation, let’s break down its key components: NOI and Total Debt Service.

Understanding DSCR Components

Net Operating Income (NOI) is the numerator in the DSCR formula. It’s calculated by subtracting total operating expenses from total revenue. However, certain items like capital expenditures, debt service, and income tax are excluded from this calculation [3][7].

When lenders evaluate NOI for DSCR purposes, they often factor in other considerations. These can include:

Market-level operating expenses

Replacement reserves

Allowances for potential vacancies

Off-site management costs

Tenant improvement expenses or leasing commissions [1]

“Accurately assessing NOI is important, as an inflated NOI will overestimate a property’s ability to generate income to cover mortgage payments, while an NOI that’s too low underestimates how much income will be available to service debt.”

Total Debt Service represents all annual debt obligations, including principal and interest payments, as well as any additional fees associated with the debt [6]. To ensure accuracy, every debt-related payment must be accounted for, as even small overlooked obligations can distort the DSCR calculation.

What DSCR Numbers Mean

Understanding what the DSCR value represents is essential. A DSCR above 1.0 indicates that the income generated is sufficient to cover debt payments. Many lenders set a minimum DSCR requirement between 1.2 and 1.25, with values closer to 2.0 being preferred for added financial security [2][6]. A DSCR of 2.00 or higher is often seen as exceptionally strong [2].

On the other hand, a DSCR below 1.0 signals that the income isn’t enough to cover debt obligations. This can result in negative cash flow and might require actions like increasing rental income, cutting costs, or refinancing the debt.

For properties with higher risk, such as hotels or self-storage facilities, lenders may demand a higher DSCR - often around 1.40 or more - to account for the greater variability in revenue and turnover [6]. Knowing these benchmarks is key to determining whether a property aligns with financing and investment goals.

DSCR Standards and What They Mean

Common DSCR Requirements

Understanding the Debt Service Coverage Ratio (DSCR) benchmarks that lenders expect is key to navigating commercial real estate financing. Generally, most lenders require a minimum DSCR of 1.25 for commercial loans. This means the property generates 25% more income than needed to cover debt payments, offering a cushion against income fluctuations or unforeseen expenses[8]. This standard serves as a foundation for how lenders evaluate loan applications.

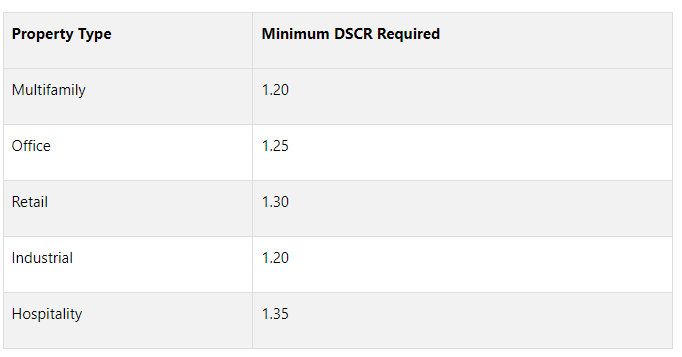

That said, DSCR requirements vary depending on the property type and its associated risks. Here’s a look at typical minimum DSCR requirements across various commercial property sectors:

For properties with greater operational volatility, such as hotels or healthcare facilities, lenders often set a higher DSCR threshold - typically 1.35 or above - to account for added risks[10]. In particularly high-risk industries, the required DSCR might climb to 1.5 or more[8]. On the other hand, more stable assets like multifamily or industrial properties generally fall on the lower end of the spectrum.

Specialized financing programs like Small Business Administration (SBA) loans tend to be more lenient. Backed by government guarantees, these loans often accept DSCRs as low as 1.15, making them a more accessible option for eligible borrowers[8].

How Lenders Use DSCR in Loan Decisions

Building on these benchmarks, lenders rely on DSCR as a crucial metric to evaluate risk and shape loan terms. It’s not just about approving or denying a loan; DSCR also influences interest rates, loan amounts, and repayment structures. A higher DSCR signals lower risk, boosting lender confidence and improving the borrower's chances of securing favorable terms[8].

When the DSCR drops below 1.0, it indicates that a property’s income isn’t sufficient to cover its debt obligations. In such cases, borrowers may face stricter loan terms, higher interest rates, or even outright rejection[8].

The connection between DSCR and loan pricing is particularly evident in rental property financing. For instance:

A DSCR of 1.25 or higher typically results in better interest rates.

A DSCR below 0.75 often requires a larger down payment and additional reserves to offset the risk[5].

Market conditions and loan duration also play a role in shaping DSCR expectations. Short-term loans usually demand higher DSCRs to reduce default risks, while economic downturns may prompt lenders to raise their required ratios to account for increased uncertainty[8].

In the commercial mortgage-backed securities (CMBS) market, a DSCR of 1.25 is standard, though exceptions are made depending on specific deals[10]. By understanding these guidelines, investors can better align their financing strategies with lender expectations, boosting their chances of securing loans with terms that fit their needs.

Using DSCR in Real Estate Deals

DSCR for Loan Approval

DSCR (Debt Service Coverage Ratio) plays a central role in securing cash-flow–based loans for investment properties. Lenders use it to determine whether a property's income is sufficient to cover its debt obligations and to calculate the maximum loan amount they’re willing to offer[11]. A DSCR above 1.25 is often the sweet spot, as it can lead to lower interest rates, larger loan amounts, and longer repayment terms. Simply put, a strong DSCR improves loan terms and increases the likelihood of approval.

For example, let’s say an investor is considering purchasing a small apartment building priced at $1,000,000. The property generates $150,000 in annual gross potential income, has a 5% vacancy rate, and incurs $45,000 in operating expenses each year. The investor plans to take out a $750,000 loan at a 4.5% interest rate over 30 years, resulting in an annual debt service of about $45,545. The DSCR for this scenario is calculated at 3.13, meaning the property generates more than three times the income needed to cover its debt payments[11].

“If they want to increase their DSCR ratio, investors should consider looking into two to four unit properties...those multiple unit properties will DSCR and cash flow a lot better than single family residences. So, if you’re looking at purchase prices over $400,000 and you want to keep your down payment lower, look at the multi-family units.”

Beyond loan approval, lenders also use DSCR to size loans, ensuring that the property can comfortably manage its debt even if income fluctuates. This makes DSCR a critical metric not just for securing financing but also for evaluating the long-term viability of an investment.

Tracking Property Performance with DSCR

Once a property is financed, DSCR becomes an essential tool for ongoing management. Monitoring the ratio regularly helps investors assess cash flow stability and spot potential financial risks before they become major problems[9]. For instance, changes in DSCR may indicate shifts in net operating income or rising debt service costs, serving as an early warning system for issues that could impact profitability.

Experienced investors often maintain cash reserves equal to three to six months of debt service. This buffer can help weather temporary income disruptions. Additionally, strategies like controlling expenses, screening tenants carefully, conducting preventative maintenance, and adjusting rents as needed are key to maintaining a healthy DSCR. For example, an investor managing a duplex that generates $36,000 annually, with $12,000 in operating expenses and $20,000 in annual mortgage payments, has a DSCR of 1.2. By keeping a close eye on this ratio, they can quickly address challenges such as rising vacancies or unexpected costs before the situation worsens[12].

Testing Different DSCR Scenarios

DSCR analysis becomes even more valuable when investors simulate potential changes in property performance. Modeling scenarios like higher vacancy rates, increased operating expenses, or economic downturns can provide insight into how these factors might affect the ability to cover debt payments[9].

Take Joe’s short-term rental property in Virginia Beach, for instance. It generates $65,000 in annual gross income and has $31,861 in annual debt obligations, yielding a DSCR of 2.04[13]. By testing different scenarios, Joe can see how the property might perform under various conditions:

Base Case: 2.04 DSCR

10% income drop: 1.84 DSCR

20% income drop: 1.63 DSCR

30% income drop: 1.43 DSCR

Even with a 30% decline in income, Joe’s property maintains a DSCR above the minimum threshold, showing the importance of starting with a strong ratio. On the flip side, a DSCR below 1.0 means the property’s income isn’t sufficient to cover its debt, leading to negative cash flow. Running these tests before committing to a deal helps investors avoid properties with insufficient financial safety nets.

Regular stress-testing also helps determine when to refinance. If interest rates drop or the property’s income improves significantly, updated DSCR calculations can highlight opportunities to restructure debt and improve cash flow.

Transform Your Real Estate Strategy

–

Transform Your Real Estate Strategy –

Debt Service Coverage Ratio (DSCR) Explained [Real Estate]

Tools for DSCR Analysis

The right tools can turn DSCR analysis from a tedious manual task into a more efficient and accurate process. By building on the DSCR calculations and scenario testing methods discussed earlier, these tools simplify workflows and support quicker, more precise decision-making. Today’s real estate professionals have access to platforms that automate calculations, minimize errors, and offer deeper insights into property performance. These tools range from basic downloadable templates to advanced software solutions that integrate seamlessly with existing systems.

DSCR Models and Templates

The Fractional Analyst offers free, Excel-based DSCR models designed for various property types. These templates include automated fields for entering rental income and PITIA, instantly calculating DSCR values using both primary (rent/PITIA) and alternative (NOI/debt service) methods. They also feature conditional formatting to highlight properties that may be underperforming. To get the best results, you’ll need accurate data such as rent rolls, loan statements, and updated tax and insurance documents [16].

While templates provide a solid starting point, integrated platforms can elevate your DSCR analysis to the next level.

CoreCast Platform for DSCR Analysis

CoreCast takes real estate analysis a step further by moving beyond scattered spreadsheets to deliver a fully integrated platform. This system can create investment-grade models in minutes and uses machine learning to identify potential anomalies that might impact DSCR calculations. With its automation features, CoreCast provides real-time DSCR dashboards and variance analysis, enabling users to track metrics like NOI-based DSCR and net cash flow against projections.

The platform also supports stress-testing under various conditions, such as rising vacancy rates, increased operating expenses, or economic downturns. CoreCast is currently available at competitive beta pricing, making it a cost-effective alternative to older solutions. Its modular design ensures smooth integration with CRM systems, accounting software, and property management tools. The platform is expected to scale to over 100,000 users by 2030 [15].

The Fractional Analyst Underwriting Services

In addition to automated tools and platforms, The Fractional Analyst offers expert analyst support for complex DSCR underwriting needs. Their services include custom financial analysis tailored to specific property types and market conditions. This allows for detailed DSCR modeling that takes into account factors like seasonal income fluctuations, lease rollover schedules, and market-specific operating expense trends. This level of detail is especially useful for properties that don’t fit into standard templates.

The on-demand analyst option is ideal for short-term projects or ongoing portfolio management, providing support for evaluating complex deals, preparing investor presentations, and conducting deep-dive due diligence on DSCR trends. Real estate analytics can deliver an annual ROI of up to 440%, thanks to benefits like predictive property maintenance and in-depth market analysis. By combining automated tools with expert insights, The Fractional Analyst ensures that DSCR remains a dependable measure of financial performance and investment potential, while also helping monitor property performance over time [14].

DSCR Summary

The Debt Service Coverage Ratio (DSCR) is a crucial metric in commercial real estate, measuring a property's ability to cover its debt obligations. It does this by comparing the Net Operating Income (NOI) to the total debt service[3][11]. A DSCR above 1.0 indicates that the property generates enough income to cover its debt, while a ratio below 1.0 suggests potential cash flow issues[9].

Most lenders set minimum DSCR requirements between 1.25x and 2.0x. For riskier property types like hotels or self-storage facilities, where revenue can fluctuate significantly, the minimum DSCR often rises to 1.40x or higher[6]. Alka Sood, a consultant with BDC Advisory Services, highlights the importance of this metric:

“Debt service coverage ratio is a basic indicator of your company’s financial health and one that all entrepreneurs should be familiar with.”

DSCR standards influence not just loan terms but also the broader financial health of an investment. Beyond securing loans, investors rely on DSCR to assess profitability and manage risk[6]. Properties with higher DSCRs often enjoy better financing terms and higher valuations[11]. Regularly tracking DSCR trends allows investors to address potential problems early, whether by adjusting rental rates, reducing expenses, or exploring refinancing options[9].

Modern tools, ranging from Excel templates to platforms like CoreCast, simplify the process of DSCR analysis. These resources, combined with expert insights, help ensure that DSCR calculations accurately reflect a property's financial health and investment potential.

DSCR plays a central role in connecting property selection, financing, and long-term performance management. By mastering DSCR analysis, investors can make informed, data-backed decisions that strengthen their investments over time[16].

FAQs

-

A higher Debt Service Coverage Ratio (DSCR) indicates to lenders that a property generates enough income to easily meet its debt payments. This can translate into better loan terms, such as lower interest rates, higher borrowing limits, or extended repayment schedules.

Beyond loan benefits, a strong DSCR boosts the financial health of a real estate investment. It acts as a cushion to manage unexpected costs or economic challenges, lowering the chances of default. In essence, a higher DSCR contributes to a more stable and resilient investment approach.

-

DSCR requirements differ based on property type, mainly due to variations in income stability and risk. Here's a breakdown of common requirements:

Office buildings: Typically need a DSCR of at least 1.25, as they often benefit from steady income generated by long-term tenants.

Retail centers: Generally require a DSCR between 1.3 and 1.4, reflecting the ups and downs of consumer spending and frequent tenant changes.

Industrial properties: Usually fall within a DSCR range of 1.25 to 1.35, balancing relatively stable income against economic uncertainties.

Hotels: Demand higher DSCRs, around 1.4, due to their income being highly dependent on seasonality and market competition.

The reasoning is straightforward: properties with consistent income are viewed as less risky, so they can operate with lower DSCR thresholds. Meanwhile, properties with fluctuating income demand higher ratios to give lenders more confidence and a safety net.

-

The Debt Service Coverage Ratio (DSCR) is a crucial metric for investors to assess whether a property generates enough income to cover its debt payments. A DSCR above 1.0 signals that the property earns more than enough to meet its loan obligations, which is a key indicator of its financial stability and risk level. For instance, a DSCR of 1.25 means the property produces 25% more income than is needed for debt payments, offering a buffer for unexpected expenses or periods of vacancy.

Lenders usually set a minimum DSCR requirement, often ranging from 1.2 to 1.5, depending on the type of property and market conditions. Properties with higher DSCRs are seen as less risky, which can result in more favorable loan terms. Keeping an eye on DSCR allows investors to make smarter decisions, such as refinancing or tweaking their strategies, to maintain financial health and minimize risk.