Rate Cap - NPV

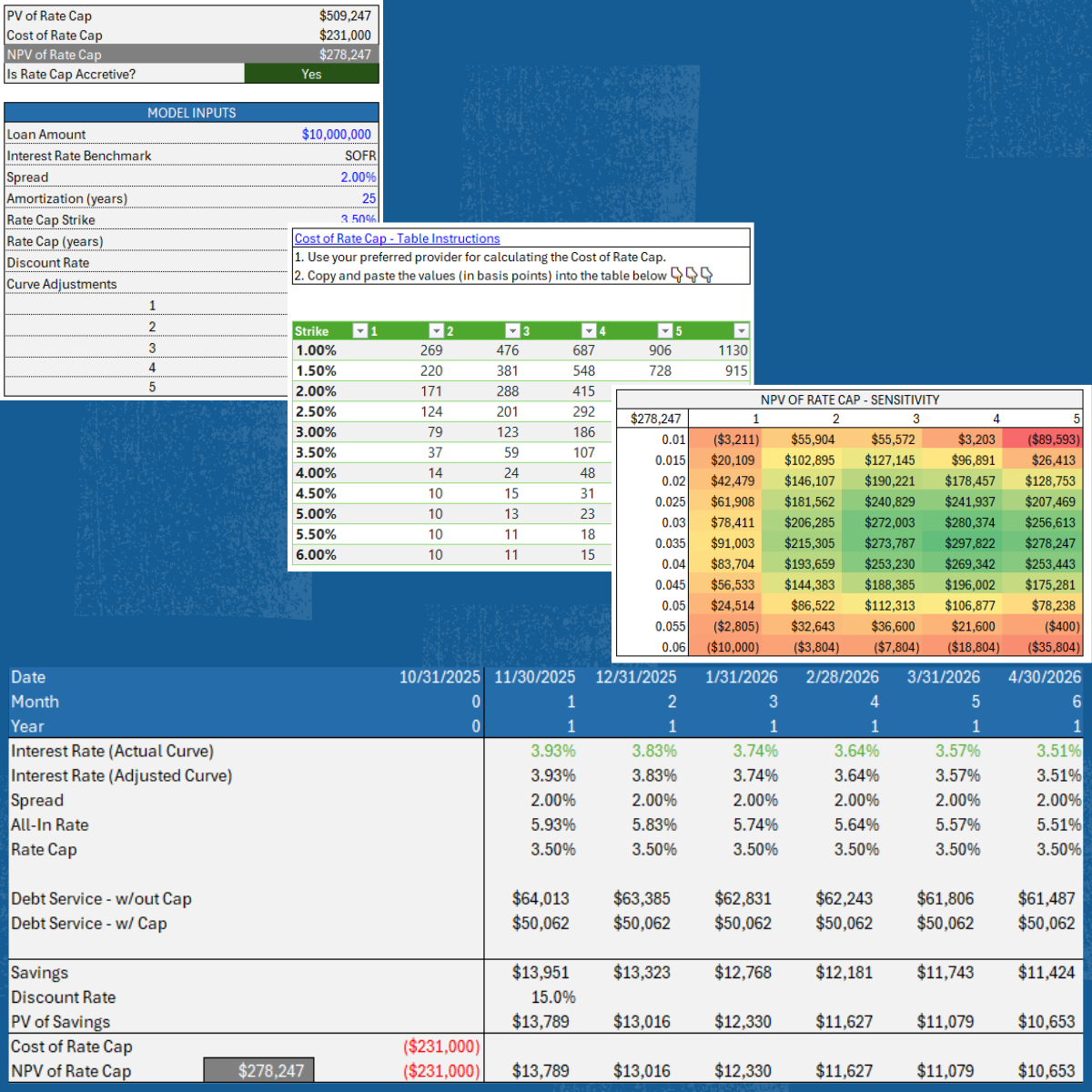

This Excel-based tool helps real estate investors and analysts evaluate the net present value (NPV) of an interest rate cap on floating-rate debt. By inputting key assumptions such as loan amount, benchmark rate (SOFR), spread, cap strike, and discount rate, the model calculates:

Present Value of the Rate Cap

Cost of the Rate Cap

NPV of the Rate Cap – showing whether the hedge is accretive

The model includes a simple input section and a built-in rate cap pricing table, making it easy to compare scenarios and assess the cost-benefit tradeoff of purchasing an interest rate cap.

Perfect for real estate underwriting, debt structuring, and risk management analysis.

The Fractional Analyst’s

Build To Rent Model

Upgrade your underwriting process with our model that delivers speed, accuracy, and confidence across all your multifamily deals