1031 Exchange Compliance: Reverse and Improvement Structures

A 1031 exchange lets you defer capital gains taxes when swapping investment properties. Two advanced types - reverse exchanges and improvement exchanges - offer flexibility but come with strict IRS rules. Here’s a quick breakdown:

Reverse Exchange: Buy a new property before selling your old one. You have 45 days to identify the property to sell and 180 days to complete the sale.

Improvement Exchange: Use sale proceeds to upgrade or build on a replacement property. All improvements must be done within 180 days.

Key Points:

Deadlines: 45 days to identify, 180 days to complete.

Costs: Reverse exchanges cost $6,000–$10,000; improvement exchanges vary based on construction.

Compliance Risks: Missing deadlines or mishandling funds can result in taxes.

Who Helps?: Qualified Intermediaries (QIs), Exchange Accommodation Titleholders (EATs), and experienced lenders.

Quick Comparison Table

Both options require precise coordination to meet IRS rules and avoid penalties. Work with experts and consider using technology for tracking deadlines and managing compliance.

How Reverse and Improvement 1031 Exchanges Work

Reverse 1031 Exchange Process

Both reverse and improvement 1031 exchanges follow strict IRS rules, and each involves specific steps to ensure compliance. A reverse 1031 exchange flips the usual order of operations, allowing you to purchase your replacement property before selling the one you currently own. This method requires careful planning and a structured legal process to meet IRS guidelines.

The process begins with hiring a Qualified Intermediary (QI) to set up an Exchange Accommodation Titleholder Agreement (EAT). The QI appoints an Exchange Accommodation Titleholder to temporarily hold the title of your new property. At the same time, you sign a Purchase and Sales Agreement with the seller of the replacement property, while the QI handles all necessary closing documents.

Once the replacement property is purchased, the EAT takes title to ensure the exchange structure is protected. Timing is critical here: you must identify the property you plan to sell within 45 days. After identifying it, you enter into a Purchase and Sales Agreement with a buyer and work toward closing. The sale of your original property must be completed within 180 days of purchasing the replacement property. Additionally, the value of the property you sell must be equal to or greater than the value of the replacement property, and both properties must qualify as like-kind investments.

“For instance, Dr. Black, a physician, used this strategy when he found a replacement property he wanted but hadn’t yet secured a buyer for his existing asset. His QI arranged for a bank loan through the EAT to purchase the new property, giving him up to 180 days to sell his original property while locking in his desired investment”

Improvement exchanges, on the other hand, offer another option for customizing your replacement property.

Improvement 1031 Exchange Process

An improvement exchange, also called a Build-to-Suit Exchange, allows you to use exchange funds to renovate or build on your replacement property. This approach is especially useful when available properties don’t meet your needs, but you can transform them into the ideal investment through upgrades or new construction.

The process starts with selling your original property and transferring the proceeds to your QI. Within the standard 45-day identification period, you must specify both the replacement property and the improvements you plan to make. Only improvements completed within the 180-day exchange window will count toward the total property value for tax deferral purposes.

Your QI then uses the exchange funds to purchase the replacement property and pay for the approved improvements. To qualify, the adjusted value of the improved property must equal or exceed the sale price of your original property. Eligible improvements can include structural upgrades, functional enhancements, or aesthetic changes that add measurable value.

The entire process, including acquiring the property and completing the improvements, must be finished within 180 days. This tight timeline demands precise coordination with contractors, architects, and local authorities for permits. Any improvements completed after the deadline won’t count toward your exchange value, which could result in taxable income.

Rules and Key Players

Both reverse and improvement exchanges fall under IRS Section 1031 and are guided by Revenue Procedure 2000-37, which outlines the rules for reverse exchanges. These regulations establish the framework for compliance and define the roles of key participants.

The Qualified Intermediary (QI) plays a central role, managing funds, overseeing property transfers, and ensuring compliance with IRS rules. The Exchange Accommodation Titleholder (EAT) temporarily holds property titles during the exchange period. When choosing a QI, look for someone with experience handling complex exchanges, up-to-date knowledge of regulations, financial stability, and a solid track record in customer service.

Other participants, like lenders for replacement property financing, are also critical when the purchase occurs before the sale. IRS rules require consistency in taxpayer identity and enforce restrictions on related parties and disqualified persons. It’s also important to note that neither the relinquished nor replacement properties can serve as your primary residence, as 1031 exchanges are strictly for investment properties.

These types of exchanges typically cost between $6,000 and $10,000, reflecting the additional legal documentation, coordination, and professional fees required to meet the intricate timing and compliance demands.

Reverse & Improvement Exchanges (WEBINAR)

Main Compliance Problems in Reverse and Improvement Exchanges

Reverse and improvement exchanges offer flexibility in managing property transactions, but they also come with strict compliance challenges that can jeopardize the entire process. Missteps can lead to immediate tax liabilities, so it’s crucial to understand and prepare for these common pitfalls.

Meeting Strict 1031 Exchange Deadlines

The deadlines for 1031 exchanges are rigid: a 45-day identification period and a 180-day exchange period. These timelines include weekends and holidays, leaving no room for extensions. Missing even one of these deadlines disqualifies the exchange, no matter how much effort has been invested.

In a reverse exchange, once the replacement property is purchased through the EAT (Exchange Accommodation Titleholder), you have only 45 days to identify the property you intend to sell. This short timeframe demands quick action - marketing, negotiating, and securing a buyer for your original property must happen fast.

Improvement exchanges come with even more constraints. Not only must you purchase the property within 180 days, but all construction or renovation must also be completed in that same period. Any improvements finished after the deadline won’t count toward your exchange value, potentially leaving you with taxable income. The IRS rarely grants exceptions, and only in disaster-related cases, making these deadlines essentially non-negotiable. These time pressures also create challenges in managing funds and securing financing.

Preventing Direct Access to Exchange Funds

Another critical compliance issue is maintaining proper control over exchange funds. If you accidentally gain direct access to the proceeds from your property sale, the entire 1031 exchange becomes invalid.

“For instance, an investor once had $1 million in sale proceeds mistakenly wired to their personal account instead of their qualified intermediary’s escrow account. This error invalidated the exchange, resulting in immediate capital gains taxes on the entire $1 million”

To prevent such costly mistakes, your exchange agreement must clearly state that only the qualified intermediary can access the funds during the exchange period. The intermediary should hold all proceeds and directly handle the acquisition of the replacement property. In reverse exchanges, this is especially important due to the added complexities. Securing proper fund management minimizes risks and ensures smooth transitions to the next steps, like financing and title transfers.

Handling Financing and Title Transfer Issues

Financing is often one of the toughest aspects of reverse exchanges. Since you must purchase the replacement property before selling your original, traditional lenders may hesitate to approve loans. The involvement of the EAT, which temporarily holds the property title, adds to the complexity. Many conventional loan products aren’t structured to handle these arrangements, requiring investors to seek specialized lenders who are familiar with 1031 exchange financing or to explore alternatives like seller financing.

Title transfer can also complicate matters. In reverse exchanges, the title must eventually move from the EAT to you once the exchange is complete. This process may incur additional transfer taxes and recording fees, typically ranging from $6,000 to $10,000. Moreover, using an "Exchange First" structure - where your original property is transferred to the EAT before acquiring the replacement property - can trigger loan acceleration clauses and disrupt existing financing agreements.

To avoid these issues, it’s essential to work with lenders experienced in reverse exchanges. Pre-approving financing arrangements that account for EAT-held titles can help you avoid delays and ensure compliance with the 180-day deadline. Addressing these financing and title challenges early is key to keeping your exchange on track and within the legal framework.

Solutions and Methods for Meeting Compliance Requirements

Handling reverse and improvement exchanges requires a structured approach. This involves properly organizing the exchange, working with skilled professionals, and leveraging technology to manage deadlines effectively.

Step-by-Step Compliance Process

The first crucial step is engaging a Qualified Intermediary (QI). They will set up an Exchange Accommodation Titleholder (EAT), often structured as a single-member limited liability company (SMLLC), to temporarily hold the title to your replacement property.

Once the EAT is established, you'll need to enter into a Purchase and Sales Agreement (PSA) with the seller of your replacement property. This agreement must explicitly state that the purchase is part of a reverse 1031 exchange. Within five business days of the transfer, you’ll also need to execute a Qualified Exchange Accommodation Agreement (QEAA), a critical document for meeting IRS requirements.

From the moment the EAT acquires the replacement property, the clock starts ticking. You have 45 calendar days to identify which of your current properties will serve as the relinquished property. After that, you have 180 calendar days to complete the sale of the identified property. These deadlines include weekends and holidays, so it’s smart to allow extra time for unexpected delays.

Following these steps ensures the foundation is in place for professional guidance to help you navigate the process.

Working with Qualified Professionals

While the compliance process provides a roadmap, working with experts ensures you stay on track. Your QI will oversee the exchange, but you’ll also need specialized lenders familiar with EAT financing and attorneys who understand the intricacies of these transactions.

Financial analysts are especially valuable in this process. They assess whether your exchange meets the equal or greater value requirements, monitor key financial metrics, and provide detailed reports for investors or lenders. This ensures your transaction not only complies with IRS rules but also makes financial sense.

For instance, The Fractional Analyst offers a team of financial analysts specializing in commercial real estate. They provide underwriting support, manage assets during the exchange period, and deliver investor reporting. This kind of expertise minimizes costly errors and helps you maximize the financial benefits of your exchange.

Additionally, experienced professionals act as advocates, guiding you through regulatory challenges and helping secure alternative financing options if traditional lenders are hesitant to work with EAT-held properties.

Using Technology for Compliance Tracking

Technology has become an essential tool for managing compliance in 1031 exchanges. Modern property management software simplifies documentation and helps track deadlines. Some platforms even use AI to optimize property selections during the critical 45-day identification period.

Automated reporting systems generate the necessary IRS documentation while offering real-time updates on the exchange’s progress. This reduces human error and ensures all stakeholders have access to accurate, up-to-date information. Additionally, data analytics tools monitor key financial metrics, such as tax savings and ROI, giving you a clear picture of your exchange’s performance.

“For example, Leasey.AI introduced a property management platform in June 2025 that assists investors in tracking potential buyers for relinquished properties and streamlines post-exchange follow-up processes with stakeholders.”

Cloud-based platforms add another layer of security by using encryption and multi-factor authentication to protect sensitive data. Automated workflows send reminders for crucial deadlines, ensuring nothing is overlooked.

Tools like The Fractional Analyst’s CoreCast platform provide real estate intelligence tailored to commercial property transactions. During its beta phase, CoreCast is available for $50 per user per month, offering compliance tracking and analytics to support your exchange.

Other specialized tools, such as ZEscrow, simplify escrow management with features like secure wire transfers and automated account numbering. Similarly, QI Connect integrates Qualified Intermediary services into a single platform, automating much of the 1031 exchange process. These technologies streamline the procedural aspects of exchanges, allowing you to focus on your investment strategy without worrying about missed deadlines or compliance missteps.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

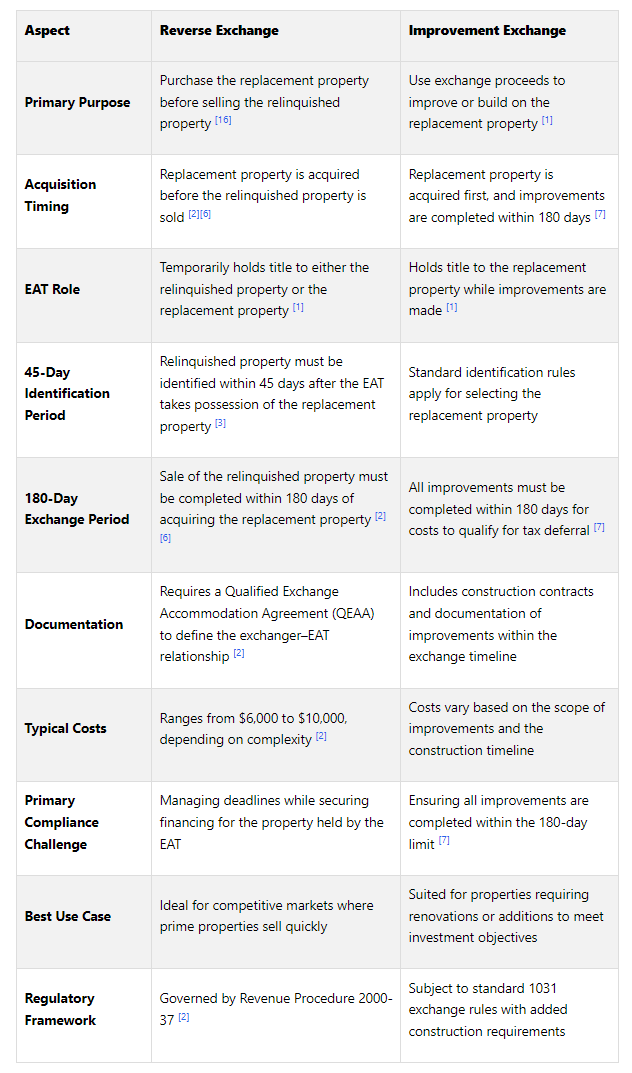

Reverse vs. Improvement 1031 Exchange Comparison

Choosing between a reverse exchange and an improvement exchange depends on your specific investment goals. While both use an Exchange Accommodation Titleholder (EAT) to facilitate the process, they serve very different purposes and come with unique compliance requirements. Below is a detailed comparison to help clarify the distinctions.

Comparison Table

This side-by-side breakdown highlights the core differences in purpose and timing. Reverse exchanges are a great option for locking in a desirable property in fast-moving markets, while improvement exchanges allow you to increase a property's value through renovations or construction.

Improvement exchanges, in particular, demand careful financial planning. You’ll need to track construction costs, monitor timelines, and confirm that all expenses meet IRS requirements for tax deferral. For this, The Fractional Analyst's team can assist in evaluating whether your planned improvements will add enough value to justify the exchange structure.

Ultimately, the choice between these two exchange types depends on your market conditions and investment strategy. Reverse exchanges are perfect when you’ve identified a replacement property but haven’t sold your current one. Improvement exchanges, on the other hand, are ideal for adding value through construction while benefiting from the tax advantages of a 1031 exchange.

Conclusion: Managing Compliance with Professional Help

Handling reverse and improvement 1031 exchanges involves careful planning, detailed documentation, and seamless coordination. These transactions are inherently complex, and the strict IRS rules governing them mean that most investors benefit greatly from professional guidance.

Compliance with IRS regulations is non-negotiable. Missing deadlines or failing to meet guidelines can lead to disqualification of the exchange and significant tax penalties. The tax-deferment benefits of a 1031 exchange are only preserved when every step adheres to the IRS's strict requirements.

Teaming up with qualified intermediaries, tax professionals, and legal advisors who specialize in these transactions can safeguard investors from costly missteps. These experts ensure that all documentation aligns with IRS standards, assist with financing replacement properties, and help resolve title transfer challenges.

Additionally, digital platforms have made compliance more manageable. These tools centralize deadline tracking, document organization, and communication among stakeholders. Features like automated reminders help minimize human errors and keep the process on track. When paired with professional oversight, these technologies simplify even the most intricate exchanges.

Beyond compliance, expert advisors help investors maximize the tax advantages of these exchanges. For those considering reverse or improvement structures, The Fractional Analyst offers in-depth financial analysis and underwriting. Our team evaluates property valuations, investment projections, and provides detailed financial modeling to help you decide if the added complexity and costs of these exchanges are worthwhile.

While hiring professionals involves upfront costs, these expenses are small compared to the potential tax liabilities of a disqualified exchange. Combining expert advice with technological solutions turns even the most complex compliance tasks into a structured and efficient process. Whether you’re securing a prime property through a reverse exchange or enhancing value with an improvement exchange, professional support ensures you stay on track and compliant.

FAQs

-

When it comes to a reverse 1031 exchange, the process allows you to buy the replacement property first, even before selling your current one. This can be a smart move if you're aiming to secure a specific property in a competitive market or need extra time to finalize the sale of your existing property.

On the other hand, an improvement 1031 exchange gives you the opportunity to purchase a property and use the exchange funds to make upgrades or renovations. This option works well if you want to tailor a property to fit your investment goals or boost its overall value.

To figure out which approach works best for your situation, think about your priorities. If securing a property quickly is your main concern, a reverse exchange might be the way to go. However, if your focus is on customizing or increasing the value of a property, an improvement exchange could be the better fit.

-

To meet the strict timelines and rules of a 1031 exchange and steer clear of tax penalties, you need to adhere to two crucial IRS guidelines: the 45-day identification rule and the 180-day exchange period. This means you have 45 days from the sale of your original property to identify potential replacement properties. Then, you must complete the purchase within 180 days - or by your tax return due date, whichever comes first.

Staying ahead of these deadlines requires careful planning. Work with experienced professionals, like a 1031 exchange accommodator, to manage the process and ensure all documentation is handled correctly. If your exchange might stretch beyond the usual tax deadline, think about filing for a tax extension to stay compliant. Keeping everything organized and on schedule allows you to take full advantage of the tax deferral benefits that a 1031 exchange offers while avoiding unnecessary complications.

-

The Role of Qualified Intermediaries (QIs) in 1031 Exchanges

Qualified Intermediaries (QIs) are essential players in the 1031 exchange process. They oversee the transaction, ensure it aligns with IRS rules, and protect the tax-deferred status of your exchange. Their responsibilities include managing the exchange funds and preparing the required documentation. When selecting a QI, it's crucial to focus on their experience, reputation, and dedication to following regulatory standards.

Understanding Exchange Accommodation Titleholders (EATs)

Exchange Accommodation Titleholders (EATs) are key to handling reverse and improvement exchanges. They temporarily hold the legal title to the replacement property, ensuring the transaction complies with IRS requirements. To guarantee a seamless and compliant process, choose professionals who bring a track record of expertise, transparency, and strict adherence to both federal and state regulations.