5 Ways CapEx Affects Portfolio Returns in CRE

Capital expenditures (CapEx) are essential for improving commercial real estate (CRE) properties. Here's how CapEx impacts portfolio returns:

Boosts Property Value: Strategic upgrades like energy-efficient systems or modern renovations attract tenants, increase rents, and raise property valuations.

Short-Term Cash Flow vs. Long-Term Gains: While CapEx reduces short-term liquidity, it enhances cash flow over time through higher income and lower expenses.

Improves ROI: Consistent CapEx spending increases property value, reduces vacancies, and lowers emergency repair costs.

Tax Benefits: Depreciation, cost segregation, and bonus depreciation lower taxable income, offering significant savings.

Reduces Risks: Preventive maintenance avoids costly repairs, extends asset life, and ensures portfolio stability.

Key Takeaway: Allocating 1–2% of a property's value annually for CapEx and planning upgrades strategically can maximize returns while minimizing risks.

Capital Expenditures (CapEx) in Real Estate Explained

1. Property Value Increases Through CapEx Investments

Investing in capital expenditures (CapEx) strategically can transform a property’s appeal, modernize essential systems, and elevate its market value. These upgrades often position a property as a premium choice, capable of attracting tenants willing to pay higher rents. Take a lobby renovation, for example - it’s not just about aesthetics but about creating a lasting first impression. As BAF Corporation puts it:

“A modern lobby isn’t just about looking good; it’s a strategic asset in attracting desirable tenants”

The financial benefits of smart CapEx investments are clear. In January 2025, Fluid Property Management shared a notable case: a $50,000 CapEx upgrade led to a 15% increase in rental income, a 25% reduction in tenant turnover, and a $200,000 boost in property valuation [7].

Energy efficiency projects often deliver some of the highest returns. For instance, a simple LED lighting retrofit added $426,000 to a property’s value [5]. These upgrades not only appeal to eco-conscious tenants but also reduce operating costs, making them a win-win investment.

To maximize gains, aligning your CapEx strategy with market demands is essential. Properties that follow structured CapEx plans tend to retain 15–20% more value over the long term compared to those relying on reactive maintenance [8]. Even cosmetic improvements, such as updated flooring, modern fixtures, and refreshed common areas, can significantly enhance a property’s perceived value, justifying higher rental rates.

The importance of staying competitive is underscored by industry trends. In fact, 97% of commercial real estate (CRE) professionals planned to maintain or increase their investments in property technology in 2024 [3]. This focus on innovation and modernization highlights how CapEx investments can set properties apart in a crowded market.

2. Short-Term Cash Flow Reduction vs. Long-Term Cash Flow Growth

Capital expenditures (CapEx) often come with a hefty price tag, creating immediate pressure on short-term cash flow. Whether it's upgrading HVAC systems, renovating shared spaces, or installing a new roof, these projects demand significant capital upfront, which can temporarily tighten liquidity. However, this short-term strain often lays the groundwork for long-term financial benefits.

Over time, CapEx can enhance rental income and reduce operating expenses, ultimately boosting cash flow. Modern fixtures and energy-efficient upgrades not only appeal to higher-paying tenants but also help cut costs. For example, energy-saving solutions like LED lighting or programmable thermostats can significantly lower utility bills [2][4][9].

To navigate these challenges effectively, careful financial planning is key. Experts suggest setting aside 10–15% of net operating income for future capital expenditures [8]. Another common approach is to reserve 1–2% of the property’s purchase price annually as a CapEx fund [8]. These proactive measures can help property owners avoid cash flow disruptions when major upgrades are needed.

Timing and financing also play a critical role. Financing CapEx allows costs to be spread over time, aligning cash outflows with the lifespan of the asset and its expected returns [10]. Maintaining reserves equivalent to 2–6 months of operating expenses can provide a safety net during large-scale projects [8].

Regularly revisiting CapEx budgets - such as quarterly reviews [8] - can help strike a balance between immediate operational needs and long-term goals. This approach transforms potential financial hurdles into opportunities, ensuring properties remain profitable and competitive in the market.

3. ROI Improvement Through Consistent CapEx Spending

When it comes to maximizing property returns, consistent capital expenditure (CapEx) spending plays a pivotal role. Beyond improving cash flow, a regular CapEx strategy significantly enhances long-term ROI. Simply put, CapEx isn’t just about maintaining properties - it’s about driving profitability over time.

Properties with well-planned CapEx schedules tend to retain 15–20% more value over the long term compared to those lacking such systems [8]. This boost comes from three main factors: improved operational efficiency, happier tenants, and fewer emergency repair costs.

Investing in modern systems is a game-changer for operational efficiency. Upgraded systems, like advanced HVAC controls or monitoring tools, can extend equipment life by up to 10 times [11]. These upgrades also lower energy costs and reduce the likelihood of equipment failure. Plus, property management technologies can unlock additional revenue streams, increasing billable services by as much as 10% [11].

Tenant satisfaction is another big win. Consistent CapEx investments lead to higher retention rates and make it possible to charge premium rents [2]. According to JLL research, demand for buildings with tenant-focused amenities is expected to rise by 12% by 2025 [12]. Meeting these expectations not only keeps tenants happy but also strengthens ROI.

Emergency repairs? They’re a costly headache. Poor planning accounts for 80% of unexpected property expenses [8]. However, effective CapEx planning can cut delays by 30% through integrated project monitoring [8]. These savings directly impact the bottom line while fostering better tenant relationships.

Financial discipline is crucial to realizing these benefits. Many property owners set aside 1–2% of the purchase price annually for CapEx, ensuring funds are available for both planned upgrades and unforeseen needs [8].

Timing also matters. Prioritizing high-impact projects - like energy-efficient upgrades, tech improvements, or shared space enhancements - can deliver quicker payback periods and stronger tenant engagement. Aligning CapEx spending with market trends and tenant preferences, rather than just maintaining the status quo, is key.

“Properties with well-laid-out CapEx plans consistently perform better than those without proper planning systems.”

The results of consistent and strategic CapEx investments speak for themselves: higher rents, fewer vacancies, and increased property values. Every dollar spent on improvements translates into measurable returns. Beyond these immediate gains, such investments also offer tax benefits and contribute to greater portfolio stability.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

4. Tax Benefits and Depreciation from CapEx Projects

CapEx projects do more than just improve ROI - they also offer significant tax advantages that can boost overall portfolio returns. These benefits come in the form of depreciation, cost segregation, bonus depreciation, and Section 179 expensing, all of which help lower taxable income over time.

Depreciation: A Key Tax Advantage

The IRS allows commercial property owners to depreciate buildings over 39 years, offering annual deductions that reduce taxable income [14]. For instance, if you own a $5 million commercial building, you could claim roughly $128,000 in depreciation deductions every year. However, it's important to note that only the building and qualifying improvements are eligible for depreciation - land is excluded from this benefit [14][16].

Cost Segregation: Speeding Up Tax Savings

Cost segregation studies can help identify components of a property that depreciate faster. This allows property owners to write off 20–30% of a property's value within 5–15 years, significantly accelerating tax savings [14].

Bonus Depreciation and Section 179: Immediate Deductions

In 2025, bonus depreciation lets you deduct 40% of eligible assets - like personal property and land improvements - right away [15]. Meanwhile, Section 179 expensing allows you to fully deduct the cost of qualifying equipment in the first year, with limits increasing to $2.5 million in 2025 [18][19].

Here’s an example: A $3 million investment could generate a $1.25 million Section 179 deduction, $700,000 in bonus depreciation, and $210,000 in standard depreciation. Altogether, this results in a total first-year deduction of $2.16 million. For a C-Corp in the 21% tax bracket, this translates to substantial cash savings [19]. These deductions, when paired with operational improvements, amplify the financial benefits of CapEx projects.

Timing Matters: Take Advantage of Bonus Depreciation

Bonus depreciation is set to decline in the coming years - dropping from 40% in 2025 to 20% in 2026, before being phased out entirely in 2027 [19][20]. Savvy investors are prioritizing capital improvements, such as HVAC upgrades and energy-efficient retrofits, to take full advantage of these benefits while they’re still available [18].

Understanding Depreciation Recapture

One thing to keep in mind is depreciation recapture, which is taxed at 25% when you sell a property. This rate often exceeds the long-term capital gains tax rate [14]. However, a 1031 exchange can help defer these taxes. For example, if you purchase a property for $1 million and claim $300,000 in depreciation, then sell it for $1.5 million, your taxable gain would include $500,000 of appreciation and $300,000 in recapture. By rolling the proceeds into another property through a 1031 exchange, you can defer the taxes owed [14].

Even with recapture taxes, depreciation remains a valuable tool. Let’s say you claim $300,000 in depreciation over 10 years, saving $111,000 in taxes at a 37% rate. Upon selling, you might owe $75,000 in recapture taxes, leaving you with a net tax savings of $36,000 [17]. The time value of money makes these benefits worthwhile.

When paired with operational efficiencies and increased ROI, these tax strategies highlight the value of well-planned CapEx investments. Strategic capital improvements not only enhance property performance but also provide a financial edge through significant tax savings.

5. Risk Reduction and Portfolio Stability Through Preventive CapEx

Preventive CapEx plays a crucial role in safeguarding your portfolio by minimizing unexpected costs and ensuring steady returns. Beyond boosting property value and ROI, as discussed earlier, proactive capital expenditures add another layer of stability. Instead of waiting for systems to fail, savvy investors prioritize preventive maintenance to reduce risks that could negatively impact portfolio performance.

Avoiding Costly Emergency Repairs

The financial difference between reactive and proactive maintenance is substantial. Reactive maintenance costs approximately 25¢ per square foot, while proactive upkeep costs only 14¢ - a 44% savings [22].

“A well-implemented preventative maintenance program allows inefficiencies in the building to be detected before they become serious problems. This extends the life of building systems and reduces the capital costs associated with upgrading or replacing such systems. In addition, regular maintenance prevents unexpected repairs and replacements, resulting in significant savings on CapEx expenses.”

The savings become even more evident when you look at the lifespan of specific building systems. For instance, roofs maintained proactively last an average of 21 years, compared to just 13 years under reactive maintenance [22]. That’s a 62% longer lifespan, allowing you to delay major capital expenditures while avoiding the steep costs of emergency repairs.

Reducing Tenant Turnover Through Consistent Property Performance

Preventive CapEx doesn’t just protect your property - it also enhances tenant satisfaction. By maintaining systems like HVAC and plumbing, tenant turnover can be reduced by up to 40%, while long-term maintenance costs decrease by 12–18% [24]. When properties are well-maintained and systems operate smoothly, tenants are more likely to stay.

Many leading property management firms have adopted proactive strategies to achieve these results. For example:

Greystar Real Estate Partners: Uses IoT sensors for predictive HVAC maintenance, addressing issues before tenants even notice them [24].

AvalonBay Communities: Conducts quarterly unit inspections with digital checklists for consistent upkeep [24].

Camden Property Trust: Utilizes mobile apps to streamline maintenance requests and scheduling [24].

Tenant turnover can lead to significant costs, such as lost rent, marketing expenses, and tenant improvement allowances. Reducing these costs has a direct, positive impact on your portfolio’s bottom line.

Ensuring Regulatory Compliance and Avoiding Penalties

Regular inspections help identify code violations early, preventing fines or costly retrofits [13]. Additionally, energy-efficient upgrades and green certifications, planned as part of preventive CapEx, can lead to tax breaks and lower insurance premiums. Notably, 63% of investors strongly agree that green strategies improve tenant retention and occupancy rates [23]. These proactive measures not only help you avoid penalties but also strengthen the overall stability of your portfolio.

Building Long-Term Portfolio Stability

Preventive CapEx is a cornerstone of maintaining a stable portfolio. Reliable building systems enable predictable cash flows and reduce financial volatility. When major systems operate efficiently, you can plan maintenance expenses more accurately and avoid unexpected budget disruptions.

“I like to use the analogy of the dentist, do you want to wait until it hurts, or do you want to prevent it from hurting?”

To achieve these benefits, focus on building strong contractor relationships, implementing management software to track maintenance, and training staff to identify potential issues early. While there’s an upfront cost to these efforts, the long-term rewards include fewer emergency repairs, extended equipment life, and happier tenants.

Preventive CapEx shifts maintenance from a reactive burden to a strategic advantage. By investing in routine upkeep and planned improvements, you not only protect your portfolio from financial shocks but also create a dependable operating environment that attracts tenants and earns investor confidence.

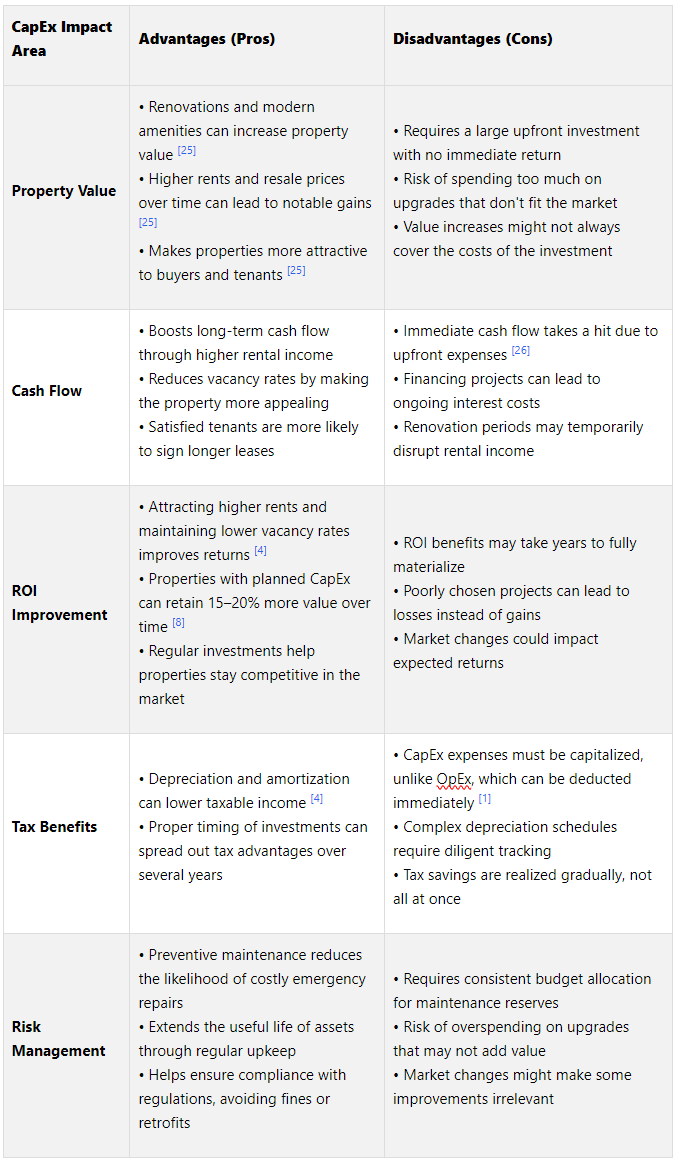

Comparison Table

Here's a quick look at the pros and cons of CapEx investments to help you make informed decisions for your portfolio.

Conclusion

Capital expenditures (CapEx) play a pivotal role in maximizing returns in commercial real estate. The five key impacts we’ve discussed - boosting property value, optimizing cash flow, improving ROI, offering tax advantages, and reducing risks - highlight why thoughtful CapEx planning is a must for any serious investor.

Properties with well-structured CapEx schedules tend to retain 15–20% more value over the long term [8]. Additionally, seasoned investors often allocate 1–2% of the purchase price annually for CapEx [8]. These figures encapsulate the benefits outlined earlier, emphasizing how a disciplined approach can distinguish thriving portfolios from those burdened by unexpected costs and declining competitiveness.

“Capital expenditures are an essential part of commercial real estate investment, helping maintain the value, competitiveness, and profitability of a property.”

As previously mentioned, this disciplined strategy forms the backbone of effective property management today. It involves creating detailed budgets, prioritizing projects based on urgency and impact, and maintaining reserves - commonly 10–15% of net operating income - for future expenditures [8].

To execute these strategies effectively, modern tools and expertise are indispensable. Centralized tracking systems, real-time analytics, and streamlined approval processes are now essential for managing CapEx efficiently. Platforms like The Fractional Analyst provide invaluable support, offering tailored financial analysis, underwriting services, and strategic insights to help investors refine their CapEx plans.

Whether you’re planning a major renovation, setting up preventive maintenance schedules, or evaluating the ROI of sustainability upgrades, expert financial modeling and market research can make the difference between a profitable decision and an expensive misstep. In today’s complex real estate market, having access to tools that combine deep analytics with actionable guidance is critical. These resources not only help mitigate risks but also enhance a portfolio’s competitive edge.

At its core, smart CapEx management is about making strategic investments that drive long-term value and ensure a resilient, profitable portfolio.

FAQs

-

Determining an appropriate CapEx budget involves balancing immediate property needs with long-term upgrades. A good rule of thumb is to allocate 10–15% of your net operating income (NOI) for future capital expenses. Another helpful approach is setting aside 1–2% of the property's value each year to preserve and potentially increase its worth over time.

To get this right, regular property evaluations and careful planning are essential. These steps help pinpoint necessary projects and prevent both over-investing and under-investing. By aligning improvements with your financial goals, you can make smarter decisions that boost your return on investment (ROI).

-

To manage short-term cash flow while reaping the long-term advantages of CapEx investments in commercial real estate, start by securing flexible financing options like lines of credit or bridge loans. These tools can help you address immediate cash needs without putting excessive pressure on your operational budget.

Creating a detailed budget is equally important. Make sure it accounts for both essential maintenance and future upgrades. This approach allows you to tackle urgent property issues while strategically planning for improvements that increase property value and long-term profitability. Regularly monitoring cash flow and staying on top of receivables and payables is another key step. This ensures liquidity is maintained, making it easier to consistently invest in CapEx projects that strengthen your portfolio's performance over time.

-

Tax perks like depreciation and cost segregation are key tools for boosting portfolio returns by cutting taxable income. Depreciation lets property owners deduct the natural wear and tear of their properties over time, which helps lower annual tax bills. Cost segregation takes this a step further by breaking down property components into shorter depreciation timelines. This means investors can claim deductions sooner, leading to earlier tax savings.

To get the most out of these benefits, it’s worth conducting a detailed cost segregation study. This process pinpoints assets that qualify for accelerated depreciation. On top of that, using bonus depreciation where it applies can amplify early tax savings. Even as bonus depreciation gradually phases out by 2027, these strategies can free up cash for reinvestment, improving cash flow and strengthening portfolio performance over the long haul.