Retail vs Industrial: Investment Analysis 2025

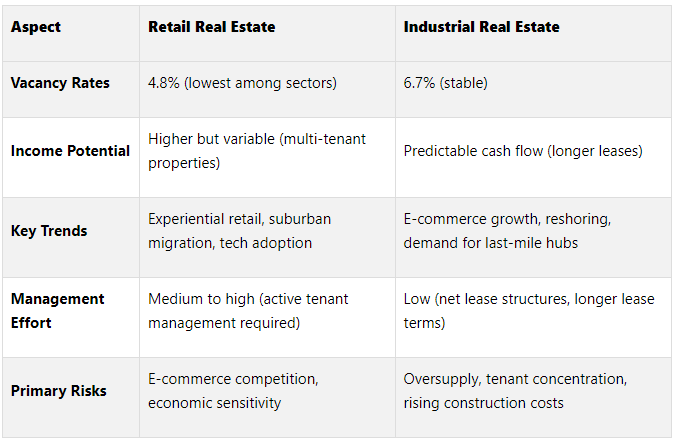

Investing in retail and industrial real estate in 2025 offers unique opportunities and challenges. Here's a quick breakdown to help you decide:

Retail Real Estate: Thrives in prime locations, with historically low vacancy rates (4.8%) and rising rents. Grocery-anchored centers and experiential retail are driving growth. However, it faces risks from e-commerce competition and economic fluctuations.

Industrial Real Estate: Supported by e-commerce and reshoring trends, it offers steady returns and long-term leases. Vacancy rates are stable at 6.7%, but rising construction costs and oversupply in some areas pose challenges.

Quick Comparison

Key Takeaway:

If you prefer higher returns and are ready for active management, retail is a strong choice, especially in Sun Belt markets.

For steady income with less day-to-day involvement, industrial real estate offers stability backed by e-commerce demand.

Choose based on your risk tolerance, investment goals, and management capacity.

1. Retail Real Estate Investments

Financial Performance

Retail real estate has shown solid financial growth in 2025. Among all commercial property types, it boasts the lowest vacancy rate, creating a tight market where landlords can charge higher rents and enjoy better net operating income (NOI)[2].

National retail vacancy rates have dipped below 5%, largely because of limited new development since 2020[11]. This scarcity has pushed lease rates up by 7% annually, directly benefiting property owners with increased cash flow[9]. For income-focused investors, this marks a positive rebound from the tougher post-pandemic years.

Capitalization rates remain appealing as public REIT and private real estate valuations align more closely. The cap rate spread narrowed significantly, from 212 basis points at the end of 2023 to just 69 basis points by late 2024, signaling growing confidence in the sector's stability and income potential[12].

Grocery-anchored retail centers have emerged as top performers, delivering consistent NOI growth compared to other property types[7].

Market Trends

The retail landscape is evolving alongside shifting consumer behavior. Global retail sales are expected to hit $32.4 trillion by 2025[9], a surge driven by suburban migration and the rise of experiential retail.

Interestingly, 85% of consumers are more inclined to visit stores that host events or offer unique experiences[9]. This has pushed retailers to adopt flexible spaces that blend shopping with entertainment.

Suburban retail locations are seeing a 15% year-over-year increase in foot traffic[9], reflecting the ongoing movement away from urban areas. Sun Belt cities, in particular, are gaining attention as institutional investors focus on these high-growth markets[2].

Technology is now a must-have in retail. In 2025, retailers are reducing their average store size by 20% while doubling investments in technology and experiential features. This shift has led to a 25% boost in sales per square foot[10]. For landlords, these changes mean higher rents per square foot and stronger tenant relationships.

Meanwhile, value retailers and food & beverage tenants are leading the charge in new store openings[7]. Additionally, 60% of consumers now prefer retailers that offer seamless omnichannel options[9], transforming physical stores into hubs for both fulfillment and customer experiences.

Risk-Return Profiles

Retail real estate's risk profile has improved significantly, thanks to strong performance metrics and promising market trends. Investor sentiment is turning positive, with retail now ranking as the third most preferred property type among commercial real estate investors, a jump from the previous year[8]. The outlook is particularly bright for well-located properties, as 70% of commercial real estate investors surveyed by CBRE plan to increase their acquisitions in 2025 compared to last year[8].

That said, not all retail properties are thriving. In Q1 2025, U.S. retail net absorption fell by 2.7 million square feet[7], primarily affecting lower-quality assets. On the other hand, high-quality properties in prime suburban areas and Sun Belt cities continue to attract tenants and investors.

With the 10-year Treasury yield expected to stay above 4% in 2025[8], valuations may face some pressure. However, this environment also presents opportunities for well-capitalized investors to make strategic acquisitions.

Geographic location and property type are key considerations. Properties designed for experiential retail tend to deliver better risk-adjusted returns compared to older malls or struggling urban assets. This makes careful selection essential for maximizing investment potential.

2. Industrial Real Estate Investments

Financial Performance

Industrial real estate held steady in 2025 after experiencing years of rapid growth. National vacancy rates hovered between 6.3% and 6.8%, showing stability in the market[1][13]. According to CBRE, national vacancy rose slightly by 20 basis points to 6.3% in Q1 2025, while net absorption reached 23.3 million square feet during the same period[13]. Meanwhile, JLL reported that roughly 253 million square feet of industrial projects were under construction by the end of Q1[13].

Rents also saw modest growth. Nationwide asking and effective rents increased by 0.3% in Q1 2025, consistent with the previous quarter[14]. Leasing activity remained solid, with approximately 180 million square feet leased during Q1, even as construction activity began to slow[13]. The average lease size for logistics and distribution facilities grew by 10.6% year-over-year, reaching 245,000 square feet, reflecting the rising demand for larger operations[15]. However, tariffs introduced in April 2025 are expected to push commercial construction costs up by about 5%, potentially impacting the economics of new developments[13].

Market Trends

These financial patterns reflect broader changes shaping the industrial real estate market. E-commerce continues to be a key driver, with projections suggesting it will account for 33% of U.S. retail sales by 2027[15]. This growth is particularly boosting demand for smaller distribution centers in urban areas, where last-mile delivery is critical.

Reshoring is another major trend, as companies bring manufacturing closer to home to create more flexible and reliable supply chains. This shift is fueling demand for domestic industrial space, with U.S. manufacturing facilities expected to expand their footprint by 6% to 13% by 2034[5][14].

“Companies that had previously been removing inefficiency from their supply chains to try to utilize just-in-time inventory to cut every cost realize that there’s a much higher cost to super-efficient supply chains, where if you run out of product, that costs you dollars, whereas just-in-time inventory saves you pennies.”

The rise of AI is also reshaping the sector, driving demand for specialized data centers that require industrial properties with significant power capacity[14]. Workforce access and proximity to ports are becoming key considerations for industrial tenants, particularly as trade policies evolve[14]. Modern tenants are increasingly seeking facilities with advanced features. Greg Schementi, president at international CRE firm Cresa, highlights demand for "highly amenitized buildings that meet power demands, the ability for flexibility of space, generous clear heights, energy efficiency, and in some cases child-care and wellness programs"[15].

Risk-Return Profiles

The industrial real estate sector is evolving, with its risk-return profile reflecting a more mature and stable phase. While the explosive growth seen during the pandemic has slowed, structural drivers like e-commerce and reshoring continue to support strong fundamentals.

“Industrial real estate isn’t falling out of favor - it’s maturing.”

The sector’s lower volatility compared to other commercial real estate types makes it attractive, with industrial and multifamily properties expected to lead any recovery in investment activity[13]. Strategic geographic and property type selection has become increasingly crucial for managing risk. Properties near expanding manufacturing hubs or designed for regional distribution tend to offer better risk-adjusted returns[15]. Smaller distribution centers, particularly those between 30,000 and 80,000 square feet near urban areas, remain highly appealing due to their role in last-mile delivery[15].

Investors should focus on properties with modern infrastructure, such as those offering flexible layouts, advanced technology, and robust power capacity. These features often command premium rents and attract high-quality tenants[15]. Active management is also essential in this maturing market. Retrofitting properties to meet modern demands can significantly boost value and attract premium tenants, offering the potential for strong returns during the hold period[5].

Although challenges like rising construction costs due to trade policies may pose some risks, the sector’s underlying demand drivers suggest continued strong performance ahead.

The Forces Driving Retail and Industrial CRE

Pros and Cons

Drawing from the metrics discussed earlier, here’s a closer look at the advantages and disadvantages of retail and industrial real estate. The table below highlights the key points to consider for each sector.

Retail real estate comes with unique challenges, particularly in adapting to shifting consumer behavior and e-commerce competition. On the other hand, industrial real estate provides more predictable cash flows, thanks to longer lease terms and demand from trends like e-commerce and manufacturing reshoring. However, these benefits come with risks like potential oversupply and higher upfront costs.

The risk profiles between these sectors vary considerably. Retail properties often experience more volatility due to their dependence on economic conditions and consumer spending. Multi-tenant retail properties help spread risk but require active management, while single-tenant industrial properties carry the risk of tenant departure, which can significantly impact cash flow.

Location plays a critical role in both sectors but in very different ways. Retail properties thrive on foot traffic, demographics, and proximity to complementary businesses. Industrial properties, however, prioritize access to transportation hubs, labor pools, and supply chain networks. While both benefit from strategic location choices, the definition of a "prime location" differs greatly between bustling shopping areas and industrial zones.

Ultimately, your investment strategy will hinge on your goals and management capacity. Retail properties offer the potential for higher returns but demand active involvement, while industrial properties provide steady income with less day-to-day oversight.

Conclusion

As you refine your investment strategy for 2025, weigh the opportunities in retail and industrial real estate based on your goals, risk tolerance, and management preferences. Both sectors preset distinct advantages, catering to different investor needs.

If you're looking for steady returns with minimal hands-on involvement, industrial properties might be the right choice. With vacancy rates around 6.7% and continued support from the e-commerce sector, this market offers reliable performance [3][4].

On the other hand, retail real estate is better suited for those ready to take an active management role in exchange for higher potential returns. The sector is showing strong recovery, with retail investments climbing 13% in Q1 2025, particularly in grocery-anchored centers and urban retail spaces [18]. Achieving success in this area requires careful attention to tenant selection, location dynamics, and evolving consumer trends - making it an appealing option for seasoned investors with a deep understanding of market nuances.

CBRE forecasts a potential 10% uptick in investment activity in 2025 [3]. To capitalize on this, consider building exposure before market distress peaks, focusing on markets with balanced supply and demand [6]. Tailoring your strategy to each sector is key: industrial properties offer stability, while well-managed retail assets provide opportunities for growth.

Data remains a critical tool in shaping your approach. Analyzing tenant mixes, foot traffic, and market demographics [3] can help you identify promising opportunities. Platforms like the Fractional Analyst's CoreCast provide the financial modeling and market intelligence needed to guide decisions in both retail and industrial investments.

Ultimately, success will hinge on leveraging technology, focusing on high-quality assets, and staying adaptable as market conditions shift.

FAQs

-

When weighing retail versus industrial real estate investments in 2025, there are a few important trends to keep in mind.

Retail real estate is making a strong comeback. Vacancy rates are low, and demand is climbing, especially for grocery-anchored shopping centers and urban retail spaces. Investment activity in this sector has risen by 13% compared to the previous year, with much of the growth fueled by strategic acquisitions in major cities like New York and Boston.

On the other hand, the industrial sector continues to benefit from the steady growth of e-commerce. However, leasing activity has leveled off to pre-pandemic norms. A key trend here is a "flight to quality", where newer, high-end properties are outperforming older ones. While some industrial properties are seeing higher vacancy rates, the market is expected to become more competitive by the end of 2025.

When deciding between these two sectors, consider factors such as current market trends, the quality of the properties, location advantages, and how well each option fits your investment strategy and risk tolerance.

-

The explosive growth of e-commerce is reshaping both retail and industrial real estate in profound ways. On the industrial front, the surge in demand for logistics and warehouse spaces is closely tied to the expansion of online shopping. To put it into perspective, e-commerce accounted for 56% of total retail goods sales growth in the U.S. in 2024. This shift is expected to fuel the need for an additional 250–350 million square feet of logistics space over the next five years. Why? E-commerce operations typically require three times more logistics space compared to traditional retail setups.

Meanwhile, the retail sector is undergoing its own transformation. Businesses are rethinking physical stores, focusing on creating experiential shopping environments and seamlessly integrating online and offline channels. Many retailers are opting for smaller store footprints while bolstering their logistics networks to meet consumer demands for faster delivery. This hybrid approach highlights the changing dynamics between brick-and-mortar locations and digital platforms, shaping how investors view these real estate markets as we move into 2025 and beyond.

-

Investors can reduce the risks associated with oversupply in industrial real estate by following a few smart strategies. Start by conducting thorough market research to pinpoint areas where demand is stable or growing, while steering clear of regions that show signs of oversupply. It’s also a good idea to diversify your portfolio by investing in a mix of locations and asset types, which helps spread out risk. Building and maintaining strong tenant relationships is another key step - happy tenants are more likely to renew leases, keeping vacancies low.

On top of that, consider offering flexible lease terms that can adjust to market shifts, such as shorter leases or options for expansion. Keeping an eye on economic trends, like changes in e-commerce or manufacturing activity, can also give you a heads-up on potential shifts in demand. Lastly, prudent financial planning - including maintaining cash reserves - can act as a safety net during market downturns. By following these steps, investors can better protect their investments and handle the challenges that come with oversupply.