How to Build CRE Investor Portals

Building a Commercial Real Estate (CRE) investor portal is about creating a secure, user-friendly platform where sponsors and investors can access data, documents, and analytics in real time. These portals simplify communication, automate reporting, and improve the investor experience. Here's a quick breakdown of how to get started:

- Define Goals and Investor Needs: Clarify whether the portal is for transparency, automation, fundraising, or investor retention. Segment investors (e.g., high-net-worth individuals, family offices, institutions) to tailor features like dashboards, reporting, and access.

- Choose the Right Platform: Options include Salesforce Experience Cloud (customizable), Yardi Voyager (ERP-focused), and AppFolio Investment Manager (easy-to-deploy). Match platform capabilities to your firm's size, resources, and technical needs.

- Core Features: Include real-time dashboards, secure document management, and role-based access. Self-service tools like tax form downloads and capital call submissions save time for both investors and sponsors.

- Integration and Security: Connect the portal to accounting and CRM systems via APIs for accurate, real-time data. Ensure security with encryption, role controls, and compliance with U.S. regulations (e.g., KYC, AML, SEC).

- Post-Launch Improvements: Use metrics like login frequency and document downloads to identify areas for improvement. Plan updates quarterly, adding features like mobile optimization or AI-driven analytics.

Key Takeaway: A well-designed portal streamlines operations, enhances investor trust, and provides actionable insights. Platforms like Salesforce, Yardi, and AppFolio offer different strengths, so choose based on your firm's priorities and resources.

How to Build an Investor Portal with No Code (+ Free Template)

Define Your Portal Objectives and Investor Requirements

Before diving into platform options, start by clarifying your objectives. Ask yourself: Is the portal meant to boost transparency with investors, cut down on manual reporting, speed up fundraising, or improve retention? Each goal will shape the features you need. For example, if transparency and trust are your priorities, focus on tools like performance dashboards, historical data, and detailed statements. If scaling operations is the aim, automation features - like streamlined document delivery, self-service access to K-1s, and automated distributions - should take center stage. On the other hand, if raising capital is critical, look for features like online deal rooms, subscription workflows, and integrated e-signatures to shorten the fundraising process. These priorities set the stage for platform selection and design.

Next, segment your investor base based on factors like ticket size, sophistication, and reporting needs. Create two to four key groups - such as high-net-worth individuals, family offices, and institutional investors - and identify their unique requirements. High-net-worth investors typically prefer simple, mobile-friendly dashboards and clear deal summaries. Family offices often need detailed performance data, downloadable reports (like Excel or CSV), and the ability to manage multiple entities under one login. Institutional investors may expect advanced benchmarks, in-depth risk metrics, compliance documentation, and strict role-based access for their teams. By tailoring the portal to these groups, you can ensure it aligns with their specific behaviors and expectations.

After defining your investor segments, identify the internal teams that will contribute to and rely on the portal. Teams like asset management, accounting, investor relations, capital markets, and legal/compliance all have distinct workflows that need to be streamlined. For instance, accounting teams benefit from integrations with fund and property ledgers to automate contributions and distributions. Investor relations teams need CRM synchronization to maintain consistent investor profiles. Asset managers require tools to update property KPIs and dashboard narratives efficiently, while legal and compliance teams need standardized templates, approval workflows, and robust tracking for document delivery. These requirements will help you determine whether platforms like Salesforce Experience Cloud, Yardi, or AppFolio are a good fit, as well as identify any APIs or middleware needed for a cost-effective solution.

Establish a set of key performance indicators (KPIs) that matter to both your team and your investors. Metrics like equity multiple, IRR, cash-on-cash return, current yield, total distributions, occupancy, NOI, and leverage ratios are crucial. Dashboards should present these KPIs in USD for U.S.-based investors, with options to view data quarterly, annually, or by deal, entity, or portfolio. Investors also value side-by-side comparisons of actual versus pro forma performance, trend charts, and aggregated views of their holdings. If your firm lacks in-house expertise in financial modeling or data structuring, partners like The Fractional Analyst can help standardize underwriting and asset-level data for seamless integration into portal reports.

Finally, conduct stakeholder interviews and surveys to validate your assumptions and fine-tune your portal objectives. Engage key investor groups to understand their most valued metrics, preferred reporting frequency (monthly or quarterly), and favored formats (PDF or web dashboards). These insights will help you align your portal design with investor needs while ensuring compliance with SEC, KYC, and AML requirements from the outset. By addressing both investor expectations and regulatory standards, your portal will be set up for success from day one.

Select the Right Platform for Your Investor Portal

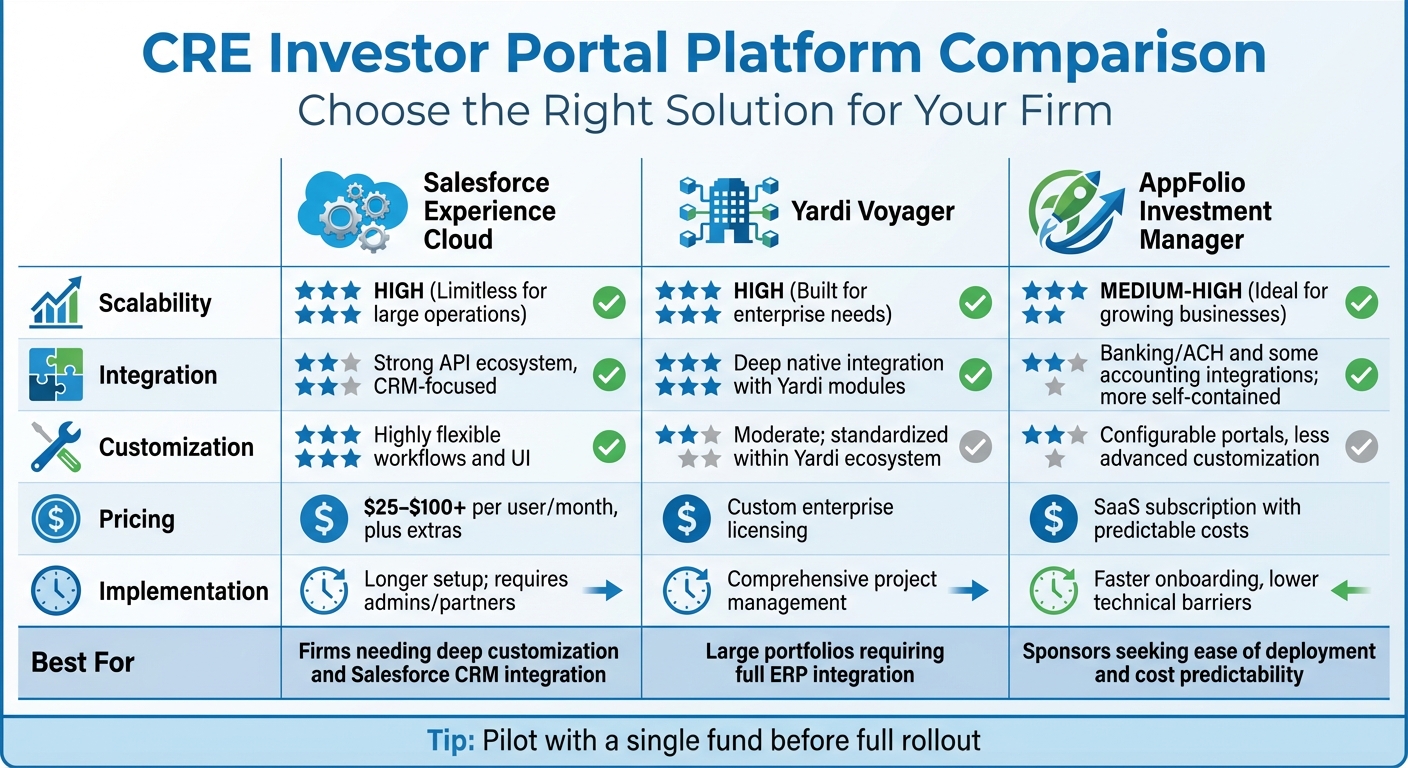

CRE Investor Portal Platform Comparison: Salesforce vs Yardi vs AppFolio

Once you've identified your goals, the next step is choosing a platform that balances functionality, integration, and cost. The right platform depends on your firm's size, technical capabilities, existing systems, and growth plans. Among the top options in the commercial real estate (CRE) investor portal space are Salesforce Experience Cloud, Yardi Voyager, and AppFolio Investment Manager. Each caters to different priorities, from deep customization to streamlined deployment. Here's how to evaluate these platforms.

It's crucial to select a platform that aligns with your investor segments and key performance indicators (KPIs).

Salesforce Experience Cloud for Customization

If your firm requires extensive flexibility and scalability, Salesforce Experience Cloud is a standout choice. This platform is perfect for firms with complex investor structures or those already using Salesforce. It offers features like custom dashboards, role-based access, AI-powered portfolio analysis, and robust API connections for seamless integration with third-party tools like accounting software and business intelligence platforms.

Take, for example, Ascendix's work with Innovative Capital. They customized Salesforce Experience Cloud to integrate CRM data into branded dashboards, creating a tailored solution. Pricing starts at $25 per user per month and can exceed $100, depending on additional costs for CRM licenses, implementation, and ongoing support. However, this platform requires dedicated technical expertise, such as admins or developers, which could pose a challenge for firms without in-house IT resources.

Yardi Voyager for System Integration

Yardi Voyager is a comprehensive real estate ERP system, making it ideal for firms that need seamless integration across property management, accounting, and investor reporting. If your firm already uses Yardi for property operations, adding its investment management and investor portal modules can centralize data and simplify processes like NAV calculations and distributions.

That said, Yardi's interface can feel outdated and complex, especially for non-accounting users, and the learning curve may slow adoption. Its custom enterprise licensing, based on portfolio size and selected modules, may also be a consideration. Yardi is best suited for firms managing large portfolios that require full ERP integration, though it may not be the most cost-effective or user-friendly option for smaller firms or those prioritizing a modern, investor-facing experience.

AppFolio Investment Manager for Growing Businesses

For growing CRE syndicators and middle-market sponsors, AppFolio Investment Manager offers an intuitive, out-of-the-box solution. It combines features like integrated CRM, document management, capital-raising tools, and investor communication under one subscription. Designed for firms without extensive IT resources, it provides faster onboarding and straightforward pricing.

AppFolio excels at delivering a modern, mobile-friendly experience with automated distributions and secure document delivery. While it scales well for mid-sized portfolios, it lacks the advanced customization of Salesforce and doesn't function as a full ERP like Yardi. This may limit its appeal for firms requiring complex integrations or highly tailored solutions. However, for sponsors looking for a quick-to-deploy platform with predictable monthly costs and a user-friendly experience, AppFolio is a strong contender.

Platform Comparison Table

| Criteria | Salesforce Experience Cloud | Yardi Voyager | AppFolio Investment Manager |

|---|---|---|---|

| Scalability | High; limitless for large operations | High; built for enterprise needs | Medium-high; ideal for growing businesses |

| Integration | Strong API ecosystem, CRM-focused | Deep native integration with Yardi modules | Banking/ACH and some accounting integrations; more self-contained |

| Customization | Highly flexible workflows and UI | Moderate; standardized within Yardi ecosystem | Configurable portals, less advanced customization |

| Pricing | $25–$100+ per user/month, plus extras | Custom enterprise licensing | SaaS subscription with predictable costs |

| Implementation | Longer setup; requires admins/partners | Comprehensive project management | Faster onboarding, lower technical barriers |

| Best For | Firms needing deep customization and Salesforce CRM integration | Large portfolios requiring full ERP integration | Sponsors seeking ease of deployment and cost predictability |

Before fully rolling out your chosen platform, consider piloting it with a single fund or a subset of investors. This approach allows you to test usability and confirm data accuracy. If your firm lacks expertise in financial modeling or data preparation for portal integration, partners like The Fractional Analyst can help standardize underwriting and asset-level data, ensuring smooth reporting on any platform you choose.

Core Features to Include in Your Investor Portal

Once you've chosen your platform, the next step is to define the core features that will make your investor portal truly effective. The right features depend on your investor base and operational goals, but some functionalities are now standard expectations for commercial real estate (CRE) sponsors. Investors today demand 24/7 access to their portfolio data and documents, ensuring they can check in at any time without delays. Your portal should not only meet these expectations but also help streamline your internal operations.

To achieve this, focus on three key areas: real-time dashboards and analytics to provide up-to-date performance insights, secure document management and communication tools to build trust and simplify collaboration, and role-based access with self-service features to empower investors while safeguarding sensitive data. Below, we’ll dive into each of these components and how they enhance the investor experience.

Real-Time Dashboards and Analytics

Investors no longer want to wait for quarterly emails or static PDF reports - they expect instant insights into how their investments are performing. Your portal should present key metrics like property-level cash flow, occupancy rates, net asset value (NAV), and distribution history in a clean, visual format. Use U.S.-specific conventions, such as displaying values in formatted USD (e.g., $1,250,000.00) and square footage for property metrics.

To ensure accuracy, dashboards should pull data directly from your accounting and property management systems in real time. On the administrative side, you can track metrics like new investor counts, total transaction volumes, and overall investment returns to monitor the portal's effectiveness and fundraising success.

For sponsors seeking advanced analytics, platforms like The Fractional Analyst's CoreCast offer robust tools to streamline operations, monitor performance, and identify new opportunities using real-time data. Their team can also create custom reporting templates for integration with systems like Salesforce, Yardi, or AppFolio, providing high-quality analytics that enhance decision-making and instill confidence in portfolio performance.

Secure Document Management and Communication Tools

A strong investor portal serves as a secure, centralized hub for all investor documents. This includes everything from subscription and operating agreements to quarterly reports and tax forms. The portal should allow investors to directly download essential tax documents like K-1s, 1099s, W-9s, and W-8BEN forms - especially during tax season.

Beyond document storage, your portal should offer secure communication tools. Features like in-portal messaging or notifications enable direct, confidential communication with investors, keeping sensitive discussions out of email and creating an auditable record of all interactions. Investors should also be able to ask questions, submit capital calls, and receive distribution notices - all within the same interface they use to track performance.

Transparency about your portal's security measures is essential. Clearly outline your encryption protocols, access logs, and compliance standards in privacy disclosures tailored to U.S. regulations. This level of openness reassures investors that their financial information is well-protected.

Role-Based Access and Self-Service Features

Not every user needs the same level of access, and role-based controls allow you to tailor permissions accordingly. For instance, retail limited partners may only need to view their individual investment details, while institutional investors might require access to consolidated portfolio data across multiple funds. Meanwhile, internal team members like asset managers, accountants, and investor relations staff need administrative privileges to upload documents, update financials, and manage user accounts.

Self-service features are another critical component. By enabling investors to download tax documents, update their contact information, view distribution schedules, and access historical reports on their own, you reduce routine inquiries and free up your team to focus on higher-value tasks like investor relations and capital raising.

It's crucial to configure access controls carefully. Investors should have the freedom to explore their portfolio data, but sensitive information - such as acquisition pricing, debt terms, or details about other investors' holdings - must remain restricted. For sponsors lacking the internal resources to design these frameworks, The Fractional Analyst's team can develop role-based reporting structures and self-service templates tailored to your specific investor base and compliance needs. These features ensure a secure, user-friendly portal that prioritizes both transparency and data security.

sbb-itb-df8a938

Step-by-Step Guide to Building Your Investor Portal

Creating an investor portal isn't just about setting up a website - it's a full-fledged software development project. Before diving into design, you need a solid plan that outlines how data will flow, how security will be handled, and how systems will integrate. Think of it like building a house: without a strong foundation, everything else is at risk.

Start by identifying your source of truth for each data category. For example, your accounting system (like Yardi, AppFolio, or QuickBooks) should handle capital accounts, distributions, and financial statements. Meanwhile, your CRM (such as Salesforce) should manage investor profiles and relationships, and your document management system should store operating agreements, tax forms, and quarterly reports. Create a data dictionary to standardize terms like "deal", "property", "investor", "commitment", "distribution", "IRR", and others. This ensures the portal matches your internal records perfectly.

According to a 2025 investor portal guide, firms that implement modern investor portals report a 30–40% reduction in administrative workload for tasks like investor reporting and communication, thanks to automation and self-service features.[4][5]

That kind of efficiency only happens when your portal is built on strong technical foundations and integrates seamlessly with your existing systems. With your data sources and terminology locked in, here’s how to move forward with integration, design, and testing.

Integrate Data with Accounting and CRM Systems

To connect your portal with back-office systems, use APIs, webhooks, and integration tools like Zapier, MuleSoft, or Boomi.[4][5] Modern accounting and CRM platforms typically provide APIs that allow you to sync crucial data - investor profiles, commitments, contributions, distributions, and capital account balances. Set up nightly or near real-time syncs to keep investor data current without straining your systems during peak business hours. Automate repetitive tasks, such as sending distribution notifications, uploading K-1 forms, or managing capital call requests.[4]

To ensure accuracy, deploy validation scripts and reconciliation dashboards that catch discrepancies between your portal and other systems before they reach investors. For instance, if a $50,000.00 distribution in your accounting system shows up as $48,500.00 in your portal, you’ll want to resolve it before your investors notice. The Fractional Analyst team can assist in designing these processes to ensure clean, reliable data flows across all systems.

Design User Interface and Apply Branding

Once your data flows are automated and validated, focus on designing a user-friendly interface. Your portal should be intuitive and professional, making it easy for investors to access what they need. Use a clean layout with clear navigation so investors can quickly find their dashboard, documents, distributions, and tax forms - preferably within two clicks from the homepage. Always display financial figures in U.S. currency format (e.g., $1,250,000.00) and property metrics in square feet to align with local conventions.

Consistent branding is key. Incorporate your logo, color scheme, fonts, and tone of voice throughout the portal to reinforce your company’s identity. Streamline onboarding by building guided subscription flows that pull investor details directly from your CRM, so users don’t have to re-enter information. Features like progress indicators, inline validation, and tooltips can make the process smooth and efficient.

Don’t forget mobile users. Test the portal on various devices and screen sizes to ensure dashboards and documents display correctly everywhere.

Test Security, Scalability, and Compliance

Before launching, perform rigorous security, scalability, and compliance tests.[4][5] Security testing should confirm that your portal uses TLS/HTTPS, encrypts data at rest, and enforces role-based access controls. Monitor critical security events, such as failed login attempts or data exports, and consider hiring third-party firms for penetration testing - both pre-launch and on an annual basis - to identify vulnerabilities.[4][5]

Scalability testing is essential because investor portals often see traffic spikes during quarterly distributions, year-end reporting, and tax season. Simulate high-traffic scenarios, like hundreds of investors logging in at once to download K-1s, to ensure your infrastructure can handle the load without crashing or slowing down.

Finally, compliance testing ensures your portal adheres to U.S. regulations for data protection, KYC/AML requirements, and securities laws. Document your encryption protocols, access logs, and data retention policies in your privacy disclosures. If your team lacks the resources to manage compliance frameworks, The Fractional Analyst can create security templates and reporting structures tailored to your needs.

Optimize and Improve the Portal After Launch

Launching your investor portal is just the first step. After the launch, it’s crucial to keep refining the portal based on key metrics that highlight areas needing improvement. Pay close attention to KPIs like login frequency, document downloads, and support tickets to measure investor engagement (refer to the core metrics mentioned earlier). For instance, track how many investors log in at least once a month, the percentage of K-1 forms downloaded directly from the portal versus those requested via email, and whether questions about "basic info" decrease as more investors adopt the platform [1][2]. Review these metrics monthly and compare trends at 3, 6, and 12-month intervals to assess ROI and pinpoint areas of friction.

Plan ahead with a quarterly roadmap. For example:

- Q1: Focus on stabilizing the platform and fixing bugs.

- Q2: Add features like dashboard filters for deals, markets, and tax years.

- Q3: Enhance the mobile experience and introduce self-service tools.

- Q4: Integrate AI-driven insights and benchmarking tools [1][6].

This structured approach ensures the portal evolves steadily without overwhelming your team or causing disruptions during critical times like tax season. It also sets the stage for deeper investor engagement and support improvements.

Use Communities for Support and Feedback

Leverage the secure document and communication tools already in place by creating an investor community within or alongside your portal. This can reduce support requests while fostering stronger relationships. Segment discussion spaces by investor type - such as high-net-worth individuals versus institutional investors - or by asset classes like multifamily or industrial [1][7]. Use these spaces to share FAQs, host Q&A sessions, and post brief explainer videos addressing common questions like "Where can I find my 2024 K-1?" or "What does IRR mean?" [1][2].

Assign a member of the investor relations team as a community manager to oversee discussions, tag experts when needed, and escalate sensitive or account-specific queries to private channels. Include a "Suggest a feature" or "Report an issue" button that routes feedback directly to your CRM [1][3]. Additionally, host periodic webinars to showcase recent updates and gather live feedback. Follow up by posting a "What's new / What's next" update inside the portal to keep investors informed and build trust.

Add AI Tools for Portfolio Analysis

AI-powered analytics can take your portal from a simple document repository to a dynamic intelligence hub. Expanding on the real-time dashboards introduced earlier, tools like CoreCast from The Fractional Analyst can compile property, lease, and financial data across your portfolio. These tools generate dashboards that display key metrics like NOI trends, DSCR, occupancy rates, and variances compared to underwriting - all formatted in U.S. dollars (e.g., $12,500,000) and American date conventions (e.g., 03/31/2025) [1][6]. Investors can filter performance data by market, asset type, or vintage year, and even run forecasting scenarios - like interest rate changes or exit cap sensitivity - without relying on manual spreadsheets.

Before integrating AI, ensure your data is clean and structured, with stable APIs connecting your accounting system and CRM. The Fractional Analyst validates models to align them with your underwriting and asset management practices, ensuring the insights meet the sophistication level expected by U.S. accredited investors and comply with PPM disclosures. Schedule quarterly reviews with external experts to keep your analytics, AI models, and content aligned with changes in your portfolio and market conditions. By incorporating AI, you transform your portal into a proactive, data-driven hub that empowers investors with real-time insights.

Conclusion

Building an effective investor portal requires a structured approach, from early planning to post-launch improvements. The process typically involves three key phases: aligning stakeholders and defining goals, selecting a platform that balances customization with integration needs, and committing to ongoing updates and enhancements.

Platform selection plays a critical role in long-term success. For example, Salesforce Experience Cloud–based portals provide extensive customization options and powerful integrations. However, these benefits come with higher setup costs and complexity. It’s crucial to choose a platform that aligns with your portfolio size, the sophistication of your investors, and the technical resources available within your firm.

After launch, the real value of your portal comes from continuous refinement. Regularly track performance metrics, implement quarterly updates, and consider integrating AI-driven analytics. These steps can transform your portal into a robust intelligence hub, offering predictive insights and empowering investors with actionable data.

For firms looking to boost their portal’s analytical capabilities, The Fractional Analyst provides services like financial analysis, underwriting, and investor reporting through its CoreCast platform. This support ensures accurate data, standardized reporting, and actionable insights, all of which enhance asset management and investor communications.

FAQs

What should I consider when selecting a platform for a commercial real estate investor portal?

When choosing a platform for a commercial real estate (CRE) investor portal, it's important to focus on a few key factors. Look for scalability to ensure the platform can grow with your business, along with seamless integration with your existing systems. Another must-have is strong security features to safeguard sensitive financial information.

You’ll also want a platform with a user-friendly interface and plenty of customization options to tailor it to your specific requirements. Platforms that offer real-time data updates and align with industry standards can make a big difference by improving communication with investors and ensuring transparency in financial reporting.

How can I keep my investor portal secure and compliant?

To keep your investor portal secure, focus on three key strategies: strong encryption, multi-factor authentication, and regular security audits. These steps are critical to protecting sensitive information and blocking unauthorized access.

Make sure your portal complies with regulations such as GDPR and SEC requirements by establishing clear data handling policies. Limit who can access confidential information and maintain comprehensive audit trails. Stay ahead of potential threats by using secure platform integrations and staying updated on the latest cybersecurity practices.

What key features should a CRE investor portal have to deliver the best experience?

An ideal commercial real estate (CRE) investor portal should offer a combination of essential features to keep investors informed and assured. Key components include secure document sharing, real-time performance tracking, and in-depth financial reporting. These tools help maintain transparency and provide investors with the confidence they need.

A user-friendly interface with customizable dashboards is equally important, allowing for smooth navigation and tailored insights. To further enhance its usefulness, the portal should incorporate communication tools and integrate effortlessly with financial models or market data platforms. This not only boosts functionality but also streamlines operations for both investors and managers.