Colorado 1031 Exchange: Key Rules, Tax Tips & Federal Differences

Want to defer taxes on real estate sales? A 1031 exchange might be your answer. It allows you to reinvest profits from selling an investment property into a "like-kind" property - without paying capital gains taxes upfront. But for Colorado investors, understanding how state rules differ from federal ones is critical.

Key Takeaways:

Federal Rules: Both properties must be for business/investment use, follow strict deadlines (45 days to identify, 180 days to close), and require a qualified intermediary.

Colorado-Specific Rules: Nonresident sellers face a 2% withholding unless Form DR1083 is filed before closing. Colorado also requires intermediaries to meet stricter standards (e.g., $1M fidelity bond).

Avoid Pitfalls: Missing deadlines or withholding exemptions can disrupt cash flow and jeopardize your exchange.

Bottom Line: Colorado adds extra layers to the 1031 process. File Form DR1083 early, choose a compliant intermediary, and plan ahead to meet deadlines. Keep reading for detailed steps to ensure your exchange is smooth and tax-efficient.

1031 Exchange Rules in Colorado

Federal 1031 Exchange Rules Overview

Before diving into Colorado-specific regulations, it’s important to first understand the federal framework for 1031 exchanges. These federal rules create the foundation upon which state-specific variations, like those in Colorado, are built.

Basic Federal Requirements

Federal 1031 exchanges have been around for a long time, and they come with strict guidelines to qualify for tax deferral benefits.

Property Eligibility is a key factor. Both the property you sell (relinquished property) and the one you buy (replacement property) must be used for business or investment purposes. Personal residences usually don’t qualify.

The like-kind requirement provides some leeway when choosing a replacement property. Under federal rules, properties are considered like-kind if they share a similar nature or character. However, U.S. real estate cannot be exchanged for property located outside the country.

Value requirements also play a critical role. To defer all taxes, the replacement property must be of equal or greater value than the relinquished property. Any cash or non-like-kind property received (referred to as "boot") will be taxable.

Additionally, a qualified intermediary (QI) is required to handle the exchange funds. This ensures that you don’t have direct access to the proceeds, which would disqualify the transaction.

Once these basics are in place, the next step is adhering to the strict timelines set by federal rules.

Important Deadlines

Timing is everything in a 1031 exchange. The federal guidelines include two key deadlines:

45-Day Identification Period: This period begins the day you transfer the first property. Within 45 calendar days, you must identify the replacement property in writing. If you’re dealing with multiple relinquished properties, the clock starts ticking on the closing date of the first one, so careful planning is crucial.

180-Day Exchange Period: You must acquire the replacement property within 180 calendar days of transferring the first relinquished property - or by the due date of your tax return for that year (including extensions), whichever comes first. If your tax filing deadline falls within this 180-day window, you’ll need to complete the exchange by that date instead of waiting for the full period to elapse.

Federal Reporting Requirements

The IRS requires you to report a 1031 exchange on your tax return for the year the exchange begins. This is done using Form 8824, Like-Kind Exchanges. Filing this form is non-negotiable, especially since your settlement agent will also submit a 1099-S when your property is sold, allowing the IRS to track the transaction.

Form 8824 collects detailed information about the exchange, including descriptions of the relinquished and replacement properties, purchase and transfer dates, and the dates you identified and acquired the replacement property. It also tracks related-party exchanges. If you exchange property with a related party and they sell it within two years, you’ll need to report the deferred gain.

If the exchange results in taxable gain, you’ll report it on Form 4797 or Schedule D, depending on the type of property. For exchanges that extend into the following year or involve a buyer’s note, you might qualify to report the gain on an installment basis using Form 6252.

Need more time to file your tax return? You can request an automatic extension until October 15 by submitting Form 4868, but remember: any taxes you owe must still be paid by April 15 to avoid penalties.

Colorado 1031 Exchange Tax Rules

Colorado aligns with federal 1031 exchange rules but adds its own state-specific requirements to ensure compliance. This section highlights the unique elements of Colorado's regulations, helping investors navigate these additional obligations.

How Colorado Follows Federal Rules

Colorado generally mirrors federal 1031 exchange guidelines, so if you're familiar with the federal process, much of it will feel the same. For instance, the state requires the use of a qualified intermediary to manage exchange proceeds and transactions, just like federal law mandates. Colorado also sticks to the federal deadlines for completing exchanges.

The like-kind property criteria are consistent with federal standards as well. This means both the relinquished and replacement properties must be used for business or investment purposes, and the replacement property must be of equal or greater value to defer all taxes.

However, following federal rules doesn't automatically mean you're in the clear at the state level. Colorado has its own licensing and operational standards for qualified intermediaries. So, the intermediary you choose must meet Colorado's specific requirements in addition to federal ones.

Beyond these similarities, Colorado has distinct rules for nonresident sellers that you need to be aware of.

Colorado Tax Withholding for Nonresidents

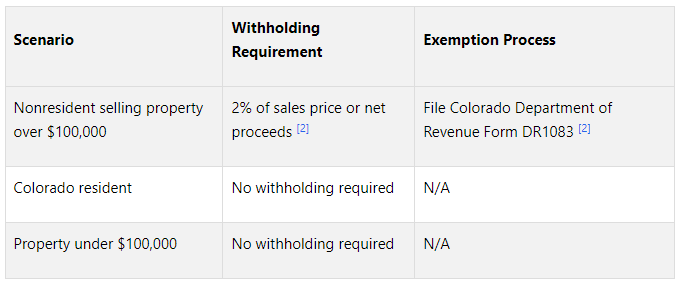

One of Colorado's standout requirements is its tax withholding rule for nonresident property sellers. If you're a nonresident selling Colorado real estate valued over $100,000, the state mandates withholding 2% of the sales price or net proceeds (whichever is less).

However, nonresident sellers can bypass this withholding by filing Colorado Department of Revenue Form DR1083. This form, titled "Affirmation of No Reasonably Estimated Tax to be Due", allows sellers to claim an exemption.

“In a 1031 exchange, the non-Colorado resident may sign an ‘Affirmation of No Reasonably Estimated Tax to be Due’ per Colorado Department of Revenue Form DR1083.”

Timing is key here. To avoid withholding, this form must be completed and submitted before the closing date. If you miss the deadline, the 2% withholding will be enforced, even if the property is part of a 1031 exchange. In such cases, you'll need to recover the withheld amount later by filing a tax return.

Colorado Documentation and Deadlines

For reporting 1031 exchanges, Colorado accepts the federal Form 8824. Filing deadlines vary depending on the entity type: individual taxpayers must file by April 15 (with an extension option until October 15), while partnerships and S corporations have a March 15 deadline (extendable to September 15).

If your exchange starts after October 18, you may want to file a tax extension using Form 4868. This allows you to take full advantage of the 180-day exchange period without being restricted by the April 15 deadline. This strategy can be particularly helpful in managing challenges related to Colorado's withholding rules.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Main Differences Between Colorado and Federal 1031 Rules

While Colorado generally aligns with federal 1031 exchange guidelines, there are some notable differences that can add extra layers of compliance. Knowing these distinctions upfront can help you plan better and avoid unexpected complications.

Colorado vs. Federal Rules Comparison

Colorado builds on the federal framework but introduces additional requirements that influence how exchanges are handled. Key differences include withholding rules, qualified intermediary (QI) standards, and investor safeguards. Here's a side-by-side look:

One of the most significant differences is Colorado's 2% withholding rule for nonresident sellers. As IPX1031 explains:

“In the state of Colorado when you’re doing an exchange here, there is a 2% withholding on the sale of investment real estate. But that 2% withholding completely is avoided by doing a Tax Deferred Exchange.”

Additionally, Colorado imposes stricter requirements for QIs, including a fidelity bond over $1,000,000 and errors and omissions insurance of at least $250,000. These measures aim to provide added security for investors during the exchange process.

Effects on Nonresident Investors

For nonresident investors, Colorado's withholding rules can pose unique challenges. If you're selling Colorado investment property worth over $100,000, a 2% state withholding applies unless you file Form DR1083 before closing. Even if you're completing a full 1031 exchange, failing to file the form means the funds will be withheld, requiring you to recover them later through your tax return. This can disrupt cash flow and complicate your exchange timeline.

Another hurdle is Colorado's escrow authorization requirement. If your exchange involves escrow accounts holding over $250,000, you'll need to provide explicit written approval for any withdrawals. This step, which differs from federal procedures, can delay transactions if not handled in advance.

On the plus side, Colorado does not enforce clawback provisions. Unlike states like California, Oregon, Montana, and Massachusetts, Colorado allows you to exchange property for out-of-state replacements without worrying about future tax recapture. This makes planning a bit easier for investors focused on interstate exchanges.

Planning Considerations for Investors

To navigate Colorado's unique rules, you'll need to take a proactive approach. Timing is critical, especially for withholding requirements - ensure Form DR1083 is submitted before closing to avoid unnecessary deductions.

Verify that your QI complies with Colorado's bonding and insurance standards by requesting proof of a fidelity bond exceeding $1,000,000 and errors and omissions coverage of at least $250,000.

Anticipate potential delays, particularly with escrow authorizations, and keep reserve funds available to address any withholding or timing issues.

Finally, Colorado's lack of clawback provisions simplifies planning for out-of-state replacements. Keeping detailed records - such as Form DR1083 submissions and QI documentation - will not only ensure compliance but also safeguard you in case of future audits.

Tips for Colorado 1031 Exchange Compliance

Navigating the rules for a 1031 exchange in Colorado requires a solid understanding of both federal and state-specific regulations. Success hinges on staying organized, meeting deadlines, and assembling a skilled team to guide you through the process. Here's how to stay on track.

Working with Financial Professionals

Colorado's dual compliance requirements can be tricky, making expert advice a must. Before selling your property, consult with financial and tax advisors to determine if a 1031 exchange aligns with your financial goals. They can help assess whether the tax savings outweigh the costs and timing challenges.

Choosing the right Qualified Intermediary (QI) is equally important. In Colorado, QIs must meet specific standards, including a fidelity bond of at least $1,000,000 and errors and omissions insurance of $250,000 or more. Always request proof of these coverages to ensure they meet the requirements.

Timing is everything when it comes to Colorado's withholding rules. Tax advisors can guide you in submitting Form DR1083 before closing, which prevents the 2% withholding that could disrupt your exchange funds. Even minor timing errors can lead to cash flow issues, putting your exchange at risk.

For additional support, The Fractional Analyst's team of financial analysts can assist with commercial real estate underwriting and asset management. Their expertise ensures your replacement property meets both your investment objectives and 1031 exchange criteria.

Handling Timing and Documentation

Colorado's extra rules mean managing your timeline is even more critical. Create a detailed schedule that includes key dates like your closing, the 45-day identification deadline, the 180-day exchange window, and Colorado-specific filings. Tools like calendar reminders or project management software can help you stay organized.

Start searching for replacement properties as soon as you decide to proceed with the exchange. This allows enough time for due diligence within the 45-day identification period. Keep meticulous records of identified properties to avoid potential IRS scrutiny.

Document everything. This includes closing statements, exchange agreements, depreciation schedules, Form DR1083 filings, and QI compliance documents. If your exchange spans two tax years, consider filing a tax extension to avoid complications with standard deadlines.

Regular communication with your real estate agent, QI, and financial advisor is crucial. Make sure everyone understands Colorado's specific requirements to avoid last-minute surprises. And remember, never take direct possession of sales proceeds from your relinquished property. This is especially important in Colorado due to state withholding rules, which require careful coordination with your QI.

By staying organized and documenting thoroughly, you’ll reduce the risk of errors and ensure a smoother exchange process.

Using The Fractional Analyst's Tools

Colorado's specific deadlines and documentation requirements can feel overwhelming, but advanced tools can simplify the process. The Fractional Analyst's platform offers solutions designed to tackle these challenges. Their financial analysis services help you evaluate replacement properties quickly, keeping you within the 45-day identification window while making sound investment decisions.

The CoreCast analytics platform automates quarterly reporting and tracks key performance metrics. This is particularly helpful for investors juggling multiple properties, where documentation can pile up fast.

Custom underwriting services ensure your replacement properties meet the equal-or-greater-value rule, critical for deferring capital gains taxes. The Fractional Analyst team can step in as needed - whether for a single project or ongoing support - to keep your exchange on track.

If you're considering out-of-state replacements, their market research tools can be a game-changer. Unlike states like California or Oregon, Colorado doesn’t have clawback provisions, giving you more flexibility to explore properties outside the state. The Fractional Analyst's research can pinpoint the best opportunities in these markets.

Investor reporting tools also simplify compliance by organizing the detailed records required for Colorado exchanges. These tools not only prepare you for potential audits but also lower the risk of errors.

For preliminary analysis, their free financial models offer immediate insights, while custom analysis services provide deeper evaluations for more complex exchanges. If you're managing multiple exchanges or building long-term strategies, CoreCast's ability to integrate with existing systems creates a centralized hub for compliance. This feature becomes increasingly valuable as your portfolio and compliance needs grow.

Conclusion: Colorado 1031 Exchange Key Points

Federal and State Differences Summary

Colorado’s 1031 exchange rules align closely with federal guidelines but include a few state-specific nuances that can influence your strategy and cash flow. For instance, nonresident investors are subject to a 2% withholding on sales (calculated as 2% of the sales price or net proceeds, whichever is less). However, this withholding can be avoided by filing Form DR1083.

Another key requirement is that your exchange intent must be explicitly stated in purchase contracts. Additionally, Colorado’s flat income tax rate of 4.63% should be factored into your tax planning. Unlike states such as California, Massachusetts, Montana, and Oregon, Colorado does not impose clawback provisions. This means future exchanges won’t result in state taxes on previously accrued property appreciation.

These specific rules highlight the importance of a well-thought-out approach when navigating Colorado’s 1031 exchange process.

Final Advice for Investors

Given these state-specific requirements, taking a strategic approach is essential for a successful exchange. With complexities like withholding rules, documentation requirements, and intermediary standards, partnering with experienced tax and financial advisors is critical. They can help ensure proper filing of Form DR1083 and compliance with all state regulations.

To simplify the process further, consider using The Fractional Analyst's platform. Their CoreCast real estate intelligence tools provide tailored financial analysis, market insights, and underwriting support. These resources can help you evaluate replacement properties within the crucial 45-day identification window and streamline your documentation and reporting.

Keep in mind that properties selling for $100,000 or less are exempt from the withholding requirement. By planning carefully, it’s possible to avoid the 2% withholding entirely. With the right guidance and tools, Colorado’s 1031 exchange rules can become manageable steps toward building a more robust real estate portfolio.

FAQs

-

While Colorado generally follows federal 1031 exchange rules, there’s an important difference that investors need to keep in mind. Colorado enforces a 2% withholding tax on the sale of investment real estate. This requirement is unique to the state and doesn’t exist under federal law, adding an extra layer of compliance for those conducting transactions in Colorado.

Both federal and state 1031 exchanges allow investors to defer capital gains taxes when swapping like-kind properties used for business or investment purposes. However, Colorado’s withholding tax stands out as a key factor that local investors must account for during their planning.

-

Nonresident property sellers in Colorado can sidestep the 2% withholding tax during a 1031 exchange by filling out and signing an Affirmation of No Reasonably Estimated Tax to be Due form. This document confirms that the transaction is not expected to generate Colorado income tax, qualifying the seller for a withholding exemption.

To stay compliant with state and federal rules for 1031 exchanges, make sure all necessary paperwork is completed and submitted correctly.

-

To navigate Colorado's stricter 1031 exchange rules, your first step should be choosing a qualified intermediary (QI) who understands both federal and Colorado-specific regulations. It's crucial that your QI is independent - meaning they haven’t served as your real estate agent, attorney, or in any other role that could disqualify them within the last two years.

Make sure your QI follows IRS safe harbor guidelines and complies with Colorado's added requirements. These include maintaining accurate documentation, securing exchange funds appropriately, and properly handling the exchange agreement. Stay mindful of the critical deadlines: a 45-day window to identify replacement properties and a 180-day period to finalize the exchange.

By keeping thorough records and working with a QI well-versed in Colorado's distinct rules, you can help ensure the process runs smoothly and remains compliant.