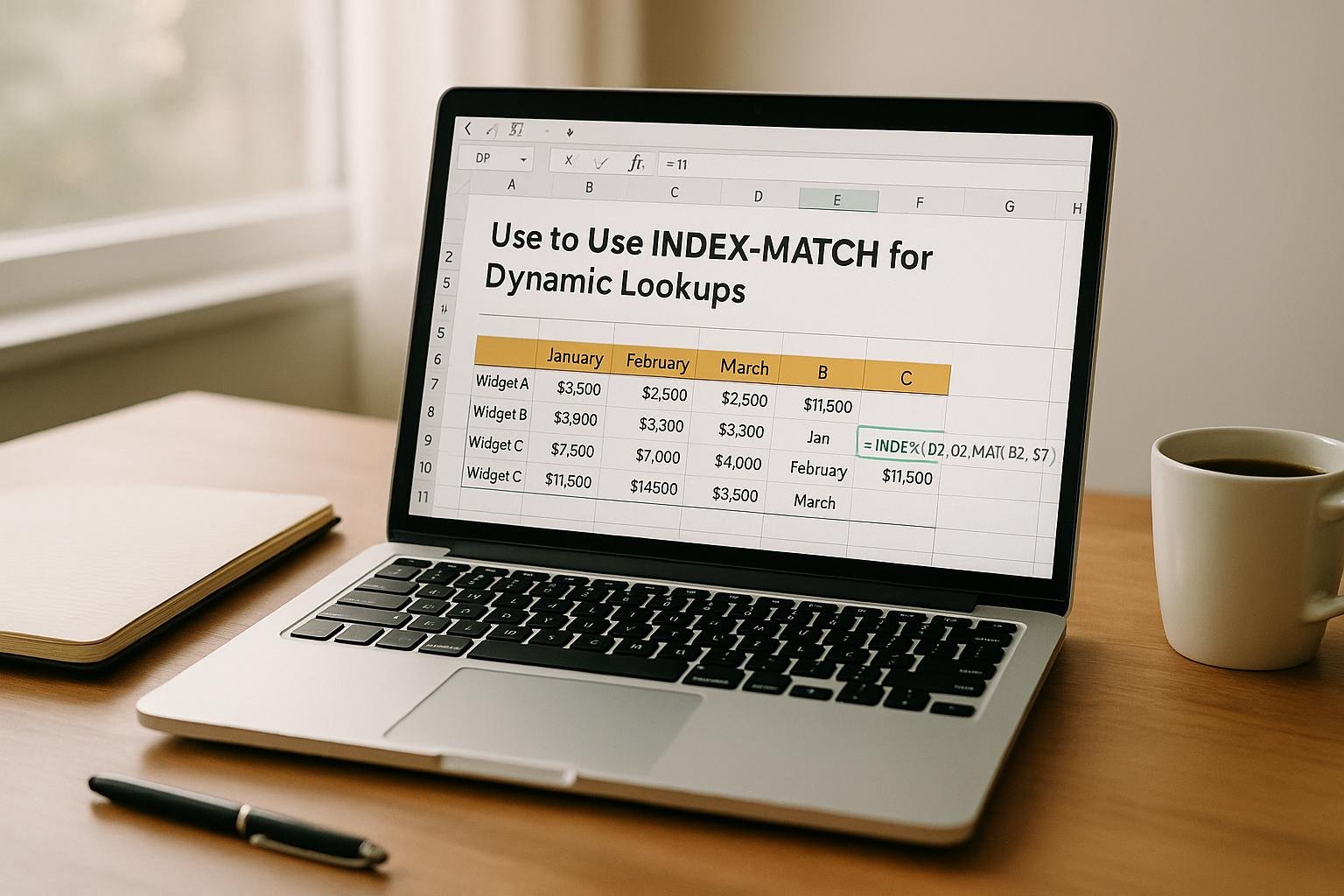

How to Use INDEX-MATCH for Dynamic Lookups

INDEX-MATCH is a powerful Excel formula combination that outperforms VLOOKUP for dynamic data retrieval, especially in commercial real estate (CRE) financial models. It allows you to search in any direction, handle large datasets efficiently, and avoid errors caused by changes in data layouts. Here's why it matters:

- INDEX retrieves data from a specific location in a range.

- MATCH identifies the position of a value in a range.

- Together, they create flexible formulas that adjust to data updates without breaking.

Key Benefits Over VLOOKUP:

- Works in any direction (not limited to rightward lookups).

- Handles dynamic columns, making it more resilient to changes.

- Faster performance with large datasets.

- Supports advanced lookups, like two-way and multi-criteria searches.

Example Use Case:

Pulling lease expiration dates for tenants in a rent roll, even if columns are rearranged: =INDEX(ExpirationDates, MATCH("Tenant A", TenantNames, 0))

Excel's INDEX + MATCH - How to use it // 7 real-world examples & tips

How INDEX and MATCH Functions Work

To truly appreciate the power of combining the INDEX and MATCH functions, it's essential to understand how each works on its own. These two Excel tools complement each other beautifully - one fetches data from a specific location, while the other figures out where that location is within your dataset.

INDEX Function Basics

The INDEX function is your go-to for pulling data from a specific position in a range. By providing a row and column number, it retrieves the value at their intersection.

Here’s the syntax: =INDEX(array, row_number, column_number). For example, =INDEX(B2:D6, 3, 2) grabs the value in the third row and second column of the range B2:D6 (e.g., $1,250,000).

What makes INDEX so handy is its flexibility. It simply counts rows and columns within the specified range, without being tied to the physical layout of your data.

Whether you're working with a single column (a one-dimensional array) or an entire table (a two-dimensional array), INDEX gets the job done. For instance, if you’re analyzing rent payments, =INDEX(C2:C10, 5) will extract the fifth rent amount from a column of monthly rents.

MATCH Function Basics

The MATCH function is like a detective for your data. It searches through a range to find a specific value and returns its position - not the value itself.

Here’s the syntax: =MATCH(lookup_value, lookup_array, match_type)

Let’s say you have a column of lease start dates formatted as 01/15/2025, 02/01/2025, and so on. The formula =MATCH("02/01/2025", A2:A10, 0) will return the position of February 1, 2025, in that range. The 0 ensures you’re looking for an exact match, which is crucial in precise financial models.

Similarly, if you’re searching for a property value, =MATCH(1500000, B2:B10, 0) will find the position of $1,500,000 in a list. Whether it’s tenant names, dates, monetary amounts, or addresses, MATCH pinpoints the location.

INDEX-MATCH vs VLOOKUP

When it comes to flexibility and efficiency, INDEX-MATCH leaves VLOOKUP in the dust, especially in commercial real estate (CRE) financial modeling. One standout feature is its ability to search in any direction. VLOOKUP, on the other hand, can only look to the right of the lookup column.

Imagine you’re working with a rent roll where tenant names are in column D and lease start dates are in column B. VLOOKUP can’t retrieve data to the left of the lookup column, but INDEX-MATCH handles this with ease.

Another advantage? INDEX-MATCH is faster when working with large datasets because it only processes the necessary ranges. Plus, it’s more robust. If you insert or delete columns in your CRE model, VLOOKUP formulas often break because they rely on static column indices. INDEX-MATCH, however, stays accurate since it references specific ranges instead of absolute positions.

For more advanced tasks - like handling multiple criteria or performing two-way lookups - INDEX-MATCH adapts seamlessly. This makes it a favorite for building dynamic and sophisticated financial models in the commercial real estate world. Up next, we’ll dive into practical ways to use these functions for dynamic CRE lookups.

Setting Up Dynamic INDEX-MATCH Formulas

Dynamic INDEX-MATCH formulas are a game-changer for keeping commercial real estate (CRE) models flexible and accurate. By leveraging the adaptability of INDEX-MATCH, you can create formulas that automatically adjust as your data updates - no more broken calculations when rent rolls or property details change.

Formula Setup Steps

To build a reliable INDEX-MATCH formula, start with the basics: use cell references for inputs instead of hardcoding values. This simple adjustment makes your formulas adaptable and ensures they grow alongside your data.

Begin by identifying the lookup value and data range. For instance, in a rent roll scenario, you might need to find a tenant’s monthly rent based on their name. Instead of embedding the tenant name directly into the formula, use an input cell where users can enter or select the tenant they’re searching for.

Here’s the basic structure: =INDEX(data_range, MATCH(lookup_cell, lookup_range, 0)). Notice how the lookup value is tied to a cell reference, not a static text string. This design lets anyone using your model change the search criteria without altering the formula itself.

Double-check that your ranges are aligned between the INDEX and MATCH functions. If the INDEX array spans rows 3 through 11, the MATCH lookup range must also cover rows 3 through 11. Misalignment will trigger errors.

Always set the match type in the MATCH function to 0 for exact matches. In CRE models, precision is critical - approximations can lead to costly errors in rent calculations, lease terms, or property valuations.

Named Ranges for Better Organization

Once your formulas are dynamic, take it a step further by using named ranges. Named ranges simplify your formulas and make them easier to understand. Instead of working with references like C3:C15 and B3:B15, you can use intuitive names like TenantNames and MonthlyRents.

Creating named ranges is simple: highlight your data range, click the Name Box (next to the formula bar), and assign a descriptive name. For a rent roll, you might create named ranges like RentRoll_Tenants, RentRoll_Rents, and RentRoll_Months.

Now, your formula becomes much clearer: =INDEX(RentRoll_Rents, MATCH(InputTenant, RentRoll_Tenants, 0)). Anyone reviewing the model will instantly understand what the formula is doing.

Named ranges also make your models scalable. When you add new tenants or expand your data, you can update the named range definition instead of manually revising multiple formulas. This saves time and reduces errors in larger CRE models.

Example: Rent Roll Data Lookup

Let’s break down a practical example. Suppose you have tenant names in column A, months across row 1 (formatted as 1/1/2025, 2/1/2025, 3/1/2025), and monthly rent amounts in the corresponding cells.

To retrieve a tenant’s rent for a specific month, you can use the formula:

=INDEX(B2:M10, MATCH("Tenant A", A2:A10, 0), MATCH(DATE(2025,3,1), B1:M1, 0)).

This formula uses the first MATCH function to locate the tenant and the second MATCH function to find the month. The INDEX function then pulls the rent amount at the intersection.

For improved usability, place the tenant name in cell P2 and the month in cell P3. The formula updates to:

=INDEX(B2:M10, MATCH(P2, A2:A10, 0), MATCH(P3, B1:M1, 0)).

Format the result cell as U.S. currency using the $#,##0.00 format to display values like $15,750.00. Ensure your date headers follow the standard U.S. format (e.g., 3/1/2025) for consistency across your model.

In September 2021, HowtoExcel.net showcased a dynamic INDEX-MATCH example by pulling Las Vegas visitor volume for January. They used input cells for both the field and month, returning $1,294,100 without hardcoding values. This approach made their model both scalable and easy to update[2].

This example highlights how dynamic formulas adjust to new lookup criteria without requiring changes to the formula itself. Users simply update the input cells, and the formula delivers the correct results - perfect for efficient CRE analysis. With this setup, you’re ready to tackle even more advanced INDEX-MATCH applications in your models.

sbb-itb-df8a938

Advanced INDEX-MATCH Applications for CRE

INDEX-MATCH becomes a powerhouse when applied to complex commercial real estate (CRE) scenarios. These advanced techniques allow you to extract data based on multiple conditions, work seamlessly with two-dimensional tables, and adjust to evolving data layouts. Mastering these methods is essential for tackling sophisticated CRE financial modeling challenges.

Multiple Criteria Lookups

In CRE, data queries often involve more than one condition. For example, you might need to find the rent for an Industrial property with a lease starting on 3/1/2025, or determine the occupancy rate for a particular building type during a specific quarter. Multiple criteria lookups make this possible by combining logical conditions within an INDEX-MATCH formula.

The trick lies in using array formulas to merge conditions. To match both property type and lease date, you can structure the formula like this:

=INDEX(MonthlyRent, MATCH(1, (PropertyType="Industrial")*(LeaseStartDate=DATE(2025,3,1)), 0))

Here, the logical arrays are multiplied so that only rows meeting both conditions return a 1 [1][5].

For instance, imagine a rent roll with columns for Property Type, Lease Start Date, and Monthly Rent. To find the rent for an Industrial property starting in March 2025, this formula evaluates both criteria simultaneously. The multiplication creates a unique identifier where the conditions align, enabling MATCH to locate the exact row.

This approach is invaluable for portfolios with multiple properties spanning various time periods. Instead of manually sifting through data or setting up extra lookup tables, your formula does all the work. To keep your financial models consistent, format results in U.S. currency (e.g., $15,750.00).

Two-Way Data Lookups

Two-way lookups are designed for scenarios where you need to cross-reference rows and columns in a matrix. Picture a rent roll where tenant names are listed in rows and months are shown in columns. If you need to find the rent payment for a specific tenant in a given month, two-way lookups are your solution.

This technique uses two MATCH functions nested within INDEX:

=INDEX(DataRange, MATCH(RowCriteria, RowHeaderRange, 0), MATCH(ColumnCriteria, ColumnHeaderRange, 0))

For example, to find Property A's occupancy rate in February 2025, you’d write:

=INDEX(OccupancyData, MATCH("Property A", PropertyList, 0), MATCH("Feb 2025", MonthList, 0)) [4][1][5].

This method simplifies the process of cross-referencing data. As new tenants are added or rent rolls are extended into future months, the formula adapts automatically. The first MATCH locates the relevant row (e.g., the property), while the second MATCH identifies the correct column (e.g., the month). INDEX then retrieves the value at their intersection.

Two-way lookups are particularly effective in operating statement analysis, where you’re tracking multiple properties across income and expense categories. By setting up input cells for selecting both property names and financial metrics, you can dynamically retrieve values like Net Operating Income or Capital Expenditures without needing to adjust the formula.

Working with Variable Column Data

Handling variable columns is critical in CRE models, as data structures often change. New months are added to rent rolls, expense categories expand, and property portfolios grow. Hardcoding column numbers makes your models fragile, but using MATCH for dynamic column identification ensures they remain functional.

The solution? Use MATCH to dynamically locate column positions. Instead of referencing a specific column (e.g., column C), use:

MATCH("Mar 2025", HeaderRow, 0)

This ensures your formula works regardless of where March 2025 appears in the header row [3][2].

For example, in a rent roll where months are added quarterly or annually, the formula:

=INDEX(RentRollData, MATCH("Property B", PropertyList, 0), MATCH("Mar 2025", HeaderRow, 0))

remains accurate whether March is in column D, H, or M. MATCH dynamically identifies the correct column.

This flexibility is crucial when working with multiple stakeholders. Property managers may add tenants, asset managers might insert extra analysis columns, and investors could request data for different time periods. By incorporating dynamic column logic into your formulas from the start, you create models that adapt to changes rather than breaking under them.

| Application Type | Formula Structure | CRE Use Case | Key Advantage |

|---|---|---|---|

| Multiple Criteria | INDEX-MATCH with array logic | Property type + lease date lookup | Handles complex filtering conditions |

| Two-Way Lookup | INDEX with dual MATCH functions | Tenant rent by month matrix | Cross-references rows and columns |

| Variable Columns | MATCH for dynamic column finding | Adaptable rent roll structures | Survives data layout changes |

Best Practices and Error Solutions

Expanding your dynamic lookup techniques requires careful attention to detail. In commercial real estate (CRE) models, accuracy is everything, and following best practices can help you avoid common pitfalls. Even seasoned professionals encounter challenges that can disrupt model reliability. By understanding these potential issues and using effective solutions, you can ensure your dynamic lookups remain dependable as your data evolves.

Building Reliable Formulas

When creating INDEX-MATCH formulas, consistency is key. Make sure your INDEX and MATCH arrays are the same size. For instance, if your INDEX range is B2:B100 (99 rows), your MATCH range must also span 99 rows.

Using named ranges can simplify your work and reduce errors. Instead of referring to ranges like D2:D100, assign descriptive names such as Lease_Expirations or RentRoll_Units. This makes formulas easier to read and update.

To prevent input mistakes, enforce data validation. For example, restrict date entries to valid ranges and use conditional formatting to identify missing or inconsistent data. If your rent roll includes units numbered 101–450, set up a validation rule to accept only those values. This avoids errors like entering "Unit 1O1" with the letter "O" instead of a zero.

Another tip: avoid hardcoding values into formulas. Instead of writing something like =MATCH("Industrial", PropertyType, 0), reference an input cell containing "Industrial." This approach keeps your formulas flexible, allowing users to update criteria without editing the formula itself.

Fixing Common Errors

Once your formulas are built, addressing common errors is essential for maintaining accuracy:

- #N/A Errors: These often mean the lookup value isn’t in the array or there’s a formatting issue. Problems like extra spaces, mismatched data types, or slight spelling differences can cause this. Use Excel’s TRIM function to ensure consistent formatting across your data.

- #REF! Errors: These occur when referenced ranges are deleted or when your INDEX and MATCH arrays are mismatched in size. Double-check that both arrays have the same number of elements. For example, if your rent roll has 50 units, the corresponding rent amount range must also include 50 entries.

- Unexpected Results: If you’re not getting the expected values, you might be using the wrong match type. Most CRE lookups require an exact match, so always set the match parameter to

0. Using1or-1assumes sorted data and may return approximate matches, which can lead to errors.

To handle errors gracefully, wrap your formulas in error-handling functions. For instance:

=IFERROR(INDEX(RentRoll_Rents, MATCH("Unit 101", RentRoll_Units, 0)), "Not Found")

This ensures clear feedback when a lookup fails, instead of disruptive error messages. If errors persist, break down complex formulas into smaller steps and use Excel’s Formula Auditing tools to trace issues.

Using The Fractional Analyst Tools

The Fractional Analyst offers tools that automate dynamic lookups and minimize errors in CRE models. Their free financial models incorporate tried-and-tested INDEX-MATCH formulas and industry best practices. With over 20,000 downloads and 81 clients served [6], these templates are designed for rent rolls, underwriting analysis, and asset management. Features like named ranges, robust error handling, and dynamic references ensure your formulas adapt seamlessly as data changes.

Their CoreCast platform, which tracks 125,000 properties [6], provides structured data and self-service analytics. Instead of building lookup formulas from scratch, CoreCast delivers pre-validated data connections and automated calculations for underwriting, asset management, and investor reporting.

For custom analysis, The Fractional Analyst also offers expert services. Their team can audit your models, identify error-prone formulas, and implement tailored INDEX-MATCH solutions that align with your portfolio’s specific needs.

| Error Type | Common Cause | Solution | Prevention |

|---|---|---|---|

| #N/A | Lookup value not found or formatting mismatch | Check data consistency; use TRIM function | Implement data validation rules |

| #REF! | Mismatched array sizes or deleted ranges | Verify INDEX and MATCH ranges are equal | Use named ranges for stability |

| Wrong Results | Incorrect match type (1 or -1 instead of 0) | Specify exact match using 0 | Always use 0 for CRE lookups |

| Formula Breaks | Hardcoded values or static references | Use dynamic input cells and named ranges | Avoid hardcoding values |

Key Takeaways

INDEX-MATCH stands out as a go-to method for dynamic data retrieval in CRE (Commercial Real Estate) models, offering both flexibility and dependability. Unlike other lookup functions, it supports searches in any direction and remains stable even when data structures shift - making it an ideal choice for CRE tasks like rent rolls or investor reports.

By leveraging named ranges and dynamic references, INDEX-MATCH scales effortlessly with expanding portfolios. This approach not only simplifies data retrieval but also links various aspects of CRE analysis, from error management to streamlined reporting.

To minimize errors, always use exact-match settings and wrap formulas in IFERROR. This ensures your models are professional and resistant to common issues like #N/A or #REF! errors.

For additional resources, The Fractional Analyst offers free financial models and expert tools designed to implement these best practices. Their models - downloaded over 20,000 times[6] - come equipped with pre-built INDEX-MATCH formulas, error handling, and dynamic references. Plus, their upcoming CoreCast platform, which tracks 125,000 properties[6], promises to simplify data connections, eliminating the hassle of creating complex lookups from scratch.

FAQs

How does using INDEX-MATCH enhance financial models for commercial real estate compared to VLOOKUP?

The INDEX-MATCH combination is a powerful tool for building financial models in commercial real estate, offering more flexibility and efficiency compared to VLOOKUP. While VLOOKUP is restricted to searching within the first column and requires data to follow a specific order, INDEX-MATCH can perform lookups in any direction and handles dynamic datasets effortlessly.

This flexibility is a game-changer for complex models where data structures frequently evolve. Another advantage is that INDEX-MATCH is less likely to break when columns are inserted or rearranged, keeping your formulas intact and reliable over time. Incorporating this method into your workflow can greatly enhance the precision and adaptability of your analyses.

What are common mistakes when using INDEX-MATCH, and how can you fix them?

When working with the INDEX-MATCH formula, a few common missteps can lead to errors or unexpected outcomes. Here's a breakdown of frequent problems and how to address them:

- Mismatched ranges: The ranges for the lookup array in the MATCH function and the return array in the INDEX function must be the same size. If they aren’t, the formula won’t provide the correct result. Always double-check that these ranges align.

- Incorrect match type: The MATCH function requires a match type, and using the wrong one can cause issues. For exact matches, set the match type to

0. Forgetting this might lead to the formula returning the closest match instead, which could throw off your results. - Unsorted data: If you use the default match type

1in the MATCH function, the lookup array must be sorted in ascending order. To avoid relying on sorted data, stick with a match type of0for exact matches. - Missing values: When the lookup value isn’t present in the array, you’ll see an

#N/Aerror. This often happens due to typos or missing entries. Carefully review your data to ensure all necessary values are included.

By addressing these potential pitfalls, you can set up your formulas correctly and achieve precise, reliable lookups in your financial models.

How do I use INDEX-MATCH for lookups with multiple criteria in a commercial real estate financial model?

To perform a lookup with multiple criteria using INDEX-MATCH in a commercial real estate financial model, you can combine these two functions with an array formula. This approach lets you search dynamically for values that meet multiple conditions, such as property type, location, or specific financial metrics.

Here’s how it works:

- Step 1: Use the MATCH function to find the row number where all your criteria align. Combine conditions using logical operators like

*for AND logic. - Step 2: Use the INDEX function to fetch the value from the corresponding row and column.

For instance, if you want to find a property’s rent based on its type and location, your formula might look like this:

=INDEX(RentColumn, MATCH(1, (TypeColumn=Criteria1)*(LocationColumn=Criteria2), 0)) In older versions of Excel, you’ll need to press Ctrl + Shift + Enter to activate the array formula. However, if you’re using a newer version with dynamic arrays, Excel handles this automatically - no extra steps required.

This method is especially handy in commercial real estate models, where datasets often involve multiple variables. For more tailored financial analysis or ready-made tools, platforms like The Fractional Analyst can simplify your workflow and support better decision-making.