Payback Period in Real Estate: Step-by-Step Guide

The payback period in real estate measures how long it takes to recover your initial investment through cash flow. It's calculated using this formula:

Payback Period = Total Investment ÷ Annual Cash Flow

For example, if you invest $1,000,000 and the property generates $250,000 annually, your payback period is 4 years. This metric is simple and helps assess investment risks, liquidity, and initial feasibility. However, it doesn't account for the time value of money or cash flows after the break-even point.

Key Takeaways:

Pros: Quick risk assessment, easy to calculate, and useful for filtering investment opportunities.

Cons: Ignores long-term profitability, time value of money, and assumes even cash flows.

Methods: Use the basic formula for steady cash flows or subtract yearly cash flows for irregular ones.

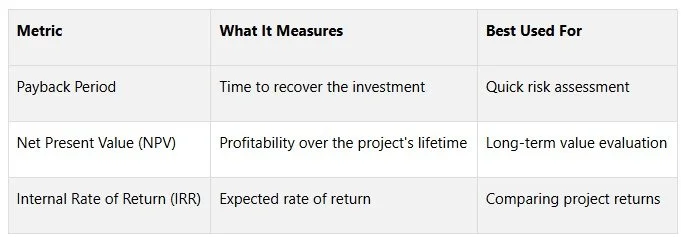

For a complete analysis, pair the payback period with metrics like Net Present Value (NPV) and Internal Rate of Return (IRR). Use tools like online calculators or financial models for faster calculations, especially for complex scenarios. Combining these approaches ensures better investment decisions.

How To Calculate Payback Period (Formula)

Payback Period Formula and Core Concepts

Understanding the payback period is a crucial part of real estate underwriting. It helps you evaluate how long it will take to recover your initial investment, making it easier to assess potential opportunities. Below, we’ll break down the formula and essential terms, along with the methods commonly used for these calculations.

Basic Payback Period Formula

The formula is straightforward:

Payback Period = Total Investment Cost ÷ Annual Cash Flow

This calculation gives you the payback period in years. For instance, if you invest $1,000,000 in a property that generates $250,000 in annual cash flow, the payback period would be 4 years ($1,000,000 ÷ $250,000 = 4 years).

This method is simple and doesn’t require factoring in discount rates. It’s purely about identifying the point at which cumulative cash flows match your initial investment.

Key Terms Explained

To calculate the payback period, it’s important to understand the components of the formula:

Total Investment Cost: This includes everything you spend to acquire and prepare the property, such as the purchase price, closing fees, renovation costs, and professional service expenses. For example, buying a property for $2,000,000, with $50,000 in closing costs and $150,000 in renovations, results in a total investment of $2,200,000.

Annual Cash Flow: This is the yearly income the property generates. You can calculate it using either gross or net figures:

Gross cash flow includes all revenue before expenses.

Net cash flow deducts operating expenses, property management fees, maintenance costs, and other property-level costs.

Many experts suggest using net operating income (NOI) for payback period calculations, as it provides a clearer picture of actual cash generation. The NOI accounts for property-level expenses but excludes financing costs and depreciation.

Common Calculation Methods

Once you’ve defined the key components, there are different approaches to calculating the payback period. The method you choose depends on your cash flow patterns and analysis goals.

The Averaging Method: This approach is ideal for properties with steady and predictable cash flows. Using the basic formula, you simply divide the total investment by the expected annual cash flow.

The Subtraction Method: This works better when cash flows vary significantly year to year. Instead of averaging, you subtract each year’s actual cash flow from the remaining investment balance until it reaches zero.

Example: With a $550,000 investment and annual cash flows of $75,000, $140,000, $200,000, $110,000, and $60,000, you recover $415,000 after three years. In year four, $110,000 reduces the remaining balance to $25,000. Dividing this by the fifth year’s cash flow ($25,000 ÷ $60,000) gives a payback period of 4.42 years.Property Type Considerations: The type of investment can also influence your calculation method. For acquisitions, the averaging method is typically sufficient. However, for development projects or value-add investments, the subtraction method is often more appropriate due to irregular cash flows during lease-up or renovation periods.

How to Calculate Payback Period: Step-by-Step Process

Here's a straightforward guide to calculating the payback period for real estate investments, whether the cash flows are steady or vary over time.

Step 1: Gather the Necessary Data

Start by collecting all the financial details needed. To calculate the payback period, you’ll need two key figures: the total investment cost and the annual cash flow.

Total Investment Cost: This includes the purchase price of the property along with all associated fees and expenses.

Annual Cash Flow: For rental properties, this is the income the property generates after accounting for its occupancy rate. To estimate this, research market rents, typical vacancy rates, and realistic occupancy assumptions for the property type and location. Subtract operating expenses like property management fees, property taxes, rental income taxes, HOA fees, maintenance costs, and amenities. Many investors use the net operating income (NOI) for this calculation since it reflects the actual cash generated by the property.

For a more detailed analysis, you might calculate the annual return by dividing the cap rate of the property by its total value. However, using projected NOI often provides a clearer picture of cash flow for individual properties.

Once you have these numbers, you’re ready to calculate the payback period.

Step 2: Perform the Payback Period Calculation

For investments with consistent cash flows, the formula is simple:

Payback Period = Initial Investment ÷ Yearly Cash Flow.

For example, if you invest $5,000,000 in a stabilized apartment building that generates $625,000 in annual NOI, the calculation would be:

Payback Period = $5,000,000 ÷ $625,000 = 8 years

A shorter payback period is typically preferred because it means you’ll recover your investment faster, reducing risks associated with market changes or unexpected events.

Step 3: Adjust for Uneven Cash Flows

If the cash flows vary year to year, the calculation becomes slightly more complex. In this case, you’ll need to track cumulative cash inflows to determine when they equal the initial investment.

Here’s the formula for uneven cash flows:

Payback Period = Years before full recovery + (Unrecovered cost at the start of the year ÷ Cash flow during the year).

Let’s break it down with an example. Suppose you invest $200,000 in a property with the following projected cash flows:

Year 1: $70,000

Year 2: $60,000

Year 3: $55,000

Year 4: $40,000

Year 5: $30,000

Year 6: $25,000.

After Year 1, you’ve recovered $70,000. By the end of Year 2, the total is $130,000 ($70,000 + $60,000). By Year 3, it’s $185,000 ($130,000 + $55,000), leaving $15,000 still to be recovered. In Year 4, even though the cash flow is $40,000, you only need $15,000 to break even. The calculation is:

Years before full recovery: 3

Unrecovered cost at start of Year 4: $15,000

Fraction of Year 4 needed: $15,000 ÷ $40,000 = 0.375

Payback Period = 3 + 0.375 = 3.375 years.

This approach is especially useful for properties undergoing lease-up, renovations, or development, as it accounts for the timing and variability of cash flows.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Understanding Results and Payback Period Limitations

What Your Payback Period Means

The payback period tells you how long it takes to recover the money you initially invested in a property through its cash flows. A shorter payback period is often more appealing because it means you recoup your investment faster, which typically translates to lower risk and greater liquidity. This straightforward calculation helps you decide if an investment aligns with your risk tolerance and financial goals. It's particularly useful as a first step when comparing properties, especially for investors focused on liquidity or navigating uncertain markets. However, it's essential to understand the limitations of this method to get the full picture.

Payback Period Drawbacks

While the payback period is easy to calculate and interpret, it has some key limitations. For one, it doesn’t account for the time value of money - essentially treating a dollar earned today the same as one earned years from now. Another issue is that it only considers cash flows up until the initial investment is recovered, ignoring any income generated after that point, which could significantly affect long-term profitability. Additionally, it assumes all cash flows happen at the same time within a year, which is rarely the case. For example, real estate income, like monthly rent, typically comes in at different times throughout the year. These shortcomings underscore the importance of using other financial tools alongside the payback period.

Using Other Metrics with Payback Period

The payback period provides a quick snapshot of liquidity, but combining it with metrics like Net Present Value (NPV) and Internal Rate of Return (IRR) gives a more complete picture of an investment’s performance. Both NPV and IRR factor in the time value of money, offering deeper insights into profitability and return expectations.

Start by using the payback period to quickly rule out investments that don’t meet your liquidity needs. Then, use NPV to gauge the overall profitability and IRR to compare the potential returns of different opportunities. This layered analysis helps you balance immediate risks with long-term gains, offering a more thorough evaluation of an investment’s potential. While setting target payback periods based on your experience and risk tolerance is helpful, always back up these initial findings with more detailed financial metrics before making a final decision.

Tools and Resources for Payback Period Analysis

Financial Models and Calculators

Manually calculating payback periods can be a tedious task, especially when dealing with multiple or irregular cash flows. Fortunately, online calculators simplify this process by quickly computing both simple and discounted payback periods. These tools use key inputs like investment costs, annual cash flows, and discount rates to deliver results efficiently, saving time and effort for feasibility assessments and investment comparisons.

To use these tools, you'll typically input details such as purchase price, renovation expenses, and expected returns. The calculators then factor in the time value of money for discounted payback periods, providing a clearer picture of your investment's potential. For more intricate analyses, specialized financial services can offer advanced insights.

The Fractional Analyst's Solutions

While online calculators are great for quick estimates, The Fractional Analyst goes a step further by delivering tailored solutions for complex financial scenarios. Specializing in commercial real estate, they provide a mix of expert-led and self-service options through their CoreCast platform.

Expert Analyst Support:

The Fractional Analyst offers on-demand access to financial professionals with flexible pricing options. Their hourly rates vary based on expertise: Associate level at $115/hour, Director level at $145/hour, and Executive level at $195/hour. For ongoing projects, they also offer a fixed monthly rate of $15,000. This flexibility allows businesses to scale their support needs, whether for short-term assistance or long-term engagements.

“We are not just sitting in on meetings. We are delivering investor-ready models, updating portfolio dashboards, and fixing outdated Excel spreadsheets. Often, our first week on the job includes identifying inefficiencies or errors in legacy models and delivering fixes within days.”

Their analysts specialize in key metrics such as NOI, IRR, and DSCR - critical for real estate evaluations. They create user-friendly pro forma models with built-in payback period calculations, design equity waterfall models, and prepare detailed capital raise materials.

“Fractional analysts equip decision-makers with real-time data, robust sensitivity analysis, and clean visuals that speed up boardroom discussions and capital deployment.”

CoreCast Platform:

For those looking for self-service options, the CoreCast platform offers real estate intelligence tools at $50 per user per month during its beta phase, with pricing expected to rise to $105 per user per month once fully launched. This platform provides access to financial modeling tools and market data, with the added benefit of escalating to expert analyst support when needed.

Client Success Stories:

Clients have highlighted the real-world impact of these services. Madison Communities AZ credited the on-demand analyst service for delivering actionable market research insights within tight deadlines for a new development project. Joseph Strobele from Crystal Peaks Data Centers praised their development model's ability to handle complex, multi-phase projects while supporting both quick analyses and detailed evaluations.

With its blend of flexible pricing, deep expertise, and scalable support, The Fractional Analyst offers a practical solution for tackling complex payback period analyses. Their services provide senior-level insights and hands-on assistance without the cost of hiring a full-time financial team.

Conclusion

The payback period is a key metric for evaluating real estate investments. It provides a simple way to see how quickly your initial investment can be recovered through cash flows. While it has its drawbacks - like ignoring the time value of money and cash flows beyond the payback point - it’s still useful for initial screening and assessing risk.

As we’ve discussed, the method you choose for calculating the payback period can influence your analysis. A straightforward approach works well for quick comparisons, while discounted methods add accuracy by factoring in the time value of money. It’s worth noting that 82% of real estate investors use some type of analytical tool, which underscores the value of technology in improving investment decisions.

That said, don’t stop at the payback period. Pair it with other metrics like IRR, NPV, and cap rates to get a fuller picture of potential returns. This combined approach helps ensure you’re making informed decisions rather than relying on a single calculation. These strategies apply whether you’re evaluating a small rental property or a large commercial project.

Today’s tools, from basic online calculators to advanced financial modeling software, can save time and reduce manual errors. For more complex projects, consulting with professionals can add an extra layer of accuracy and efficiency.

When choosing software, make sure it fits your investment strategy, portfolio size, and goals. Look for tools that offer features like market analysis, financial forecasting, and performance tracking. As highlighted, precise analytics and the right tools are essential for making confident, data-driven investment decisions.

FAQs

-

The payback period is all about speed - how fast an investment recoups its initial cost. It's a straightforward way to gauge liquidity and short-term risk. However, it overlooks two critical aspects: the time value of money and the overall profitability of the investment.

On the other hand, Net Present Value (NPV) takes a broader view. It calculates the total value of future cash flows in today's dollars, giving a detailed look at long-term profitability. Similarly, the Internal Rate of Return (IRR) provides a percentage-based measure, showing the rate of return where the NPV equals zero. This makes it a handy tool for understanding the efficiency of an investment.

In essence, while the payback period works well for short-term risk assessment, NPV and IRR offer deeper insights into the overall value and performance of a real estate investment.

-

When working with uneven cash flows, the subtraction method stands out as a more precise way to calculate the payback period. This method looks at each year's cash inflows separately, subtracting them from the initial investment until the total amount is fully recovered. By doing so, it pinpoints the exact timeline for when the investment breaks even.

On the other hand, the averaging method assumes that cash flows remain the same every year. This assumption can distort results, particularly in fields like real estate, where cash flows are often unpredictable due to factors like market shifts or property performance. For investments with irregular cash flows, the subtraction method delivers a clearer and more dependable picture.

-

The time value of money (TVM) matters because it emphasizes that a dollar today holds more value than a dollar received in the future. Overlooking this principle can result in flawed evaluations of an investment’s actual profitability.

To overcome this issue, investors turn to the discounted payback period. This approach adjusts future cash flows to their present value before determining the payback period, providing a clearer and more dependable picture of the investment’s financial performance.