Multifamily Acquisition Toolkit

13 Templates

Master every stage of the multifamily acquisitions process with this complete bundle of professional-grade Excel models, templates, and tools.

This toolkit equips you to:

Underwrite deals with speed and accuracy using the Multifamily Acquisition Model, One-Sheet Model, IRR Matrix, Rate-Cap NPV tool, and more.

Analyze opportunities with confidence through comps tracking, portfolio rollups, forecasting tools, and pipeline management.

Stay organized and deal-ready with a full due-diligence checklist, acquisition pipeline tracker, and a clean LOI template.

Level up your skills and workflow with the Excel Shortcuts Cheatsheet and the 100 Careers in Real Estate guide.

Built for analysts, investors, and acquisition teams, this toolkit gives you everything you need to evaluate, compare, and close multifamily deals with clarity and speed — all in one download.

What’s Included (13 files)

Core Financial Models

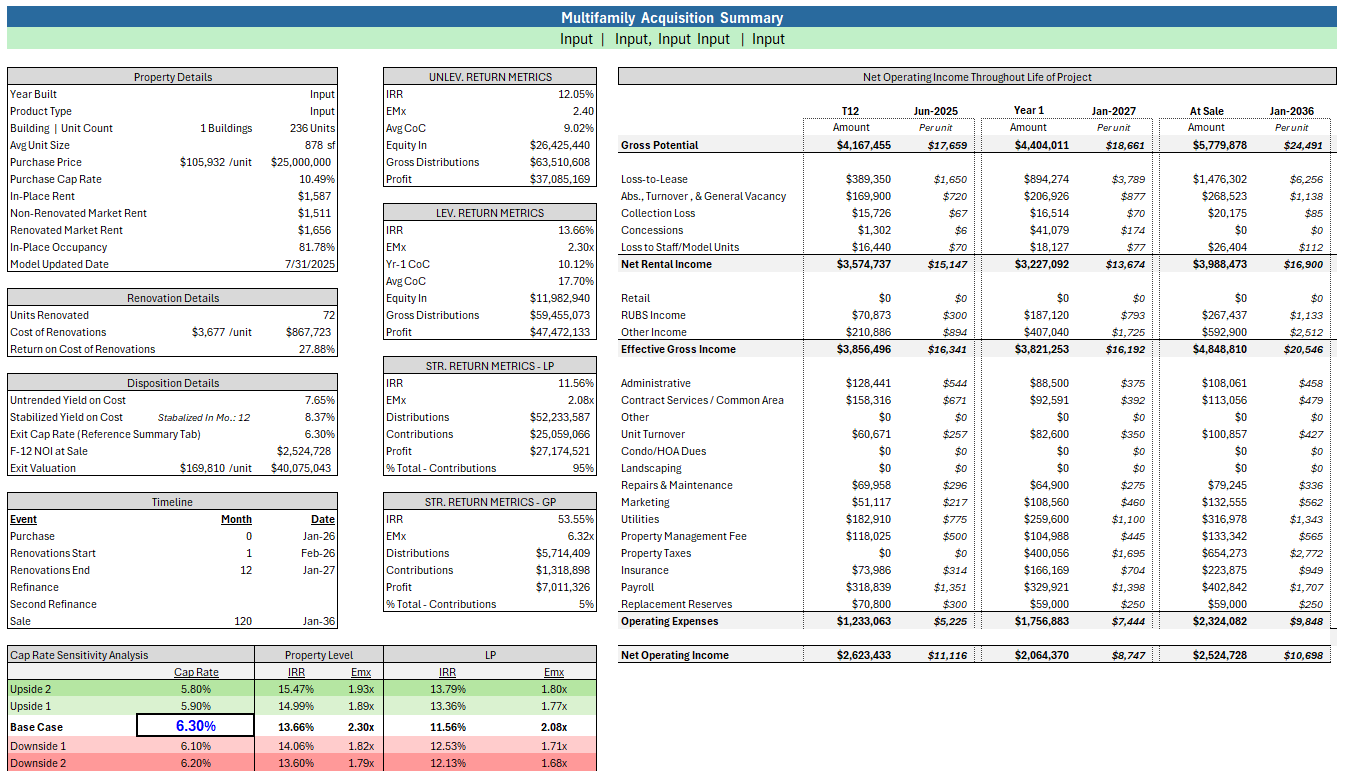

Multifamily Acquisition Model – Full underwriting model for stabilized or value-add multifamily deals

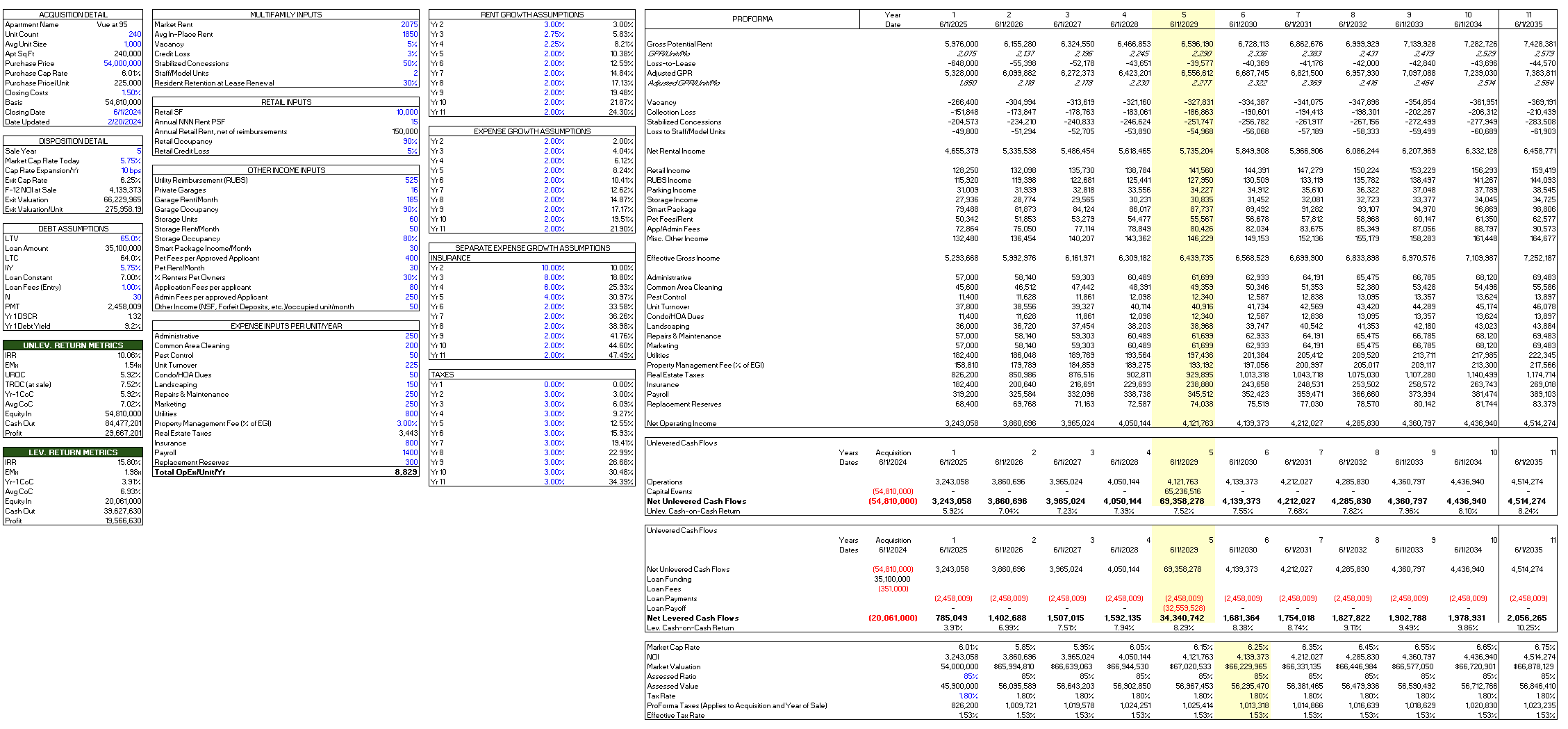

One-Sheet Multifamily Model – For those that prefer a deal screener, use this sophisticated one-sheet model to quickly review new opportunities.

Actuals & Forecast Model – Once the asset is purchased, manage your reforecasts here in this lightweight model

Drop-In Modules

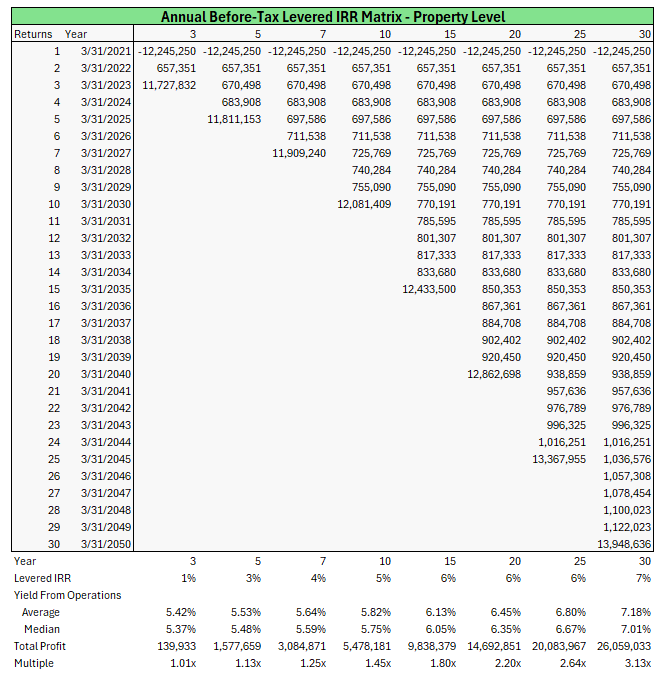

Analysis IRR Matrix – Visualize return sensitivity across equity and exit assumptions

MF Comp Sheet – Evaluate market comps with automated metrics

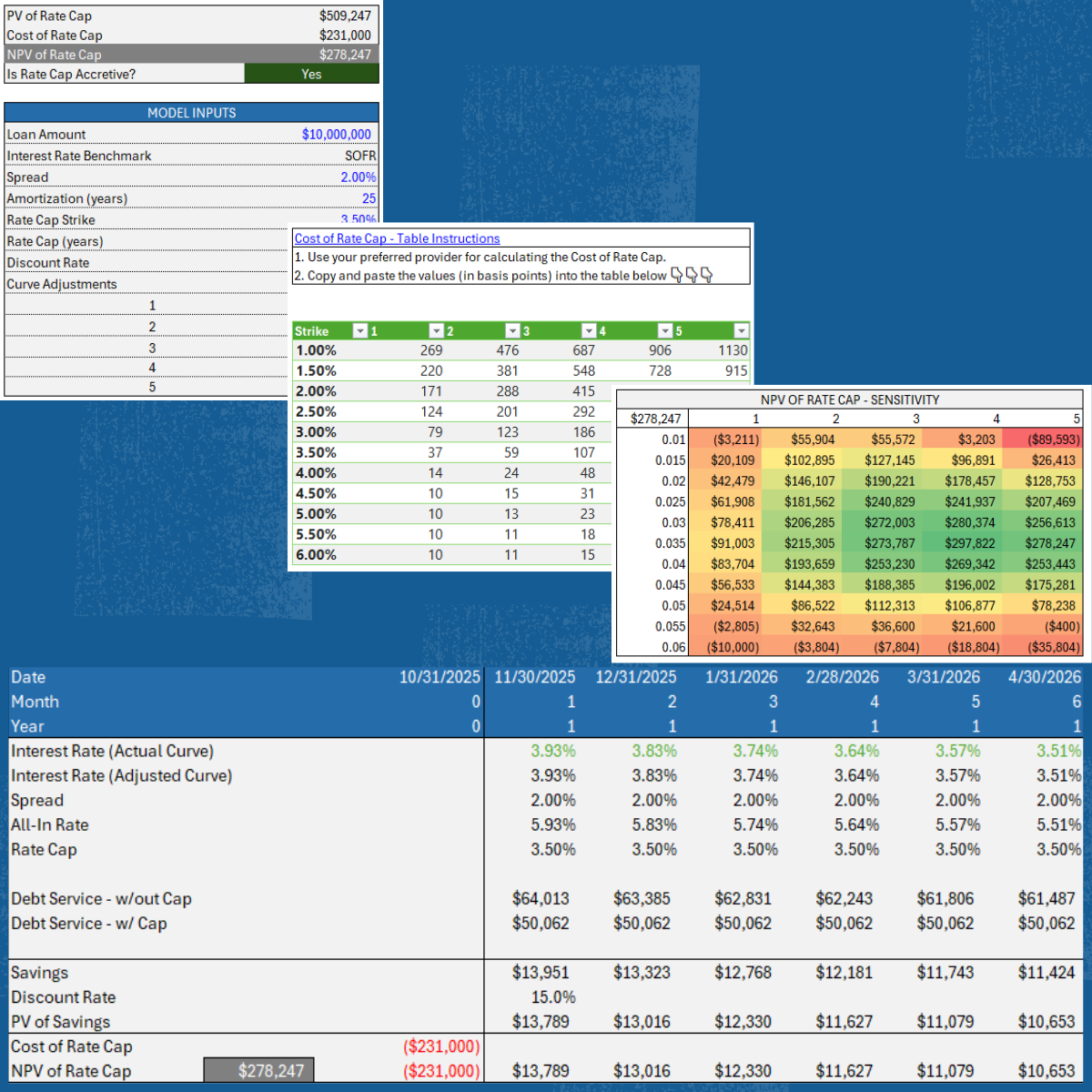

NPV of Rate Cap – Is buying that rate cap worth it? Find out with this template

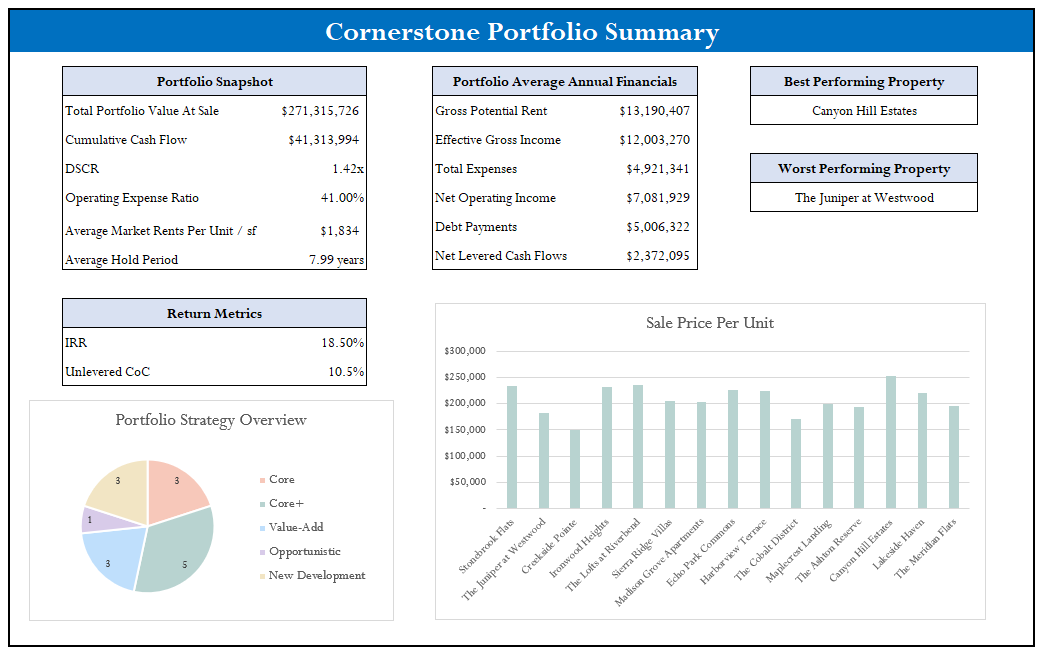

Portfolio Roll-Up– Consolidate multiple deals into a single view

Tools & Resources

Business Plan Template – Fully templated business plan, perfect for clearly communicating syndicate or fund targets.

Excel Shortcuts Cheat Sheet – Work smarter and faster

Pipeline Tracker – Never lose track of another deal

Letter of Intent Template – Streamline the early negotiation process

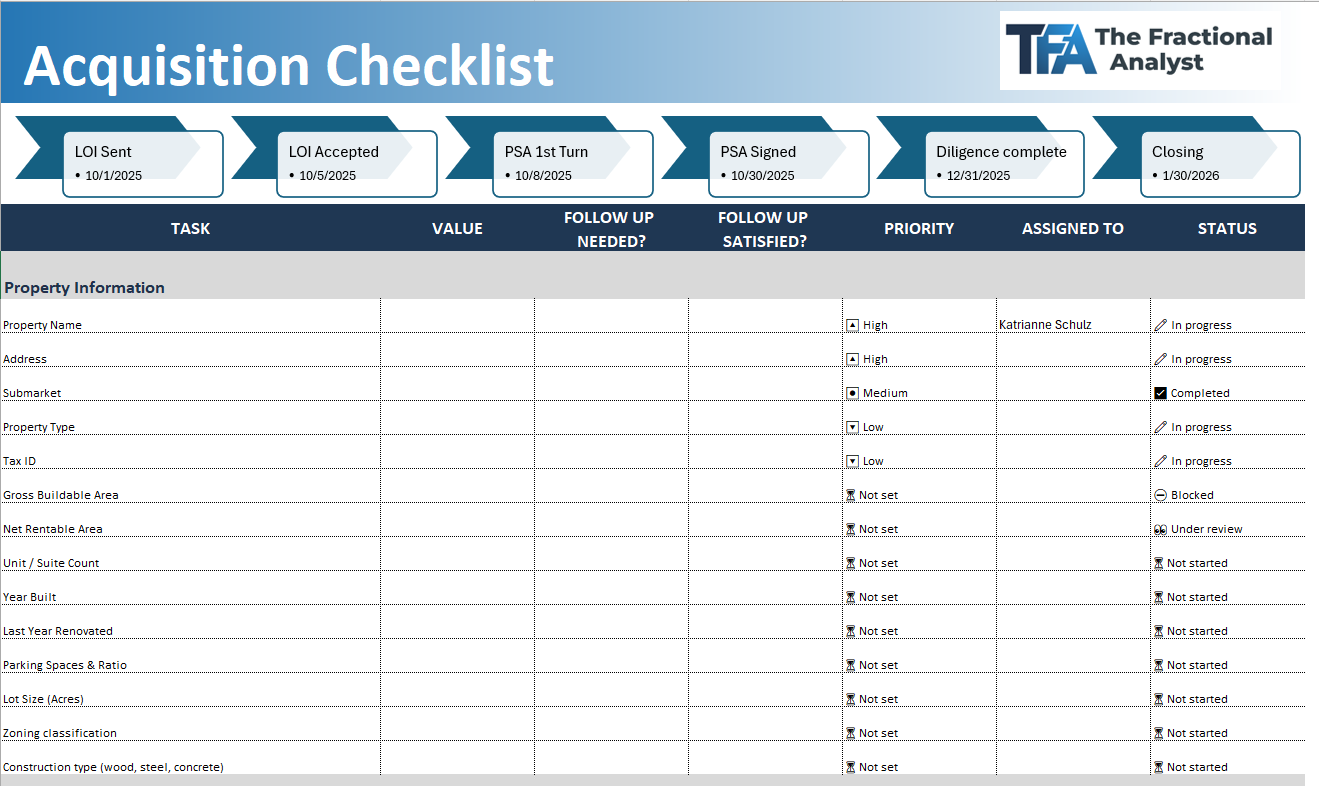

Real Estate Acquisition Checklist – Ensure diligence is complete from sourcing to close

100 Careers in Real Estate – Explore pathways across the industry

Samples

Multifamily Acquisition - Input Fields

Portfolio Rollup

IRR Matrix

Acquisition Checklist

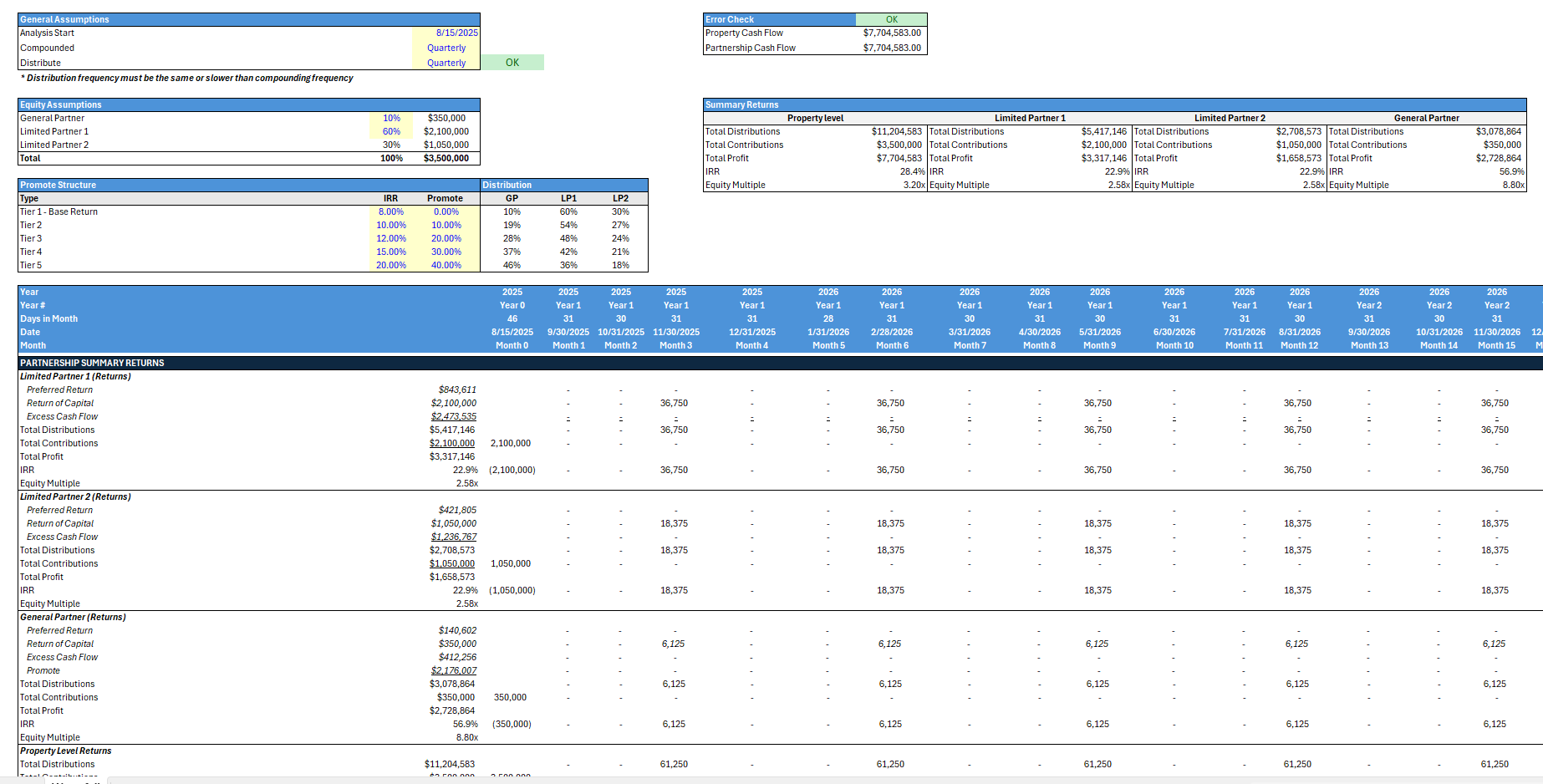

Equity Waterfall

Multifamily Acquisition - Investment Summary

Multifamily Acquisition - OneSheet

NPV - Interest Rate Cap

The Fractional Analyst’s

Multifamily Acquisition Toolkit

Upgrade your underwriting process with our resources that deliver speed, accuracy, and confidence across all your deals

What our customers are saying

FAQ

-

After completing your purchase, you’ll receive an email with a secure download link. You can also access your files anytime through the confirmation page immediately after checkout.

-

Most downloads are provided in Excel (.xlsx), PDF, or PowerPoint (.pptx) formats depending on the product. Each listing specifies the exact formats included.

-

Absolutely. All templates are fully editable and fully unlocked. You can modify formulas, branding, and inputs to fit your project or client deliverable.

-

Your purchase email includes a download link valid for 24 hours. We update these files periodically. If you ever want an updated copy, reach out to us at info@thefractionalanalyst.com for a discount code (80% off current price). We’ll get you taken care of!

-

Due to the nature of the product being sold – digital file downloads – all orders are final. Your satisfaction is our highest priority. Please contact us at info@thefractionalanalyst.com with any comments/concerns. Thank you for your order!

-

Each purchase grants a company-wide license. Please feel free to share the model with your team members and key stakeholders. For anyone asking you for the model, we would ask that you would please send them to our site to purchase their own copy. Thank you for your support, and we look forward to hearing how you use our resources.

-

Our templates are optimized for desktop. Some functions may not work perfectly in Google Sheets or on Mac, though most users find they can still adapt the file with minor adjustments.

-

Yes — we specialize in custom real estate financial models and investment deck design. If you need a model/deck built or adapted for your unique deal structure, visit our On Demand Analyst page or email info@thefractionalanalyst.com

-

We offer 1:1 training for $145/hr. You can reach us at info@thefractionalanalyst.com to set up a call.

The Fractional Analyst’s

Real Estate Resource Toolkit

Upgrade your underwriting process with our resources that deliver speed, accuracy, and confidence across all your deals