Multifamily Acquisition

Our Multifamily model enables faster, more accurate deal underwriting, regardless of the apartment’s size or type.

Its comprehensive features streamline the underwriting process and ensure precision.

Rent roll and T12 deposit sheets for setting up unit mix and baseline expenses

Robust comps sheet for accurate rent forecasting

Ideal for a variety of deals, from small core-plus acquisitions to large value-add projects

What’s Inside the Model

Inputs

Main Inputs – Centralized tab for all deal-level assumptions.

Reno Inputs – Major renovation and repositioning assumptions.

T-12 Deposit (Optional) – Drop in trailing-12 income/expense data for reference.

Rent Roll Deposit (Optional) – Import rent roll details for unit mix and renovation tracking.

Outputs

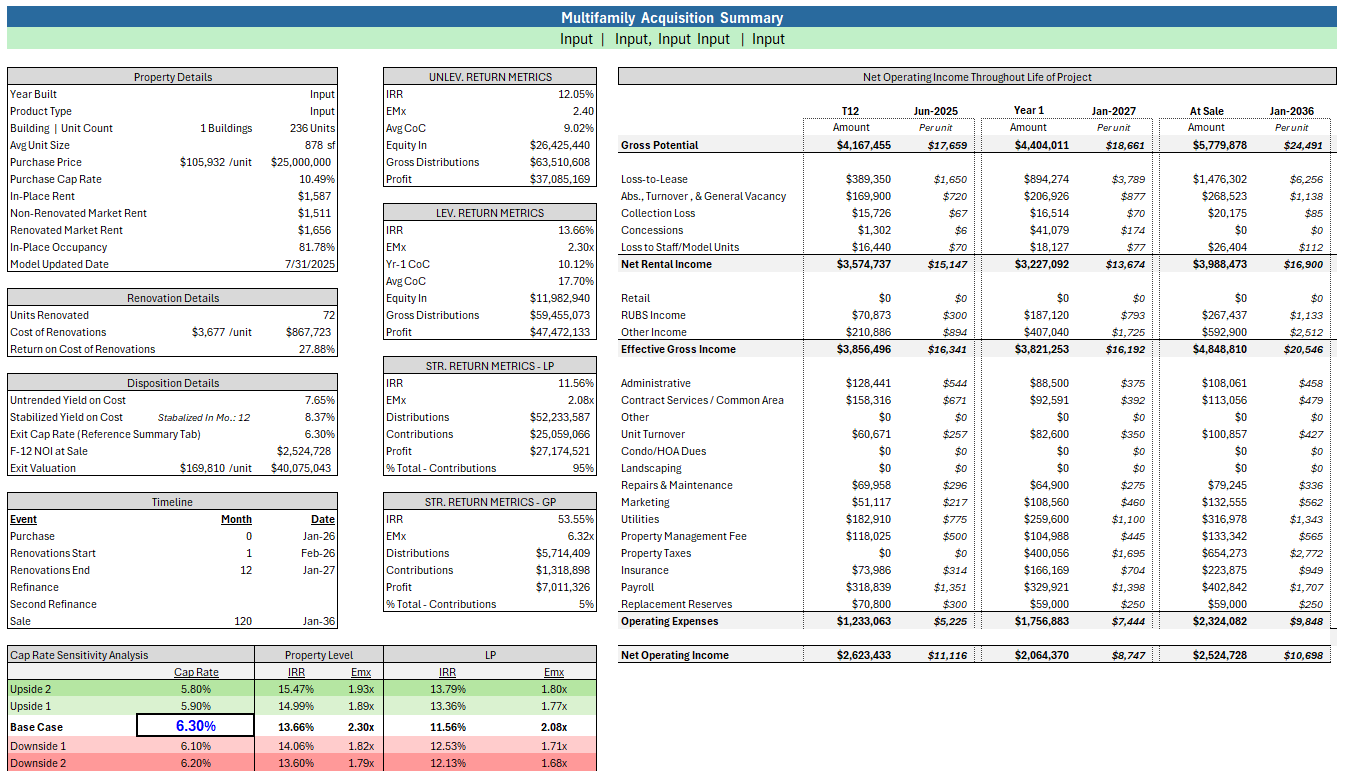

Investor Report – A concise, presentation-ready overview with returns and highlights.

Summary – Snapshot of deal metrics, valuation, and investor returns.

Sources & Uses – Capital structure overview with broad renovation analysis.

Unit Mix – In-place vs. pro forma unit mix with rent growth assumptions.

Comp Analysis – Rent and sales comps to benchmark underwriting assumptions.

Cash Flows – Full monthly-to-annual cash flow engine, both nominal and per-unit.

Calculations

Equity Waterfall – GP/LP distribution mechanics with customizable structures.

CALC – Renovation Schedule – Renovation timelines and cost modeling for non-renovated vs. renovated units.

CALC – Financing – Senior debt, renovation loan, and refinancing assumptions with integrated schedules.

SOFR Rate Drop – Insert prevailing SOFR curve

Key Features

Acquisition-Focused Design

Tailored for buyers evaluating multifamily properties with retail or office components.

Value-Add & Renovation Capabilities

Model repositioning scenarios with customizable renovation schedules and assumptions.

Detailed Investor Reporting

Generate presentation-ready reports that highlight key returns, investment rationale, and metrics.

Debt & Equity Structures

Fully integrated financing, including fixed and floating rate senior loans, renovation loans, refinances, and equity waterfall modeling.

Scenario Flexibility

Test in-place vs. pro forma unit mixes, comp-driven rent growth, and various sources and uses of funds.

Samples

Input Fields

T12 Deposit Sheet

Rent Roll Deposit Sheet

Cash Flows Sheet

Renovation Inputs

Investment Summary

The Fractional Analyst’s

Multifamily Acquisition Model

Upgrade your underwriting process with our model that delivers speed, accuracy, and confidence across all your multifamily deals

What our customers are saying

FAQ

-

After completing your purchase, you’ll receive an email with a secure download link. You can also access your files anytime through the confirmation page immediately after checkout.

-

Most downloads are provided in Excel (.xlsx), PDF, or PowerPoint (.pptx) formats depending on the product. Each listing specifies the exact formats included.

-

Absolutely. All templates are fully editable and fully unlocked. You can modify formulas, branding, and inputs to fit your project or client deliverable.

-

Your purchase email includes a download link valid for 24 hours. We update these files periodically. If you ever want an updated copy, reach out to us at info@thefractionalanalyst.com for a discount code (80% off current price). We’ll get you taken care of!

-

Due to the nature of the product being sold – digital file downloads – all orders are final. Your satisfaction is our highest priority. Please contact us at info@thefractionalanalyst.com with any comments/concerns. Thank you for your order!

-

Each purchase grants a company-wide license. Please feel free to share the model with your team members and key stakeholders. For anyone asking you for the model, we would ask that you would please send them to our site to purchase their own copy. Thank you for your support, and we look forward to hearing how you use our resources.

-

Our templates are optimized for desktop. Some functions may not work perfectly in Google Sheets or on Mac, though most users find they can still adapt the file with minor adjustments.

-

Yes — we specialize in custom real estate financial models and investment deck design. If you need a model/deck built or adapted for your unique deal structure, visit our On Demand Analyst page or email info@thefractionalanalyst.com

-

We offer 1:1 training for $145/hr. You can reach us at info@thefractionalanalyst.com to set up a call.