Image 1 of 1

Image 1 of 1

Build To Rent Model (Advanced)

Build-for-Rent Development Model

The Fractional Analyst Build-for-Rent Development Model is a purpose-built tool designed to simplify and streamline underwriting for large-scale single-family and multifamily rental communities. Whether you are acquiring land, breaking ground on new phases, or seeking capital, this model provides a complete end-to-end framework for analyzing deal economics with confidence.

Key Features

Comprehensive Development Assumptions

Input detailed site, unit count, and square footage assumptions across acquisition and multiple development phases. The model flexibly accommodates phased buildouts, enabling side-by-side comparisons of performance at the project, phase, and consolidated level.Granular Cost Tracking

Built with a fully integrated construction budget, the model breaks down land, hard costs, soft costs, contingencies, and financing, providing per-unit and per-square-foot benchmarks to validate assumptions against market norms.Dynamic Returns Analysis

Review projected Return on Cost, Levered/Unlevered IRR, Equity Multiples, and Cash-on-Cash yields in one place. The integrated equity waterfall tab calculates returns for both GP and LP structures, giving clear visibility into capital allocation.Integrated P&L

Track stabilized operating performance with consolidated and phase-level P&L statements. Capture the revenue profile, operating expenses, and NOI to evaluate long-term portfolio contribution.Sensitivity Testing

Built-in sensitivity analysis allows users to stress-test variables such as lease-up timing, cap rates, rent growth, and cost inflation to understand risk and upside potential.Scalable Across Deal Sizes

The model supports projects from a few dozen units to large master-planned communities with hundreds of rental homes, making it suitable for both private developers and institutional investors.

Why Use This Model?

The BTR sector is rapidly expanding as demand grows for single-family rental communities and horizontal apartments. This model was built to give investors, developers, and capital partners the clarity needed to structure deals, raise equity, and make informed investment decisions with institutional-level rigor.

What’s Inside the Model

Our Build-for-Rent Development Model is designed with a clear structure, making it easy to navigate from inputs to results. Every tab is purpose-built to give you transparency and confidence in your underwriting.

Inputs

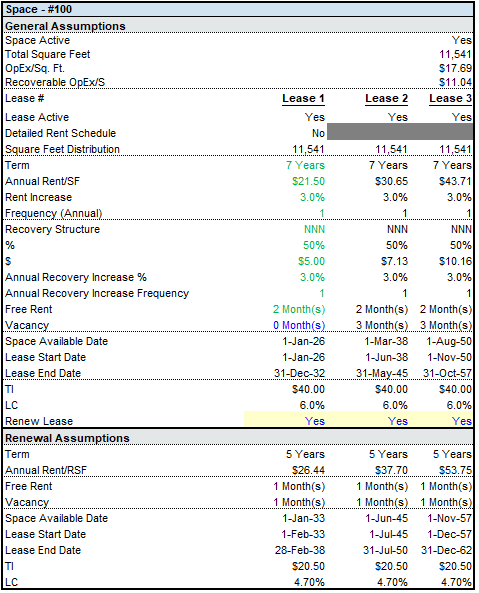

Assumptions – Centralized hub for all global assumptions, project details, and phased inputs.

Detailed Construction Costs – Break down land, hard costs, soft costs, and contingencies with precision.

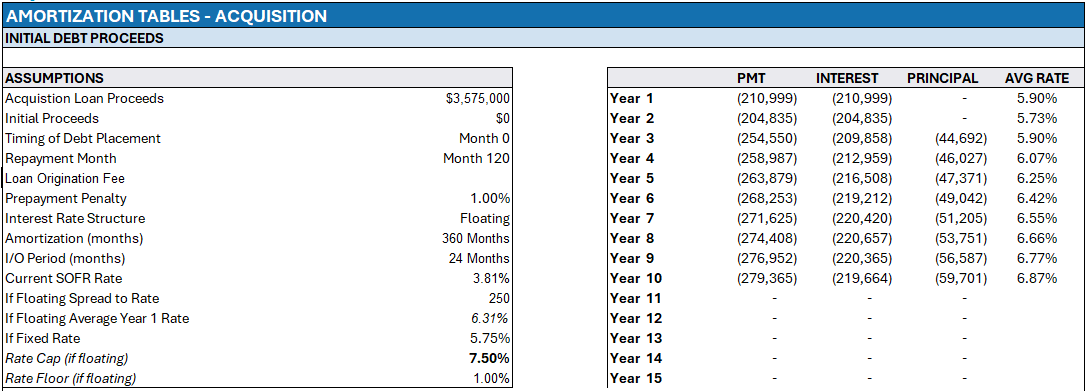

SOFR – Preloaded SOFR curve for accurate debt financing projections.

Major Outputs

Deals & Returns – High-level investment summary with project-wide economics.

Return on Cost – Yield, valuation metrics, and developer spread analysis.

Annual P&L – Consolidated – Project-wide operating statement including debt and equity impacts.

Annual P&L – Acquisition – Track performance and financing impacts from the acquisition phase.

Annual P&L – Phase 1 – Phase-level financials with debt and equity integration.

Annual P&L – Phase 2 – Phase-level financials with debt and equity integration.

Monthly P&L – Month-by-month operational results and financing impact analysis.

Calculations

Debt Tables – Detailed debt schedules supporting consolidated cash flows.

Equity Waterfall – GP/LP equity waterfall with customizable promote structures.

Sensitivity Analysis – Test scenarios across rent growth, costs, cap rates, and more.

Sensitivity Analysis – Debt Tables – Combined stress testing with integrated debt schedules.

Build-for-Rent Development Model

The Fractional Analyst Build-for-Rent Development Model is a purpose-built tool designed to simplify and streamline underwriting for large-scale single-family and multifamily rental communities. Whether you are acquiring land, breaking ground on new phases, or seeking capital, this model provides a complete end-to-end framework for analyzing deal economics with confidence.

Key Features

Comprehensive Development Assumptions

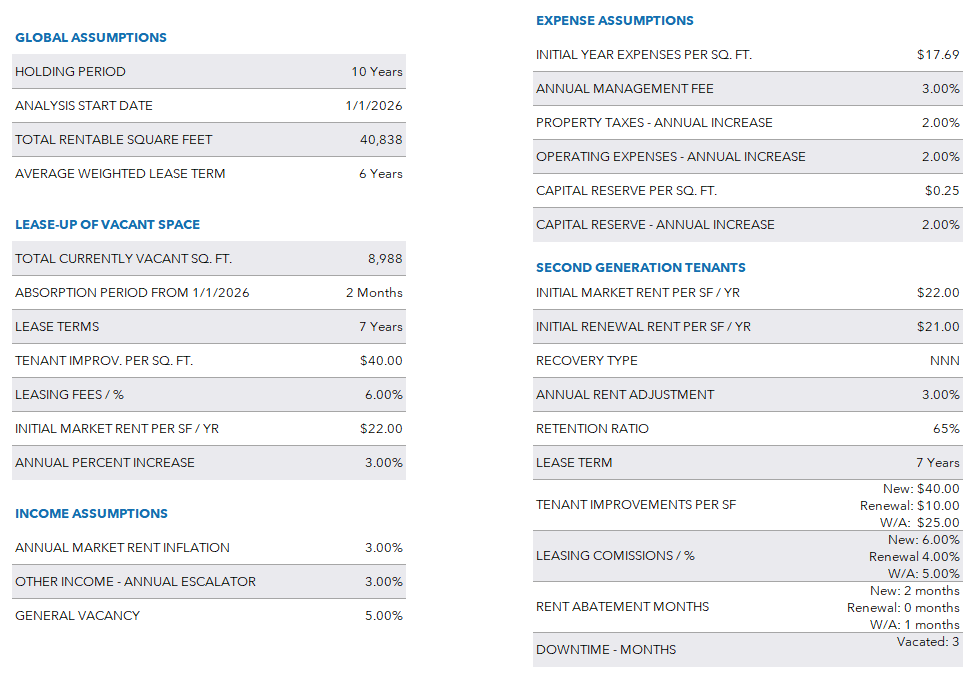

Input detailed site, unit count, and square footage assumptions across acquisition and multiple development phases. The model flexibly accommodates phased buildouts, enabling side-by-side comparisons of performance at the project, phase, and consolidated level.Granular Cost Tracking

Built with a fully integrated construction budget, the model breaks down land, hard costs, soft costs, contingencies, and financing, providing per-unit and per-square-foot benchmarks to validate assumptions against market norms.Dynamic Returns Analysis

Review projected Return on Cost, Levered/Unlevered IRR, Equity Multiples, and Cash-on-Cash yields in one place. The integrated equity waterfall tab calculates returns for both GP and LP structures, giving clear visibility into capital allocation.Integrated P&L

Track stabilized operating performance with consolidated and phase-level P&L statements. Capture the revenue profile, operating expenses, and NOI to evaluate long-term portfolio contribution.Sensitivity Testing

Built-in sensitivity analysis allows users to stress-test variables such as lease-up timing, cap rates, rent growth, and cost inflation to understand risk and upside potential.Scalable Across Deal Sizes

The model supports projects from a few dozen units to large master-planned communities with hundreds of rental homes, making it suitable for both private developers and institutional investors.

Why Use This Model?

The BTR sector is rapidly expanding as demand grows for single-family rental communities and horizontal apartments. This model was built to give investors, developers, and capital partners the clarity needed to structure deals, raise equity, and make informed investment decisions with institutional-level rigor.

What’s Inside the Model

Our Build-for-Rent Development Model is designed with a clear structure, making it easy to navigate from inputs to results. Every tab is purpose-built to give you transparency and confidence in your underwriting.

Inputs

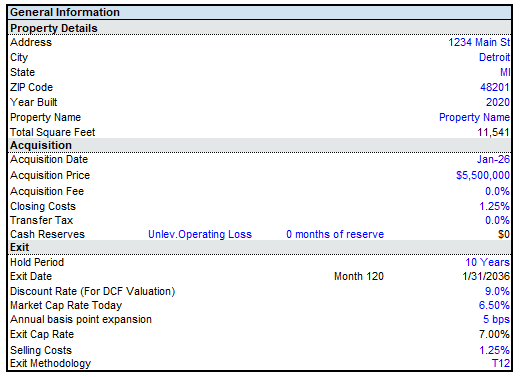

Assumptions – Centralized hub for all global assumptions, project details, and phased inputs.

Detailed Construction Costs – Break down land, hard costs, soft costs, and contingencies with precision.

SOFR – Preloaded SOFR curve for accurate debt financing projections.

Major Outputs

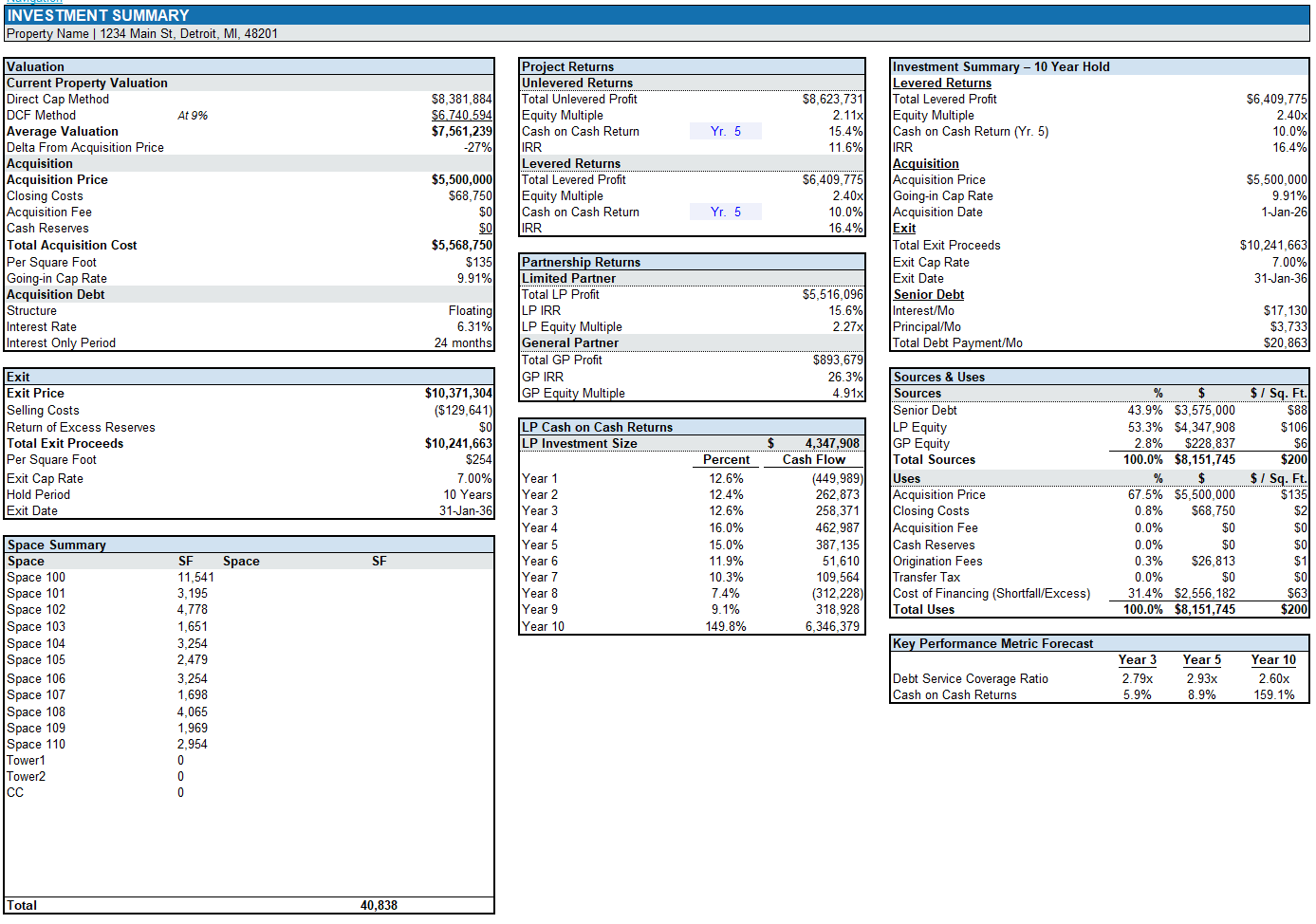

Deals & Returns – High-level investment summary with project-wide economics.

Return on Cost – Yield, valuation metrics, and developer spread analysis.

Annual P&L – Consolidated – Project-wide operating statement including debt and equity impacts.

Annual P&L – Acquisition – Track performance and financing impacts from the acquisition phase.

Annual P&L – Phase 1 – Phase-level financials with debt and equity integration.

Annual P&L – Phase 2 – Phase-level financials with debt and equity integration.

Monthly P&L – Month-by-month operational results and financing impact analysis.

Calculations

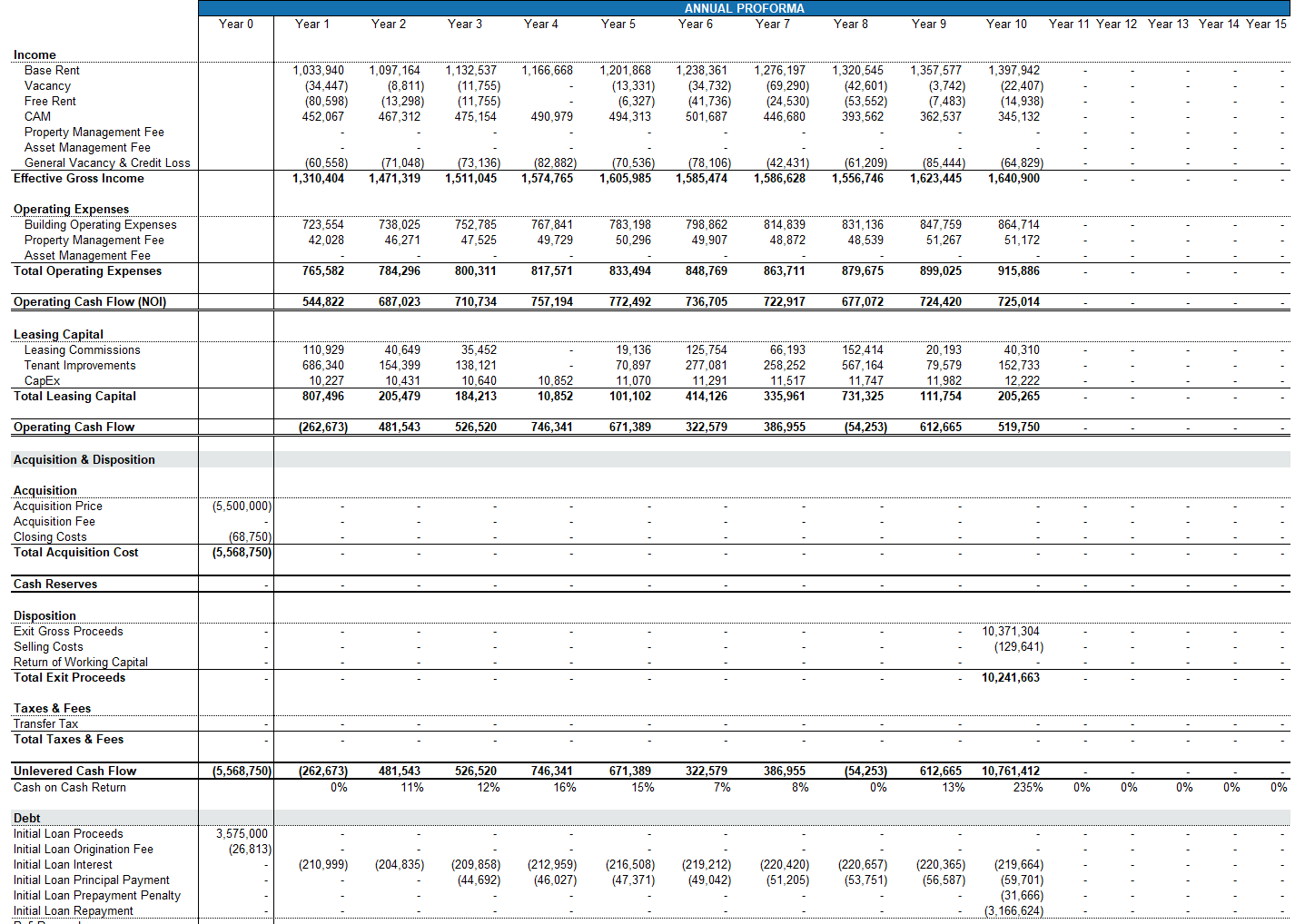

Debt Tables – Detailed debt schedules supporting consolidated cash flows.

Equity Waterfall – GP/LP equity waterfall with customizable promote structures.

Sensitivity Analysis – Test scenarios across rent growth, costs, cap rates, and more.

Sensitivity Analysis – Debt Tables – Combined stress testing with integrated debt schedules.