Image 1 of 6

Image 1 of 6

Image 2 of 6

Image 2 of 6

Image 3 of 6

Image 3 of 6

Image 4 of 6

Image 4 of 6

Image 5 of 6

Image 5 of 6

Image 6 of 6

Image 6 of 6

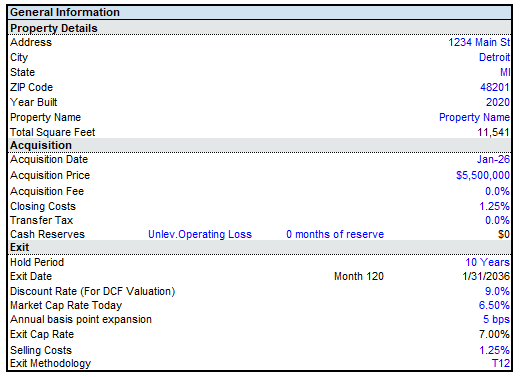

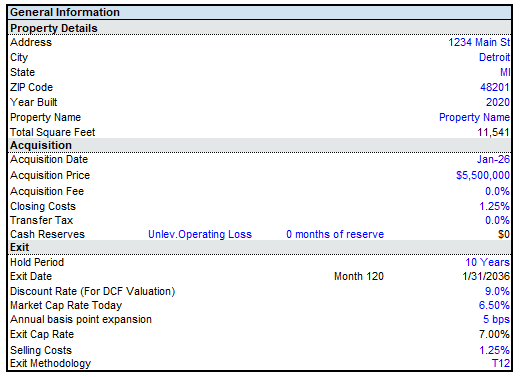

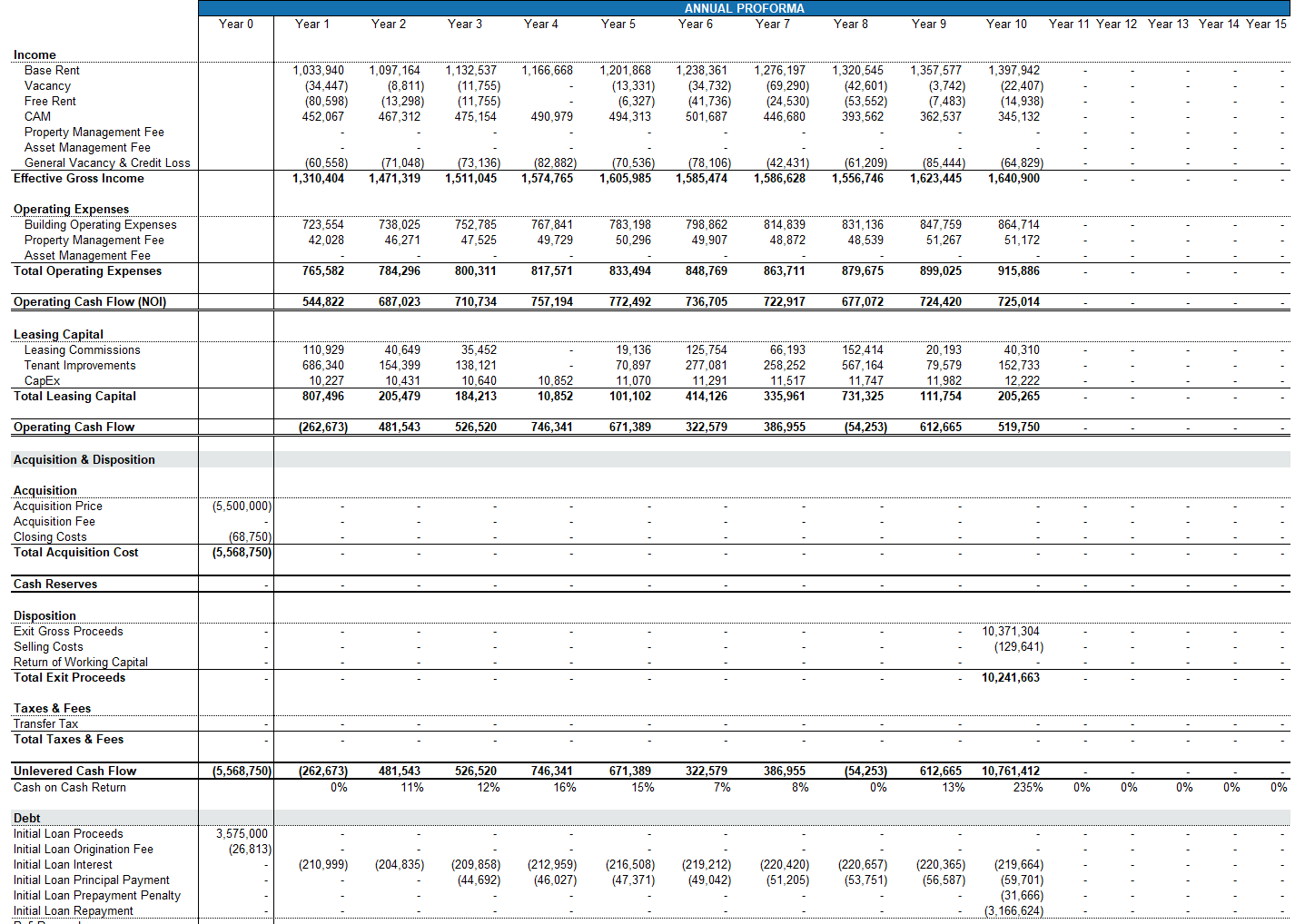

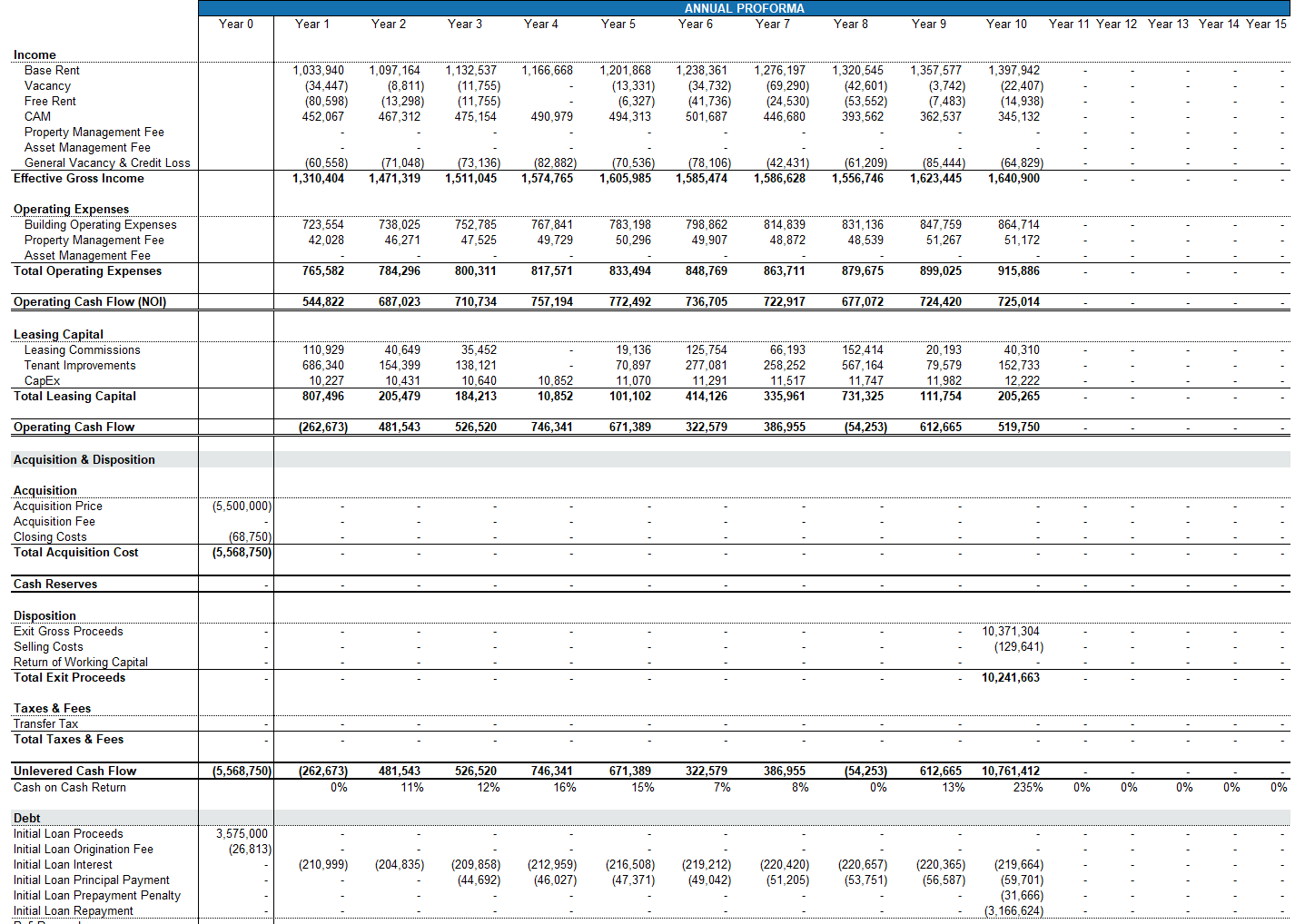

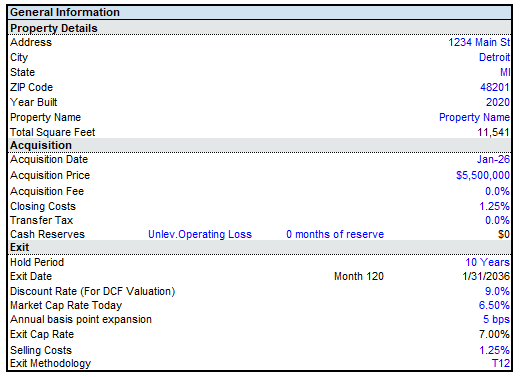

Commercial Acquisition Model

Commercial Acquisitions Model

Institutional-Grade Underwriting. Instant Download.

Make faster, smarter, and more profitable investment decisions with the Commercial Acquisitions Model—a complete, professional underwriting tool built for brokers, investors, developers, asset managers, and independent sponsors. This model gives you everything you need to evaluate any commercial property with confidence—from tenant-by-tenant cash flows to partnership waterfalls and refinance projections.

If you underwrite deals, this model instantly becomes your competitive advantage.

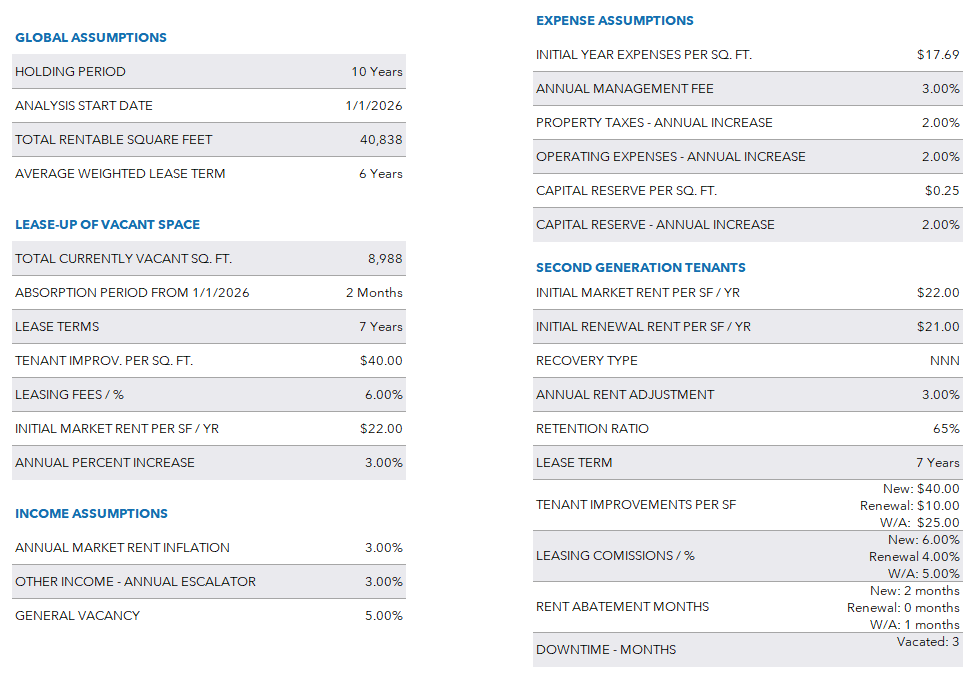

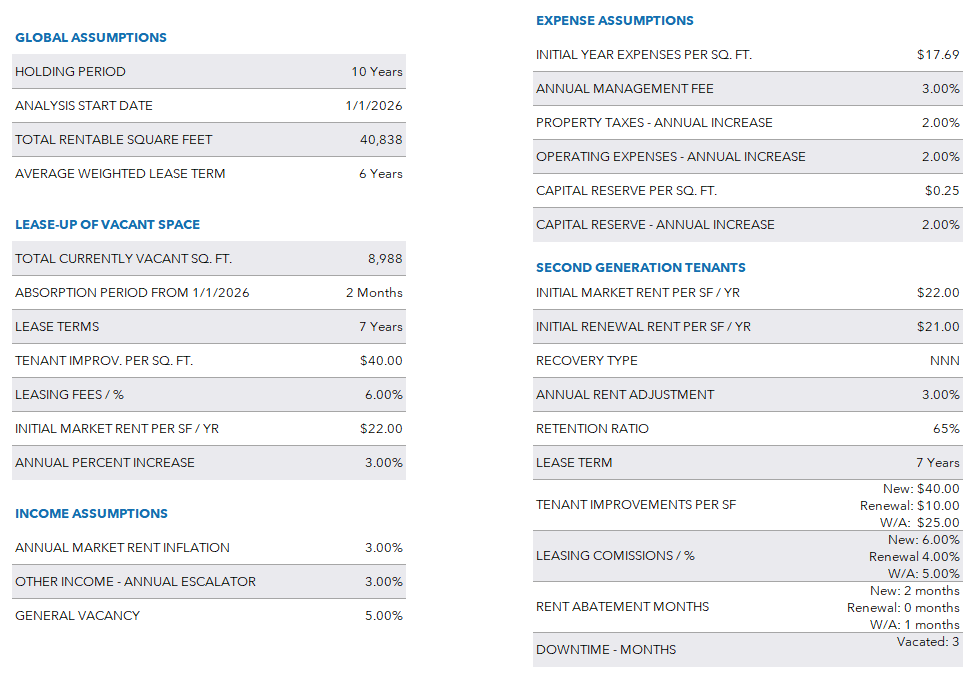

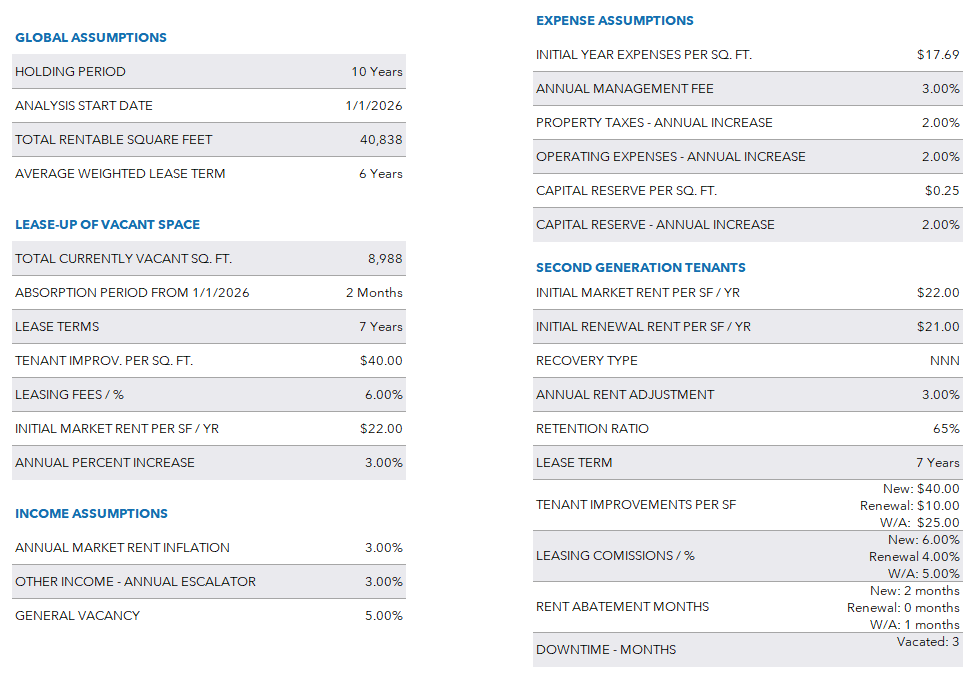

Why This Model?

Underwrite Deals in Minutes, Not Hours

Stop rebuilding spreadsheets from scratch. The model handles:

Market rents

Lease expirations

Recoveries

TIs & LCs

Escalations

Vacancies

Debt assumptions

…all automatically, so you can focus on the investment—not the formulas.

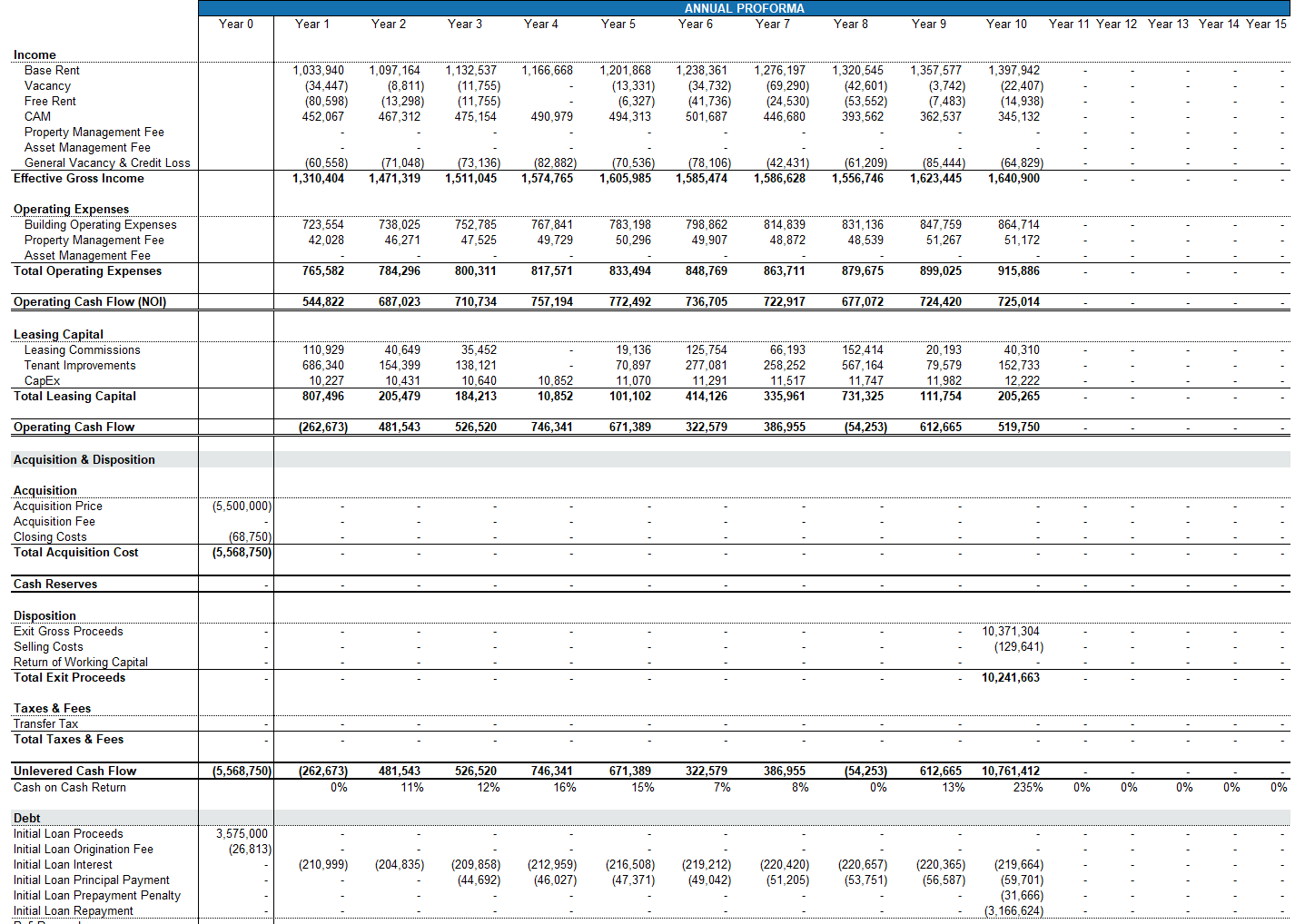

See the Full Life Cycle of a Deal

You get a complete picture of performance across acquisition, operations, refinance, and exit.

Analyze:

NOI growth

DSCR

Cash-on-cash returns

LP/GP payouts

10-year investment performance

…all with one input sheet.

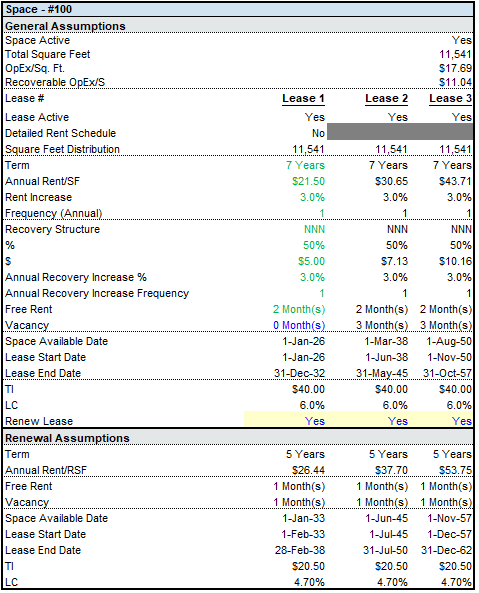

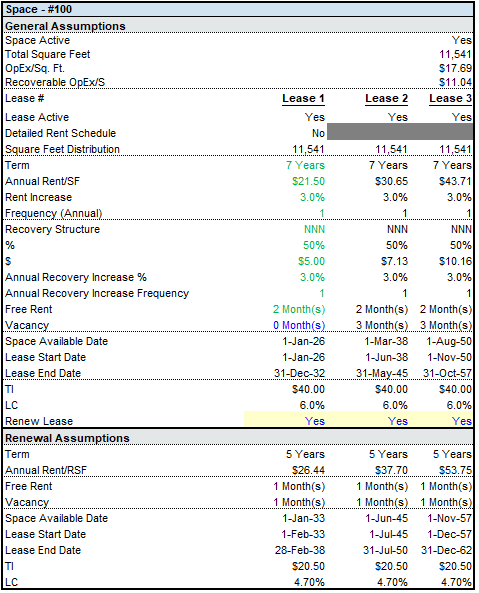

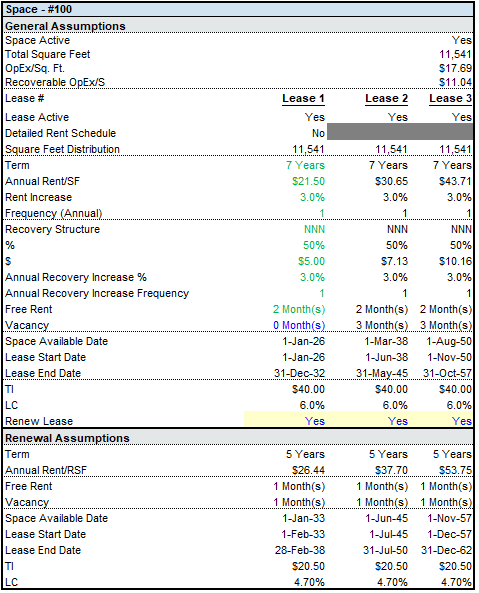

Perfect for Real Multi-Tenant Deals

Built for real life, not textbook examples:

Model multiple leases per space

Control every assumption (TI, LC, free rent, downtime, recovery structures)

Track each tenant’s rent steps, increases, and reimbursements

Automatically roll everything into your pro forma

If you underwrite retail, industrial, office, or mixed-use—this model is built specifically for you.

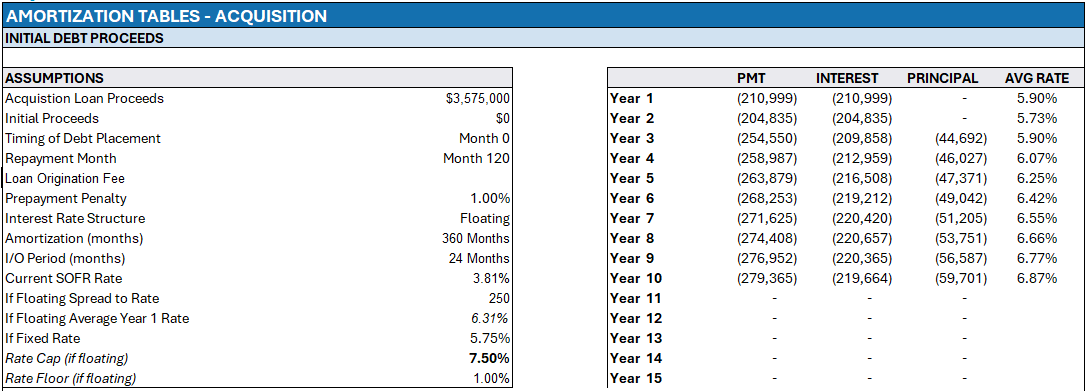

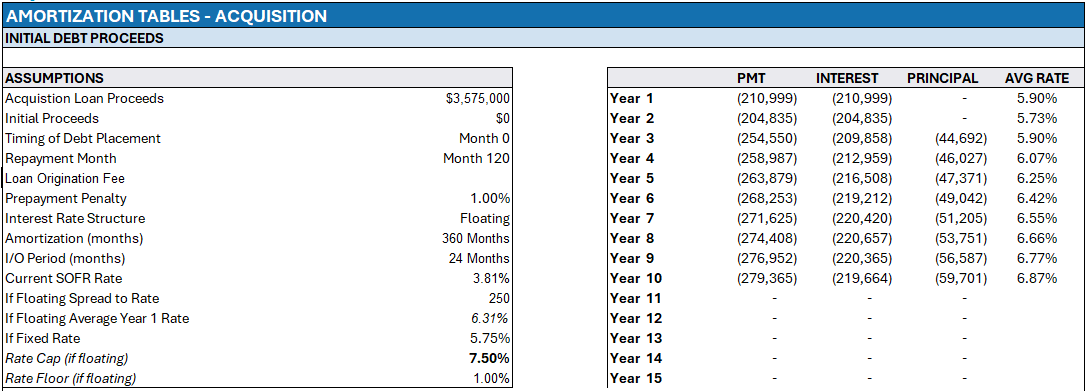

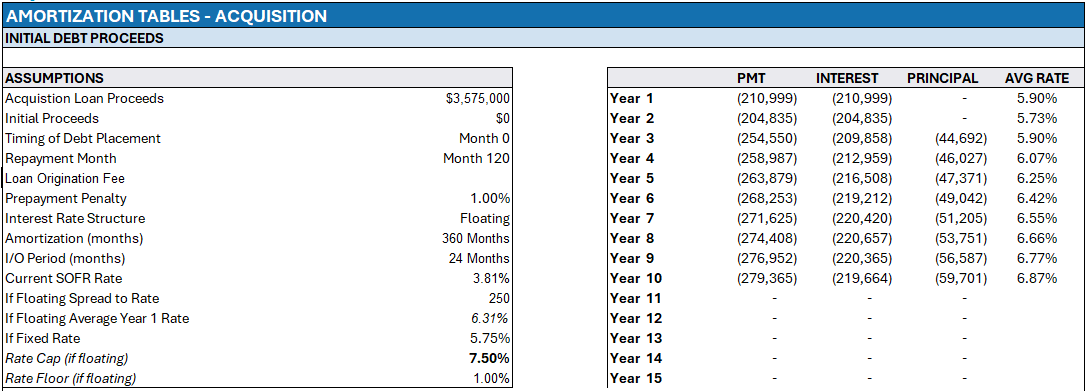

Debt & Equity That Mirrors How Deals Actually Get Done

Quickly customize:

Floating or fixed-rate debt

SOFR-based pricing, caps, and floors

Interest-only periods

Amortization schedules

Refinance proceeds

Full partnership waterfalls with preferred returns & promotes

All calculations flow through to LP and GP returns—no manual tracing required.

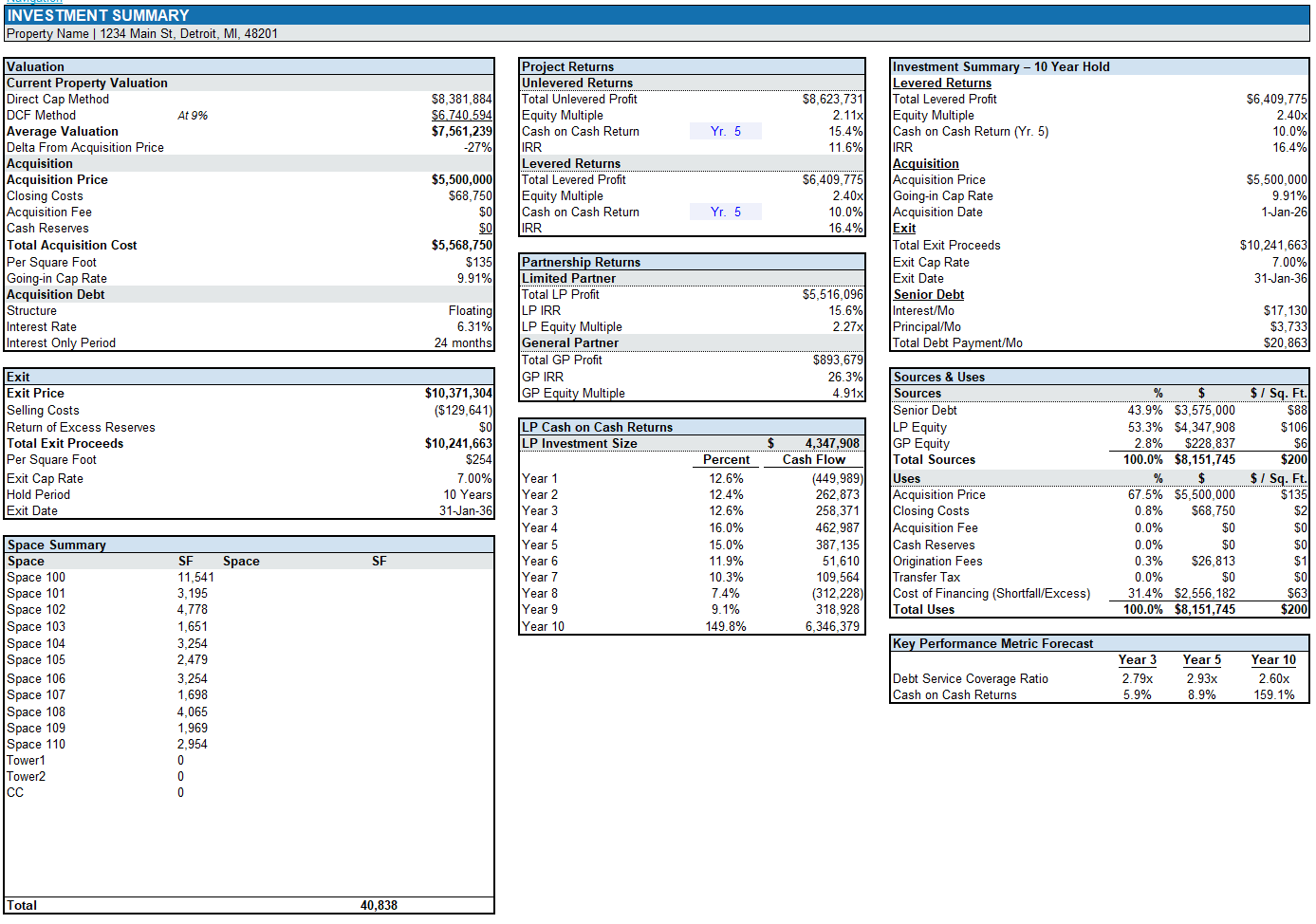

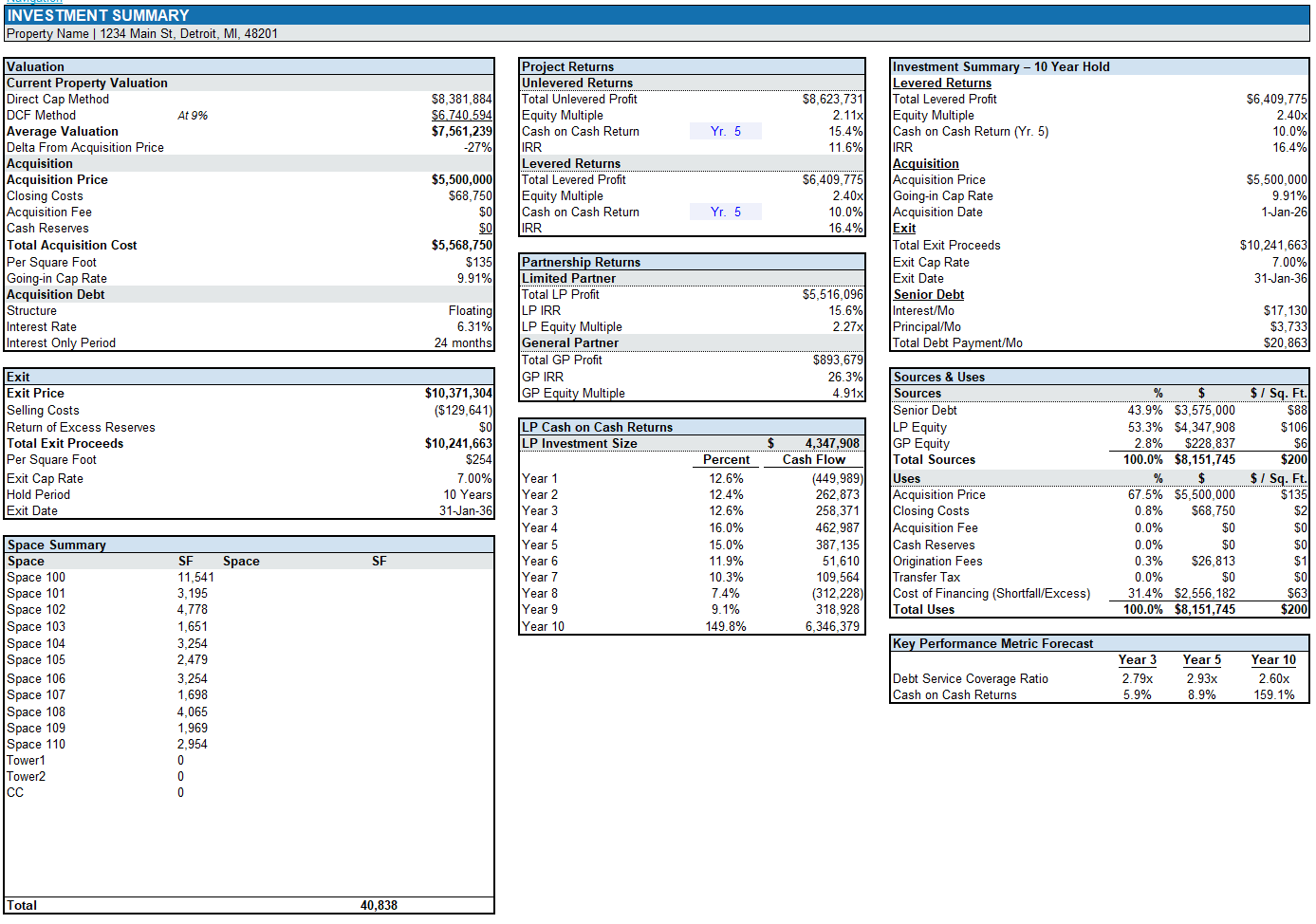

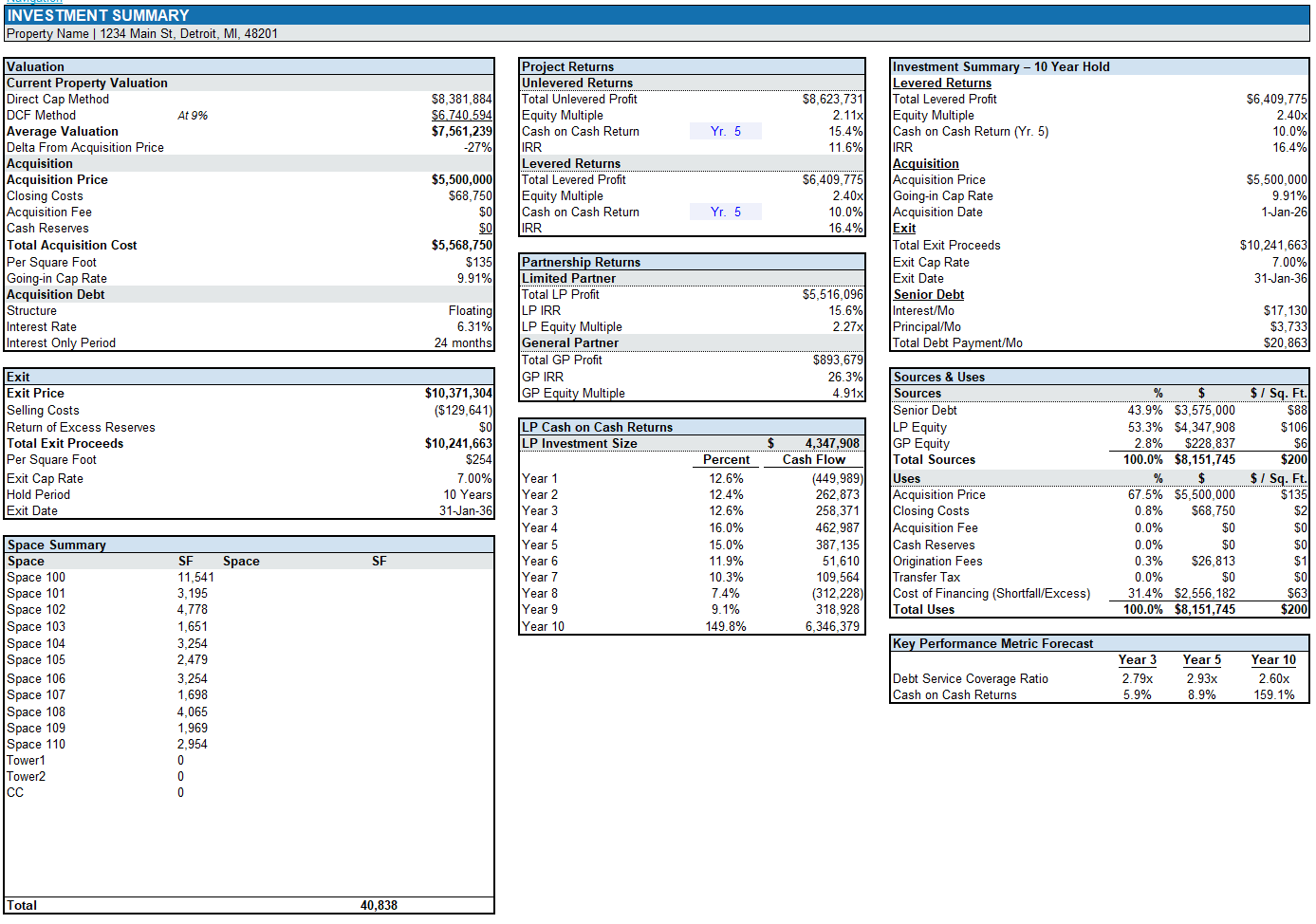

Client-Ready Outputs Included

Every deal automatically produces beautifully formatted, presentation-ready outputs:

Investment Summary

Key metrics (IRR, Equity Multiple, DSCR, CoC)

Space summary

10-year pro forma

Partnership return charts

Sources & Uses

Debt summaries

Perfect for investor decks, lender packages, and IC presentations.

What You Can Do With This Model

✓ Quickly compare purchase opportunities

Swap in assumptions and instantly see how valuations, returns, and cash flows change.

✓ Stress-test rents, vacancy, debt, and cap rates

Every variable is adjustable for sensitivity or downside analysis.

✓ Produce professional underwriting for clients or partners

No more messy spreadsheets—this model builds trust and credibility.

✓ Underwrite deals of any size or complexity

From single-tenant NNN to multi-tenant retail or office buildings, the model handles it all.

✓ Confidently communicate the story of a deal

Outputs highlight strengths, risks, returns, and value creation clearly and professionally.

Who This Is For

This model is designed for:

Commercial acquisition teams

Independent sponsors & syndicators

Private equity and CRE funds

Brokers preparing underwriting for clients

Asset managers evaluating value-add opportunities

Anyone who needs fast, accurate deal modeling

If you’re serious about underwriting, this tool will save you time, reduce errors, and elevate your work.

Download Includes

✔ Fully unlocked Excel model

✔ 10+ years of cash flow logic

✔ Debt modeling + refinance module

✔ Full waterfall with up to 5 tiers

✔ Tenant-level lease engine

✔ Presentation-ready output pages

✔ Step-by-step instructions

Ready to underwrite with unmatched clarity, speed, and confidence?

Download the Commercial Acquisitions Model today and start underwriting like an institution.

Commercial Acquisitions Model

Institutional-Grade Underwriting. Instant Download.

Make faster, smarter, and more profitable investment decisions with the Commercial Acquisitions Model—a complete, professional underwriting tool built for brokers, investors, developers, asset managers, and independent sponsors. This model gives you everything you need to evaluate any commercial property with confidence—from tenant-by-tenant cash flows to partnership waterfalls and refinance projections.

If you underwrite deals, this model instantly becomes your competitive advantage.

Why This Model?

Underwrite Deals in Minutes, Not Hours

Stop rebuilding spreadsheets from scratch. The model handles:

Market rents

Lease expirations

Recoveries

TIs & LCs

Escalations

Vacancies

Debt assumptions

…all automatically, so you can focus on the investment—not the formulas.

See the Full Life Cycle of a Deal

You get a complete picture of performance across acquisition, operations, refinance, and exit.

Analyze:

NOI growth

DSCR

Cash-on-cash returns

LP/GP payouts

10-year investment performance

…all with one input sheet.

Perfect for Real Multi-Tenant Deals

Built for real life, not textbook examples:

Model multiple leases per space

Control every assumption (TI, LC, free rent, downtime, recovery structures)

Track each tenant’s rent steps, increases, and reimbursements

Automatically roll everything into your pro forma

If you underwrite retail, industrial, office, or mixed-use—this model is built specifically for you.

Debt & Equity That Mirrors How Deals Actually Get Done

Quickly customize:

Floating or fixed-rate debt

SOFR-based pricing, caps, and floors

Interest-only periods

Amortization schedules

Refinance proceeds

Full partnership waterfalls with preferred returns & promotes

All calculations flow through to LP and GP returns—no manual tracing required.

Client-Ready Outputs Included

Every deal automatically produces beautifully formatted, presentation-ready outputs:

Investment Summary

Key metrics (IRR, Equity Multiple, DSCR, CoC)

Space summary

10-year pro forma

Partnership return charts

Sources & Uses

Debt summaries

Perfect for investor decks, lender packages, and IC presentations.

What You Can Do With This Model

✓ Quickly compare purchase opportunities

Swap in assumptions and instantly see how valuations, returns, and cash flows change.

✓ Stress-test rents, vacancy, debt, and cap rates

Every variable is adjustable for sensitivity or downside analysis.

✓ Produce professional underwriting for clients or partners

No more messy spreadsheets—this model builds trust and credibility.

✓ Underwrite deals of any size or complexity

From single-tenant NNN to multi-tenant retail or office buildings, the model handles it all.

✓ Confidently communicate the story of a deal

Outputs highlight strengths, risks, returns, and value creation clearly and professionally.

Who This Is For

This model is designed for:

Commercial acquisition teams

Independent sponsors & syndicators

Private equity and CRE funds

Brokers preparing underwriting for clients

Asset managers evaluating value-add opportunities

Anyone who needs fast, accurate deal modeling

If you’re serious about underwriting, this tool will save you time, reduce errors, and elevate your work.

Download Includes

✔ Fully unlocked Excel model

✔ 10+ years of cash flow logic

✔ Debt modeling + refinance module

✔ Full waterfall with up to 5 tiers

✔ Tenant-level lease engine

✔ Presentation-ready output pages

✔ Step-by-step instructions

Ready to underwrite with unmatched clarity, speed, and confidence?

Download the Commercial Acquisitions Model today and start underwriting like an institution.