Image 1 of 1

Image 1 of 1

Mixed-Use Development Model

TFA Mixed-Use Development Model

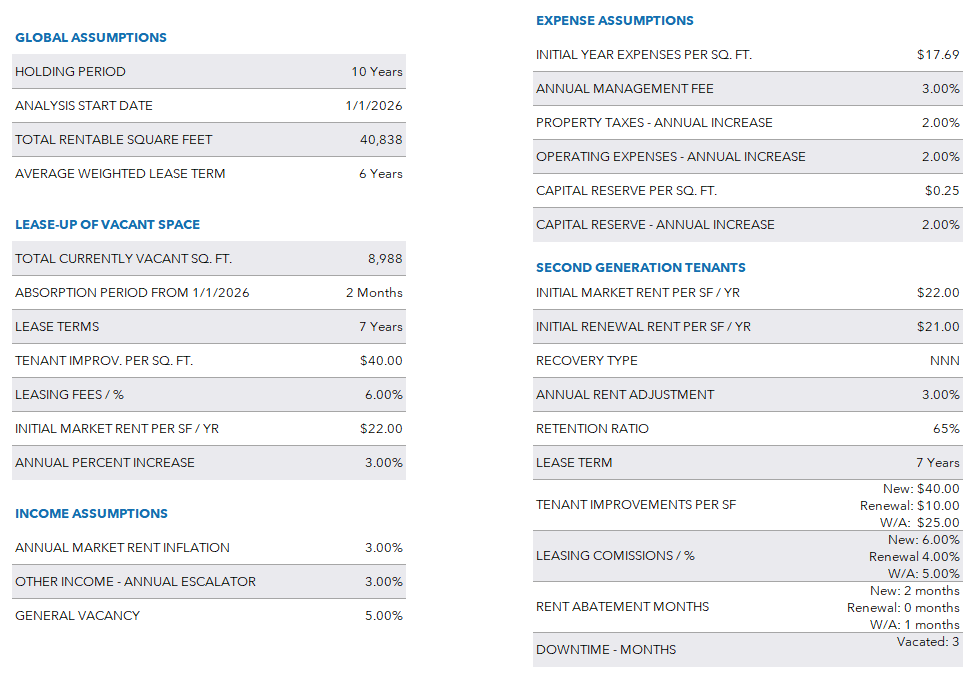

The TFA Mixed-Use Development Model is a comprehensive underwriting tool designed for projects that combine multifamily residential units with significant commercial components such as retail, office, or ground-floor shops. This model provides developers, investors, and capital partners with a clear, data-driven framework to evaluate complex, multi-use projects.

Whether you’re structuring financing, analyzing feasibility, or presenting returns to stakeholders, the model integrates residential and commercial assumptions into a single, streamlined platform.

Key Features

Dual-Focus Assumptions – Model multifamily and commercial components independently while capturing blended project returns.

Robust Construction Budgeting – Track development costs across sitework, residential, and retail construction.

Integrated Financing Schedules – Build and evaluate construction loans, permanent financing, and blended capital stacks.

Return on Cost Analysis – Compare multifamily, retail, and combined project yields to understand profitability drivers.

Equity Waterfall Mechanics – Capture GP/LP distributions with institutional-style waterfall modeling.

Scenario Flexibility – Stress-test unit absorption, rent comps, cap rates, and commercial lease-up assumptions.

What’s Inside the Model

Deal Summary & Returns

Deals & Returns – Snapshot of main deal points with blended economics.

Return on Cost – Clear look at untrended yields for multifamily, retail, and blended components.

Financials & Operations

Annual P&L – Yearly profit & loss across all uses.

Monthly P&L – Detailed month-by-month operating cash flows.

Project Assumptions

Project Assumptions – Apartments – Multifamily unit count, rents, and absorption inputs.

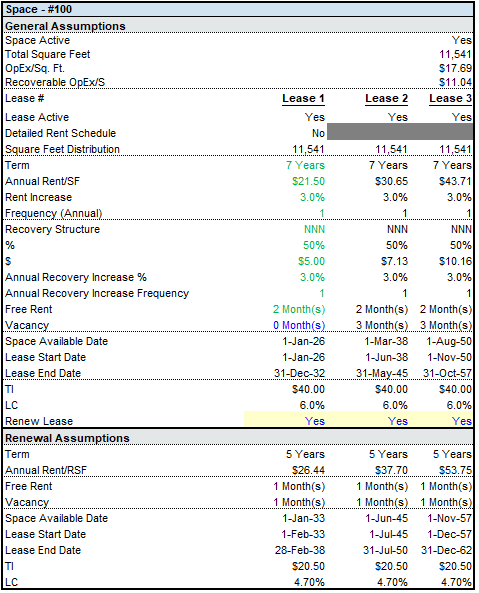

Project Assumptions – Retail – Commercial lease-up, rents, and tenanting assumptions.

Development & Capitalization

Construction Budget – Line-item construction budget for residential and retail components.

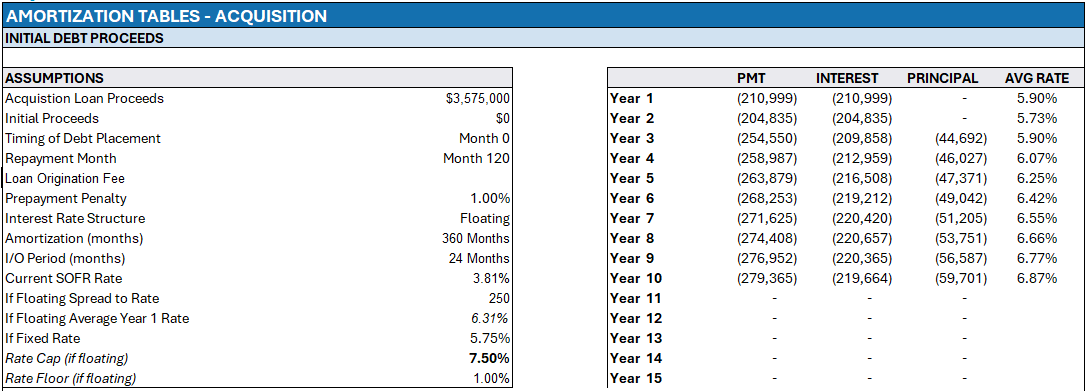

Financing Schedule – Construction and permanent loan schedules with draw modeling.

Equity Waterfall – GP/LP distributions across the project lifecycle.

Market Benchmarking

Comp Analysis – Rent comps, sales comps, and development pipeline benchmarking.

TFA Mixed-Use Development Model

The TFA Mixed-Use Development Model is a comprehensive underwriting tool designed for projects that combine multifamily residential units with significant commercial components such as retail, office, or ground-floor shops. This model provides developers, investors, and capital partners with a clear, data-driven framework to evaluate complex, multi-use projects.

Whether you’re structuring financing, analyzing feasibility, or presenting returns to stakeholders, the model integrates residential and commercial assumptions into a single, streamlined platform.

Key Features

Dual-Focus Assumptions – Model multifamily and commercial components independently while capturing blended project returns.

Robust Construction Budgeting – Track development costs across sitework, residential, and retail construction.

Integrated Financing Schedules – Build and evaluate construction loans, permanent financing, and blended capital stacks.

Return on Cost Analysis – Compare multifamily, retail, and combined project yields to understand profitability drivers.

Equity Waterfall Mechanics – Capture GP/LP distributions with institutional-style waterfall modeling.

Scenario Flexibility – Stress-test unit absorption, rent comps, cap rates, and commercial lease-up assumptions.

What’s Inside the Model

Deal Summary & Returns

Deals & Returns – Snapshot of main deal points with blended economics.

Return on Cost – Clear look at untrended yields for multifamily, retail, and blended components.

Financials & Operations

Annual P&L – Yearly profit & loss across all uses.

Monthly P&L – Detailed month-by-month operating cash flows.

Project Assumptions

Project Assumptions – Apartments – Multifamily unit count, rents, and absorption inputs.

Project Assumptions – Retail – Commercial lease-up, rents, and tenanting assumptions.

Development & Capitalization

Construction Budget – Line-item construction budget for residential and retail components.

Financing Schedule – Construction and permanent loan schedules with draw modeling.

Equity Waterfall – GP/LP distributions across the project lifecycle.

Market Benchmarking

Comp Analysis – Rent comps, sales comps, and development pipeline benchmarking.