Automating Title Insurance Renewals with CoreCast

Managing title insurance renewals manually is inefficient and error-prone. CoreCast, an AI-powered platform, simplifies this process for commercial real estate lenders by automating tasks like policy tracking, data validation, and risk analysis. This reduces costs, minimizes errors, and ensures compliance with evolving regulations.

Here’s how CoreCast helps:

- Automation of Repetitive Tasks: Tracks policy expiration dates, sends reminders, and pre-fills renewal packages.

- Risk and Compliance Management: Flags high-risk renewals, validates data, and ensures regulatory compliance.

- Integration: Connects with underwriting and asset management systems for seamless workflows.

- Performance Tracking: Monitors metrics like processing time and exception rates to improve efficiency.

With CoreCast, lenders can process renewals faster, reduce labor costs, and focus on complex cases requiring human judgment.

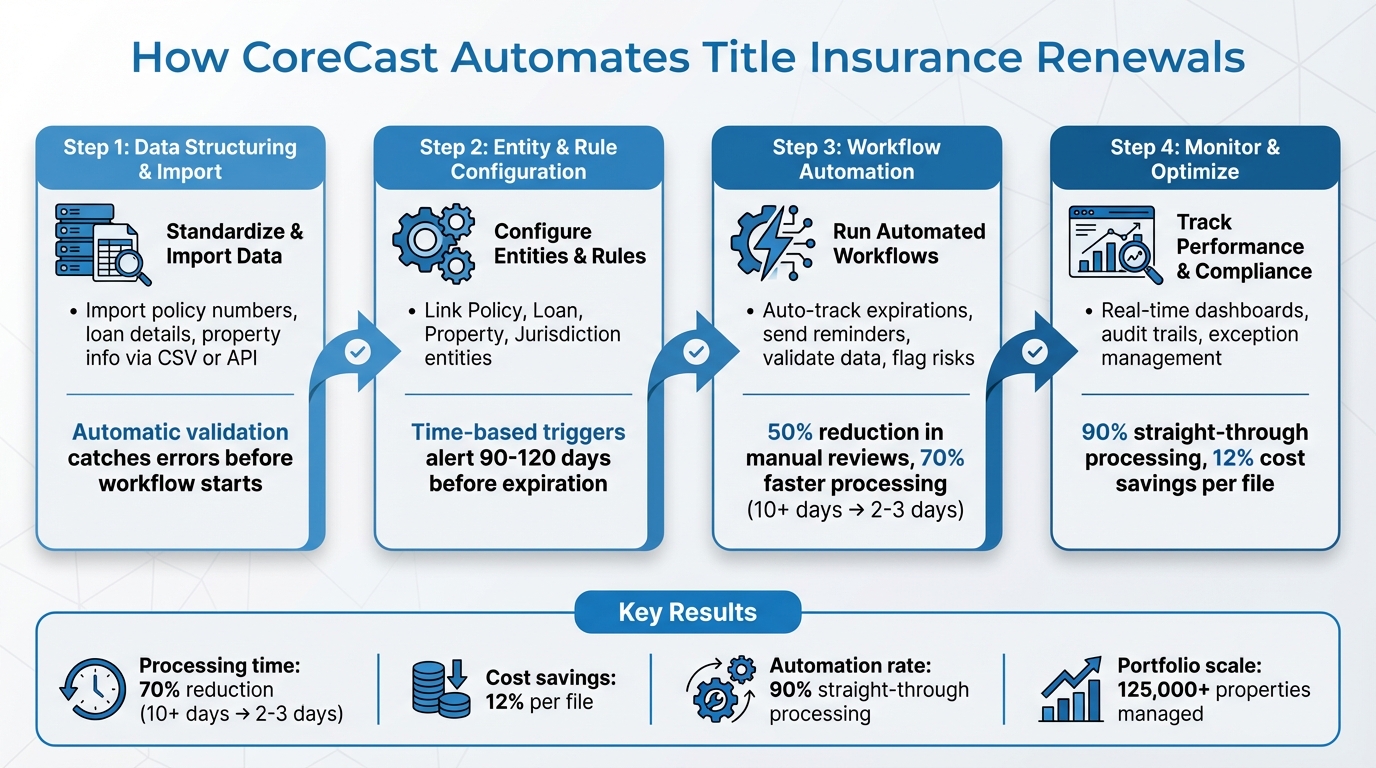

CoreCast Title Insurance Renewal Automation Workflow: 4-Step Process

Problems with Manual Title Renewals

The Manual Renewal Process

Handling title insurance renewals manually involves juggling a series of tedious, repetitive tasks. Many lenders rely on Excel spreadsheets, shared calendars, or informal reminder systems managed by individual analysts to track policy expiration dates[5]. When a renewal is due, staff must pull data from servicing platforms, review policies and endorsements, verify the loan's status, and confirm ownership through title searches[1][2]. Afterward, they coordinate with title companies to get renewal quotes, reconcile premiums and fees with loan documents and servicing guidelines, and secure internal approvals. The process continues with collecting and processing invoices, posting transactions in the general ledger and servicing system, and finally filing updated policies to meet audit and regulatory requirements[1][2].

Each of these steps involves manual data entry, document retrieval, and constant back-and-forth communication, taking hours per file. For lenders managing large portfolios, this workload quickly becomes overwhelming, creating opportunities for errors and inefficiencies.

Where Manual Processes Fail

The shortcomings of manual renewals are clear. Missed or delayed renewals can happen when expiration dates are scattered across various systems without centralized alerts. This issue worsens if a key analyst is unavailable, exposing lenders to significant risks[2]. Re-entering information - such as borrower names, loan numbers, or property addresses - into internal templates or title company forms opens the door to typos, mismatched loan IDs, or incorrect coverage amounts, which can derail or invalidate renewals[2].

Additionally, manually comparing policy terms and endorsements across PDFs or scanned documents is both time-consuming and prone to errors, increasing the chance of overlooking changes in ownership, new liens, or updated regulatory requirements[1][2]. Coordination becomes even more challenging when lenders, servicers, title companies, and legal teams work with different versions of spreadsheets and documents. Communication often relies on email threads and phone calls to clarify details like coverage, pricing, and curative items[2][6].

These inefficiencies lead to higher labor costs, rush fees from title providers, greater claim risks, and potential breaches of investor or regulatory expectations[1][2][3].

Which Tasks to Automate

Some tasks in the renewal process are repetitive and rule-based, making them ideal for automation. For example, automated tracking of policy effective and expiration dates across loan portfolios can prevent missed deadlines and ensure consistent record-keeping[1][2]. Setting automated reminders at intervals like 180, 90, and 30 days before expiration helps prioritize renewals based on risk[1][2][3].

Automation can also streamline data ingestion from servicing systems to pre-fill renewal packages. Automated validation of key fields - such as loan numbers, property IDs, coverage amounts, insurers, and policy numbers - can flag discrepancies, reducing the need for manual checks[1][3][8]. Standardized communication templates for title companies and internal teams, along with automated task assignments and document logging for audit purposes, minimize manual intervention and allow analysts to focus on exceptions requiring human judgment[1][2][3][8].

These automations can cut per-file costs by 10–15% and speed up processing times, as seen in similar workflows involving title and underwriting[1][3][7]. By addressing these manual challenges with CoreCast automation, lenders can create a more efficient and reliable renewal process.

Configuring CoreCast for Title Renewals

Structuring Your Data

To automate renewals in CoreCast, the first step is to standardize your core data fields. Start by organizing key information such as policy numbers, loan details (including loan amount in USD, formatted with commas for thousands), lender name, origination date, property details (like legal description, address, and parcel ID), and maturity dates (formatted as MM/DD/YYYY). Once your data is prepared, import it into CoreCast using either a CSV file or an API connection. During import, map each column to its corresponding CoreCast field, and the platform will automatically validate the entries. This validation cross-checks policy numbers, loan amounts, and parcel IDs against title commitments and property records, catching incomplete or mismatched data before it enters your workflows.

By organizing your data into structured tables, you ensure that every policy is directly linked to its related loan and property, creating a relational data model. This model updates automatically whenever changes occur, keeping your data accurate and synchronized. Once your data is standardized, you can configure your entities and rules to activate automated workflows.

Setting Up Entities and Rules

In CoreCast, entities serve as the foundation for your renewal workflows. Define and connect entities like Policy, Loan, Property, and Jurisdiction using relational mapping. For example, the Policy entity should include fields such as policy number, coverage amount, effective date, and endorsements. Meanwhile, the Loan entity should capture details like loan ID, maturity date, and current status. By linking these entities, any changes - like an updated loan maturity date - can automatically adjust the related policy's renewal timeline.

Next, configure time-based triggers in CoreCast's rules engine to streamline your workflows. For instance, set alerts to activate 90 to 120 days before a policy's maturity date, such as: "If maturity < 90 days, trigger renewal workflow." This ensures your team has adequate lead time. Additionally, you can create event-based triggers for specific scenarios like loan modifications, title defects, or covenant breaches that require immediate updates to a policy. To address regulatory differences across states, define jurisdiction-specific rules by tagging policies with state codes. For example: "If CA, require environmental endorsements" or "If FL, include flood coverage check." These rules help maintain compliance with various recording requirements and regulations nationwide.

Connecting to Other Workflows

Once your data structure and entities are in place, integrate CoreCast with your existing underwriting and asset management systems to create a seamless renewal process. CoreCast connects directly with The Fractional Analyst's underwriting and asset management services via API. This integration allows renewal data - such as updated policy terms, risk flags, and endorsement changes - to flow into underwriting modules. Analysts can then review key metrics like lien priority and coverage adequacy. At the same time, performance indicators from asset management systems, such as DSCR (Debt Service Coverage Ratio) or occupancy rates, feed back into CoreCast. This helps prioritize renewals based on risk. For example, properties with declining NOI (Net Operating Income) or lease rollover issues can be flagged for more detailed title reviews.

This two-way synchronization reduces manual tasks and ensures all stakeholders stay aligned. For instance, if an asset management report identifies a change in a borrower entity, CoreCast can automatically trigger a new title search and update the policy. This integration creates a unified workflow that connects initial underwriting with ongoing asset management and policy renewal, keeping the entire process efficient and transparent.

Creating and Running Automated Workflows

Building Your Workflow

Start by defining your objectives and identifying triggers to automate tasks like title renewals. This can significantly reduce manual reviews - by as much as 50% - while ensuring compliance with lender requirements[1][10]. Triggers might include policy expiration dates within 30 days or alerts from property management systems like Buildium or RealPage[10]. These conditions ensure that the workflow activates automatically when needed.

Next, outline the specific tasks within your workflow. For example, you can automate title searches, retrieve documents from your data repository, and send renewal notifications to lenders and internal teams. With CoreCast's platform, these tasks are seamlessly managed through a unified dashboard, enabling you to handle renewals across your entire portfolio at once - no need to process them individually[2][11]. Conditional rules can also be set up to auto-approve straightforward renewals with no lien changes or adverse data, while more complex cases, such as ownership disputes, are routed to an underwriter for manual review[1][4][9]. This structure lays the groundwork for fully utilizing CoreCast's automation capabilities.

Using CoreCast Automation Features

CoreCast's automation tools streamline the renewal process by handling tasks like document review and data extraction, reducing processing time from days to mere hours. These features are tightly integrated within the CoreCast ecosystem, making the entire workflow more efficient. For instance, CoreCast can automatically send renewal notifications as policies near their expiration date, pulling updated data from systems like QuickBooks or RealPage[2][10]. Lenders receive real-time alerts when a policy is 60 days from expiring, allowing them to act proactively and minimize risks[2][10].

The platform also uses AI-driven risk flagging to identify high-risk renewals, such as those involving ownership changes or new liens. This predictive analysis, similar to advanced title underwriting models, evaluates risks in seconds[1][3]. You can further enhance efficiency by setting up automated emails with renewal quotes or continuation endorsements, while also assigning internal tasks for analysts to handle exceptions[1][4]. A noteworthy example is First American Financial's adoption of AI and automation, which allowed them to add 100 new title plants - bringing their total to over 1,800 - and earned them a 2025 American Business Award for their achievements in scaling automation within the title industry[1].

Managing Exceptions and Validations

While automation handles routine tasks, exceptions require careful validation. Before completing renewals, ensure they meet lender requirements. Automated checks can verify endorsements, lien updates, and compliance with OFAC sanctions, all through real-time dashboards that align with underwriting guidelines[1][2][3]. It’s essential to confirm that property usage, ownership details, and coverage limits remain consistent with lender expectations. Additionally, ensure all required documents - such as prior policies, endorsements, payoff statements, and lien releases - are included before marking a workflow as complete[1][4].

For more complex issues, like title defects or borrower disputes, CoreCast uses customizable rules to pause automation and route these cases to human review[1][10]. The system logs all historical data for audits and automatically resumes workflows once issues are resolved, maintaining accuracy throughout the process[2][10]. It also tracks rule versions, approval timestamps, and communication logs to meet audit and regulatory standards[1][4][9].

To ensure your workflow runs smoothly, test it in a sandbox environment using mock expiring policies. This allows you to verify that entry conditions and outputs function as expected. Once testing is complete, activate the workflow via the dashboard and monitor its performance in real time across your portfolio. CoreCast also ensures compliance with U.S. standards by formatting dollar amounts with commas (e.g., $1,250,000) and using the MM/DD/YYYY date format[2][10].

sbb-itb-df8a938

Tracking and Improving Your Automated Renewals

Monitoring Performance Metrics

CoreCast dashboards offer a real-time view of your renewal pipeline, highlighting renewals due in the next 30, 60, or 90 days. By automating the process, you can cut processing times dramatically - from over 10 days to just 2–3 days, reducing time spent by 70%. The dashboard also tracks exception rates, making it easier to spot recurring issues like zoning endorsement flags or risks tied to environmental factors. For example, if multi-family renewals frequently face exceptions, you can dig deeper to see if the root cause lies in missing documents or title defects.

These performance metrics are key to measuring the impact of automation. Users often see around 12% savings per file, while straight-through processing can handle up to 90% of renewals without manual intervention. Keeping an eye on key indicators - like average policy value, underwriting speed, and customer retention - provides a clear understanding of how automation contributes to your bottom line. With this data, you can adjust triggers and refine rules to further boost efficiency.

Refining Rules and Triggers

Your historical data is a goldmine for improving automation strategies. CoreCast's analytics engine uses this data to recommend adjustments. For instance, if 85% of renewals are completed on time with a 60-day trigger, you might shorten lead times from 90 days to save resources. The Rule Editor lets you test these changes - like tweaking environmental checks for low-risk properties - and potentially speed up processing by as much as 25%.

Recurring patterns, such as frequent exceptions for specific property types, provide opportunities to fine-tune workflows. Adjusting triggers based on actual performance data can reduce false positives by 20–30%. You can experiment with different rule configurations, whether it’s modifying OFAC check thresholds or updating lien priority validations, to better align with your portfolio’s unique needs.

Maintaining Compliance and Audit Trails

CoreCast ensures compliance by maintaining detailed, unchangeable audit logs. These logs record every step in your renewal workflow - from the initial data pull to final policy issuance. They include timestamps, user IDs, rule adjustments, and resolutions for exceptions, and they’re stored for over seven years to meet regulatory standards. When auditors or lenders request documentation, exportable reports provide a complete history of actions, offering nearly full coverage of the workflow.

Compliance controls, built to align with UETA standards, enforce automated validations and require clear justifications for any manual overrides. Rule versions are tracked for audit purposes, ensuring transparency. This level of documentation is increasingly crucial as the industry faces growing cybersecurity risks, including wire fraud and business email compromise scams, which have caused significant financial losses.

Real life Uses of AI in Title

Conclusion

CoreCast revolutionizes title insurance renewals in commercial real estate by automating tedious tasks like document review, data extraction, and risk validation. This not only slashes processing times but also frees up your team to handle more intricate cases that require human expertise. The result? Faster workflows and a sharper focus on compliance and decision-making.

The platform strengthens compliance with its built-in audit trails and standardized workflows. Every action is meticulously logged with timestamps and user details, ensuring adherence to regulatory and lender requirements. Automated checks eliminate inconsistencies in underwriting, preventing errors and missed steps along the way.

With the Fractional Analyst, CoreCast combines self-service automation with direct expert support. This hybrid approach provides real-time workflow automation while offering tailored solutions for underwriting, asset management, and investor reporting - customized to fit your portfolio's unique demands. It’s a comprehensive strategy that brings data-driven precision to renewals.

For professionals juggling multiple transactions, CoreCast offers a centralized hub for data and standardized processes, making scaling operations manageable. Industry insights highlight how automation transforms cumbersome renewals into efficient, data-backed workflows. With CoreCast managing over 125,000 properties, you gain cutting-edge tools and expert guidance to streamline operations and ensure compliance at every step.

FAQs

How does CoreCast handle state-specific regulations when renewing title insurance policies?

CoreCast takes the complexity out of renewing lender's title insurance policies by embedding state-specific regulations directly into its automated workflows. This approach not only ensures compliance with the diverse rules across different jurisdictions but also minimizes errors and cuts down on administrative tasks.

By simplifying these workflows, CoreCast helps you save valuable time and ensures precision, making the renewal process for title insurance both smoother and more dependable.

How does CoreCast simplify the title insurance renewal process?

CoreCast simplifies the renewal process by automating essential tasks like monitoring policy expiration dates, sending renewal reminders, and managing necessary paperwork. Additionally, it enhances communication between lenders and insurers, creating a more organized and efficient workflow.

How does CoreCast help simplify the renewal process for lender's title insurance policies?

CoreCast streamlines the renewal process for lender's title insurance policies by integrating effortlessly with your current systems. Its real estate intelligence platform takes over essential tasks like tracking property details and handling renewal schedules, ensuring a smoother workflow without disrupting your existing operations.

By automating these steps, CoreCast cuts down on manual work, reduces errors, and frees up valuable time for real estate professionals to concentrate on more critical responsibilities.