How to Be Successful in Commercial Real Estate: Choosing the Right Career Path for Your Strengths

We’re going to take a step back from the data today and talk more about the roles available in the commercial real estate (CRE) industry. CRE is more than just buying and selling buildings—it's a sophisticated, multi-trillion-dollar industry with diverse career paths that touch finance, development, sales, operations, and strategy. Whether you're driven by spreadsheets, relationships, negotiations, or design, there's a CRE career path tailored to your strengths.

If you’re mature in your career, consider sharing this article with someone earlier on. It may have a bigger impact on them than you could ever know.

This comprehensive guide explores how to succeed in commercial real estate by understanding the various roles available, how to enter them, and what skills or traits are essential at every stage. By the end, you'll have a clear picture of which CRE track aligns with your personality, interests, and long-term goals.

What is Commercial Real Estate (CRE)?

CRE refers to real estate used exclusively for business purposes. This includes office buildings, industrial facilities, retail spaces, multi-family apartment complexes (over 5 units), hotels, and special-use properties. CRE differs from residential real estate in its capital structure, complexity, transaction size, and stakeholder involvement.

Success in CRE means knowing how to navigate large transactions, manage financial risk, build lasting relationships, and identify undervalued or opportunistic assets. But how you do that depends greatly on your role within the ecosystem.

Career Paths in Commercial Real Estate

Most CRE career tracks follow a progression from analyst to partner-level roles. While timelines vary, the general structure is as follows:

Analyst (0–2 years) – Execution and support

Associate (2–5 years) – Independent deal work, coordination

Manager / Senior Associate (4–8 years) – Leading smaller deals, junior mentorship

Vice President / Director (7–12 years) – Leading deals, client relationships

Senior Director / Principal (10–15+ years) – Strategic planning, oversight

Managing Director / Partner (12–20+ years) – Firm leadership, equity ownership, P&L responsibility

Depending on your interests and personality, the following five paths offer distinct ways to break into and ascend the CRE world.

1. Acquisitions: The Investment Strategist

If you're analytical, detail-oriented, and interested in evaluating deals, acquisitions could be your niche.

What You Do

Acquisitions professionals work for REITs, real estate private equity firms, developers, or investment funds. Their job is to:

Source potential acquisitions

Build financial models to assess feasibility

Conduct due diligence

Present investment memos to internal committees

Negotiate purchase terms

Career Progression

Analyst (0–2 years): Financial modeling, market research, memos, due diligence support

Associate (2–5 years): Underwriting ownership, deal support, stakeholder communication

VP/Director (7–12 years): Lead deals, negotiate terms, manage broker and lender relationships

Managing Director/Partner (12+ years): Raise capital, oversee team, drive investment strategy【5†source】

Ideal Traits

Financial acumen

Risk assessment capability

Strong written communication (for memos and presentations)

Relationship-building with brokers and capital partners

Entry Points

Finance, economics, or real estate degree

Internships in private equity, REITs, investment banking

Excel modeling and ARGUS proficiency

2. Investment Sales: The Rainmaker

Do you thrive in high-stakes, commission-driven environments? Are you a persuasive communicator with relentless drive? Then investment sales might be for you.

What You Do

Working for brokerages like CBRE, JLL, or Cushman & Wakefield, investment sales professionals:

Market commercial properties for sale

Build relationships with buyers and sellers

Negotiate transaction terms

Conduct valuations and create offering memorandums

Earn commissions based on closed deals

Career Progression

Analyst (0–2 years): Create financial models, offering memos, market comps

Associate Broker (2–5 years): Prospecting, cold calling, marketing support

VP/Senior Broker (5–12 years): Lead listings, manage clients, specialize in asset types

Managing Director/Partner (10–20+ years): Oversee large portfolios, build brand, recruit junior talent【5†source】

Ideal Traits

Charisma and salesmanship

High tolerance for rejection

Ability to build rapport quickly

Knowledge of local markets

Entry Points

Bachelor's degree in business, marketing, or real estate

Sales experience is a plus

Real estate license often required

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

3. Leasing: The Matchmaker

If you like working with people and facilitating long-term solutions, leasing offers a consultative, relationship-oriented role.

What You Do

Leasing professionals work either on the landlord side (helping owners lease space) or tenant rep side (helping companies find office/retail/industrial space). Daily responsibilities include:

Touring properties with clients

Negotiating lease terms

Conducting market analysis

Coordinating with brokers, attorneys, and asset managers

Career Progression

Analyst/Coordinator (0–2 years): Market surveys, tour coordination, marketing support

Associate Broker (2–5 years): Assist lease negotiations, manage client communication

VP/Senior Associate (5–12 years): Lead lease negotiations, manage portfolios

Principal/Managing Director (12+ years): Top producer, manage teams, specialize by sector【5†source】

Ideal Traits

Strong interpersonal and communication skills

Detail orientation for lease language

Market knowledge

Negotiation and time management skills

Entry Points

Entry-level roles at brokerages or leasing teams

Degrees in real estate, business, or communications

Real estate license is often mandatory

4. Development: The Visionary Builder

Development is the path for those who enjoy managing complexity, overseeing construction, and bringing ideas to life.

What You Do

Development professionals guide projects from concept to completion. That includes:

Site selection and feasibility

Zoning and entitlement work

Financial modeling and budgeting

Construction oversight

Managing architects, engineers, GCs, and consultants

Career Progression

Development Analyst (0–2 years): Financial modeling, feasibility, zoning research

Development Associate (2–5 years): Manage timelines, budgets, and scopes

Development Manager/Director (6–12 years): Run $20M+ projects, oversee city approvals and consultants

Managing Director (12+ years): Source land, raise capital, oversee large-scale pipelines【5†source】

Ideal Traits

Project management mindset

Strong interpersonal and technical coordination

Risk management

Creativity and patience

Entry Points

Real estate, urban planning, or construction degrees

Construction or architecture internships

Certifications like PMP or MSRED can be valuable

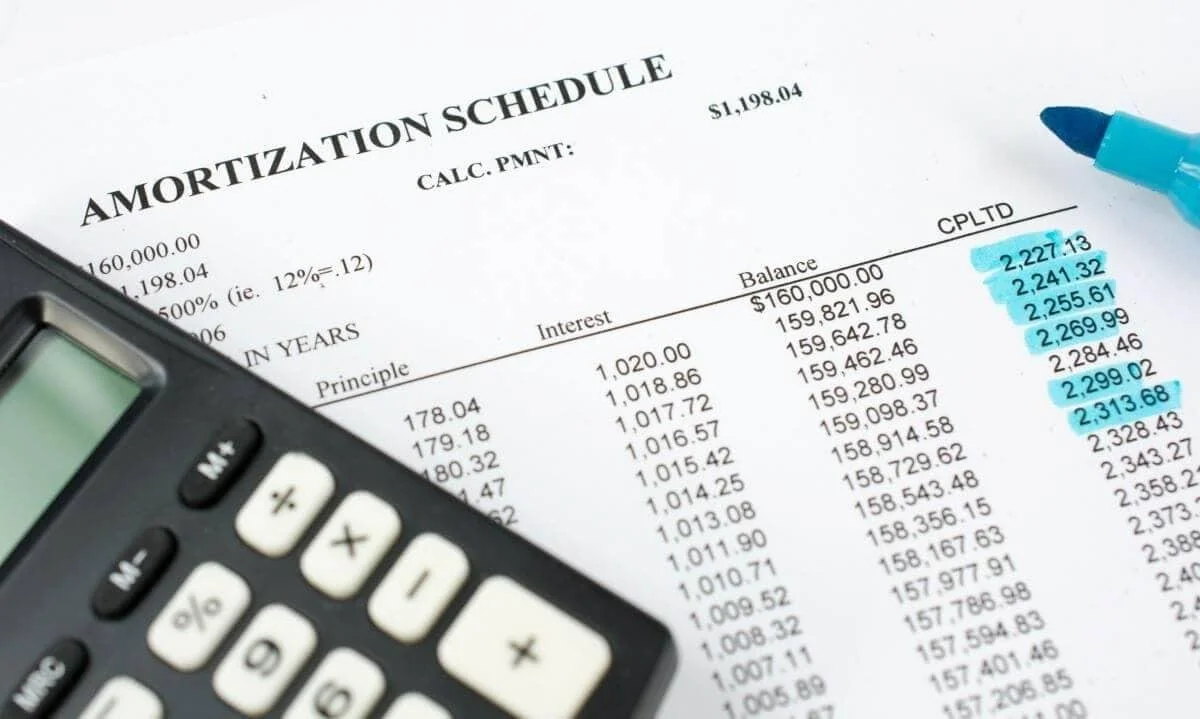

5. Lending: The Capital Allocator

If you're financially savvy and enjoy managing risk, lending roles may be your calling.

What You Do

Lenders provide the capital needed for acquisitions and developments. You’ll:

Underwrite loans

Conduct borrower due diligence

Prepare credit memos

Structure loan terms

Monitor portfolio risk

Career Progression

Analyst (0–2 years): Underwriting, memo prep, research, borrower support

Associate/Underwriter (2–5 years): Structure terms, manage borrower relations

VP/Senior Underwriter (5–10 years): Approve loans, mentor juniors, manage risk

Director/Managing Director (10–20+ years): Originate large loans, manage credit policy, lead lending team【5†source】

Ideal Traits

Quantitative ability

Analytical mindset

Risk awareness

Relationship management with borrowers and brokers

Entry Points

Finance, accounting, or economics degree

Banking internships or analyst programs

Excel and ARGUS proficiency

Key Skills Required Across All CRE Careers

| Skill | Application |

|---|---|

| Financial Modeling | Acquisitions, development, lending |

| Market Analysis | All roles |

| Relationship Building | Brokerage, acquisitions, lending |

| Communication | Memos, client meetings, negotiations |

| Negotiation | Leasing, investment sales, acquisitions |

| Project Management | Development, leasing |

| Entrepreneurial Drive | Especially brokerage and capital-raising roles |

As we review all of these skills, you have to be a well-rounded professional to succeed in the CRE industry.

Common Certifications and Degrees

ARGUS Certification: Industry standard for cash flow modeling

Real Estate License: Required for leasing and brokerage roles

MBA: Helpful for senior roles in acquisitions, development, or strategy

MSRED (Master of Real Estate Development): Ideal for development-focused careers

CFA: Rare but valued in institutional acquisitions or lending

PMP or Construction Certs: Useful in development and project management

How to Choose the Right Path for You

Here’s a personality-to-path alignment table to help you identify your best fit:

Personality Type Best-Fit CRE Career Path Analytical + Risk-Averse Lending, Acquisitions Visionary + Detail-Oriented Development Outgoing + Competitive Investment Sales, Leasing Collaborative + Strategic Asset Management, Leasing Creative + Process-Driven Development, Marketing

Final Thoughts: Your Roadmap to CRE Success

No matter your background, there's a path in commercial real estate that fits your strengths. The key is to:

Choose a path aligned with your interests.

Build technical and interpersonal skills early.

Find mentors and seek hands-on experience.

Stay updated on industry trends and market cycles.

Keep a long-term mindset for growth and learning.

Commercial real estate isn’t just a career—it's a journey filled with deals, relationships, and value creation. Whether you become a rainmaker, a strategist, a builder, or a financier, your success will depend on aligning your strengths with the right role.