Capitalizing vs. Expensing Pre-Development Costs

Managing pre-development costs in real estate is crucial for financial success. These costs - like land acquisition, feasibility studies, and design fees - can be capitalized (treated as an asset) or expensed (recorded as an immediate cost). The choice impacts your financial statements, taxes, and cash flow.

Here’s what you need to know:

Capitalize costs if they directly prepare a property for use and meet GAAP criteria (e.g., tied to a specific property and probable acquisition). Examples: land options, site permits, engineering studies.

Expense costs that don’t directly contribute to asset readiness or occur in early project stages. Examples: evaluation costs, contract negotiations, and general overhead.

Key takeaway: Capitalizing spreads costs over time, boosting early profits but reducing future ones. Expensing lowers immediate profits but improves later financial metrics. Proper classification ensures compliance with GAAP and aligns with your financial strategy.

Capitalizing vs. Expensing Costs [CPA Prep]

What Are Pre-Development Costs?

Pre-development costs cover the research and planning efforts that happen before construction begins. These expenses help evaluate a project's feasibility and ensure all legal requirements are in place. Understanding and categorizing these costs properly is essential for determining whether they should be capitalized or expensed under GAAP.

Although pre-development costs typically make up just 5–10% of the total cost of an affordable housing project, they play a vital role in decision-making. For commercial projects, these costs can take up an even larger share of the overall budget. Here's a breakdown of the main categories of pre-development costs.

Main Types of Pre-Development Costs

Land and site-related costs:

Land acquisition often accounts for as much as 25% of the total project cost. Beyond that, site surveys and soil testing typically range from $100,000 to $200,000, while utility and infrastructure assessments can cost between $100,000 and $300,000.

Professional services:

Feasibility studies generally cost about 1–2% of the total project budget, similar to design and engineering fees. Legal fees, which cover real estate transactions, zoning issues, and contract drafting, also tend to hover around 1% of the project cost. Design fees alone can range from 6–20% of the estimated building construction costs.

Regulatory and approval costs:

These include permitting and other approvals, which typically cost 0.5–1% of the total project budget. Such fees are necessary to navigate through zoning regulations, development ordinances, and design requirements.

Financing and marketing preparation:

Costs related to project financing - such as loan origination fees and interest - usually represent 1–2% of the total project cost. Marketing and sales preparation expenses typically account for an additional 0.5–1%.

Direct vs. Indirect Costs

Properly distinguishing between direct and indirect pre-development costs is critical for ensuring compliance with GAAP.

Direct costs are tied specifically to a single project. Examples include site-specific surveys, architectural plans, legal fees for property purchases, and project-specific permits. These expenses are easier to track and are more likely to qualify for capitalization.

Indirect costs are broader expenses that benefit multiple projects or the overall operation. Examples include general market research, executive salaries during the planning phase, or office rent for the development team. These costs are more complex to allocate and are often expensed as incurred.

Under GAAP, direct costs tied to a specific project are typically capitalized, while indirect costs are not.

Where Pre-Development Fits in Project Stages

Pre-development costs play a key role in the overall real estate development process, which can be divided into three main phases:

Pre-development is the longest and most detailed phase. It focuses on activities like site selection, feasibility analysis, design development, permitting, and arranging financing. These costs require careful evaluation to determine whether they should be capitalized or expensed.

Development and construction covers the actual building process. Costs like materials, labor, and contractor payments are generally capitalized as part of the asset's value.

Post-development involves sales, marketing, and property management after construction is complete. These costs are typically expensed as operating costs.

Each phase has specific accounting implications, with pre-development requiring particularly close attention to ensure compliance with GAAP. Proper handling of these costs not only ensures regulatory compliance but also has a lasting impact on a project's financial performance.

When to Capitalize Pre-Development Costs

Under US GAAP, pre-development costs can be capitalized if they meet specific criteria outlined in ASC 360-10-30-1 and ASC 970-340-25-3. The challenge lies in determining which costs should be added to the asset's value and which should be immediately expensed. This requires a detailed assessment of the capitalization criteria, building on the earlier breakdown of pre-development costs.

GAAP Rules for Capitalization

In real estate development, ASC 970-340-25-3 provides clear guidance:

“All other costs related to a property that are incurred before the entity acquires the property, or before the entity obtains an option to acquire it, shall be capitalized if all of the following conditions are met and otherwise shall be charged to expense as incurred: 1. The costs are directly identifiable with the specific property. 2. The costs would be capitalized if the property were already acquired. 3. Acquisition of the property or of an option to acquire the property is probable (that is, likely to occur). This condition requires that the prospective purchaser is actively seeking to acquire the property and has the ability to finance or obtain financing for the acquisition and that there is no indication that the property is not available for sale.”

This guidance underscores that only costs directly tied to a specific property - and that would be capitalized upon acquisition - are eligible for capitalization. For pre-acquisition activities, only pension and postretirement cost components directly linked to the project qualify for capitalization.

Examples of Costs You Can Capitalize

Several types of pre-development costs typically qualify for capitalization once project feasibility is established:

Land Options: Costs for securing the right to purchase a property are capitalized once linked to a specific property and would be capitalized upon acquisition.

Engineering, Procurement, and Construction (EPC) Contract Costs: Preliminary expenses like engineering studies, soil testing, and utility assessments are capitalized if they prepare the property for its intended use.

Regulatory Costs: Expenses such as site permits and license fees, directly tied to asset preparation, are capitalized once construction becomes probable.

Site Security Costs: Incremental security expenses specific to development activities qualify for capitalization.

Employee-Related Costs: Compensation for employees involved in pre-acquisition activities may also be capitalized.

One real-world example involves AthenaHealth, which capitalized costs for its internally developed software platform. This included employee compensation and consulting fees when it was probable the project would result in new functionality. However, costs incurred during preliminary or post-implementation stages were expensed.

When Capitalization Starts and Stops

The timing of capitalization aligns with key project milestones:

Start of Capitalization: This begins when the project transitions from the preliminary stage to the pre-acquisition stage - essentially when construction becomes probable, supported by active pursuit and confirmed financing. Costs incurred before this stage are expensed.

During Construction: Once construction starts and ownership or usage rights are established, all directly identifiable costs that prepare the asset for its intended use are capitalized.

End of Capitalization: Capitalization ends when the asset is ready for its intended use. Under GAAP, this typically means the asset can produce its first saleable or internally usable unit. For real estate, this milestone often aligns with obtaining a certificate of occupancy and the ability to generate rental income or proceed with a sale. Additional costs incurred after this point are treated as operating expenses.

These guidelines provide a framework for ensuring compliance with GAAP, setting the stage for the strategies discussed in the next section.

When to Expense Pre-Development Costs

This section outlines why certain pre-development costs must be expensed right away, ensuring compliance with accounting standards and accurate financial reporting.

GAAP Rules for Expensing

Under GAAP, specific rules define what cannot be capitalized. Costs that do not directly contribute to making an asset ready for use must be expensed immediately. During the early stages of a project - when construction or development is not yet considered probable - all incurred costs must be recorded as expenses. Similarly, any expenditures not essential for asset readiness must also be expensed as they occur.

Examples of Costs That Require Immediate Expensing

Here are some common categories of pre-development costs that must be expensed:

Evaluation and exploration costs: Expenses related to evaluating potential projects should be expensed at the time they are incurred.

Contract negotiation costs: Costs tied to negotiating agreements - such as fuel supply contracts, power sales deals, or maintenance agreements - must be expensed.

Organizational, recruiting, and training costs: Expenses for setting up corporate structures, like drafting bylaws or partnership agreements, fall under ASC 720-15 and must be expensed. Recruiting and training costs are treated the same way.

Contributions: Payments to local organizations or similar contributions made as part of permit requirements should be expensed when incurred, unless they are part of an exchange transaction for goods or services.

Demolition costs: These costs typically need to be expensed immediately unless they are tied to acquiring or leasing real estate.

Overhead expenses: Overhead costs - such as rent, depreciation, or support services like legal, HR, or IT - must be expensed during the pre-acquisition phase.

Following these guidelines ensures accurate financial reporting and compliance with GAAP.

Why Immediate Expensing Is Necessary

The reasoning behind expensing certain costs immediately lies in the uncertainty of their future benefits and the application of the matching principle. GAAP requires that research and development costs, for instance, be expensed in the same year they are incurred because these activities often do not result in immediate or guaranteed financial returns.

This logic applies broadly to pre-development activities. For instance, costs tied to new technologies with uncertain economic benefits must be expensed as they occur. Many of these activities are considered period costs - expenses that neither directly generate revenue nor contribute to creating an asset. The matching principle dictates that such costs be recognized in the same period they are incurred, reflecting the uncertainty of future benefits. As a result, preliminary-stage costs are expensed to account for the inherent risks and unknowns of a project's future feasibility.

Recognizing these requirements is critical for staying compliant with GAAP and ensuring sound financial planning. Expensing these costs immediately affects cash flow and short-term profitability, making it essential to clearly distinguish between costs that can be capitalized and those that must be expensed. This clarity is vital for accurate financial statements and cash flow management.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Capitalizing vs. Expensing: Side-by-Side Comparison

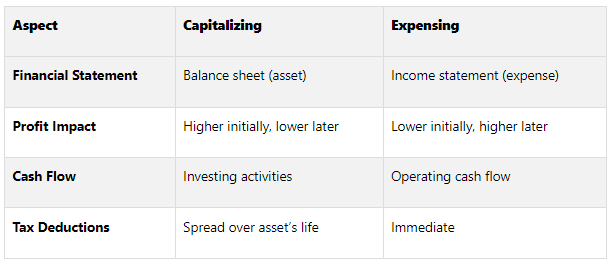

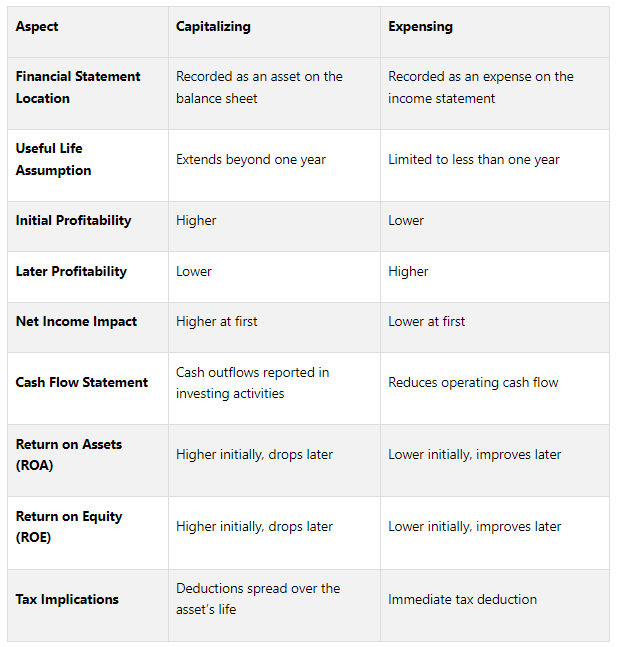

Building on the GAAP analysis from earlier, let’s dive into a side-by-side comparison of how costs are treated under capitalizing versus expensing. The decision between these two methods can have a lasting impact on financial statements, cash flow, and overall profitability.

Comparison Table

Here’s a breakdown of the differences:

Source: Derived from GAAP guidelines and tax regulations [12][13].

These differences highlight key factors to consider when managing pre-development costs while staying compliant with GAAP. The matching principle under GAAP ensures that expenses are recognized in tandem with the revenues they help generate.

Capitalizing allows for deferring expenses, which boosts early net income and short-term ROA and ROE. However, depreciation over time reduces future profitability. On the other hand, expensing results in lower initial performance but leads to improved metrics in subsequent periods.

Cash flow is another area where these methods diverge. With capitalizing, cash outflows are categorized under investing activities in the cash flow statement. Expensing, by contrast, directly reduces operating cash flow. Tax treatment also differs: smaller businesses may benefit from immediate deductions, while larger companies often face stricter capitalization requirements.

Grasping these distinctions helps in making informed decisions about cost treatment, ensuring compliance with GAAP, and aligning financial strategies. Proper classification of pre-development costs not only supports regulatory adherence but also strengthens the financial framework discussed earlier.

How to Stay GAAP Compliant

Maintaining compliance with GAAP (Generally Accepted Accounting Principles) is crucial throughout every stage of a project. When it comes to pre-development costs, strict adherence to established standards, thorough documentation, and timely professional advice can save significant expenses. For context, non-compliance can result in costs ranging from $9.4 million to $14.8 million, compared to proactive investments of $3.5 million to $5.5 million.

Key GAAP Standards to Keep in Mind

Pre-development cost accounting hinges on several key standards: ASC 970, ASC 360, ASC 606, and ASC 842. These standards are regularly updated by the Financial Accounting Standards Board (FASB), so staying informed about the latest Accounting Standards Updates (ASUs) is essential throughout your project. It's also important to note that IRS rules often differ significantly from GAAP guidelines, meaning you may need to maintain separate records for tax purposes and financial reporting. This highlights the importance of staying vigilant with your documentation and review processes.

The Role of Documentation and Regular Reviews

Accurate and organized documentation is the backbone of GAAP compliance. Keep detailed records of all transactions, including invoices, receipts, and contracts, to justify how costs are treated. Using a cloud-based document management system can simplify this process, making records easier to access during audits or when presenting information to lenders or investors.

To strengthen compliance, establish internal controls like segregating duties, implementing checks and balances, and conducting regular audits. Regular reviews of cost estimates and allocations at the end of each financial reporting period are vital - especially as circumstances evolve until the project reaches substantial completion. Accurate job costing, which tracks both direct and indirect costs across all project phases (acquisition, pre-development, construction, and sale or lease-up), is a cornerstone of effective construction accounting.

Frequent audits and financial reviews can help identify potential issues early, ensuring that pre-development costs are classified correctly and backed by solid documentation. If internal controls or documentation fall short, seeking professional expertise becomes critical.

When to Seek Professional Assistance

Navigating GAAP compliance for pre-development costs can be complex, often requiring expert help. Real estate accountants with specialized knowledge can guide you through evolving standards, ensuring your financial records are accurate and that accounts payable and receivable are properly managed. These experts can also help implement accounting software tailored to track and classify pre-development costs in line with GAAP.

For commercial real estate professionals, The Fractional Analyst offers specialized financial analysis services. Their team provides underwriting support, asset management insights, and detailed financial reporting to help maintain compliance throughout the pre-development phase. Additionally, their CoreCast platform offers self-service tools and financial models to assist with cost classification and documentation.

Staying ahead of new FASB pronouncements is another area where professional guidance can be invaluable. As accounting standards evolve, having a dedicated expert ensures your organization remains compliant without diverting resources from core development activities. If your internal team lacks the capacity to handle these complexities, outsourcing real estate accounting services may be a smart move to keep your project on track.

Key Points for Real Estate Professionals

When it comes to financial management in real estate, understanding how to handle pre-development costs is critical. Whether to capitalize or expense these costs can significantly impact financial performance. Capitalizing spreads costs over time as assets, while expensing records them immediately on the profit and loss statement.

Research from McKinsey highlights a common challenge: cost and schedule overruns in construction projects often exceed 50%. This makes accurate financial management not just important, but essential. Missteps in accounting can jeopardize project feasibility and shake investor trust.

The size of your business also dictates compliance requirements, adding another layer of complexity. For small business taxpayers with gross receipts under $25 million, only costs directly tied to property production must be capitalized. Other expenses, like interest, real estate taxes, and insurance, can be expensed right away. Larger businesses, however, face stricter rules under Section 263A, requiring them to capitalize certain indirect costs.

Frank Osborn offers a helpful perspective:

“Construction costs are capitalized when they create long-term value and meet two criteria: the expense generates future revenue and provides benefits beyond one fiscal period.”

For commercial real estate professionals, navigating these financial intricacies requires more than just basic accounting knowledge. Specialized tools and services can make a huge difference. The Fractional Analyst is one such resource, offering tailored solutions for underwriting, financial tracking, and cost classification. Their CoreCast platform provides self-service tools like financial models, investor dashboards, and automated portfolio reporting . This combination of expert support and accessible technology ensures compliance with GAAP while streamlining financial reporting.

FAQs

-

Under GAAP (Generally Accepted Accounting Principles), pre-development costs can be capitalized if they are directly associated with acquiring or building a long-term asset. This includes expenses like legal fees, permits, or initial site preparation, especially once the property purchase is complete. These costs are treated as part of creating a tangible asset that is expected to generate future economic benefits.

However, costs tied to research, planning, or design are generally expensed as incurred because they don't directly lead to the creation of a long-term asset. The distinction lies in whether the expense contributes to the development of a long-term asset or is simply part of routine operations. It's always a good idea to work with a qualified financial professional to ensure your approach aligns with GAAP standards.

-

When you capitalize pre-development costs, you spread these expenses over a longer period. This approach can improve short-term profitability and boost the value of your assets on the balance sheet. In the short term, your project may look more profitable. However, this method could lead to higher tax obligations since it increases reported earnings.

On the flip side, expensing pre-development costs immediately lowers current profits and asset values. While this might hurt profitability metrics in the short term, it offers an immediate tax advantage by reducing taxable income. This, in turn, can enhance short-term cash flow.

Choosing between capitalizing or expensing comes down to your financial strategy and what aligns best with your long-term goals.

-

Differentiating between direct and indirect pre-development costs plays a key role in staying aligned with GAAP standards. Direct costs - like land acquisition and design fees - are clearly linked to a specific project and must be capitalized as part of the total development costs. Meanwhile, indirect costs, such as property taxes, utilities, or general overhead, are typically treated as period expenses or allocated based on the circumstances.

Getting this classification right ensures precise financial reporting, keeps your records in line with GAAP, and promotes clarity in financial statements. This distinction is especially critical in real estate projects, where proper capitalization can significantly influence project valuation and overall financial outcomes.