How to Model Ground Lease Rent Escalation

Key Points:

What It Is: A clause in leases (50-99 years) that increases rent at set intervals.

Why It Matters: Keeps rent aligned with inflation and market changes, ensuring fair returns for landlords and predictable costs for tenants.

Common Methods:

Fixed increases (e.g., 3% annually).

CPI-linked adjustments (based on inflation).

Step-ups (e.g., 20% every 10 years).

Market reviews (rent adjusted to current market rates).

How to Model:

Gather lease details: base rent, term, payment schedule.

Apply escalation methods: fixed, CPI-linked, or step-ups.

Calculate cash flows: include caps, floors, and present value analysis.

Pro Tip: Use real market data and test scenarios to ensure your model is accurate and flexible.

Want to dive deeper? Read on for detailed steps and examples.

Commercial Real Estate Lease Analysis Tool Walkthrough

Key Variables and Assumptions for Escalation Models

Building accurate ground lease escalation models hinges on a few essential variables that shape long-term rent forecasts and investment strategies.

Initial Lease Terms

Start with the base rent - for example, $50,000 per year or $2.50 per square foot - as the foundation for all escalation calculations.

The lease duration plays a crucial role in structuring the model. Ground leases often span 50 to 99 years, and a 75-year lease, for instance, requires different cash flow projections than a 50-year term. This difference impacts the number of escalation periods and the overall value calculation. The longer the term, the more critical it becomes to make precise escalation assumptions to determine the lease's present value.

You’ll also need to define the payment schedule - whether payments are made monthly, quarterly, or annually. This detail is key for refining both cash flow and present value computations.

Escalation Methods and Timing

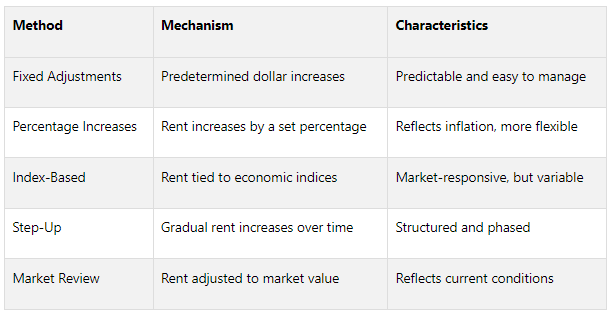

The way rent escalates over time can significantly impact financial outcomes. Different methods create varying cash flow patterns:

Fixed adjustments offer simplicity and predictability with predetermined dollar increases.

Percentage increases adjust rent by a set percentage, often reflecting inflation.

Index-based escalations tie rent to measures like the Consumer Price Index (CPI), making them responsive to market conditions and shielding landlords from inflation.

The timing of these increases also matters. Some leases escalate annually, while others adjust every five or ten years. For example, a lease with 3% annual increases provides smoother cash flow growth compared to one with larger, less frequent adjustments, even if the total increases over time are similar.

Market Value and Fair Market Rent

Understanding current land values and comparable rent rates is essential for validating escalation assumptions. Market research ensures your model stays grounded in realistic expectations rather than overly optimistic or conservative estimates. This involves studying rental prices for similar properties in the area and factoring in elements like location, property type, and broader market trends.

For leases with market review escalations, fair market rent analysis is especially critical. These adjustments rely on current market conditions rather than fixed formulas. For example, County-Wide Fair Market Rents (FMRs) provide average rents across metropolitan areas, while Small Area FMRs - calculated at the ZIP code level - offer more detailed comparisons.

Regularly assessing market conditions, including shifts in the CPI and rental trends, helps ensure your assumptions remain realistic over the lease term. Staying informed allows for more accurate modeling and better decisions when negotiating rent adjustments or revisiting lease terms. A solid understanding of market benchmarks is essential for evaluating common ground lease escalation structures.

Common Ground Lease Escalation Structures

Ground lease escalation structures dictate how rent adjustments occur, influencing cash flow patterns and risk levels. These mechanisms play a key role in shaping the financial performance of long-term leases. Below are the primary escalation structures commonly used in ground leases, each with its own approach to rent adjustments.

Fixed Percentage Increases

This structure applies a consistent rate of rent growth at predetermined intervals. For example, if the starting rent is $100,000 and increases by 10% every five years, it would rise to $110,000 in year six and $121,000 by year eleven. The straightforward nature of this method makes it easier for tenants to plan their budgets while providing landlords with predictable income growth. However, fixed increases may fail to keep pace with market trends, especially during periods of high inflation.

Step-Up Escalations

Step-up escalations involve periodic rent increases, often scheduled every five to ten years. For instance, the rent might increase by 15% every seven years or follow a graduated pattern, such as 5% annually for the first decade, 7% for the next ten years, and 10% thereafter. This approach offers a balance: stable rent in the early years and more substantial adjustments later, providing landlords with a steady income boost over time.

Index-Linked Escalations

Index-linked escalations adjust rent based on economic indicators like the Consumer Price Index (CPI). This method aligns rent with actual market conditions, offering landlords protection against inflation while creating variable cash flows. Some agreements may include caps, limiting annual CPI adjustments to a range such as 2% to 6%.

Randy Blankstein, President of The Boulder Group, highlights the growing appeal of this structure:

“With interest rates and inflation increasing, those rent escalations are very appealing to buyers, and that is something that is much more important than it was historically because of the current interest rate and inflation environment.”

Pete Stone, Managing Partner at Trinity Real Estate, emphasizes the importance of staying market-relevant:

“It’s important to have the ability to keep up with inflation or what we call mark-to-market provisions where you have an ability to reset the lease rate based on what’s happened in the market.”

While index-linked escalations provide flexibility and inflation protection, they require careful monitoring and periodic recalculations to ensure the rent remains aligned with market trends. For instance, ground leases for fast-food chains like McDonald’s often trade at cap rates around 4.5%, reflecting the value placed on predictable and steadily increasing income streams. These structures play a crucial role in the financial modeling process, which will be detailed in the next section.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Step-by-Step Guide to Building an Escalation Model

Creating a ground lease escalation model involves three main phases: inputting lease terms, applying escalation methods, and generating cash flow outputs. Using the escalation structures discussed earlier, here’s how to build your model step by step.

Input Lease Terms and Assumptions

Start by gathering all the essential lease details. Your model should capture base rent amounts, lease duration, and payment timing. Ground leases often have durations ranging from 50 to 99 years.

Organize these inputs clearly to make calculations straightforward. Include fields like:

Ground Lease Start Date

Next Ground Lease Payment

Lease Length (Years)

Analysis Start Date

Analysis End Date

These fields establish the timeline for your calculations. Next, define the Initial Payment Amount and Payment Frequency - whether payments are made monthly, quarterly, or annually. Payment frequency directly affects both timing and present value calculations.

Set up escalation parameters by specifying the Lease Increase Method, Increase Frequency, and Increase Amount. For fixed percentage escalations, input the specific rate (e.g., 3% annually). For CPI-linked increases, identify the exact index series, such as the Consumer Price Index for All Urban Consumers (CPI-U), that will guide your adjustments. These inputs serve as the foundation for applying escalation methods.

Apply Escalation Methods

Once inputs are in place, apply formulas to adjust rents at specified intervals:

Fixed Percentage Increases: Use a formula that multiplies the current rent by (1 + escalation rate). For example, a 3% annual increase on a $10,000 monthly rent would raise it to $10,300 after the first year.

CPI-Linked Escalations: Base your calculations on the percentage change in the CPI index. For instance, if the CPI rises by 2.5% in a year, the rent should increase by the same percentage. Ensure your model can handle different CPI series and adjustment periods (quarterly, semiannual, or annual).

Step-Up Escalations: Use conditional logic to apply varying rates at specific milestones in the lease. Adjust formulas to reflect the schedule outlined in the lease agreement.

Incorporate caps and floors to manage volatility. For example, a tenant might negotiate a cap of $500 per month to limit increases, even if the calculated escalation exceeds that amount. Build these limits directly into your formulas to ensure they’re applied automatically when triggered. After finalizing the escalation formulas, you’re ready to calculate and review cash flows.

Calculate Cash Flows and Review Results

Use your model to calculate rent payments for each period based on the selected escalation method. The output should include a detailed cash flow schedule showing payment amounts, escalation dates, and cumulative rent increases. Apply discounted cash flow (DCF) techniques to calculate present values, which factor in the time value of money.

Run sensitivity tests by adjusting key assumptions, such as escalation rates and discount rates. For example, if a business anticipates 5% revenue growth, ensure rent escalations don’t outpace this figure to maintain profitability.

Validate your results by comparing them to market trends and similar leases in the same area. Check for consistency in your outputs - rent should increase steadily according to the specified method, without unexpected fluctuations.

Test various scenarios to confirm the model’s reliability under different conditions. Document any assumptions, such as leap year adjustments, payment timing, or delays in index publication, that could impact your calculations.

Finally, create summary metrics to highlight key financial insights. These might include total rent over the lease term, average annual escalation rates, and present value calculations. These metrics are crucial for evaluating investments and negotiating lease terms effectively.

Best Practices for Escalation Modeling

Following established modeling practices can strengthen both the reliability of your model and the decisions that stem from it.

Use Market-Based Assumptions

To ensure your escalation model holds up under scrutiny, base your assumptions on solid, market-driven data rather than arbitrary numbers. Start by researching potential lease rates, taking into account factors like asset type, class, and location. Keep an eye on key market indicators such as occupancy levels, lease rates, and absorption rates to gauge the overall health of the market.

For CPI-linked escalations, historical data from the Bureau of Labor Statistics is a reliable source for setting inflation expectations. Since ground lease terms often range from 50 to 99 years, understanding long-term inflation trends is essential for creating accurate projections.

Test Multiple Scenarios

Running sensitivity analyses can help you understand how changes in market conditions might affect your model. Develop base-case, best-case, and worst-case scenarios, assigning clear probabilities to each. For instance, test escalation assumptions by modeling different annual CPI increases, ranging from 1% to 4%. Similarly, for ground lease escalations, experiment with a range of annual CPI increases or adjust fixed percentage escalations by ±1% from your baseline assumption. Track how these variations influence total rent payments, present values, and overall investment returns across the lease term. Be sure to document these findings, as they will be valuable for both validating your model and making future adjustments.

Document All Assumptions and Sources

Once you've defined and tested your model's assumptions, document everything thoroughly for transparency and easy reference. Include all inputs, sources, and methodologies in a dedicated assumptions sheet within your model. This sheet should detail each input variable, its source, and the date the information was gathered. Clearly outline the calculation methods for each type of escalation, noting any caps or floors that apply.

Additionally, tracking economic occupancy trends against physical occupancy over time can reveal signs of weakening demand, which could influence future negotiations. Store all supporting documents in an organized and accessible system to make updates and reviews more efficient.

Next Steps

Creating a reliable ground lease escalation model is just the beginning. The real challenge lies in refining and validating your projections to ensure they align with actual market conditions.

Start by performing a detailed review of the property and lease terms. This includes confirming ownership, checking accessibility, and assessing zoning restrictions that could influence rent escalations. Pay close attention to key clauses, such as those addressing the lease duration, rent increase schedules, and responsibilities at the end of the lease term. Once you've verified these critical details, update your model to reflect current market trends and realities.

Keeping your model accurate requires regular updates. Make sure to refresh market data frequently to account for shifts in comparable lease rates, economic trends, and inflation expectations. Given that ground leases often span decades, even minor adjustments in assumptions can lead to significant changes in long-term forecasts.

It’s often helpful to bring in experts for a deeper analysis. Real estate attorneys, brokers, and seasoned investors can offer valuable perspectives and help you identify potential risks in lease agreements. Their input is especially useful for leases in high-demand locations, where ground leases are more prevalent. Collaborating with professionals not only strengthens your analysis but also ensures you’re spotting nuances that might otherwise go unnoticed.

Once your model is updated and reviewed, consider leveraging advanced tools and services for additional support. For example, The Fractional Analyst offers tailored solutions, including custom escalation models designed to fit specific lease terms. Whether you need a new model built from scratch or adjustments to an existing one, their team of analysts provides flexible options without the need to hire full-time staff. Their services ensure your models meet the high standards required for institutional investments.

For those looking to sharpen their own modeling skills, The Fractional Analyst also provides free downloadable templates and custom financial analysis services. Their CoreCast intelligence platform delivers market research tools to back your assumptions with up-to-date market data.

FAQs

-

When deciding on a rent escalation method for a ground lease, there are several important factors to weigh. Start by looking at economic indicators like inflation rates and the Consumer Price Index (CPI), as these can significantly impact the lease's financial trajectory. The length of the lease term and current market trends also play a critical role in shaping the best approach.

The property's location and condition are additional elements to take into account, as they can influence the property's value over time and, in turn, the rent escalation strategy.

It's also crucial to choose the right type of escalation clause. Options include fixed percentage increases, adjustments tied to the CPI, or resets based on market rent. Each method comes with its own set of advantages and drawbacks, so it's important to match the escalation approach to your financial objectives and the realities of the market.

-

To keep your ground lease escalation model accurate over time, it's crucial to build in flexible escalation mechanisms. These mechanisms should adjust based on dependable economic indicators like inflation or market value, ensuring the model stays aligned with shifting market dynamics.

Make it a habit to regularly review and update the model’s assumptions using the latest market data and economic trends. Another smart move is to include rent reset provisions, which allow for periodic rent adjustments tied to inflation indices or interest rates. This approach ensures the model remains relevant and precise over the lease’s lifespan.

By blending these strategies, you’ll have a model that stays dependable and effective throughout the term of the lease.

-

Not keeping rent increases in step with inflation and market trends can lead to some tough financial situations. If rents are set too low, property owners might experience lost revenue and shrinking profit margins - especially during times of rising inflation. On the flip side, setting rents too high can put a strain on tenants' finances, leading to higher vacancy rates and frequent tenant turnover.

There’s also the issue of operating costs. If these climb faster than the rent, profitability can take a hit, and the property may lose its competitive edge in the market. Over time, poorly managed rent adjustments could even lower the overall value of the property, particularly during uncertain economic periods. Keeping rent changes in line with market conditions and economic realities is crucial for staying financially stable and protecting long-term investments.