Data Centers & Industrial CRE – 10‑Year Performance vs Other Real Estate and the S&P 500

November 2025

1. Executive Takeaways

Industrial has been the standout private real estate sector for the past decade. NCREIF data (via Clarion Partners) shows industrial has delivered the strongest total returns of the core property types over the last 10–20 years, driven by outsized rent growth and persistent low vacancies.

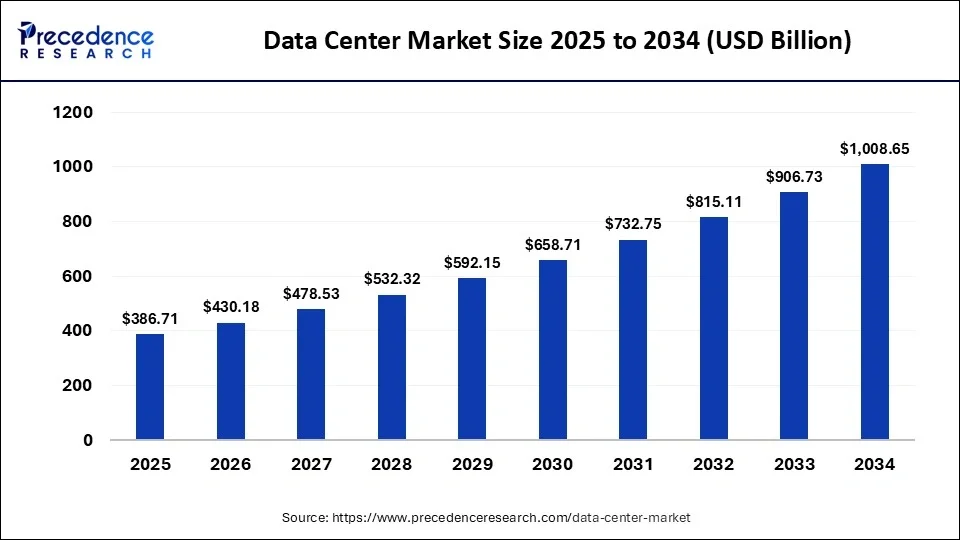

Within public markets, data center and industrial REITs have been among the best performers. Nareit’s 10‑year analysis (2014–2024) shows:

FTSE Nareit All Equity REITs: ~5.8–6.6% annualized 10‑year total return.

Data centers (measured since early 2016) generated ~15% annualized returns – the highest of all REIT property types.

Industrial and telecommunications sectors also show top‑tier risk‑adjusted performance.

Despite this, the overall listed REIT universe has lagged the S&P 500 over the last decade. For the 10‑year period ending mid‑2025, All Equity REITs produced ~6.6% annualized vs ~13.6% for the S&P 500, largely due to weak office, lodging, and some retail exposure.

Data centers are now one of the most favored CRE asset classes globally. JLL, CBRE, Newmark, Capright and others report record development pipelines, extreme pre‑leasing, and structurally constrained power and land in major hubs.

Near‑term (12‑month) set‑up:

Industrial: fundamentals are normalizing from the post‑COVID boom but remain healthy; new supply is tapering just as e‑commerce, on‑/near‑shoring, and inventory re‑stocking keep demand elevated.

Data centers: demand from AI and cloud is outpacing power and land availability; pre‑leasing and rents remain strong but development is increasingly bottlenecked by grid constraints and permitting.

Portfolio implication: In both private and public markets, an overweight to modern logistics and data centers (funded by underweights to structurally challenged office and commodity retail/lodging) still appears warranted, but investors need to underwrite higher cap‑rate volatility, construction inflation, and power‑availability risk.

2. Current State of the Data Center Sector

2.1 Demand Drivers

Across recent research (CBRE, JLL, Newmark, Capright, and others), the same core themes recur:

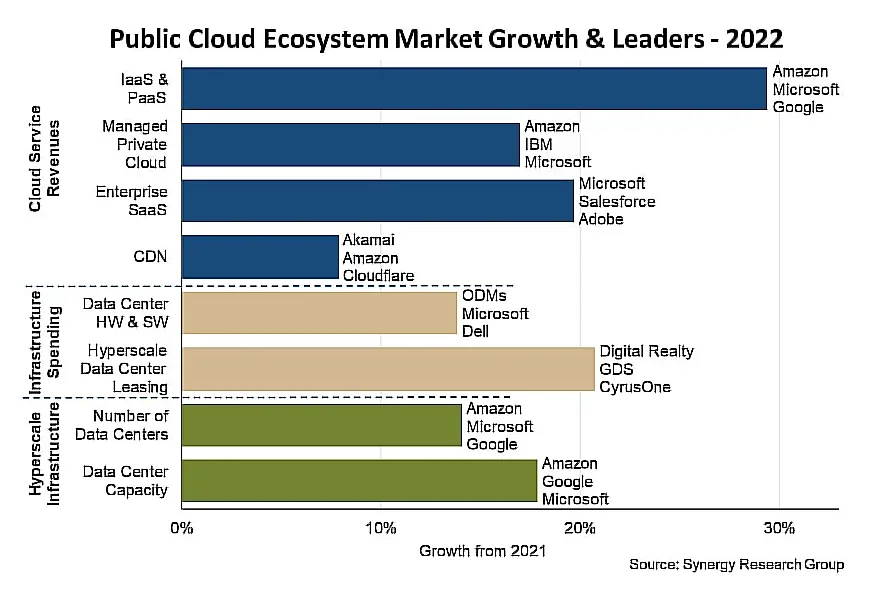

Cloud & hyperscale expansion – Hyperscalers (AWS, Azure, Google, Meta, etc.) continue multi‑gigawatt expansion plans globally.

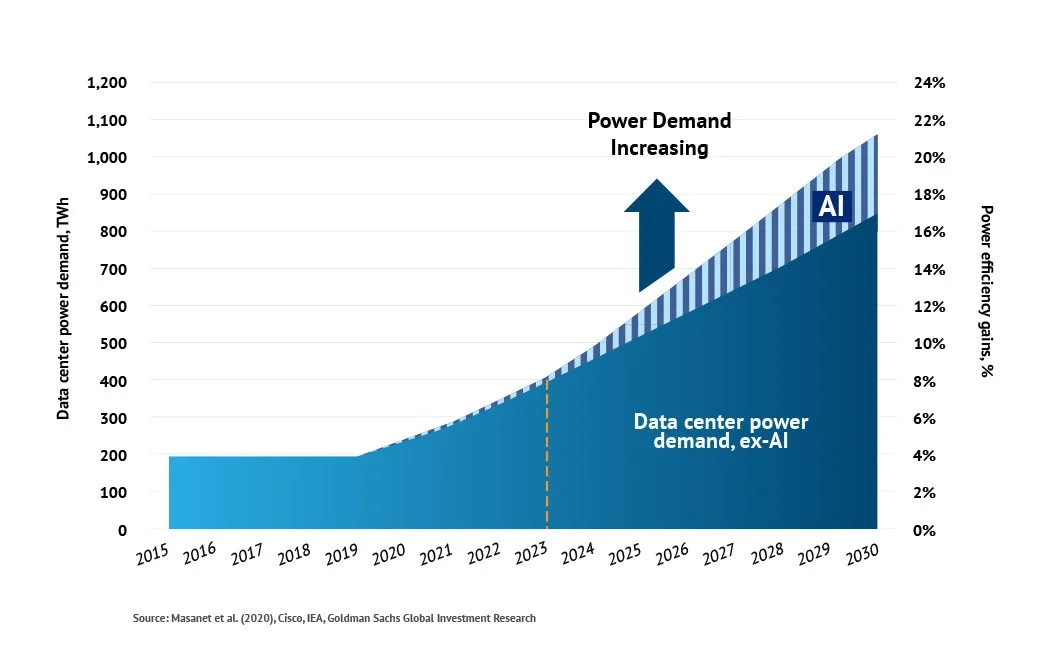

AI & high‑performance computing (HPC) – Training and inference workloads are orders of magnitude more power‑intensive than typical cloud workloads; this is the primary incremental demand driver in 2024–2025.

Digitalization of everything – Streaming, gaming, fintech, SaaS, and industrial IoT continue to push baseline demand higher.

Key recent datapoints:

CBRE (U.S. Data Center Market Outlook 2025)

Under‑construction data center capacity in primary U.S. markets is expected to reach record highs in 2025.

100+ MW campuses are becoming the new “standard unit” for hyperscale builds.

Pre‑leasing rates for under‑construction space in primary markets are very high, supporting financing and forward sales.

JLL (North America Data Centers – Midyear 2025)

Data centers remain “among the most favored real estate asset classes” due to insatiable tenant demand, limited supply, and rising rents.

Pre‑leasing demand supports all phases of financing: construction, bridge, and permanent loans.

Newmark (2025 U.S. Data Center Outlook)

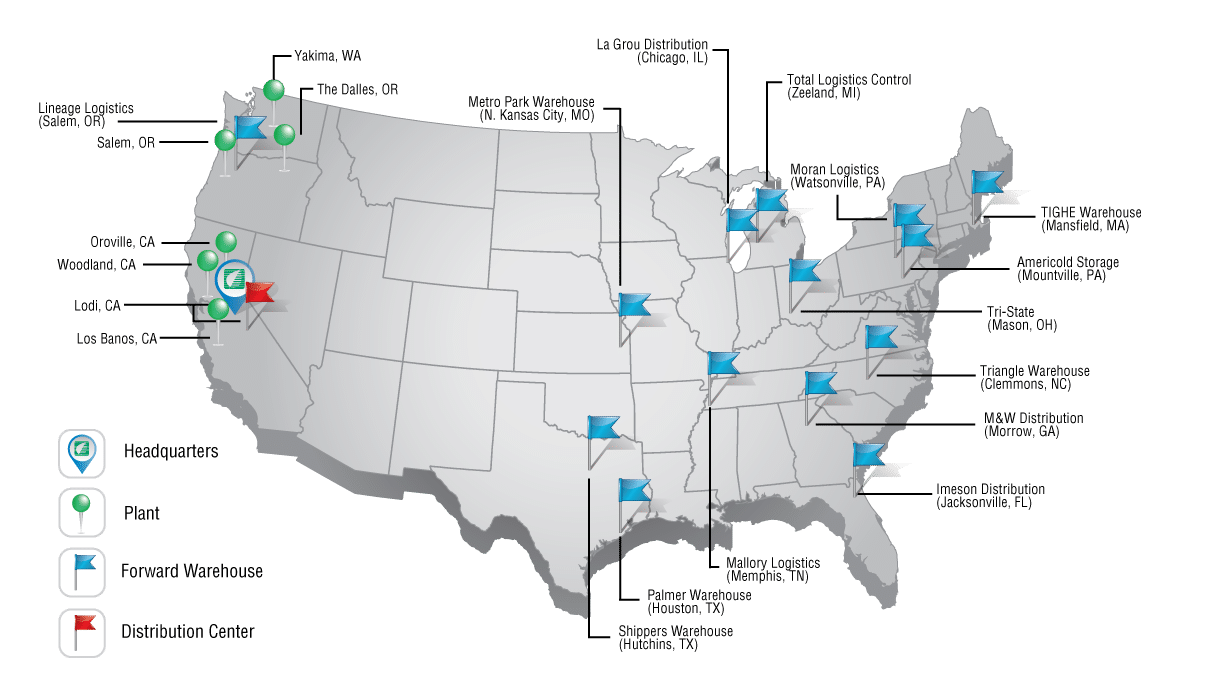

An estimated 24% of industrial‑zoned development site acquisitions over the last 24 months were for data center development.

Hyperscalers accounted for >10% of all commercial development site purchases in 2024, illustrating how aggressively they are locking up land and power.

Capright (Data Center Market Update – Oct 2025)

U.S. data centers reached record growth in 2025 as AI demand surged.

Investor confidence remains high, with substantial capital targeting the sector despite higher interest rates.

2.2 Supply, Power, and Regulatory Constraints

The limiting factor for the sector is no longer capital—it is power, land, and permitting:

Power constraints in EMEA:

A Savills report covered by Reuters and ITPro shows that 2025 EMEA data‑center capacity growth slowed vs 2024 because grid connections and power approvals are lagging, even while demand and contracted capacity keep climbing.

Only ~850 MW of new capacity went live in 2025 YTD, down ~11% from the prior year, yet contracted capacity and occupancy continued to rise and now sits above 90% in many markets.

Cost inflation:

Construction costs in mature European hubs now range roughly $7.3–13.3M per MW according to Savills/ITPro coverage.

Similar themes show up in North America: high‑spec power and cooling systems, plus long‑lead‑time transformers and switchgear, are pushing hard costs higher.

Environmental and community scrutiny:

Commentary such as the New Yorker feature on AI data centers highlights growing backlash around water use, land consumption, and the strain on electrical grids. Expect more ESG‑driven permitting and zoning challenges in key hubs.

2.3 Development & Investment Trends

Recent headlines illustrate where capital is flowing:

New large‑scale campuses: DataCenterKnowledge’s November 2025 round‑up lists new multi‑hundred‑MW projects across North America, Europe, and APAC—including a large campus in Port Washington, Wisconsin backed by OpenAI, Oracle, and Vantage Data Centers.

Industrial‑data center hybrids: Goodman Group’s 2025 purchase of an 18.5‑hectare site in San Jose (Silicon Valley) for a mixed campus of data centers, advanced manufacturing, and warehouse space shows the convergence of logistics and digital infrastructure.

REIT exposure: American Tower’s Q3 2025 earnings highlight strong performance in its data‑center business alongside towers, with AI and hybrid‑cloud workloads driving leasing and prompting raised guidance.

Bottom line for data centers (2025–2026):

Structural demand from AI & cloud remains extremely strong.

The main check on development is access to power, not tenants or capital.

Rents and development margins remain attractive in power‑constrained Tier‑1 markets, but pricing is rich and political/ESG risk is rising.

3. The Broader Industrial Sector – Fundamentals & 10‑Year Context

3.1 Fundamentals Over the Last Cycle

Industrial (warehouse, distribution, light manufacturing, and related subtypes) has transformed from a “sleepy” asset class to the core growth engine of CRE over the last decade.

Key long‑term drivers (Clarion, CBRE, J.P. Morgan, Cushman/CBRE e‑commerce work):

Explosive e‑commerce growth and the shift to fast, reliable last‑mile delivery.

Supply chain re‑configuration post‑COVID (greater inventory, near‑/on‑shoring, and regionalization).

Domestic manufacturing boom, particularly in semiconductors, EVs, batteries, and clean energy equipment.

Highlights from recent institutional research:

Clarion Partners (Q2 2024 – “Ongoing Outperformance of U.S. Industrial Real Estate”)

Industrial has been the best‑performing property type in the NCREIF Property Index over the past two decades.

Vacancy rose from a historic low of ~2.9% in 2022 to ~5.7% in 2024 but remains below the long‑term average (~6.7%) even after a heavy development wave.

New construction as a percent of stock is forecast to fall to ~1.7% between 2024–2028, below the prior 5‑year average (~2.3%), supporting rent growth.

Clarion expects industrial to have the highest NOI growth among core and alternative sectors from 2024–2028.

CBRE U.S. Industrial Outlook (2024 & 2025)

2024–2025 is a normalization phase: vacancy drifts back toward its 10‑year average near 5%, as new deliveries from the 2022–2023 construction surge are absorbed.

E‑commerce’s share of core retail sales continues to climb, projected to hit ~25% by 2025, sustaining demand for modern distribution space.

J.P. Morgan (Industrial Real Estate Trends, 2025)

Industrial is no longer the “can’t‑miss darling,” but it remains a highly sought‑after, relatively resilient sector.

As supply catches up with demand, investors need to be more selective on location, building quality, and tenant credit.

Additionally, cross‑border demand remains robust: for example, Asian logistics operators have been rapidly expanding U.S. warehouse leasing to support direct‑to‑consumer shipping and returns fulfillment.

3.2 10‑Year Performance vs Other Real Estate & the S&P 500

There are two distinct but related views: private market core real estate and public REITs.

3.2.1 Private Core Real Estate (NCREIF / Clarion View)

In the NCREIF Property Index (NPI), industrial has delivered the highest total returns among the four main property types (industrial, apartments, office, retail) over the last 10–20 years.

Industrial has benefited from:

The strongest rent growth, driven by structural demand and limited functional substitutes.

Cap‑rate compression as investors aggressively increased allocations (Clarion notes institutional allocations to industrial rising from ~14% in 2017 to ~35% in 2023).

Office and traditional retail (especially non‑grocery‑anchored formats) have been the laggards, with weaker NOI growth and significant value write‑downs since 2020.

While precise 10‑year NPI annualized numbers vary by cut, the directional ranking is clear: Industrial > Apartments > Retail > Office in terms of total return and NOI growth.

3.2.2 Public Markets – REITs vs S&P 500

Nareit and REITWatch provide the most comparable long‑term public‑market benchmarks.

All Equity REITs vs S&P 500 (10‑Year total return, period ending 30 June 2025):

FTSE Nareit All Equity REITs Index: ~6.6% annualized.

S&P 500: ~13.6% annualized.

Conclusion: over this specific decade, listed REITs underperformed the S&P 500, primarily due to rate sensitivity and weakness in office, lodging, and some retail.

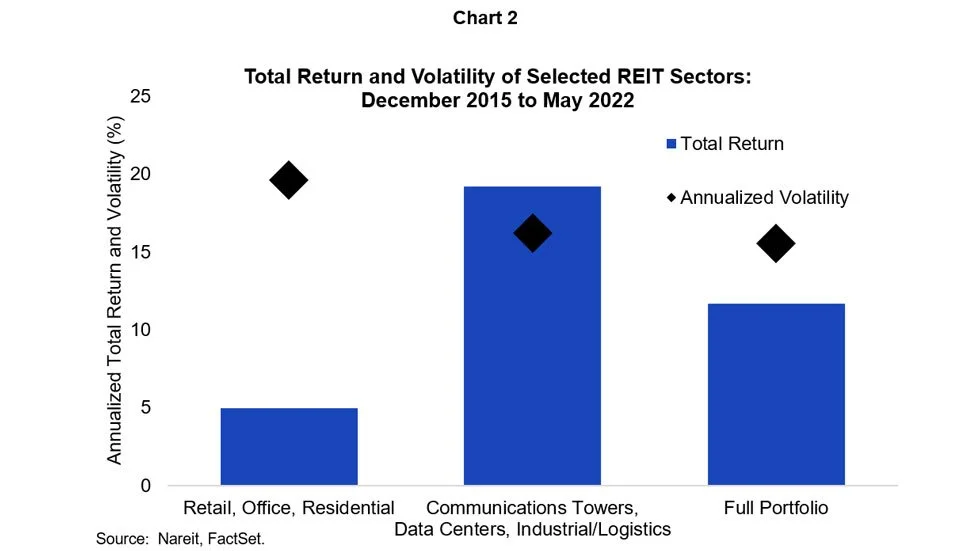

By REIT property sector (10‑year CAGR 2014–2024 – Nareit Sharpe‑ratio study):

All Equity REITs: 5.8% 10‑year CAGR.

Data centers: ~15.2% annualized (measured since 2016 inception) – the highest of any REIT sector.

Specialty REITs: ~14.8%.

Industrial and telecommunications sectors generated above‑index returns and the highest Sharpe ratios, reflecting strong performance relative to volatility.

Office, lodging/resorts, and diversified REITs had low or negative real CAGRs over the same period.

Very long‑term (since early 1970s):

Nareit data (summarized by sources like Motley Fool) show that over multi‑decade horizons, equity REITs have delivered total returns broadly comparable to or slightly above the S&P 500, despite the most recent decade’s underperformance.

Key takeaway:

The average REIT investor has lagged the S&P 500 over the last 10 years.

However, industrial and especially data center REITs have been major bright spots, materially outperforming the broad REIT index and, in the case of data centers, approximately matching or beating S&P‑like returns.

This dispersion is exactly why sector selection—and within sector, asset selection—matters more today than in prior cycles.

4. Sector‑by‑Sector Positioning for the Next 12 Months

Below is a practical framework for how lenders and equity investors might position across key sectors with an emphasis on data centers and industrial.

4.1 Data Centers

Thesis: Secular AI and cloud tailwinds + constrained power and land = strong medium‑term fundamentals, but valuations are rich and development risk is shifting from lease‑up to power/permit execution.

For Lenders

Favorable themes:

Construction and bridge loans for well‑capitalized sponsors with contracted power and strong hyperscale or blue‑chip enterprise pre‑leasing.

Stabilized term loans on existing assets in Tier‑1 power‑constrained markets (Northern Virginia, Silicon Valley, Phoenix, Dallas, major European FLAP‑D hubs, etc.).

Key underwriting focuses:

Power certainty: documented, non‑speculative interconnection agreements; realistic timelines; contingency plans for delays.

Pre‑leasing & credit: anchor hyperscale MSAs, contract tenors, renewal options, and termination rights; granular understanding of tenant capex commitments (e.g., GPUs) that make relocation costly.

Capex and cost inflation: build in contingencies for electrical gear, cooling systems, and labor costs; be conservative on budgets and schedules.

Exit liquidity: who are the logical take‑out buyers—core funds, infrastructure managers, public REITs? Underwrite to cap rates consistent with long‑term infrastructure‑like assets, not peak tech multiples.

Structures to consider:

Lower leverage (50–60% LTC) with strong completion guarantees.

Interest reserves that assume delayed energization and phased lease‑up.

Performance covenants tied to energization milestones, not just construction progress.

For Investors

Core:

Overweight stabilized data centers in power‑constrained hubs with long‑term leases to investment‑grade cloud/AI tenants.

Focus on assets with embedded expansion potential (additional land/power on campus) and strong interconnection ecosystems.

Value‑add / development:

Target edge markets with better power availability (e.g., select secondary U.S. metros, West Texas, some emerging EMEA/Middle East locations) where entry yields are higher and power is more accessible.

Partner with utility‑savvy developers or infra funds; success is increasingly a function of grid and energy expertise.

Public markets:

Data center REITs may remain volatile given high expectations and AI sentiment, but on pullbacks they continue to offer one of the clearest liquid plays on AI infrastructure demand.

4.2 Traditional Industrial & Logistics

Thesis: The white‑hot phase has cooled, but industrial still offers the strongest fundamental backdrop among the major “core” sectors.

For Lenders

Favorable themes:

Modern distribution facilities in infill and key transport nodes (port, intermodal, and major population corridors).

Build‑to‑suit manufacturing linked to on‑/near‑shoring, especially where supported by federal/state incentives (chips, EVs, batteries, clean energy equipment).

Underwriting focus:

Tenant durability: prioritize 3PLs, major retailers, and manufacturers with strategic facilities (not just cost‑driven, “footloose” tenants).

Spec industrial: be selective—require strong sponsorship, lower leverage, and evidence of tenant interest in oversupplied submarkets.

Lease rollover: in markets that saw rapid rent spikes, stress test re‑leasing spreads—some tenants may resist 2–3x rent resets as leases roll.

Structures:

55–65% LTV for stabilized assets, with DSCR sized to more normalized rent‑growth assumptions.

Construction loans with tight covenants around leasing velocity in submarkets where vacancy is trending up.

For Investors

Core:

Maintain or modestly overweight to modern logistics and infill industrial.

Focus on high‑barrier markets (coastal gateway metros, major inland hubs) and buildings that can accommodate automation and higher clear heights.

Value‑add:

Acquire Class B in infill locations where rent growth and repositioning can justify moderate capex (dock upgrades, clear height improvements, ESG retrofits).

Target small‑bay and last‑mile assets where tenant demand remains deep and replacement costs are high.

Development:

Proceed selectively; the window is best in undersupplied submarkets or for customized manufacturing/mission‑critical logistics.

Avoid commodity big‑box spec in markets that already carry a large construction pipeline and rising vacancy.

4.3 Other Major CRE Sectors (For Allocation Context)

Briefly, relative to data centers and industrial:

Office:

Structural headwinds from hybrid work and high capex requirements.

For most portfolios, office remains an underweight outside of very selective life‑science, medical office, or best‑in‑class trophy assets at reset pricing.

Retail:

Necessity and grocery‑anchored centers are stable; many malls remain challenged.

Given industrial’s stronger growth profile, retail is generally a neutral to modest underweight, used tactically for yield.

Multifamily:

Still supported by long‑term housing shortages, but some Sunbelt markets are digesting heavy new supply.

Multifamily can sit alongside industrial/logistics as a core anchor, but does not offer the same AI/supply‑chain upside as data centers and logistics.

Self‑storage & hospitality:

More cyclical and operationally intensive; best treated as satellite allocations unless the mandate is very income‑oriented or opportunistic.

5. Practical 12‑Month Playbook

For Lenders

Tilt Credit Exposure Toward Industrial & Data Centers

Increase quota for loans on modern logistics facilities and data centers, while tightening standards for office, hotel, and weaker retail.

Prioritize Power & Infrastructure Risk in Data Centers

Treat power availability and grid interconnection as core credit variables, not just technical checkboxes.

Underwrite to Normalized Industrial Rent Growth

Shift assumptions from double‑digit annual rent growth to mid‑single‑digit, but still above inflation in prime locations.

Shorter Tenors for Development Risk

Use 3–5‑year structures for spec industrial and data center developments, with extension options tied to leasing milestones.

ESG and Regulatory Compliance

Factor in potential carbon, water‑use, and zoning constraints, particularly for large data centers and energy‑intensive industrial sites.

For Equity Investors

Overweight Data Centers & Modern Industrial in Strategic Hubs

Treat data centers and prime logistics as a combined “digital + physical infrastructure” sleeve.

Balance Core and Growth

Pair stabilized core assets (income, modest growth) with select development or value‑add opportunities that capture AI, e‑commerce, and on‑shoring upside.

Use Listed REITs Tactically

Consider public data center and industrial REITs as a way to quickly adjust exposure; use volatility to add on pullbacks.

Be Realistic on Exit Cap Rates

Underwrite to slightly higher exit cap rates than current spot levels, given the possibility of persistently higher base rates.

Focus on Operator Quality

For data centers especially, sponsor operating expertise (network, energy, customer relationships) is as critical as the underlying real estate.

Source List

Industrial & broader real estate performance

Clarion Partners – "The Ongoing Outperformance of U.S. Industrial Real Estate" (Q2 2024) – https://www.clarionpartners.com/cpinsights/Documents/ongoing-outperformance-of-us-industrial-real-estate.pdf

Nareit – "REIT Sharpe Ratios Closely Follow Sector Performance Trends" (Feb 2025) – https://www.reit.com/news/blog/market-commentary/reit-sharpe-ratios-closely-follow-sector-performance-trends

Nareit – REITWatch (June 30, 2025 data) – https://www.reit.com/sites/default/files/reitwatch/RW2507.pdf

Nareit – FTSE Nareit U.S. Real Estate Index Series – historical values & returns – https://www.reit.com/data-research/reit-indexes/ftse-nareit-us-real-estate-index-historical-values-returns

CBRE – U.S. Real Estate Market Outlook 2024 – Industrial – https://www.cbre.com/insights/books/us-real-estate-market-outlook-2024/industrial

CBRE – U.S. Real Estate Market Outlook 2025 – Industrial & Logistics – https://www.cbre.com/insights/books/us-real-estate-market-outlook-2025/industrial

J.P. Morgan – "Industrial Real Estate Trends" – https://www.jpmorgan.com/insights/real-estate/commercial-real-estate/industrial-real-estate-trends

Motley Fool – "REITs vs. Stocks: What Does the Data Say?" – https://www.fool.com/research/reits-vs-stocks/

Data centers – fundamentals, power, development & investment

CBRE – U.S. Real Estate Market Outlook 2025 – Data Centers – https://www.cbre.com/insights/books/us-real-estate-market-outlook-2025/data-centers

JLL – "North America Data Center Report – Midyear 2025" – https://www.jll.com/en-us/insights/market-dynamics/north-america-data-centers

Newmark – "2025 U.S. Data Center Market Outlook" – https://www.nmrk.com/insights/market-report/2025-us-data-center-market-outlook

Capright – "Data Center Market Update – October 2025" – https://www.capright.com/data-center-market-update-october-2025/

Reuters / Savills – "Power supply constraints slowing EMEA data centre rollout" – https://www.reuters.com/business/energy/power-supply-constraints-slowing-emea-data-centre-rollout-report-says-2025-11-06/

ITPro – "Lack of power supplies hitting data centre construction" – https://www.itpro.com/infrastructure/data-centres/lack-of-power-supplies-hitting-data-centre-construction

DataCenterKnowledge – "New Data Center Developments: November 2025" – https://www.datacenterknowledge.com/data-center-construction/new-data-center-developments-november-2025

The New Yorker – "Inside the Data Centers That Train A.I. and Drain the Electrical Grid" – https://www.newyorker.com/magazine/2025/11/03/inside-the-data-centers-that-train-ai-and-drain-the-electrical-grid

The Wall Street Journal – "American Tower Swings to a Profit Amid Strong Cell-Phone, AI Demand" – https://www.wsj.com/business/earnings/american-tower-swings-to-a-profit-amid-strong-cell-phone-ai-demand-085114c9

The Australian – "Goodman Group buys $305m Silicon Valley site for data centre complex" – https://www.theaustralian.com.au/business/property/commercial/goodman-stumps-up-305m-for-silicon-valley-slice-of-data-centre-demand/news-story/1c1b61eabc4ce181930ee69b1d50b82d

Additional context & cross-border industrial demand

CBRE – "E-Commerce's Impact on Industrial Real Estate Demand" – https://www.cbre.com/insights/briefs/ecommerces-impact-on-industrial-real-estate-demand

Associated Press – "Why Asian logistics operators are leasing more US warehouses" – https://apnews.com/article/eba5283b0762fa958ab90fb731370117