How Title Insurance Protects CRE Owners

Title insurance protects commercial property owners from financial losses caused by title defects. It covers issues like ownership disputes, unpaid liens, fraud, and boundary problems that could threaten your property rights. Unlike other insurance, it focuses on pre-existing issues and provides lifetime coverage with a one-time payment.

Key Benefits of Title Insurance:

Protects Against Title Defects: Covers financial losses from disputes, liens, fraud, or documentation errors.

Legal Defense Included: Pays for attorney fees and court costs if ownership is challenged.

Covers Undisclosed Risks: Protects against hidden issues like unknown heirs or unrecorded easements.

Customizable Coverage: Add endorsements for zoning, access rights, environmental risks, and more.

Why It Matters for CRE Owners:

High Stakes: Commercial real estate deals often involve large sums and complex legal issues.

Lender Requirement: Title insurance is mandatory for loans to confirm clear ownership.

Risk Mitigation: 15% of commercial property disputes stem from unresolved title issues.

Title insurance ensures peace of mind by safeguarding your investment and providing legal and financial protection against unexpected title problems.

Commercial Title Insurance - A beginners guide

Common Title Risks in Commercial Real Estate Transactions

Commercial real estate deals come with their fair share of risks, especially when it comes to ownership rights and title issues. Being aware of these risks not only helps you prepare for potential problems but also shows why title insurance is a must-have to safeguard your investment. Let’s break down the key title risks you might face in these transactions and why addressing them is crucial.

Ownership Disputes and Prior Claims

One of the trickiest challenges in commercial real estate is dealing with undisclosed heirs. Imagine this: A previous owner passes away without leaving a clear will or proper estate plan. Years later, an unknown heir shows up, claiming ownership of the property. This becomes even more complicated when the property has changed hands multiple times.

Ownership disputes can also arise from incomplete or improper transfers in the property’s history. For example, a prior owner might not have had the legal authority to sell, or important documents from past transactions could be missing. On top of that, unresolved claims from previous owners - such as disputes over partnership breakups or allegations that ownership rights were never fully relinquished - can create a legal mess. These issues could delay or derail your plans to sell, refinance, or develop the property.

Unpaid Liens and Encumbrances

Liens are another major headache in commercial real estate. Here are some common types to watch out for:

Tax liens: Unpaid property taxes, income taxes, or other government debts can attach to the property itself. These liens often take priority over other claims and could even force a sale to settle the debt.

Mortgage liens: If satisfaction documents aren’t properly filed, old mortgage liens may linger, causing confusion and complicating your ability to secure new financing or sell the property.

Contractor and mechanic’s liens: These occur when construction or renovation work hasn’t been fully paid for. Contractors, subcontractors, or suppliers may file liens to recover their money. For example, in Pennsylvania, liens are typically prioritized based on when they’re recorded.

Judgment liens: These arise from court rulings against previous owners. If a prior owner lost a lawsuit and didn’t pay the judgment, the winning party can place a lien on the property. Sometimes these liens remain hidden for years before surfacing.

Fraud, Forgery, and Documentation Errors

Fraudulent documents and forged signatures can wreak havoc on property ownership. A buyer might end up with a deed that doesn’t grant clear ownership, leaving the original owner with legal rights to the property.

Clerical errors in public records are another common issue. Simple mistakes - like misspelled names, incorrect property descriptions, or inaccuracies in recorded data - can disrupt the chain of title. These errors might not seem like a big deal at first, but they can make it difficult to prove ownership or transfer the property later on.

Boundary and Survey Issues

Disputes over property lines can cause major problems for commercial real estate projects. If there’s disagreement over where boundaries lie, it could limit development opportunities, block access, or even result in losing parts of the land you thought you owned.

Encroachments - such as a neighbor’s structure crossing onto your property - can also create conflict. Similarly, unrecorded easements might give others rights to use parts of your property without your knowledge. Survey discrepancies, where the deed’s description of boundaries doesn’t match actual measurements, can lead to confusion about what’s really yours.

“In Weirton, West Virginia, a homeowner discovered that a neighbor’s shed encroached onto their property, delaying the sale while they negotiated a solution.”

“In Brooke County, a buyer found significant differences between the boundary lines described in the deed and those shown in a survey, causing months of delays as legal teams worked to resolve the issue.”

These examples highlight why thorough due diligence and title insurance are essential in commercial real estate. They provide the protection and clarity you need to navigate these risks with confidence.

How Owner's Title Insurance Protects CRE Owners

Understanding the risks tied to title issues in commercial real estate is one thing, but knowing how owner's title insurance shields your investment is another. Unlike most insurance policies that cover future events, owner's title insurance focuses on preexisting problems that might have slipped through during the title search. With a one-time premium paid at closing, this policy safeguards your ownership for as long as you hold the property.

Financial Protection Against Title Defects

Owner's title insurance is your safety net against financial losses stemming from unforeseen title defects. The coverage typically matches your property’s purchase price. If someone successfully challenges your ownership rights, the policy can reimburse you for the full purchase price. This protection isn’t limited to ownership disputes - it also covers financial setbacks caused by title defects like unpaid taxes, boundary disputes, or unrecorded liens.

To put things in perspective, title insurance companies paid out $596 million in claims in 2022 alone. Fraud and forgery cases accounted for 21% of these payouts, with an average claim of over $143,000 per case. Beyond financial reimbursement, the policy also provides legal support to defend your ownership.

Legal Defense and Cost Coverage

One of the most valuable aspects of owner's title insurance is its built-in legal defense. If a claim threatens your title, the policy steps in to cover legal expenses, including attorney fees, court costs, and investigation charges. This coverage begins the moment a claim is filed and continues until the issue is resolved - whether through settlement or litigation. Essentially, your policy ensures expert legal representation without additional out-of-pocket costs.

Protection from Fraud and Undisclosed Heirs

Owner's title insurance also guards against hidden risks that may surface long after your purchase. These include errors in public records, fraud, forgery, and even undisclosed heirs. For instance, there have been cases where buyers faced claims from former owners or relatives of sellers who alleged ownership rights. In such scenarios, title insurance not only covered the claims but also handled the legal expenses involved.

Title problems aren’t rare - 26% of title searches uncover issues that need fixing before insurance can be issued. If you suspect a title issue, it’s crucial to alert your insurance company immediately and provide any relevant documentation so they can act swiftly to protect your investment.

In short, owner's title insurance is a must-have for commercial real estate owners. It acts as a financial and legal safety net, shielding you from unexpected title issues that could otherwise put your investment at risk.

Title Insurance Policy Features and Customization Options

An owner's title insurance policy comes with standard protections, but you can expand these protections through customization. With around 80 ALTA-approved endorsement forms available, commercial real estate owners have plenty of options to tailor their coverage. Below, we’ll break down the core protections and ways to customize your policy.

Standard Coverage Provisions

A standard owner's title insurance policy offers essential protection against title defects that can be uncovered through a review of public records. It covers both recorded defects and certain risks that might not show up in those records. This means your policy extends its protection beyond what’s publicly available. If title issues arise during or after the purchase, the insurance company assumes financial and legal responsibility, as outlined in your contract.

For example, if a financial institution demands payment due to a previously unknown lien on your property, your insurer would handle the associated costs.

Policy Endorsements for Specific Risks

In addition to standard coverage, endorsements allow you to address specific risks tied to your property. These add-ons help fill gaps in coverage by addressing exclusions, exceptions, or unique challenges that standard policies don’t cover.

Here are some common endorsements and what they protect against:

Zoning and Land Use Endorsements: The ALTA 3 Series endorsements (3, 3-06, 3.1, 3.2) ensure your property’s zoning classification and authorized use are protected. For instance, ALTA 3.1 provides coverage against court-ordered changes due to zoning violations.

Environmental Protection: ALTA 8.1 and 8.2-06 endorsements cover losses from recorded environmental liens that aren’t listed in your policy’s exceptions. ALTA 8.2-06 is designed specifically for commercial properties and doesn’t require extra underwriting.

Access and Entry Endorsements: ALTA 17-06 and 17.1-06 safeguard against losses if your property lacks access rights. ALTA 17-06 specifically ensures that your property has vehicular and pedestrian access to a publicly maintained street.

Contiguity Endorsements for Multiple Parcels: If your property includes multiple parcels, ALTA 19-06 and 19.1-06 endorsements confirm there are no gaps or intervening parcels between them. The Same as Survey Endorsement (ALTA 25-06) ensures the land described in your survey matches what’s in your policy.

For specialized property types, additional endorsements are available:

Condominium Endorsements: ALTA 4-06 and 4.1 confirm that the condominium project complies with state laws and protect against maintenance liens.

Planned Unit Development Endorsements: ALTA 5-06 and 5.1-06 address issues like violations of restrictions and the priority of homeowners association assessments.

Endorsements typically cost around $75, though prices vary by state and underwriter. This small fee can go a long way in strengthening your coverage.

“An experienced commercial real estate attorney can evaluate the land, structure, loan terms and other factors to request the endorsements applicable to a given transaction to provide the client with the highest possible level of title insurance protection.”

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

When choosing endorsements, think about factors like zoning compliance, environmental risks, access needs, land boundaries, and any restrictive covenants. The goal is to align your endorsements with your property’s unique characteristics and your intended use of the land.

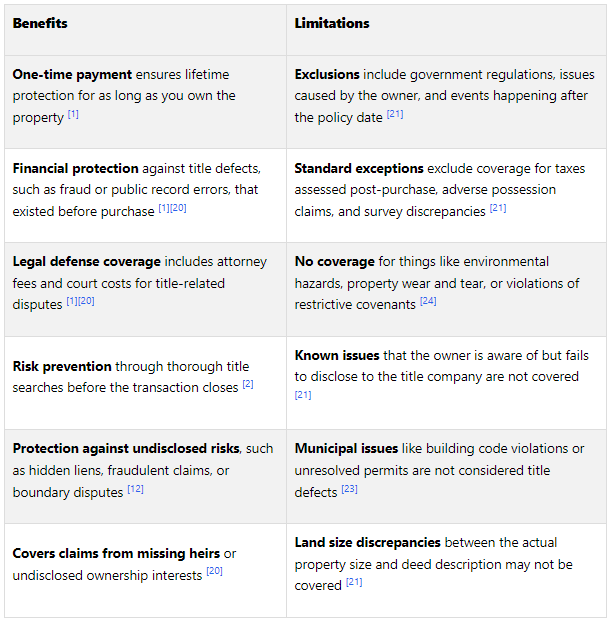

Benefits and Limitations of Owner's Title Insurance

Owner's title insurance provides essential protection for commercial real estate (CRE) owners, but understanding its limitations is key to making informed decisions about coverage.

Advantages Versus Drawbacks

The balance between benefits and limitations shows why title insurance plays a critical role in CRE transactions.

This table highlights the value of title insurance while acknowledging its boundaries.

Costs for owner’s title insurance typically range between 0.5% and 1% of the property’s purchase price. For example, on a $1 million property, the premium would be around $5,000 to $10,000. In Florida, the rate is $5.75 per $1,000 for the first $100,000, then $5.00 per $1,000 up to $1 million, with a minimum premium of $100. These costs, combined with the protection offered, are important when assessing your overall risk exposure.

“Commercial title insurance offers you peace of mind by transferring the risk of hidden title defects to the insurer. This protection can cover legal fees, financial losses, and the expenses needed to correct any discovered title issues.”

Interestingly, insurers pay out less than 10% of the premiums collected due to the effectiveness of title searches. This demonstrates both the thoroughness of the process and the rarity of claims.

The stakes in commercial real estate transactions are much higher compared to residential deals, making title problems potentially more damaging. When deciding whether title insurance is worth it, consider factors like your risk tolerance, potential liabilities, and budget. If you plan to sell the property within a few years, ask about binder rates. These allow you to pay about 10% more upfront but could save you money if you sell the property later.

“Title insurance makes commercial real estate transactions possible and keeps the closing process running smoothly. Without title insurance, it would be impossible to get lenders to risk large amounts of capital on complicated transactions, and buyers would be much more reluctant to buy from strangers.”

One key limitation to remember is that title insurance focuses on past events and existing defects. Unlike other types of insurance that protect against future risks, title insurance is specifically designed to cover issues that occurred before your purchase date. This backward-looking approach is both its strength and its limitation.

As with other safeguards in CRE, title insurance addresses specific risks tied to the property’s history. Carefully review your preliminary title report and consult with experts to customize endorsements that fit your needs. This preparation will help ensure a secure and smooth transaction.

Conclusion

Owner's title insurance plays a crucial role in commercial real estate (CRE) transactions, shielding investors from the financial pitfalls that can arise with property ownership. With nearly 15% of commercial property disputes tied to unresolved title issues, this coverage isn't just a recommendation - it's a necessity.

Final Thoughts on Title Insurance for CRE Owners

Title insurance is a cornerstone of the commercial real estate market, allowing complex transactions involving significant capital to move forward with confidence. By shifting title-related risks to insurers, it creates a safety net that supports the industry's functionality.

This type of insurance protects against a range of potential issues, including undiscovered liens, forged signatures, errors in public records, unrecorded easements, fraudulent conveyances, and claims from unknown heirs. These risks can surface long after a property purchase, making the protection it offers invaluable.

“Title insurance protects against financial loss due to defects in a property’s title that were not discovered during the initial title search.”

For CRE owners, securing owner's title insurance is a straightforward decision. It’s a small upfront cost that provides peace of mind and shields you from potentially devastating financial losses. Pairing this policy with expert legal guidance - reviewing title commitments, surveys, and endorsements - ensures comprehensive protection.

Ultimately, title insurance acts as a risk management tool, enabling buyers, sellers, and lenders to move forward with transactions that might otherwise seem too risky. By incorporating it into your investment strategy, you’re not just protecting a single property - you’re safeguarding the stability of your entire CRE portfolio.

FAQs

-

Title insurance is quite different from other kinds of insurance, both in what it covers and how you pay for it. While homeowners or auto insurance focus on protecting against future risks and require regular premium payments, title insurance is all about guarding against past problems tied to a property's title. These could include things like liens, ownership disputes, or mistakes in public records.

The payment structure is unique too. With title insurance, you only pay a one-time premium at closing, and from that point on, you're covered for as long as you own the property. This makes it an essential safeguard for commercial real estate owners who want to protect their investments from title-related issues.

-

Title Issues in Commercial Real Estate

Title issues can pose serious hurdles in commercial real estate deals. Some frequent problems include outstanding liens or mortgages, unpaid property taxes, and undisclosed easements or restrictions that could limit how the property is used. These issues don’t just complicate the transaction - they can also threaten ownership rights or result in unexpected financial burdens.

That’s where owner’s title insurance comes in. This type of insurance offers protection against hidden title problems that might surface after the deal is done. It ensures your investment is safeguarded, giving you much-needed peace of mind during what can often be a complicated process.

-

Yes, title insurance can be customized to handle the specific challenges tied to commercial real estate properties. For example, custom endorsements can address concerns like easements, zoning restrictions, or survey discrepancies. These additions offer property owners protection against risks unique to their transactions, which is especially helpful in complex real estate deals.

By tailoring title insurance to the needs of a property, owners can better protect their investments and reduce the chances of facing unexpected legal or financial complications.