How to Align Exit Plans with Investment Goals

A solid exit plan is crucial for real estate investors to meet their financial goals. Without one, you risk losing money, overpaying taxes, or selling under poor conditions. Here’s how to ensure your exit strategy matches your investment objectives:

Set Clear Goals: Decide if your focus is on maximizing returns, minimizing risks, ensuring liquidity, or reducing taxes.

Choose the Right Strategy: Options include outright sales, refinancing, 1031 exchanges, or hybrid approaches. Each fits different goals and timelines.

Factor in Market Conditions: Timing matters - strong markets favor sales, while weaker markets might require holding or refinancing.

Plan for Taxes: Strategies like 1031 exchanges can defer capital gains taxes, but professional advice is key.

Use Financial Models: Simulate scenarios to evaluate risks and returns for each exit option.

Start your planning early, analyze your portfolio, and seek expert advice to optimize your strategy. A tailored exit plan ensures your investment aligns with your goals while minimizing risks and costs.

SS229: The Importance of an Exit Strategy in Real Estate

Investment Goals and Exit Strategies Basics

Before diving into specific exit strategies, it’s essential to connect your investment goals with how you plan to exit. Your objectives should shape your exit strategy, serving as the backbone of any successful commercial real estate investment.

Setting Clear Investment Objectives

Investors typically focus on four key goals, and each one calls for a distinct exit approach:

Maximizing returns: This involves aiming for the highest possible profit through property appreciation, better cash flow, or strategic upgrades.

Minimizing risk: Here, the priority is preserving capital and achieving steady, predictable outcomes rather than chasing aggressive growth.

Achieving liquidity: This is about ensuring you can quickly convert assets into cash when needed.

Leveraging tax efficiency: Structuring your exit to reduce tax burdens while boosting after-tax returns is the focus here.

Your approach will also depend on whether you’re pursuing short-term or long-term strategies. As mentor Peter Harris puts it:

"Finders aim for short-term investments, increasing NOI and selling quickly, while Keepers are long-term holders seeking consistent monthly income with stabilized NOI". – Peter Harris

Finders usually hold properties for 2–5 years, focusing on value-add opportunities and rapid appreciation. Keepers, on the other hand, often hold onto properties for decades, prioritizing steady cash flow and long-term value growth. Your investment timeline plays a big role here - short-term investors might need quicker liquidity options, while long-term investors can afford to wait for market conditions to improve and may benefit from tax-deferred strategies.

Common Exit Strategy Options

Commercial real estate offers several ways to exit your investment, each suited to different goals and market conditions:

Outright sale: Selling the property outright is the simplest option. You list it, negotiate with buyers, and close the deal. This approach works well if you need immediate liquidity or want to take advantage of favorable market trends. However, it often comes with immediate capital gains tax obligations.

Refinancing: With a cash-out refinance, you can tap into your property’s equity without selling it. This allows you to access funds for other investments while still benefiting from appreciation and cash flow. It’s a great option for those looking to expand their portfolio.

1031 exchange: This tax-deferral strategy lets you reinvest proceeds from a sale into a "like-kind" property within specific timeframes. It’s ideal for building long-term wealth while avoiding immediate capital gains taxes and potentially upgrading to larger or better-performing assets.

Hybrid strategies: Combining approaches can optimize outcomes. For instance, you might refinance to pull out some equity while continuing to hold the property for appreciation. Another hybrid option is a sale-leaseback, where you sell the property but lease it back for ongoing use.

Each strategy comes with its own risks, tax considerations, and timeline requirements. By understanding these nuances, you can choose the option that best aligns with your investment goals and the current market landscape.

Factors That Determine Your Exit Strategy Choice

While the previous section introduced basic exit strategies, the choice of the right path depends heavily on factors like market trends, property performance, and tax considerations. It's not just about your goals - it's about aligning them with the realities of the market and the regulatory environment.

Market Conditions and Timing

Understanding market cycles is key. Property values, buyer demand, and financing availability all shift depending on where the market stands. In a strong market, where property values are high and buyers are actively searching, selling outright could bring in the highest returns. On the flip side, weaker markets might push investors to hold onto their properties longer or explore alternatives like refinancing to access equity.

Interest rates are another piece of the puzzle. When rates rise, buyers' purchasing power shrinks, and refinancing becomes more expensive. Falling rates, however, can boost buyer activity and make cash-out refinancing more attractive. Recognizing whether the market is in a growth, peak, decline, or recovery phase can help determine whether to act now or wait for better conditions. If the market is unstable, having flexible exit options can provide a safety net.

Property and Portfolio Performance

The performance of your property plays a big role in shaping your options. Properties with strong cash flow and a solid rental history might be better suited for refinancing or holding, while those that have significantly appreciated in value may be ideal for selling. Tax-deferment strategies like 1031 exchanges can also be appealing when dealing with properties that have appreciated substantially.

Your broader financial goals matter too. If you need immediate cash to fund other investments or diversify your portfolio, strategies that provide quick liquidity, like selling, become more appealing. Other factors, including the property's location, market value, and the difference between your purchase price and its current value, also influence the decision.

Experience and risk tolerance are equally important. Seasoned investors might explore more complex options, such as installment sales or advanced 1031 exchanges. Meanwhile, newer investors may prefer simpler choices like direct sales or refinancing. Additionally, your creditworthiness and relationships with lenders can either open up or limit your financing options, further shaping your strategy.

Tax and Legal Requirements

Taxes often play a deciding role in exit strategies, so consulting with tax professionals is essential. For instance, the length of time you've held a property affects how much tax you'll owe. Selling a property you've owned for less than a year could subject you to ordinary income tax rates, which can go as high as 37%. In contrast, holding it longer may qualify you for long-term capital gains rates, which max out at 20%, depending on your income.

Depreciation recapture is another factor to consider. Any depreciation you've claimed is taxed at 25% when the property is sold. Additionally, non-professional investors may face an extra 3.8% under the Net Investment Income Tax (NIIT).

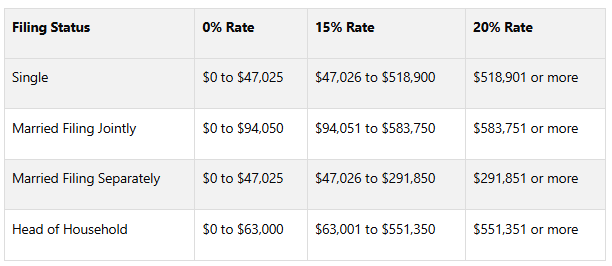

Here's a look at the 2025 long-term capital gains tax brackets by filing status:

Tax-deferment strategies like 1031 exchanges allow you to reinvest proceeds into similar properties, deferring capital gains taxes. However, these strategies come with strict IRS rules and deadlines, making professional guidance essential. Installment sales, which spread tax liabilities over several years, can also help keep you in a lower tax bracket. For investors moving out of high-tax states, understanding residency rules and the "close connection" test is crucial to avoid ongoing state tax obligations.

"Every real estate investor's goal is to earn income from the cash flow and the appreciation of their investment." - Withum.com

Legal compliance also varies by exit strategy. For instance, 1031 exchanges require adherence to complex regulations and deadlines, while installment sales demand precise contracts. Consulting with legal and tax professionals ensures you stay compliant while maximizing financial advantages and minimizing risks.

These factors play a critical role in aligning your exit strategy with your investment goals, paving the way for the next section, which will dive into specific strategy matching.

Matching Exit Strategies to Your Investment Goals

Choosing the right exit strategy depends on your investment priorities. Are you aiming for maximum returns, minimizing risks, quick access to cash, or reducing your tax burden? Each approach aligns with different goals, and understanding these can help you make the best decision.

Which Strategy Fits Your Goal

If your focus is maximizing returns, selling the property outright can be highly effective. On average, full property sales have yielded a total ROI of 22.8%, with an annualized ROI of 10.9% over an average holding period of 25.4 months. This strategy works best when market conditions are strong, allowing you to capitalize on peak property values.

For investors who want to retain ownership but access equity, refinancing is a popular option. In 2024, refinances made up over 30% of all mortgage applications as investors sought better terms amidst fluctuating interest rates. This approach allows you to pull equity from your property without selling, which is particularly useful if you plan to reinvest in other properties or diversify your portfolio.

When tax efficiency is a priority, a 1031 exchange can help. This method allows you to defer taxes while reinvesting in similar properties. In 2023, the use of 1031 exchanges grew by 5% as more investors chose to reinvest in larger projects while delaying tax payments.

If risk minimization is your goal, diversifying across notes might suit you. Performing notes provide steady returns, while non-performing notes carry more risk but offer the potential for higher rewards.

For those who need quick liquidity, direct sales or exit windows are ideal. Exit windows, in particular, streamline transactions. Stake’s data shows that transaction times dropped dramatically from 22 hours in May 2023 to just 3 hours in May 2024.

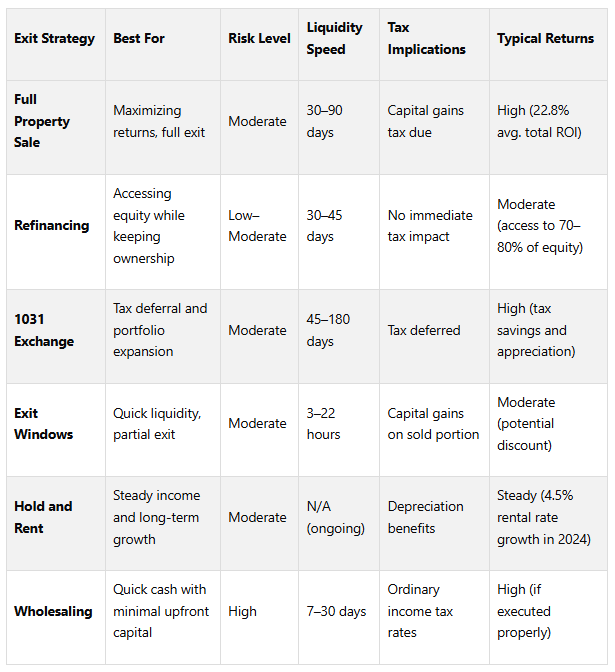

Exit Strategy Comparison Chart

Here’s a breakdown of how these strategies align with different investment objectives:

Your choice ultimately depends on your investment timeline and how much risk you’re willing to take. Long-term investors often accept higher risks for greater rewards, while short-term investors may lean toward safer options to protect their capital. Market conditions also play a key role - strong markets may favor direct sales, while uncertain times might make refinancing or other flexible strategies more appealing.

This groundwork will help you move forward with a well-structured exit plan in the next steps.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

How to Build Your Exit Plan: 3 Steps

Crafting an exit plan that works requires a thoughtful approach, ensuring your strategy aligns with your investment goals. Follow this three-step process to help you make the most of your investment while keeping risks in check.

Step 1: Review Your Goals and Analyze the Portfolio

Start by revisiting your original investment objectives - whether they were focused on cash flow, property appreciation, or portfolio diversification.

Take a close look at your property’s performance. Evaluate its cash flow, occupancy rates, and maintenance costs. Don’t stop there - factor in local market conditions, potential tax implications, and exit costs. This will help you determine if the property is still meeting your financial expectations.

Ask yourself: Does this property still fit into my long-term wealth-building plans, or has it fulfilled its purpose? At the same time, assess your risk tolerance and consider your financing options to ensure your strategy remains on track.

Step 2: Run Financial Models and Explore Scenarios

Once you’ve clarified your goals and analyzed your portfolio, it’s time to dive into the numbers. Use financial models to simulate various scenarios based on the property’s metrics and broader market trends.

Your analysis should include purchase prices, rental income, operating expenses, financing terms, and local market conditions. This will give you a clear view of the pros and cons of each exit option. Make sure to analyze the investment from both equity and debt perspectives for a complete picture.

To ensure your financial models are accurate, gather up-to-date data on market rents, property values, construction costs, and operating expenses. Run sensitivity analyses by tweaking key variables like rent growth, vacancy rates, and interest rates. For example, if a dip in rental income would significantly impact your returns, selling might be the safer choice. Regularly update your analysis with fresh data and compare your projections to similar investments to validate your findings.

Step 3: Define Your Timeline and Seek Expert Advice

After weighing your options through financial modeling, establish a clear timeline for your exit and bring in professional expertise.

Set a realistic timeline based on your research, market trends, and any planned property improvements. Keep in mind that unexpected events can disrupt even the best plans, so build flexibility into your strategy. For instance, if you plan to sell in 18 months but the market takes a downturn, having a refinancing option ready could help you avoid selling at a loss.

"Failing to plan is planning to fail." – Alan Lakein

This is the stage where professional guidance becomes invaluable. Work with tax professionals and real estate experts to fully understand the fees and taxes tied to your exit strategy. If you’re new to real estate investing, stick to approaches you’re familiar with before diving into more complex strategies. Stay updated on market trends and any regulatory changes that could impact your plan.

Build a reliable team of specialists - agents, attorneys, accountants, and analysts - who align with your investment goals. Ideally, you should plan 1–3 years in advance to optimize your strategy, taking into account market conditions and legal or financial considerations. As you gain experience, you can tackle more complex projects and refine your exit strategies. Remember, knowing how you intend to profit from an investment should always be part of your plan from the very beginning.

Using Professional Analysis for Better Exit Planning

Incorporating professional analysis into your exit planning can ensure your decisions are aligned with your investment goals. Making the right call when exiting an investment requires more than just intuition - it demands a deep understanding of market conditions and a data-driven approach. With expert insights, you can turn what might feel like guesswork into a well-informed strategy that aims to maximize returns and reduce risks.

Here’s how tailored financial analysis can refine each step of your exit planning process.

Why Custom Financial Analysis Matters

Custom financial analysis provides insights that are specifically tailored to your property, the local market, and your personal investment objectives. Unlike one-size-fits-all models, this approach digs into property-specific risks and your unique financial position, offering a far more nuanced understanding.

Professional underwriting can reveal opportunities or risks that generic evaluations often miss. For instance, scenario modeling - a key tool in custom analysis - lets you compare multiple exit strategies by running simulations. Analysts can assess how changes in factors like interest rates, vacancy levels, or market appreciation could affect each option. This clarity helps you identify which strategy performs best under various conditions.

Another critical advantage of custom analysis is its ability to account for overlooked costs, such as transaction fees, capital gains taxes, and depreciation recapture. These factors can significantly impact your net proceeds, and accurate projections from professional analysis ensure you’re fully prepared for these financial realities.

Tools and Services from The Fractional Analyst

To support precise exit planning, The Fractional Analyst offers a range of tools and services designed to help investors make informed decisions.

Their CoreCast platform integrates financial and operational data to provide actionable insights for investors, lenders, and asset managers. Priced at $50 per user per month during beta (with an expected increase to $105 per user per month post-launch), CoreCast equips you with professional-grade tools to analyze market trends, property performance, and timing for your exit decisions.

For those who prefer a more hands-on approach, The Fractional Analyst also offers a library of free financial models and templates. These Excel-based tools cover areas like multifamily acquisitions, mixed-use developments, and IRR matrices, all of which can be customized to fit your specific planning needs.

If you need expert guidance, their on-demand analyst support delivers personalized insights for complex scenarios. This service is ideal for validating your analysis or navigating challenging exit decisions. Their offerings include underwriting, asset management support, market research, investor and lender reporting, and even pitch deck creation.

What sets The Fractional Analyst apart is its combination of cutting-edge technology and human expertise. CoreCast provides the data and analytical framework, while their team of financial analysts interprets the results and offers strategic recommendations tailored to your situation. This dual approach ensures you have the resources and advice you need to make confident, informed decisions that align with your investment goals.

Whether you prefer self-service tools or expert consultation, The Fractional Analyst can help you optimize your exit strategy.

Conclusion: Building Exit Plans That Work

Creating an exit plan that aligns with your investment goals takes a thoughtful, data-driven approach. Seasoned investors know the importance of starting this process years ahead of their intended exit.

The backbone of a strong exit plan lies in setting SMART goals - goals that are specific, measurable, achievable, relevant, and time-bound. Whether your priority is maximizing returns, minimizing taxes, or safeguarding your capital, these goals should shape every decision. As Andrew Van Alstyne from Fiduciary Financial Advisors explains:

"The best way to work through this is by having a plan in place years before you are looking to sell." – Andrew Van Alstyne, Fiduciary Financial Advisors

Your plan should also account for factors like market conditions, property performance, and timing. Profitable exits often stem from proactive measures, such as improving operational efficiency, cutting unnecessary costs, and fostering strong tenant relationships well before the sale. These preparations are especially vital in a shifting market, where uncertainty can impact stakeholders and outcomes. Regularly revisiting your strategy ensures it stays relevant as circumstances evolve.

Market cycles and buyer demand can shift dramatically, particularly in commercial real estate. What worked in the past might not suit today’s conditions. That’s why updating your exit strategy to reflect current goals, market trends, and property performance is essential.

To navigate these complexities, professional financial analysis is a game-changer. Tools like custom modeling, scenario analysis, and expert guidance empower you to make informed decisions based on data rather than guesswork. Platforms such as The Fractional Analyst’s CoreCast, along with on-demand analyst support, provide the insights needed to align your exit strategy with your investment objectives.

Additionally, cultivating relationships with potential buyers or partners early in your investment timeline can significantly smooth the exit process. Buyers who are already familiar with your property's strengths and market position are more likely to recognize its value when the time comes.

The most effective exit plans combine clear goals, meticulous preparation, expert analysis, and adaptable timing. By bringing these elements together, you can maximize returns, reduce risks, and ensure your exit strategy delivers the meaningful conclusion your investment deserves.

FAQs

-

To craft an exit strategy that matches your investment goals and fits the current market landscape, start by defining what you want to achieve. Are you aiming to maximize returns, reduce risks, or hit a specific financial target? Having a clear objective will guide your decisions.

Once your goals are set, take a close look at market trends, economic conditions, and how your asset is performing. This analysis will help you pinpoint the best time to make your move.

There are several exit options to consider, including selling on the open market, negotiating a strategic acquisition, or setting up a management buyout. The right choice will depend on your objectives, the asset's value, and the state of the market. By aligning your exit plan with both your long-term goals and current market conditions, you’ll be better positioned to achieve financial success.

-

When planning an exit strategy in the U.S., there are several tax factors to keep in mind. These include capital gains taxes on asset sales, depreciation recapture, and the 3.8% net investment income tax (NIIT) that applies to certain investors. For those considering expatriation, there’s also the potential for an exit tax, which treats unrealized gains as if they were sold at fair market value - this can significantly affect your final proceeds.

To reduce these tax burdens, you might consider strategies like deferring gains through structured sales, leveraging tax-advantaged investment options, or carefully planning ahead if expatriation is part of your plan. Working with a financial advisor or tax professional can help you tailor your exit strategy to meet your financial objectives while keeping tax liabilities in check.

-

When it comes to shaping a strong exit strategy, professional financial analysis is a game-changer. It provides precise forecasts, evaluates the financial standing of your investments, and highlights potential growth areas. This allows you to make informed choices while keeping risks under control.

With the insights from expert analysis, you can better predict outcomes, enhance the valuation of your assets, and map out a smooth transition. Whether your goal is to boost returns or lower risk exposure, this approach ensures your exit strategy is tailored to your investment goals.