Importance of Lease Abstracts in CRE Deals

Lease abstracts simplify complex commercial lease agreements into concise summaries, saving time and aiding decision-making in real estate transactions. These summaries condense critical legal, financial, and operational details, allowing professionals to assess risks and opportunities faster. Here's why they matter:

Time-Saving: Instead of reviewing 50+ page leases, abstracts provide key details in 2-5 pages.

Risk Management: Highlight crucial clauses like rent schedules, renewal options, and legal obligations.

Improved Decision-Making: Enable quick comparisons across properties for better portfolio management.

Cost Efficiency: AI-powered tools reduce manual abstraction costs and errors.

Stakeholder Clarity: Simplifies communication for investors, lenders, and legal teams.

Lease abstracts are essential for efficient real estate operations, offering clear insights into lease terms and reducing risks in property management.

Walk-through of a Commercial Lease Abstract

Key Information Captured in Lease Abstracts

Lease abstracts play a crucial role in commercial real estate (CRE) analysis by summarizing the essential details of a lease. These summaries provide the foundation for informed decision-making and efficient operations. Below are the key elements typically captured in a lease abstract.

Lease Terms and Key Dates

Dates are the cornerstone of any lease abstract. They help CRE professionals avoid costly mistakes like defaults or penalties, allow for timely lease renewals, and assist in planning relocations or terminations. Key dates also enable effective restructuring of leases when needed.

Lease commencement and expiration dates: These are essential for cash flow forecasting and portfolio management. They also influence long-term property value and investment strategies.

Renewal option periods: These specify when tenants can renew their lease, which directly affects property stability and value.

Option exercise deadlines: Missing these deadlines can result in automatic renewals or lost opportunities for both landlords and tenants.

Rent escalation dates: These clarify when and how rental rates will adjust over time.

Notice periods: Various provisions in a lease require specific notice periods, which are critical for property management and investment planning.

A clear understanding of these dates ensures smooth lease administration and helps avoid unnecessary risks.

Rent Schedules and Financial Obligations

The financial terms in lease abstracts are central to accurate property valuations and investment analysis. Rent schedules outline the current and future rental rates, offering a snapshot of expected cash flows.

Base rent schedules: These detail the agreed-upon rent and any projected adjustments over the lease term.

Escalation clauses: These explain how rent will increase, whether tied to external benchmarks like the Consumer Price Index (CPI), fixed annual increases, or stepped schedules.

Additional rent obligations: These include costs like common area maintenance (CAM) charges, property taxes, insurance premiums, and utilities. The abstract specifies whether tenants pay these directly or reimburse the landlord, along with how these costs are calculated and divided.

By providing clarity on these financial commitments, lease abstracts support precise portfolio evaluations and long-term investment planning.

Options and Legal Clauses

Legal clauses and tenant rights are vital components of lease abstracts, as they help mitigate risks and ensure compliance with lease terms.

Tenant termination rights: These allow tenants to exit a lease if specific performance targets aren’t met.

Exclusive use clauses: These protect tenants from competition by preventing similar businesses from occupying nearby spaces. Violations can give tenants grounds to cancel their lease.

Rights of first refusal and first offer: These clauses require landlords to offer certain opportunities to tenants before involving third parties, potentially delaying transactions.

Co-tenancy requirements: These clauses create interdependencies among tenants. For example, a tenant may withhold rent if neighboring businesses are not operational.

Expansion and contraction rights: These allow tenants to adjust their leased space over time, which is critical for cash flow planning and space management.

Accurately capturing these elements not only reduces risks but also enhances strategic planning. This is especially important given that, according to a Deloitte study, 40% of commercial leases are not properly administered. By ensuring all details are documented, lease abstracts become a powerful tool for managing CRE portfolios effectively.

How Lease Abstracts Affect Decision-Making and Risk Assessment

In commercial real estate, making timely and informed decisions is crucial. Lease abstracts simplify dense lease agreements into clear, concise summaries, helping teams make quicker decisions while addressing potential risks more effectively.

Faster Decision-Making

In real estate, time isn't just valuable - it's everything. Lease abstracts save time by distilling lengthy, complex leases into easy-to-digest summaries. Instead of sifting through a 50+ page document, teams can reduce processing time by as much as 30%. This streamlined access to key information eliminates the need to navigate inconsistent document formats, speeding up decision-making.

Centralizing lease data takes this efficiency a step further. With all lease information in one place, companies can conduct portfolio-level analyses and strategic planning with ease. This not only accelerates individual transactions but also sets the stage for identifying risks with precision.

Identifying Key Risk Factors

The ability to quickly review leases also sharpens risk assessment. Lease abstracts highlight critical clauses and obligations that might otherwise remain buried in legal jargon, enabling proactive management of potential issues.

Financial Risks: Abstracted rent schedules, escalation clauses, and details on common area maintenance charges, taxes, and insurance reveal the true cost of occupancy. This helps investors spot cash flow concerns before they become operational problems.

Operational Risks: Summarized tenant rights and restrictions, like exclusive use clauses or co-tenancy requirements, provide clarity on how leases may impact property operations. This allows property managers to anticipate and address potential conflicts.

Legal and Compliance Risks: Abstracts outline notice periods, reporting obligations, and regulatory requirements, ensuring critical deadlines and conditions are met during due diligence.

Additionally, lease abstracts offer a snapshot of tenant creditworthiness, lease rollover schedules, and vacancy risks across portfolios. This transparency is invaluable for assessing the overall health of a real estate portfolio.

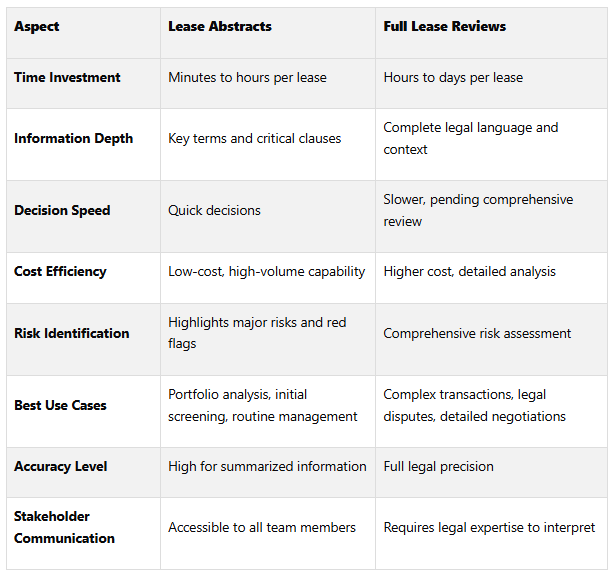

Comparison: Lease Abstracts vs. Full Lease Reviews

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Improving Stakeholder Communication and Operational Efficiency

Streamlined lease summaries do more than just speed up decision-making - they also improve communication across various roles. Lease abstracts act as a shared language in the world of commercial real estate, bridging the gap between internal teams and external stakeholders. By simplifying dense legal documents into easy-to-digest summaries, they lay the groundwork for better collaboration and smoother operations.

Supporting Internal Teams

Lease abstracts don’t just aid in quick decisions and risk management - they also play a key role in improving internal communication. Standardized summaries keep everyone on the same page, cutting down on miscommunication and avoiding costly mistakes.

Asset managers can quickly evaluate a property's financial health and monitor key lease expirations, freeing them to focus on strategic portfolio planning rather than administrative tasks.

Property managers use abstracts to track critical dates and tenant responsibilities, ensuring smoother day-to-day operations and providing immediate answers during tenant interactions.

Leasing teams rely on abstracts to access comparable rent rates and escalation clauses, helping them negotiate with confidence.

Legal departments benefit from clear overviews of the portfolio, allowing attorneys to pinpoint key lease clauses quickly, saving valuable review time.

When everyone works from the same set of lease data, coordination becomes effortless. Teams can respond faster to tenant concerns, meet compliance requirements, and plan finances more effectively.

Meeting External Stakeholder Needs

External stakeholders also rely on concise lease data to guide their investment and financing decisions. Lease abstracts provide clear, actionable insights into lease terms, financial commitments, and tenant risks - key factors during due diligence.

Investors can evaluate tenant credit, rent stability, and potential risks without wading through lengthy documents.

Lenders use abstracts to assess collateral value and cash flow stability, making loan underwriting more efficient.

Potential buyers gain confidence in a property’s financial and legal standing, easily identifying tenant renewal schedules and vacancy risks without needing in-depth legal reviews.

These tools help external stakeholders complete initial assessments in days rather than weeks, speeding up transactions and cutting down on due diligence costs.

The Fractional Analyst's Role

To further enhance operational efficiency, specialized services and digital tools come into play. The Fractional Analyst bridges gaps in efficiency through expert services and self-service digital tools offered via the CoreCast platform, complementing the benefits of lease abstracts.

For more complex lease abstractions requiring a human touch, direct services provide access to top-tier analysts. Meanwhile, the CoreCast platform, currently in its beta phase with scalable pricing, enables teams to handle large portfolios using automated tools that integrate seamlessly into existing workflows.

This dual approach allows organizations to customize their lease abstraction process. Routine updates can be managed through the platform’s self-service tools, while more intricate transactions benefit from hands-on analyst expertise. The result? Stronger collaboration between internal and external teams, faster decisions, and a noticeable boost in operational efficiency.

Technology Advances and Best Practices in Lease Abstraction

The commercial real estate world is undergoing a major shift, thanks to advancements in technology. Lease abstraction, a critical process in property management, has become faster, more accurate, and easier to scale across large portfolios. Modern tools and automation are transforming how lease data is extracted, organized, and analyzed, building on the communication and efficiency improvements already shaping the industry.

Automation and Digital Tools

Artificial intelligence (AI) and machine learning (ML) are now central to improving lease abstraction. These technologies can quickly scan lease documents, pinpoint key terms, and extract essential details with impressive accuracy. Tools like optical character recognition (OCR) convert scanned documents into searchable text, while natural language processing (NLP) categorizes complex legal language, making it easier to understand and manage.

Cloud-based platforms are another game changer. They store lease abstracts in centralized databases, allowing team members to collaborate in real time. This means asset managers, property managers, and legal teams can track updates, maintain version control, and generate reports instantly. Even better, many of these platforms integrate seamlessly with property management systems, accounting software, and financial analysis tools. This integration reduces manual data entry errors and ensures consistency across various operations.

For organizations managing large lease portfolios, these tools drastically cut down review times, turning weeks of manual work into just days. With such efficiency, the focus naturally shifts to adopting standardized practices to ensure accuracy and consistency.

Best Practices for Lease Abstraction

To fully capitalize on these digital tools, it’s essential to adopt standardized best practices. Using uniform templates ensures that all critical lease details - like tenant information, lease terms, rent schedules, escalation clauses, renewal options, and termination provisions - are captured consistently.

Regular updates are another must. Setting up a systematic review schedule, whether quarterly or semi-annually, ensures that any amendments, modifications, or new lease terms are promptly reflected. This prevents outdated information from leading to poor decision-making.

Quality control is equally important. Peer reviews and periodic audits of lease abstracts against the original documents help maintain accuracy across portfolios. Integrating lease data with financial analysis tools can also speed up underwriting and improve property valuations. Additionally, documenting assumptions and clarifying ambiguous language ensures that lease abstracts remain useful and reliable over time.

Free and Custom Tools from The Fractional Analyst

Taking operational efficiency a step further, The Fractional Analyst offers innovative tools designed to simplify lease abstraction. Their CoreCast platform is a robust real estate intelligence system that integrates lease abstraction with other property management functions.

For teams that prefer self-service options, The Fractional Analyst provides free financial models tailored to specific deals. These include templates for multifamily acquisitions, mixed-use developments, and IRR matrices, all designed to work seamlessly with lease abstraction workflows.

CoreCast also expands its offerings with additional free downloadable financial models, making it easier to handle routine lease abstractions. For more complex transactions, CoreCast provides direct analyst support to ensure that unique or nuanced lease provisions are properly addressed. This combination of automation and expert insight allows businesses to gradually integrate these tools into their workflows, offering a scalable solution that adapts to their growing needs.

Conclusion: The Value of Lease Abstracts in CRE Transactions

Lease abstracts have become essential tools in commercial real estate, driving faster decisions, reducing risks, improving communication, and boosting operational efficiency - all of which directly affect profitability.

One of the standout benefits is speed. Traditional manual lease reviews take 4-8 hours per document, but AI-powered tools can process the same data in mere minutes. This speed becomes critical during high-stakes moments like property sales, refinancing, or lease negotiations. For example, AI tools processed lease data for 800 locations in just 72 hours during bankruptcy auctions - a task that would have been impossible with manual methods.

Risk reduction is another major advantage. Manual lease abstracts often carry a 10% error rate, while AI platforms achieve up to 95% accuracy. This higher precision helps identify potential liabilities, clarify key dates and financial obligations, and ensure all parties fully understand their responsibilities before closing a deal.

Concise and accurate lease abstracts also bridge communication gaps. Studies show that 35% of traditional abstracts are incomplete, leading to misunderstandings and inefficiencies. By addressing these issues, modern tools ensure stakeholders have the information they need to make informed decisions.

Cost savings are another compelling factor. Traditional abstraction fees range from $100 to $4,000 per document, but AI tools can reduce this to around $25 per export. For companies managing large property portfolios, these savings add up quickly while also improving speed and accuracy.

Platforms like CoreCast further enhance the process by integrating lease abstraction with broader real estate systems. This eliminates data silos, reduces manual entry errors, and enables real-time collaboration, keeping all stakeholders aligned. The Fractional Analyst's CoreCast platform exemplifies this approach, transforming how CRE operations are managed.

"Lease abstracts turn complicated lease documents into powerful tools for efficiency, risk reduction and informed decision-making." - Yardi Corom

"AI powered lease abstraction isn't just about saving time - it's about making faster, more informed decisions that accelerate your expansion timeline." - Clyde Christian Anderson, CEO of GrowthFactor.ai

Looking ahead, the potential for even greater advancements is clear. With 61% of CRE teams still using outdated systems, those who adopt modern lease abstraction tools gain a competitive edge in speed, accuracy, and stakeholder satisfaction. By combining human expertise with advanced technology, organizations can build a strong foundation for smarter, faster, and more effective decision-making in commercial real estate.

FAQs

-

Lease abstracts are essential tools for managing risks in commercial real estate (CRE) transactions. They provide a straightforward summary of crucial lease terms, obligations, and conditions, making it easier for stakeholders to spot potential legal, financial, or operational risks and tackle them head-on.

By breaking down important details like rent escalation clauses, tenant responsibilities, and key dates, lease abstracts help minimize the likelihood of expensive disputes. They also enable smarter decision-making, improve risk evaluation, safeguard asset value, and ensure smoother operations in CRE transactions.

-

Technology, especially AI and automation, has transformed how lease abstraction is handled in commercial real estate. With automation, key lease details - like clauses, financial terms, and renewal options - can be extracted in just hours instead of days, drastically cutting down on time and reducing the chance of human error.

This shift frees up CRE professionals to concentrate on more strategic tasks, such as risk assessment and decision-making, rather than spending time on tedious data entry. On top of that, automation simplifies scaling operations, allowing teams to manage larger property portfolios with improved accuracy and efficiency.

-

Lease abstracts play a crucial role for both internal teams and external stakeholders by breaking down complex lease agreements into clear, straightforward summaries. They focus on essential details like key dates, financial terms, and obligations, making it easier to make quick, informed decisions.

By organizing critical lease information in an accessible way, these summaries help minimize errors, lower risks, and simplify processes such as acquisitions, sales, or refinancing. This ensures that everyone involved in a transaction has access to accurate, up-to-date information, supporting smarter planning and efficient portfolio management.