Recent Performance & Positioning Recommendations for 2026

Executive Summary

The commercial real estate (CRE) picture over the last 30 days shows tentative stabilization in several sectors and persistent stress in others. Office vacancy has seen its first YoY decline since 2019, while CMBS delinquencies ticked higher in October with office still the weak link. Multifamily asking rents fell again on heavy deliveries, while industrial fundamentals remain healthy with robust leasing from logistics users. Retail availability is flat at a multi-decade low, self-storage shows rate growth returning, hospitality is mixed (luxury resilient; broader RevPAR wobbling), and SFR rent growth has cooled to a 15-year low.

On the capital markets side, the Fed cut rates in late October and banks’ SLOOS shows still-tight standards with pockets of improving loan demand. The MBA reports Q3 CRE loan delinquencies improved modestly versus Q2, although October CMBS data deteriorated.

Positioning for 2026

Lenders: prioritize industrial, grocery-anchored retail, select hotel (upper-upscale & resort), stabilized self-storage; underwrite office conservatively with business-plan-driven structures; in multifamily, lean into high-quality, well-located assets through lower leverage, DSCR floors, and structured reserves; for SFR/BTR, emphasize sponsors with scale and operating efficiency.

Investors: target industrial and necessity retail for core income; pursue value-add in office only with clear re-tenancy/capex path and basis below replacement; in multifamily, focus on 2023–2025 vintage lease-ups nearing stabilization or light-rehab buys below replacement; consider selective self-storage and hotel opportunities; be mindful of STR/MTR regulatory risk.

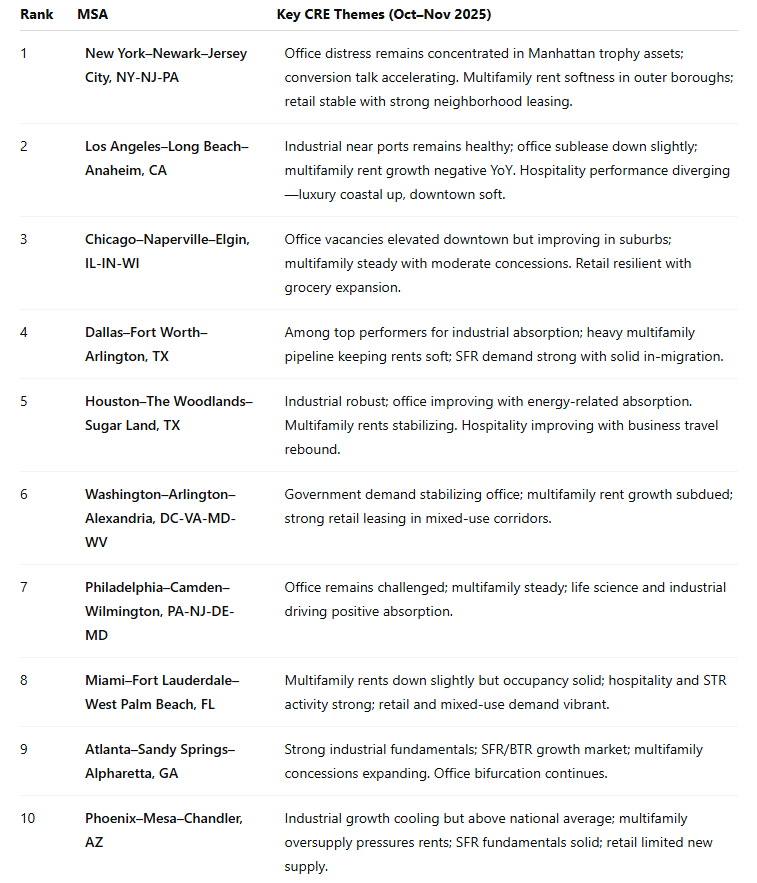

Top 10 MSAs and CRE Market Highlights (by Population)

Overall: These top metros show a pattern of industrial resilience, multifamily softness due to heavy supply, and office bifurcation with flight-to-quality themes. Sun Belt metros (Dallas, Atlanta, Phoenix, Miami) remain demographic winners despite near-term rent pressure, while coastal markets (New York, LA, SF) face lingering office stress but are seeing renewed retail and hospitality vitality.

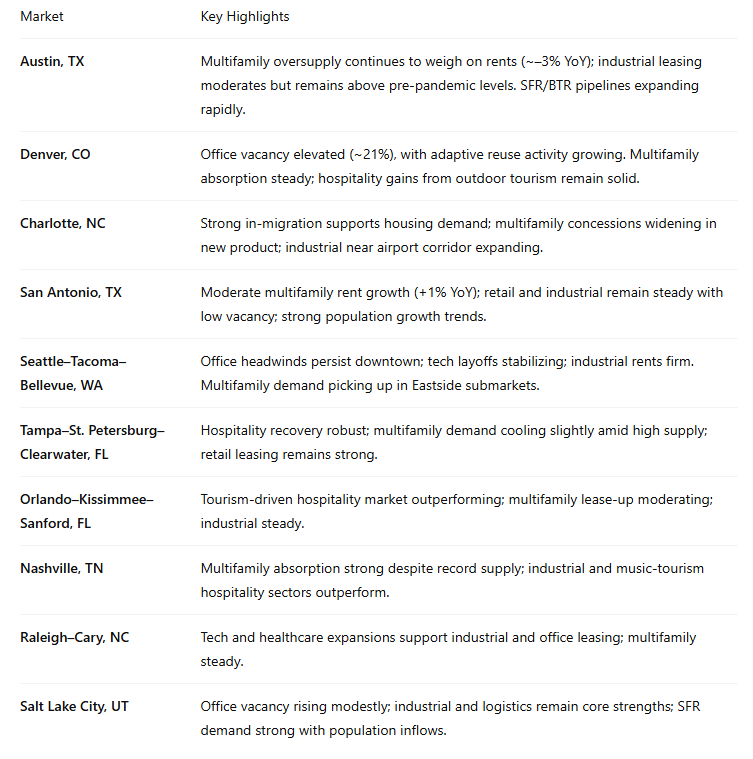

Secondary & Emerging MSAs to Watch (CRE Focus)

Insight: Secondary and emerging metros continue to benefit from population inflow, lower cost bases, and logistics advantages, although many face short-term multifamily supply headwinds. These markets remain compelling for build-to-rent and industrial development, as national capital seeks yield and growth exposure.

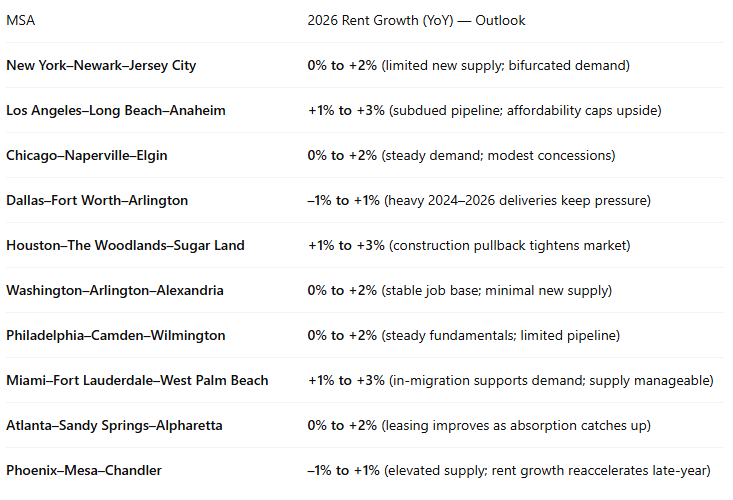

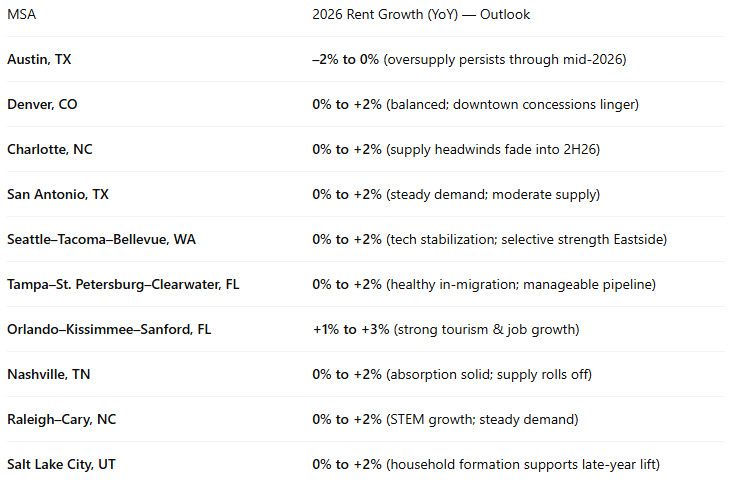

2026 Multifamily Rent Growth Outlook — Select Metros (Directional Ranges)

Ranges reflect consensus directional estimates synthesized from CBRE’s 2025 Outlook & Q3 figures, Yardi Matrix’s October forecast update, Apartments.com’s 2026 trends, and recent local reporting (Oct–Nov 2025). Use for planning; confirm with lender/IC as underwriting assumptions.

Top 10 MSAs by Population

Secondary & Emerging MSAs

Underwriting Notes (2026): For markets in the –1% to +1% range, consider flat rent base cases with upside only after proven absorption; maintain higher concession assumptions through 1H26 in high‑supply Sun Belt markets. Where ranges show +1% to +3%, consider partial loss‑to‑lease recapture in stabilized Class B/C assets, but keep turn costs and property taxes conservative.

Macro & Capital Markets

Policy rate: The Fed cut its policy rate in late October and implemented new administered rates effective Oct 30, 2025, signaling a cautious easing stance. Mortgage rates remain elevated by historical standards but are drifting lower from 2024 peaks.

Bank lending: The October 2025 SLOOS indicates banks maintained generally tight CRE loan standards, with some categories showing improved demand relative to prior quarters.

Delinquencies: The MBA’s Q3 2025 survey shows overall CRE loan delinquencies eased from Q2’s spike, but Trepp’s October read shows CMBS delinquencies up to ~7.5%, with office at a fresh all-time high, underscoring divergence by capital source and property type.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Sector Snapshots (Last 30–45 Days)

Office

Trend: Signs of stabilization. Q3 posted a sixth straight quarter of positive net absorption; vacancy down 20 bps QoQ to ~18.8% and the first YoY decline since early 2019. Monthly trackers show listing rates roughly flat YoY and very limited new construction.

Risk: Despite stabilization, office remains the largest source of CMBS stress with late-payment spikes tied to specific large-loan maturities.

What to watch: Flight-to-quality bifurcation; conversion feasibility; limited new starts could set up gradual tightening through 2026 if demand holds.

Multifamily

Trend: Asking rents fell in September (largest monthly drop in ~3 years) amid heavy supply; forecasts point to muted rent growth into 2026–2027 as deliveries work through.

Pipeline: Elevated completions persist into late 2025; new starts slowing.

What to watch: Lease-up pace for 2024–2025 deliveries; concessions; 2026 supply gap if starts stay subdued.

Industrial / Logistics

Trend: Leasing demand remains solid; industry bellwethers reported strong Q3 leasing and cautiously upbeat rent/occupancy outlooks. IBI readings point to continued expansion; vacancy remains low in most distribution markets.

What to watch: Trade policy/tariffs, import volumes, and inventory normalization.

Retail

Trend: Stable and tight. Availability steady around 4.9% with openings/expansions offsetting closures. New construction remains limited; rents generally firm for necessity and service-oriented formats.

What to watch: Consumer spending normalization; small-format expansion from discounters, QSR, and health/beauty.

Hospitality (Hotels)

Trend: Mixed. Weekly RevPAR prints in late October showed declines YoY, but luxury brands outperformed in Q3 and select event-driven markets posted spikes.

What to watch: Group & international inbound, rate integrity into holiday period, and 2026 pipeline.

Self-Storage

Trend: After a three-year dip, annual rate growth has turned positive (~+0.9% YoY in Sept.), with REITs leading. Supply pressure persists but development share slipped slightly.

What to watch: New-supply pockets, seasonality normalization, and operating expense discipline.

Single-Family Rental (SFR / BTR)

Trend: Rent growth slowed to a 15-year low by late summer; operations remain healthy with high occupancy and improving retention. BTR deliveries continue, concentrated in the Sun Belt.

What to watch: Acquisition cap rates vs. scattered-site operating costs; regional demand dispersion (Midwest firming, some Sun Belt softness).

Short-Term & Mid-Term Rentals (STR/MTR)

Trend: Regulatory risk is rising in multiple markets (e.g., Bay Area towns escalating fines; ongoing debates in NYC). Corporate housing/MTR demand remains a bright spot for certain relocations and project work, with expectations of steady demand into 2026.

What to watch: City-level ordinance changes; platform compliance requirements; seasonality into Q1.

Positioning Playbook - 2026

For Lenders

Office: Favor shorter-term, structure-heavy financings anchored by clear business plans (spec-to-suit conversions, targeted re-tenancy). Employ lower LTVs, DSCR floors, TI/LC reserves, and re-margin triggers tied to leasing milestones. Scrutinize rollover within 24 months and monitor CMBS comps for loss severity signals.

Multifamily: Emphasize sponsor execution on lease-ups; underwrite to normalized concessions and slower trade-outs. For stabilized assets, consider modest proceeds with earn-outs on NOI thresholds. Watch 2026 supply gap potential; rate hedges prudent for bridge.

Industrial: Maintain allocations; hedge policy/tariff volatility with sensitivity cases. For development, prioritize infill and near-port nodes with pre-leasing or proven tenant rosters.

Retail: Grocery-anchored and service-oriented centers: solid credit; use co-tenancy and sales reporting where possible. Be selective on big-box backfills.

Hospitality: Focus on upper-upscale/luxury in strong urban/resort markets with demonstrated group demand. Require FF&E reserves and rate/occupancy covenants; stress test ADR.

Self-Storage: Lean in where supply pipelines are receding; emphasize micro-market feasibility and operating maturity.

SFR/BTR: Favor institutional operators with scale, centralized maintenance, and technology-enabled ops; assess property tax and insurance trajectories; underwrite slower rent growth.

STR/MTR: Require regulatory reps & warranties and compliance covenants; consider DSCR haircuts for regulatory risk and enforceable cash sweeps.

For Investors

Core/Core-Plus: Industrial (tier-1 logistics) and necessity retail for income durability; select stabilized self-storage in supply-constrained submarkets.

Value-Add: 2023–2025 multifamily lease-ups nearing stabilization; light-rehab garden apartments below replacement cost; office only with basis resets and a credible leasing path.

Opportunistic: Note pockets of distress in CMBS, especially office; pursue loan-to-own or note acquisitions with patient capital and strong local execution teams.

Hospitality: Target event-driven and experiential markets; consider branded-residential components where allowed.

SFR/BTR: Focus on Midwest/Southeast infill with durable demand drivers; seek bulk purchase discounts from builders.

Key Data Points & Headlines (past ~30 days)

Office vacancy and absorption improving: Positive net absorption for a sixth consecutive quarter; vacancy ~18.8% in Q3; monthly read shows 18.6% in Sept. and listing rates roughly flat YoY.

Multifamily rents dipped: September saw the biggest one-month drop in nearly three years; forecasts imply subdued growth through 2027 as supply delivers.

Industrial strength: Logistics REIT posted record quarterly leasing and nudged guidance higher; IBI indicates expansion.

Retail steady: Availability ~4.9% with openings/expansions offsetting closures.

Hotels mixed: Late-October RevPAR down ~5% YoY on weekly read, but luxury brands reported Q3 outperformance and strong earnings.

Self-storage turning: +0.9% YoY national rate growth in Sept.; development pipeline ~2.6% of stock under construction.

SFR cooling: 15-year low in rent growth; operations remain sound with high occupancy.

STR regulation: Municipal crackdowns intensify (e.g., Sausalito fines for advertising; ongoing NYC policy debate).

Delinquencies diverge: MBA Q3 improvement vs. Trepp October rise to ~7.46% CMBS delinquency.

Rates & lending: Fed cut in late Oct; SLOOS still shows tight standards with selective demand improvement.

Sources (Last 30–45 Days; direct links)

CBRE — Q3 2025 US Office Figures: https://www.cbre.com/insights/figures/q3-2025-us-office-figures

JLL — U.S. Office Market Dynamics Q3 2025: https://www.jll.com/en-us/insights/market-dynamics/us-office

CommercialCafe — U.S. Office Market Report (Oct 2025): https://www.commercialcafe.com/blog/national-office-report/

Trepp — CMBS Delinquency Rate Climbs in October 2025: https://www.trepp.com/trepptalk/cmbs-delinquency-rate-climbs-in-october-2025

MBA — Delinquency Rates for Commercial Properties Decreased in Q3 2025: https://www.mba.org/news-and-research/newsroom/news/2025/10/28/delinquency-rates-for-commercial-properties-decreased-in-the-third-quarter-of-2025

Mortgage Professional America — Summary of MBA Q3 Delinquencies: https://www.mpamag.com/us/specialty/commercial/commercial-mortgage-delinquencies-eased-in-q3-but-risks-linger-mba/554608

Connect CRE — MBA Reports Lower Commercial Mortgage Delinquency Rate for Q3: https://www.connectcre.com/stories/mba-reports-lower-commercial-mortgage-delinquency-rate-for-q3/

Yardi Matrix — National Multifamily Market Report (Sept 2025): https://www.yardimatrix.com/blog/national-multifamily-market-report/

Yardi — Press Release: Supply Up, Rents Down (Oct 23, 2025): https://www.yardimatrix.com/blog/us-multifamily-supply-up-and-rents-down/

Yardi Matrix — Forecasts overview & publications: https://www.yardimatrix.com/Publications

CREDaily — Apartment completions/slowing construction: https://www.credaily.com/briefs/apartment-completions-decline-amid-slower-construction-activity/

Reuters — Prologis tops estimates on strong warehouse leasing (Q3 2025): https://www.reuters.com/business/prologis-tops-quarterly-estimates-strong-warehouse-leasing-2025-10-15/

CBRE — Q3 2025 US Retail Figures: https://www.cbre.com/insights/figures/q3-2025-us-retail-figures

STR via HotelNewsResource — Weekly RevPAR down for week ending Oct 25, 2025: https://www.hotelnewsresource.com/article138734.html

Investopedia — Hilton Q3 2025 earnings (luxury outperformance): https://www.investopedia.com/hilton-stock-jumps-luxury-brands-boost-q3-2025-earnings-11834538

Yardi Matrix — Self Storage National Report (Oct 2025) summary page: https://www.yardimatrix.com/publications/download/file/7928-MatrixSelfStorageNationalReport-October2025

Yardi Matrix — Self Storage National Report PDF (sample): https://www.yardimatrix.com/media/downloads/file/7928-MatrixSelfStorageNationalReport-October2025?direct=true&sample=true

Yardi Blog — Self‑storage update (Oct 6, 2025): https://www.yardi.com/blog/matrix/matrix-self-storage-report-september-2025/41308.html

National Mortgage Professional — SFR Rent Growth Hits 15‑Year Low (Oct 24, 2025): https://nationalmortgageprofessional.com/news/single-family-rent-growth-hits-15-year-low

Arbor — SFR Investment Snapshot (Oct 2025): https://arbor.com/blog/single-family-rental-investment-snapshot-october-2025/

RentalScaleUp — NYC STR rules debate (Sept 2025): https://www.rentalscaleup.com/new-york-short-term-rental-regulations/

SFGATE — Sausalito fines for advertising STRs (Oct 2025): https://www.sfgate.com/local/article/posting-rental-airbnb-ads-fines-bay-area-sausalito-21114917.php

Federal Reserve — Implementation Note (Oct 29, 2025 policy actions): https://www.federalreserve.gov/newsevents/pressreleases/monetary20251029a1.htm

AP News — Fed cut Sept 16, 2025 (context): https://apnews.com/article/2d05401d7c9cb2393925f494aac71d89

Federal Reserve — October 2025 SLOOS main page: https://www.federalreserve.gov/data/sloos/sloos-202510.htm

Calculated Risk — SLOOS summary (Nov 3, 2025): https://www.calculatedriskblog.com/2025/11/fed-october-sloos-survey-banks-reported.html

Reuters — Office late payments spike on NYC loan default (Fitch): https://www.reuters.com/business/finance/us-office-late-payments-spike-new-york-city-loan-default-fitch-says-2025-10-10/

CBRE — U.S. Real Estate Market Outlook 2025: Multifamily: https://www.cbre.com/insights/books/us-real-estate-market-outlook-2025/multifamily

CBRE — 2025 U.S. Market Outlook Midyear Review (multifamily): https://www.cbre.com/insights/reports/2025-us-real-estate-market-outlook-midyear-review

Apartments.com — 2026 Multifamily Trends (white paper PDF): https://www.apartments.com/grow/sites/apartments.com.advertise/files/2025-10/2026-multifamily-trends-white-paper.pdf

Houston Chronicle — Houston apartment construction slowdown & rent outlook: https://www.houstonchronicle.com/business/real-estate/article/houston-apartment-market-2025-21025355.php

Axios Charlotte — Apartment rents & supply context (Apr 2025): https://www.axios.com/local/charlotte/2025/04/21/apartment-rents-growth-construction-supply-demand

Moody’s (context) — 2025 rent growth forecast methodology: https://www.moodyscre.com/insights/market-insights/will-this-market-have-the-highest-rent-growth-in-2025/