Reverse 1031 Exchanges: Step-by-Step Guide

A reverse 1031 exchange lets you buy a new property before selling your current one, offering flexibility in competitive markets. However, strict IRS rules make the process complex. Here's what you need to know:

- How It Works: An Exchange Accommodation Titleholder (EAT) temporarily holds the title to one property to comply with IRS rules. You must identify the property you're selling within 45 days and complete the sale within 180 days.

- Costs: Reverse exchanges are more expensive than standard 1031 exchanges, often costing $6,000–$10,000 or more.

- Challenges: Requires upfront capital or bridge loans, and missing deadlines can lead to capital gains taxes.

- Key Players: You'll need a Qualified Intermediary (QI) and an EAT to handle the exchange.

Reverse exchanges are ideal for securing must-have properties quickly but demand careful planning, financing, and compliance with IRS guidelines.

Rules and Participants in a Reverse 1031 Exchange

IRS Rules and Requirements

Reverse exchanges follow the guidelines set out in Revenue Procedure 2000-37, ensuring the process meets the criteria for tax deferral. These exchanges are strictly limited to business or investment real estate - primary residences and inventory don't qualify[1].

The timeline begins as soon as the Exchange Accommodation Titleholder (EAT) takes ownership of the replacement property. From that point, you have 45 days to identify the property you're relinquishing and 180 days to complete the exchange. It's important to note that these deadlines are non-negotiable, with no extensions allowed[2].

To defer all capital gains taxes, the replacement property must be purchased for an amount equal to or greater than the adjusted sale price of the relinquished property. Additionally, all sale proceeds must be reinvested, and any existing debt must be replaced with new financing or cash. The same taxpayer who sells the relinquished property must also acquire the replacement property[2].

If the relinquished property isn't sold within the 180-day period, the exchange fails. In such cases, the EAT will transfer ownership of the replacement property back to you, which will result in immediate capital gains taxes[2].

Successfully meeting these IRS requirements hinges on the collaboration of key professionals.

Roles of Each Party

Executing a reverse exchange requires precise coordination among multiple participants to ensure compliance with IRS rules.

Three main roles are involved in this process. As the taxpayer, your responsibilities include initiating the exchange, securing financing for the replacement property, and adhering to critical deadlines. However, since holding title to both properties simultaneously would disqualify you from tax deferral, you'll need help from two specialized entities.

The Qualified Intermediary (QI) plays a crucial role by managing the legal paperwork, coordinating the transaction timeline, and holding the proceeds from the sale of the relinquished property. This ensures you don't have direct access to the funds, which could otherwise void the tax deferral[2].

"The Exchange Accommodator Titleholder (EAT) holds the title of the property. If you own the title while also owning the relinquished property, then you'll be disqualified from the tax deferral status." - Realized 1031[2]

The Exchange Accommodation Titleholder (EAT), typically a single-member LLC created by the QI, temporarily holds the title to either the replacement or relinquished property during the 180-day window. This arrangement ensures compliance with IRS regulations[2].

Standard vs. Reverse 1031 Exchanges

The main differences between standard (forward) and reverse 1031 exchanges lie in their timing and complexity. Here's a quick comparison of the two approaches:

| Feature | Standard (Forward) Exchange | Reverse Exchange |

|---|---|---|

| Sequence | Sell first; acquire second | Acquire first; sell second |

| Timeline Trigger | Starts with the sale of the relinquished property | Starts when the EAT acquires the replacement property |

| Complexity | Moderate; involves standard procedures | High; requires "parking" arrangements with an EAT |

| Capital Requirements | Lower; uses sale proceeds for purchase | Higher; often needs upfront capital or bridge financing |

| Typical Use Case | Reinvesting real estate gains in a straightforward market | Securing a desirable property in competitive markets |

Due to the added complexity and state-specific regulations, reverse exchanges generally cost between $6,000 and $10,000. If additional properties are involved, expect extra fees ranging from $400 to $600 per property[5].

sbb-itb-df8a938

Reverse 1031 Exchange (In-Depth Tutorial)

How to Execute a Reverse 1031 Exchange

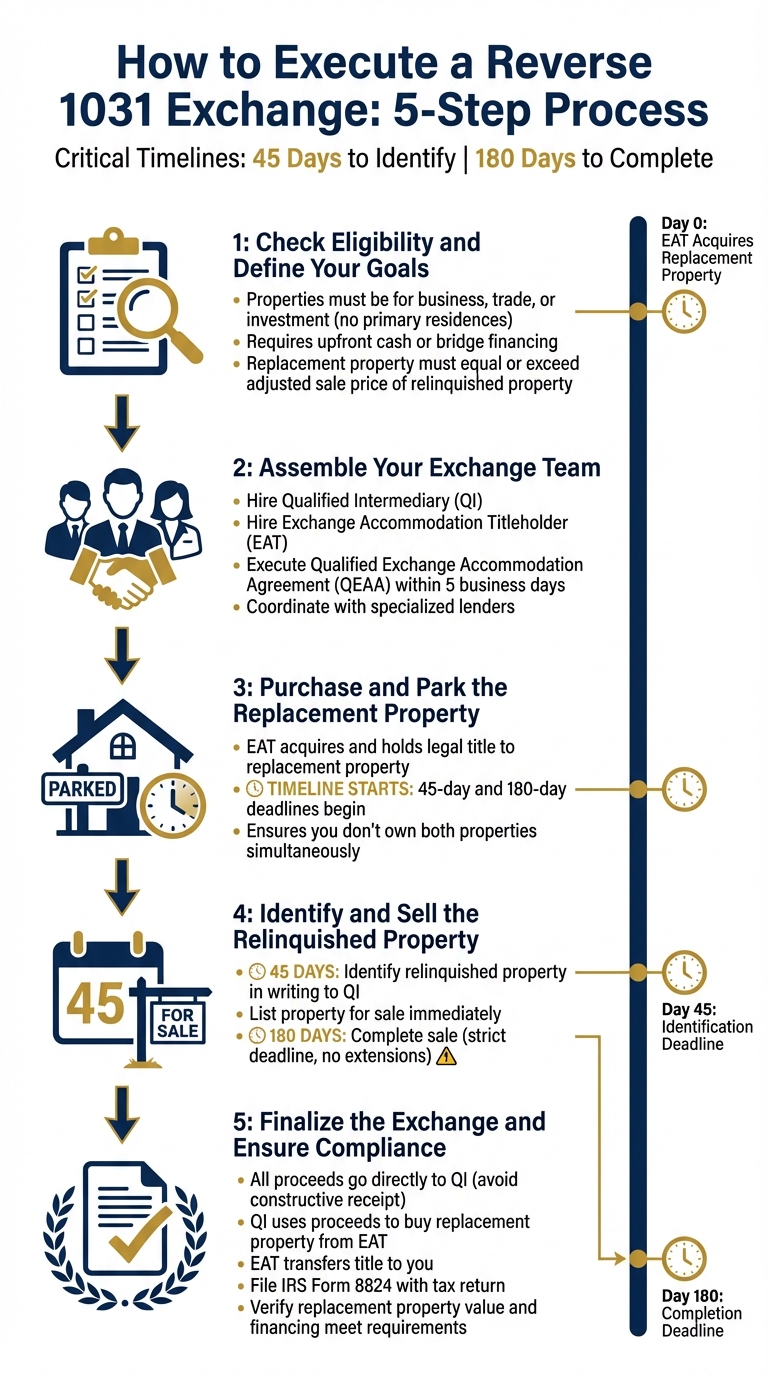

5-Step Reverse 1031 Exchange Process with Timeline Requirements

Step 1: Check Eligibility and Define Your Goals

First, make sure both properties meet the IRS's like-kind exchange rules. This means they must be held for business, trade, or investment purposes - primary residences are not eligible. You'll also need to evaluate your finances, as reverse exchanges require upfront cash or bridge financing since you won’t have access to proceeds from your relinquished property right away.

Your replacement property must be purchased for at least the adjusted sale price of the relinquished property if you want to defer all capital gains taxes. Once you've confirmed eligibility and clarified your investment goals, it's time to assemble your team of experts.

Step 2: Assemble Your Exchange Team

Your next step is to hire a Qualified Intermediary (QI) and an Exchange Accommodation Titleholder (EAT) before purchasing the replacement property. The EAT is often a single-member LLC created specifically for your exchange.

Within five business days of the EAT taking title to the property, you’ll need to execute a Qualified Exchange Accommodation Agreement (QEAA). This agreement establishes the safe harbor arrangement under IRS Revenue Procedure 2000-37.

It’s also crucial to coordinate with lenders early. Traditional lenders often won’t provide loans directly to an EAT LLC, so you’ll need a lender who understands the reverse exchange process and is comfortable with the EAT holding the title.

Step 3: Purchase and Park the Replacement Property

Once the EAT acquires the replacement property, it "parks" the property by holding legal title throughout the exchange period. This setup ensures you don’t simultaneously own both properties, which could disqualify the tax deferral.

The moment the EAT takes title, two critical timelines begin: the 45-day identification period and the 180-day exchange period. These deadlines are non-negotiable, so make sure to stay on track.

Step 4: Identify and Sell the Relinquished Property

You have 45 days from when the EAT acquires the replacement property to identify, in writing, the property you plan to relinquish. This written identification must be signed by you and delivered to the QI.

List the relinquished property for sale as soon as possible. The 180-day period to complete the sale is strict, and missing this deadline will result in a taxable event. For instance, some investors have successfully identified multiple properties within the 45-day window and completed their sales within the 180-day limit.

After identifying and marketing the relinquished property, move on to the final step to ensure compliance and complete the exchange.

Step 5: Finalize the Exchange and Ensure Compliance

When your relinquished property sells, all proceeds must go directly to the QI - this step is critical to avoid "constructive receipt", which would disqualify the tax deferral.

Next, the QI uses the proceeds to "buy" the replacement property from the EAT, which then transfers the title to you. To complete the process, file IRS Form 8824 with your tax return for the year the exchange is finalized. This form reports the deferred gain and adjusts your property’s tax basis.

Lastly, double-check that the replacement property’s value and any new financing meet or exceed the relinquished property’s sale price and debt obligations. Meeting these requirements ensures you maximize your tax deferral benefits.

Risks and How to Avoid Them

After understanding the exchange process, it’s crucial to be aware of potential risks and how to navigate them effectively.

Main Risks in Reverse 1031 Exchanges

One major risk in a reverse 1031 exchange is failing to meet the strict IRS deadlines for selling your relinquished property. These deadlines are non-negotiable - there are no extensions for market delays, financing issues, or even natural disasters [4][6]. If the sale isn’t completed within 180 days, the exchange collapses, leading to immediate capital gains taxes.

Financing can also pose a challenge. Traditional lenders typically won’t extend loans directly to an Exchange Accommodation Titleholder (EAT). This means you’ll need to secure alternative funding, like personal financing, bridge loans, or even pay cash upfront [2][4]. Handling two properties at once requires enough liquidity to cover carrying costs until the relinquished property is sold.

Another risk is tax disqualification. Violating IRS safe-harbor rules - such as taking constructive receipt of funds, holding both properties simultaneously, or mismatching debt levels - can result in losing the tax deferral benefit [1][2][4]. Even small errors in documentation or timing can lead to significant tax liabilities.

How to Reduce Risk

Start by preparing your relinquished property for sale before purchasing the replacement property. Complete any necessary repairs, arrange professional photography, and create your listings so you can hit the market as soon as the EAT acquires the replacement property [2][6]. This preparation helps maximize your selling window and avoids the stress of scrambling to sell late in the process.

Secure financing approval with a lender experienced in working with EAT structures. Have your funding sources ready before closing on the replacement property [4][6]. Using financial models to project cash flow needs - including carrying costs - can also help you manage the financial demands of holding two properties during the exchange period.

Price your relinquished property realistically from the start. Overpricing in hopes of a higher return can backfire if the property doesn’t sell within the required timeframe [6]. Partnering with experienced professionals, such as a Qualified Intermediary and an EAT provider familiar with reverse exchanges, can ensure you stay compliant and that all documentation is accurate.

These strategies can help you avoid common pitfalls while keeping your exchange on track.

How The Fractional Analyst Can Help

The Fractional Analyst offers tools and expertise to support your risk management efforts. Our financial modeling tools help you determine if a reverse exchange is the right choice for your situation. We provide detailed projections that account for carrying costs, debt matching requirements, and timing scenarios, ensuring you maintain enough liquidity throughout the process.

Our underwriting support evaluates your relinquished property’s realistic sale price and timeline, helping you avoid the risks of overpricing. Additionally, we offer compliance tracking tools to monitor critical deadlines and IRS safe-harbor rules, keeping all financial details organized and accessible during the transaction. With these resources, you can confidently navigate the complexities of a reverse 1031 exchange.

Conclusion

A reverse 1031 exchange comes with strict IRS deadlines that leave no room for flexibility. You must identify the property you're relinquishing within 45 days and complete the entire exchange process within 180 days of the EAT acquiring the replacement property. These timelines are non-negotiable and require careful planning [1][6].

"The key to a successful reverse 1031 exchange lies in identifying clear objectives, conducting comprehensive due diligence, and working with experienced professionals." – 1031 Specialists [7]

Meeting deadlines is only part of the equation. Having the right team in place is equally critical. Experienced QI and EAT professionals who specialize in reverse exchanges can make all the difference [3]. Additionally, securing financing ahead of time is a must, as traditional lenders typically won’t lend directly to an EAT [2].

Finally, make sure your relinquished property is ready for the market. This means completing any necessary repairs and ensuring it’s properly listed before the EAT takes possession of the replacement property [2][6].

FAQs

What financial risks should I consider before starting a reverse 1031 exchange?

A reverse 1031 exchange carries several financial risks that you need to be aware of. One major challenge is the strict deadlines - you have just 45 days to identify replacement properties and 180 days to finalize the purchase. These tight timeframes can create a lot of pressure, making it essential to act quickly and decisively.

Another concern is the higher costs often associated with these transactions. You might face increased financing expenses and additional transaction fees, which can add up quickly.

The most significant risk, however, is the possibility of failing to meet the IRS requirements. If that happens, you could lose the tax-deferral benefits entirely. To navigate these risks, meticulous planning and the help of a qualified expert are crucial to stay on track and ensure everything is done by the book.

How can I select the best Qualified Intermediary and Exchange Accommodation Titleholder (EAT) for a reverse 1031 exchange?

When choosing a Qualified Intermediary (QI) and Exchange Accommodation Titleholder (EAT) for a reverse 1031 exchange, it’s important to find a provider with deep experience in reverse exchanges and a strong reputation. Make sure they adhere to IRS safe-harbor rules, especially when setting up and managing the EAT, which is often structured as a single-member LLC.

Look for a QI that provides segregated escrow accounts, maintains a clear and upfront fee structure, and has a solid history of successfully managing complex transactions. Don’t hesitate to ask for references and confirm their expertise. Partnering with a dependable provider is key to staying on track with strict timelines and avoiding costly errors.

What are the consequences of missing the 180-day deadline in a reverse 1031 exchange?

If you go past the 180-day deadline in a reverse 1031 exchange, the deal loses its tax deferral perks. At that point, the IRS will treat the transaction as a standard sale, and any capital gains will become taxable right away. To steer clear of this, it's essential to plan carefully and stick to the strict timelines outlined by the IRS for reverse 1031 exchanges.