SALT Deductions for Commercial Properties

State and Local Tax (SALT) deductions can help commercial property owners lower their federal taxes. Here's what you need to know:

What Are SALT Deductions? They allow you to deduct state and local taxes, like property taxes, from your federal taxable income.

Current Cap: The Tax Cuts and Jobs Act (TCJA) capped SALT deductions at $10,000 annually through 2025.

Upcoming Changes: Proposals like the One Big Beautiful Bill Act aim to raise the cap to $40,000 for some taxpayers starting in 2025.

Why It Matters: Property taxes often make up 40% of operating costs for commercial real estate. Maximizing deductions can improve cash flow and property value.

Key Takeaways:

Business Structure Matters: C corporations can deduct SALT taxes fully, while pass-through entities (LLCs, partnerships, etc.) face the $10,000 cap unless they use Pass-Through Entity Taxes (PTETs).

Plan Ahead: Use tax-saving strategies like bunching payments, cost segregation for depreciation, and PTET elections to optimize your deductions.

Stay Compliant: Keep detailed records of taxes, expenses, and property assessments to avoid audits or missed deductions.

With the current cap expiring in 2025 and potential legislative changes on the horizon, now is the time to revisit your tax strategy. Consult a tax professional to ensure you're getting the most out of your SALT deductions.

Ultimate Tax Guide for Commercial Real Estate: Latest Benefits & Laws | COMMERCIALLY SPEAKING EP054

Recent Tax Law Changes Affecting SALT Deductions

Over the past few years, changes to SALT (State and Local Tax) deductions have created challenges for commercial property owners who rely on these deductions for tax planning. Keeping up with these changes - and preparing for what's ahead - is crucial for making smart investment decisions. Here's a breakdown of the latest legislative proposals and their potential impact.

The SALT Deduction Cap and Upcoming Adjustments

The Tax Cuts and Jobs Act (TCJA) of 2017 introduced a $10,000 annual cap on SALT deductions, replacing the previously unlimited deduction for state and local taxes. This cap is set to expire after 2025, but recent legislative efforts could lead to significant changes.

One major proposal is the One Big Beautiful Bill Act (H.R. 1), passed by the House of Representatives, which seeks to raise the SALT cap to $40,000. However, this bill faces an uphill battle in the Senate, where compromise is likely to play a key role.

Key features of the House proposal include:

Under this plan, the $40,000 cap would gradually decrease for individuals earning more than $500,000, eventually phasing down to the current $10,000 limit for higher earners.

Despite these proposals, the Senate's current draft sticks to the existing $10,000 cap, described by Senate Finance Committee members as a placeholder for further discussions. Senate Majority Leader John Thune acknowledged the challenges ahead, stating:

“I think at the end of the day, we’ll find a landing spot, hopefully that will get the votes that we need in the House, a compromise position on the SALT issue.”

How SALT Changes Impact Business Owners

For business owners, these proposed changes bring varied outcomes depending on their business structure. The House bill keeps full SALT deductibility for C corporations but introduces new restrictions for certain pass-through entities.

Pass-through entities, such as partnerships and S-corporations, face the most significant adjustments. Starting in 2026, federal income tax will apply to Pass-Through Entity Taxes (PTETs) paid by partners and shareholders. Additionally, SALT deductions for income taxes on partnerships and S-corporations will be limited if they exceed the individual SALT cap when allocated to partners and shareholders.

Not all sectors are equally affected. Commercial real estate businesses, along with retail, wholesale trade, and restaurants, can still deduct taxes paid by their pass-through entities. However, industries like finance, legal services, healthcare, and performing arts face stricter limitations.

The financial implications of these changes are substantial. According to the Tax Foundation, the business-related SALT adjustments in the House bill could generate $73 billion in revenue from 2025 to 2034, while changes to individual and family SALT deductions would cost about $350 billion over the same period.

In high-tax areas such as New York City, the impact is particularly pronounced. Taxable PTET payments, combined with local taxes, could add an estimated $2.7 billion to federal tax liabilities for high-income earners, effectively increasing their federal tax rate by 2.5%. NYC Comptroller Brad Lander expressed concern, stating:

“By disallowing the deduction of the vast majority of NY State and City’s PTETs and of the City’s GCT and UBT payments, the bill puts the NYC’s economy and businesses at a competitive disadvantage and threatens the local tax base.”

The Importance of Tax Planning

For commercial property owners, these proposed changes underscore the need to carefully evaluate their entity structure. While C corporations maintain full SALT deductibility, pass-through entities in certain industries could face higher tax liabilities. Real estate owners, in particular, should work with tax professionals to assess whether their current structure remains effective under the proposed rules.

With legislative negotiations still ongoing, the final outcome could differ significantly from current proposals. Staying informed and planning ahead will be crucial for navigating these potential changes.

How to Maximize Your SALT Deductions

Navigating state and local tax (SALT) deductions as a commercial property owner requires a well-thought-out strategy. By understanding which taxes qualify, choosing the right business structure, and utilizing professional tools, you can significantly reduce your tax burden.

Types of Deductible Taxes for Commercial Properties

For commercial property owners, SALT deductions primarily revolve around real estate taxes. These taxes, which are levied uniformly on all real property for public welfare, represent the largest deductible expense. In 2021 alone, individual federal income tax returns included $100 billion in real estate property tax deductions.

Other deductible taxes include personal property taxes - based solely on the value of assets like equipment, machinery, or business vehicles - which accounted for $4 billion in deductions the same year. Additionally, owners can deduct either state income taxes or sales taxes, though not both. For most, state income taxes yield greater benefits, especially since business taxpayers can deduct these as a business expense without being subject to the $10,000 cap imposed on individuals.

However, not all taxes qualify for deductions. Non-deductible taxes and fees include federal income taxes, Social Security taxes, transfer taxes, homeowner's association fees, estate and inheritance taxes, and utility service charges for water, sewer, or trash collection.

To fully optimize these deductions, the choice of business structure plays a critical role.

Selecting the Best Entity Structure for SALT Benefits

The type of business entity you operate under can greatly influence how much you can deduct. Whether you’re a C corporation, a pass-through entity (like an S corporation, partnership, or LLC), or an individual owner, each structure has unique advantages and limitations.

C corporations stand out for being able to deduct SALT without any limits, making them attractive for property owners in high-tax states. On the other hand, pass-through entities (S corporations, LLCs, and partnerships) transfer income and expenses directly to the owners’ personal tax returns, where the $10,000 deduction cap applies.

This is where Pass-Through Entity Taxes (PTETs) come into play. PTETs allow business owners to pay state taxes at the entity level, bypassing the individual deduction cap. As of December 2024, 36 states and Washington, D.C. had implemented these PTET workarounds.

For instance, a sole proprietor in New York earning $300,000 who transitioned to an S corporation and elected PTET managed to fully deduct $18,721 instead of being capped at $10,000. This saved approximately $3,052 at a 35% tax rate. Beyond increasing deductions, electing PTET can also reduce your Adjusted Gross Income (AGI), offering additional tax benefits. For sole proprietors or single-member LLC owners, restructuring into an S corporation or partnership may prove worthwhile.

While entity structure is crucial, accurate compliance and record-keeping are equally important to maximize benefits.

Using Professional Tools for Accurate Compliance

Staying compliant with SALT regulations requires precision, especially as tax laws continue to evolve. Professional tools and automation technologies can simplify this process by tracking legislative changes and ensuring accurate tax calculations. This is especially critical after the South Dakota v. Wayfair decision, which mandates that businesses without a physical presence collect and remit sales taxes if they meet certain thresholds - 200 transactions or $100,000 in in-state sales.

For commercial real estate, platforms like The Fractional Analyst provide tailored solutions to help property owners navigate SALT requirements. Their services combine expert financial analysis with tools like the CoreCast intelligence system, offering custom financial models, underwriting support, and investor reporting. These resources ensure accurate record-keeping and compliance with tax laws.

Tax automation tools can also handle sales tax calculations and remittances instantly, reducing errors that could trigger audits. Regularly reviewing property assessments is another key step - if your property’s assessed value seems inflated, filing an appeal might save you money. Additionally, maintaining detailed records of all income and expenses, such as maintenance costs, utilities, and mortgage interest, ensures you capture every deductible expense.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Avoiding Common SALT Compliance Problems

Staying on top of compliance is key to maximizing SALT deductions. However, commercial property owners often encounter hurdles that lead to audits, penalties, or missed opportunities. Being proactive with tax filings can help avoid costly mistakes and unnecessary headaches.

Frequent Mistakes in SALT Deduction Filings

One of the most common pitfalls is missing important deadlines or misreporting property classifications. Many property owners lack an organized, year-round tax strategy, instead scrambling to gather data at the last minute. This rush often results in missed deductions and errors in filings.

Pass-through entity (PTE) elections can also be tricky. Mistakes often arise with eligibility requirements, improper credit usage, or misallocating taxes between entity and individual filings.

Other common errors include misclassifying expenses or mixing personal and business accounts. For example, failing to differentiate between capital expenditures and routine repairs can shift deductions to the wrong tax year. Similarly, blending business and personal finances makes record-keeping more complicated and increases the risk of audit exposure.

Record Keeping and Audit Preparation Tips

Avoiding these issues starts with maintaining well-organized records. Your system should clearly outline all income and expenses.

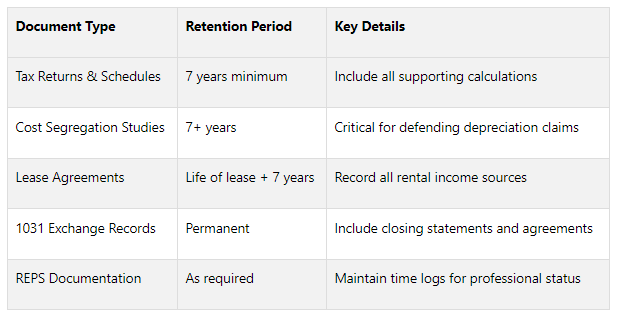

Key documents to keep on hand include purchase agreements, lease contracts, tax returns, receipts, and financial statements. For commercial properties, specific records like cost segregation studies and depreciation schedules are crucial. These documents should be retained for at least seven years, as they’re often needed to justify depreciation claims or address tax assessments.

Accuracy in income reporting is equally important. Cross-check 1099-MISC or 1099-NEC forms from tenants against your own records to avoid discrepancies that could trigger IRS scrutiny.

Additionally, be clear when documenting repairs versus capital improvements. Repairs that restore a property to its original condition are usually deductible, while improvements that increase value or extend a property’s life must be depreciated. Keep invoices and contractor statements that specify the nature of the work.

For 1031 exchanges, ensure a detailed paper trail. This includes closing statements, Qualified Intermediary agreements, and reinvestment records to avoid disqualification and unexpected tax liabilities.

Claims for Real Estate Professional Status (REPS) require thorough documentation of active participation in property management. Vague or incomplete records may not meet IRS standards for offsetting other income.

“You can choose any recordkeeping system suited to your business that clearly shows your income and expenses.”

Consistency is key. Whether using spreadsheets, accounting software, or specialized platforms, maintaining detailed records throughout the year can prevent a last-minute scramble during tax season.

Technology Solutions for Better Compliance Management

Modern technology can simplify compliance and reduce errors. Automation tools and real-time monitoring keep you updated on changing tax laws across jurisdictions, minimizing missed opportunities or mistakes.

AI-powered platforms can analyze tax data, flag potential issues, and identify areas for optimization. For example, the Fractional Analyst's CoreCast platform is designed to tackle commercial real estate compliance. It combines financial analysis with automation, helping property owners track requirements, maintain accurate records, and stay informed on tax law updates across multiple locations.

Automated record-keeping systems can also integrate with banking and accounting platforms. These systems categorize expenses automatically and flag items needing additional documentation, making it easier to stay organized year-round and avoid the year-end rush.

For those managing multiple entities or navigating PTE elections, compliance platforms can model different scenarios and track deadlines across various states. This is especially helpful when dealing with states that have differing PTE rules, credit types, or filing requirements.

Getting the Most from Your SALT Deductions

To make the most of your SALT deductions, you need a combination of strategic planning, smart structuring, and staying on top of compliance. Tax strategies should evolve with changing regulations to ensure consistent, long-term benefits. Let’s dive into key deduction types and timing strategies to help you get ahead.

Take advantage of every deduction available to you, including depreciation through cost segregation, repairs, mortgage interest, Section 179 expensing, and energy efficiency credits. These can significantly reduce your tax liability.

“Maximizing deductions requires strategic planning to enhance returns.”

One powerful tool is the use of PTE (pass-through entity) elections, which allow state taxes to be paid at the entity level. This helps bypass the $10,000 SALT cap imposed on individual taxpayers. Since the Tax Cuts and Jobs Act, many states have adopted PTE workarounds, enabling property owners to lower their federal taxable income while still claiming full state tax deductions.

Timing matters. Strategies like bunching payments - prepaying property taxes or grouping other deductible expenses into one tax year - can help maximize deductions. This works especially well when alternating between standard and itemized deductions in different years. Combining this approach with PTE benefits and other deductions can lead to greater overall tax efficiency.

Platforms like The Fractional Analyst's CoreCast simplify the process by automating record-keeping, tracking deadlines, and modeling tax scenarios. These tools help you stay ahead of regulatory changes and ensure you’re maximizing your deductions effectively.

It’s also crucial to stay informed about legislative changes. For instance, the current SALT cap is set to expire after 2025. According to the Joint Committee on Taxation, federal revenue losses from SALT deductions are expected to skyrocket from $23 billion in fiscal year 2025 to $197 billion in fiscal year 2027 after the cap's expiration. This shift will likely present new opportunities for tax planning, but it will also come with its own set of compliance challenges.

“Work closely with a tax professional who specializes in commercial real estate to adapt your strategies as new legislation is enacted.”

The most successful commercial property owners don’t rely on a single strategy. They combine multiple approaches: structuring their entities to maximize PTE benefits, keeping detailed records year-round, and regularly reviewing their plans with experienced professionals. They recognize that SALT optimization isn’t a one-and-done task - it’s an ongoing process. Regular reviews ensure they stay aligned with new tax laws, property acquisitions, and business growth, avoiding missed opportunities or compliance issues.

With increasing audit scrutiny and ever-changing state tax laws, having the right tools and expert guidance is no longer optional - it’s essential. By integrating these strategies with consistent record-keeping and compliance practices, you can protect your commercial real estate investments and maximize long-term returns.

FAQs

-

Commercial property owners have a smart option to work around the $10,000 cap on state and local tax (SALT) deductions: Pass-Through Entity Taxes (PTETs). By choosing to pay taxes at the entity level instead of as individuals, these taxes become fully deductible on federal income tax returns, effectively sidestepping the SALT cap.

This approach is especially helpful while the SALT cap is still in place. Even though there’s talk of raising the cap in the future, PTETs remain a practical and legal method for commercial property owners to ease their tax burdens for now.

-

If the SALT deduction cap increases to $40,000 under the One Big Beautiful Bill Act, commercial property owners could stand to gain in a big way. With a higher cap, they’d be able to deduct a larger chunk of their state and local taxes, which could help reduce their overall tax bills. This adjustment might also simplify tax planning and make investing in commercial real estate more appealing, especially for properties with hefty tax liabilities.

That said, a higher deduction limit could also attract more attention from tax authorities. Property owners would need to be extra diligent with their records and ensure they’re fully compliant with tax laws. While the higher cap offers more breathing room financially, staying up-to-date on any related tax rule changes is crucial to make the most of the benefits and steer clear of any potential pitfalls.

-

Your choice of business entity plays a major role in how well you can take advantage of state and local tax (SALT) deductions for commercial properties. Entities like LLCs and S-corporations often have an edge here. Why? They can opt to pay state taxes at the entity level using pass-through entity (PTE) taxes. This method can help them sidestep the $10,000 SALT deduction cap, potentially offering considerable tax savings.

The way transactions are structured also matters. For example, structuring deals as asset sales can allow pass-through entities to make better use of PTE taxes, opening up additional SALT deduction opportunities. Picking the right entity type and aligning it with a smart transaction strategy is key to maximizing deductions while staying within the bounds of tax regulations.