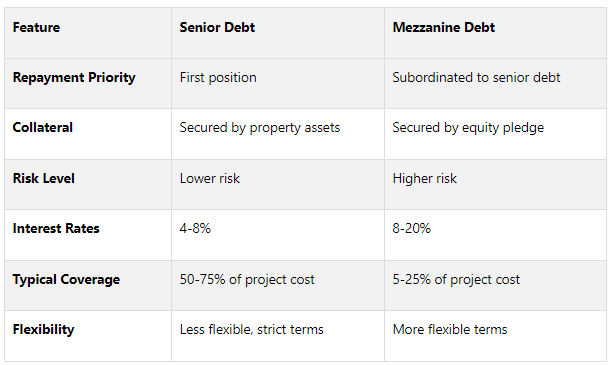

Senior Debt vs. Mezzanine Debt: Key Differences

Looking to finance a commercial real estate project? Here's what you need to know:

Senior Debt: Lower risk, lower interest rates (typically 4-8%), secured by property assets, and takes first priority in repayment. Covers 50-75% of project costs.

Mezzanine Debt: Higher risk, higher interest rates (8-20%), secured by equity in the property-owning entity, and ranks below senior debt in repayment. Fills 5-25% of funding gaps.

Key Takeaway: Senior debt is ideal for stable, lower-risk projects. Mezzanine debt offers flexibility for higher-risk ventures but comes at a higher cost. Both can complement each other in the capital stack to balance risk and funding needs.

Quick Comparison

Understanding these differences helps you choose the right financing for your project based on risk, cost, and funding requirements.

How Equity, Senior Debt & Mezzanine Loans Work in a Commercial Real Estate Investment

Senior Debt in Commercial Real Estate

Senior debt forms the backbone of commercial real estate (CRE) financing, offering the highest repayment priority and a comparatively lower risk. Its "senior" status reflects its privileged position in the capital stack and its role as a more secure funding source.

Position in the Capital Stack

In the repayment hierarchy, senior debt takes precedence. It ensures that lenders are paid before mezzanine lenders, preferred equity investors, or common equity holders in cases of financial distress or liquidation.

“Senior debt is money provided by a lender in return for a first position mortgage on the collateral property. It is considered ‘senior’ because the lender is first in line to be repaid at all times.”

This first-position lien acts as a safety net, increasing the chances of recovering investments even if a CRE project underperforms. Payments on senior debt are prioritized above distributions to other stakeholders in the capital stack, ensuring consistent debt servicing regardless of market volatility. These structural safeguards set the foundation for senior debt's defining features.

Main Characteristics

Senior debt is secured by a first-position lien on the property and comes with strict covenants designed to protect the lender. Interest rates for senior debt typically range from 4% to 8%, and lenders focus on the tangible collateral rather than solely relying on the borrower's credit profile.

The inclusion of strict loan covenants adds another layer of protection. These covenants often require borrowers to meet specific financial benchmarks, such as maintaining a minimum debt service coverage ratio, adhering to maximum loan-to-value (LTV) thresholds, and holding sufficient liquidity reserves. Such measures allow lenders to monitor the borrower's financial health and intervene if necessary.

“Senior debt is the cornerstone of the capital stack in real estate investment, representing the most secure and lowest-risk form of financing.”

Loan-to-value ratios for senior debt generally fall between 60% and 80%, providing a substantial equity buffer. This ensures that borrowers remain financially committed to the project while offering lenders additional security. These characteristics explain why senior debt is a preferred funding source across various CRE transactions.

Typical Uses in CRE Projects

Senior debt plays a pivotal role in financing acquisitions, refinancing, and transitioning from construction loans to permanent financing. It is especially suited for long-term hold strategies and is commonly used to finance properties such as office buildings, retail centers, industrial facilities, and multifamily housing.

In development projects, senior debt is typically introduced during the later stages, once construction risks have diminished. Upon project completion and stabilization, permanent senior debt often replaces construction loans, providing long-term funding at favorable rates.

This stability makes senior debt particularly attractive to institutional investors like insurance companies, pension funds, and conservative real estate investment trusts. By anchoring the capital stack with low-cost financing, senior debt allows investors to manage portfolio risk effectively while allocating resources to higher-risk, higher-return opportunities.

Mezzanine Debt in Commercial Real Estate

Mezzanine debt bridges the gap between traditional debt and equity financing. It’s a more expensive option but can be a lifeline when senior debt falls short of covering the full funding needs of a commercial real estate project.

Position in the Capital Stack

In the capital stack, mezzanine debt sits between senior debt and equity. This means mezzanine lenders are paid after senior debt holders but before equity investors see any returns. Its risk and return fall somewhere between the low-risk, lower-return senior debt and the high-risk, higher-return equity. This repayment hierarchy becomes crucial during financial troubles or liquidation.

Typically, senior debt accounts for 60–75% of a project’s financing, while mezzanine debt fills in 5–25% of the gap.

Main Characteristics

Mezzanine debt comes with higher interest rates, often ranging from 10% to 20%.

“Mezzanine debt in this context serves as a subordinate loan, positioned between the senior mortgage debt and the sponsor’s equity in the capital stack. Unlike senior debt, which is secured by the real property itself, mezzanine debt is secured by an interest in the entity that owns the real property.”

Lenders secure their position with equity pledges in the property-owning entity and may include conversion rights. These rights often allow lenders to convert their debt into equity if certain conditions arise, such as a default. This structure can significantly enhance returns, with annual returns ranging from 12% to 30%.

Loan terms are typically short, running from 1 to 5 years, and often feature interest-only payments followed by a large balloon repayment. These characteristics make mezzanine debt a flexible tool for projects that need additional leverage.

Structure Types and Applications

Mezzanine debt is particularly useful in value-add projects or opportunistic investments where extra leverage is needed. For example, combining mezzanine debt with senior debt can increase total leverage from around 70% to as much as 90%.

This type of financing is often used for property expansions, renovations, and acquisitions, allowing borrowers to minimize their equity contributions while retaining control of the asset. Development projects, which carry higher risks during construction and lease-up phases, generally see higher mezzanine rates - between 10% and 13% - compared to 8% to 12% for stabilized properties.

In response to growing demand for flexible financing, some institutional lenders like Freddie Mac have introduced mezzanine financing products. These programs have made mezzanine debt more accessible and standardized for qualified borrowers.

Mezzanine debt also offers flexibility in its structuring. Depending on the borrower’s needs, it can be designed as either debt or equity. However, this flexibility often comes with lender-friendly covenants and restrictive terms, which borrowers must weigh against the benefit of reduced equity requirements.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

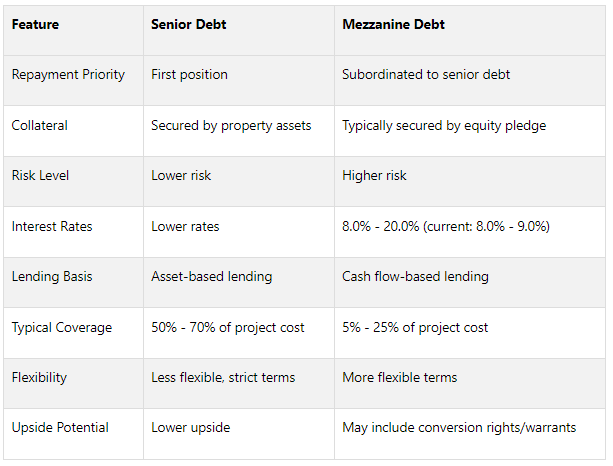

Senior Debt vs. Mezzanine Debt Comparison

Senior debt and mezzanine debt occupy distinct positions in the capital stack, each with its own risk profile, terms, and costs. Understanding these differences helps clarify how they impact financing structures and overall project funding.

Risk, Repayment Order, and Collateral Differences

Senior debt takes precedence in repayment, holding the first claim on both assets and earnings. Mezzanine debt, on the other hand, is subordinate, meaning it ranks lower in repayment priority during financial distress, such as bankruptcy or liquidation. This subordinated position increases the risk for mezzanine lenders, which is why they typically demand higher returns.

Senior debt is secured by property assets, giving lenders the right to foreclose if the borrower fails to meet obligations.

“Banks lend off of asset values so most senior loans are collateralized with assets. The bank loan is always secured and in the first position.”

In contrast, mezzanine debt is often unsecured, though it may include partial guarantees or equity stakes as a fallback in case of default. When security is involved, it usually comes in the form of an equity pledge in the entity owning the property, rather than a direct claim on the real estate itself.

The lending approach also differs: senior debt relies on asset-based lending, while mezzanine debt is more focused on cash flow-based lending. Mezzanine lenders often negotiate for additional protections, such as partial guarantees or equity positions, to offset their higher risk.

Interest Rates and Capital Costs

The differences in risk and repayment structure directly influence interest rates and overall capital costs. Senior debt typically has lower interest rates, reflecting its lower risk profile and secured nature. With first-position repayment priority, lenders are able to provide more competitive terms.

Mezzanine debt, however, commands higher interest rates to account for its elevated risk. As of June 2025, mezzanine loan interest rates range from 8.0% to 9.0%, though rates can vary significantly - anywhere from 10% to 20% annually - depending on the specifics of the deal. This can make mezzanine rates two to three times higher than traditional bank loans.

The type of project also influences mezzanine pricing. For example, development projects, which are inherently riskier, often see rates between 10% and 13%. Stabilized properties, with their more predictable cash flows, might attract rates closer to 8% to 12%. Senior debt, typically provided by banks or institutional lenders, usually covers 50% to 70% of a project's total cost. Borrowers often turn to mezzanine financing to bridge the gap, despite its higher cost, as it allows for greater leverage.

Side-by-Side Comparison Table

This comparison highlights the distinct roles senior and mezzanine debt play in financing. Senior debt is the more secure and primary funding source, while mezzanine debt offers flexibility and the potential for higher returns - but at a greater cost and risk. These factors are critical when planning your capital stack and choosing the right financing structure for your project.

Choosing the Right Debt Structure

Selecting the right type of debt is critical - it directly influences your project's funding, long-term returns, and even your exit strategy. The choice should align with your project’s needs, risk profile, and overall financial goals.

Capital Stack Planning Factors

The type of project and its associated risks are key when deciding on a debt structure. Senior debt is ideal for stable properties with reliable cash flow, as these income streams can support consistent debt payments. Examples include fully leased office buildings, well-established retail centers, or multifamily properties with high occupancy rates.

On the other hand, mezzanine financing is better suited for projects needing additional flexibility, such as value-add opportunities or acquisitions that exceed the limits of senior lending. Development projects, major renovations, or properties requiring significant upgrades often benefit from mezzanine debt, which offers higher loan-to-value ratios and greater adaptability.

Leverage requirements are another important consideration. Mezzanine debt allows borrowers to minimize equity contributions while pursuing ambitious business plans. This can be particularly advantageous for projects with higher potential returns, though it comes with increased repayment risk.

Your risk tolerance and return goals should also guide your decision. Senior debt typically offers lower interest rates and greater predictability, while mezzanine debt comes with higher returns but demands a higher risk appetite. For shorter-term projects, senior debt’s simplicity often makes it the better choice. However, for long-term holds or properties with planned improvements, mezzanine debt can provide the necessary funding to achieve your vision.

Additionally, market conditions and borrower experience significantly influence financing terms. Borrowers with proven track records often secure better access to both senior and mezzanine options. The strength of the property and the local market also play a role in shaping the terms and availability of financing.

To make these decisions effectively, it’s essential to rely on precise financial analysis and data-driven insights.

How Financial Analysis Tools Help

Accurate financial modeling is indispensable when evaluating debt structures. Platforms like the Fractional Analyst's CoreCast provide tools to analyze capital stack dynamics and compare financing scenarios, helping you determine the best approach for your project.

For example, debt service coverage ratio (DSCR) analysis can reveal whether a property’s income is sufficient to support different debt levels. CoreCast allows you to model various combinations of senior and mezzanine debt, helping identify the optimal leverage point while maintaining healthy coverage ratios.

Cash flow modeling is equally important, particularly for mezzanine debt, which often involves flexible payment terms. In some cases, mezzanine lenders may accept equity participation instead of cash interest payments. While this can improve cash flow during the holding period, it may impact overall returns.

CoreCast’s scenario analysis tools let you simulate different market conditions to see how they might affect your chosen debt structure. This is especially important given the higher cost of mezzanine debt, which can weigh on returns if cash flows fall short of expectations.

The platform also offers custom underwriting capabilities to evaluate the total cost of capital across various debt combinations. While mezzanine debt might come with rates between 12% and 20%, compared to 4% to 6% for senior debt, the ability to use less equity can still lead to higher overall returns.

Lastly, CoreCast includes risk assessment tools to help quantify the impact of subordinated debt on your capital stack. This ensures you maintain the flexibility needed for future financing opportunities.

With the added support of the Fractional Analyst’s team of financial experts, you gain access to tailored advice and advanced modeling tools. This combination ensures your debt structure aligns perfectly with your project’s needs, helping you balance risk and maximize returns effectively.

Conclusion

Grasping the distinctions between senior and mezzanine debt is crucial for making informed commercial real estate (CRE) financing decisions.

Senior debt typically offers lower interest rates and takes priority in repayment, covering up to 60–75% of the total capital structure in multifamily projects. On the other hand, mezzanine debt fills the funding gap when senior debt falls short, albeit at higher borrowing costs. Each serves a distinct purpose: senior debt is ideal for stabilized asset acquisitions, while mezzanine debt is better suited for value-add projects that require extra funding for improvements or expansions.

Despite its higher cost, mezzanine debt can be a smart choice when it enables larger acquisitions or preserves cash for property upgrades. Tools like CoreCast can assist in financial modeling, helping investors understand how different debt structures influence overall returns and the total cost of capital.

Rather than viewing senior and mezzanine debt as competing options, successful investors see them as complementary elements of a well-rounded financing strategy. By analyzing your property’s fundamentals, cash flow forecasts, and long-term growth plans, you can create a capital stack that balances risk and reward. The right mix of debt types can support both immediate performance and future goals, ensuring a solid foundation for financial success in CRE.

Strategic planning and thorough financial analysis are key to leveraging senior and mezzanine debt effectively, helping you build capital structures that align with your investment objectives and drive sustainable growth.

FAQs

-

When deciding between senior debt and mezzanine debt for your commercial real estate project, you’ll need to weigh factors like risk, repayment order, and overall cost.

Senior debt is often the safer choice. It comes with lower interest rates, is secured by the property, and gets repaid first in the event of default. However, this lower risk comes with stricter terms, which can limit your flexibility in managing the project.

Mezzanine debt, on the other hand, sits behind senior debt in repayment priority, meaning it’s considered riskier. It’s usually unsecured and comes with higher interest rates. That said, it’s a good option if you need additional funding beyond what senior debt can cover.

Ultimately, the right choice depends on your project’s cash flow, how much financing you need, and how comfortable you are with taking on risk.

-

Mezzanine debt plays a crucial role in financing high-risk commercial real estate projects, acting as a middle ground between senior debt and equity. It carries more risk than senior debt but less than equity, making it an appealing choice for investors looking for moderate risk with the potential for higher returns.

For developers, mezzanine financing is a practical way to bridge funding gaps while keeping more equity in the project. However, it comes with a higher cost and ranks below senior debt but above equity in repayment priority. This means developers need to carefully weigh its impact on the project's overall risk and expected returns. When used strategically, mezzanine debt can provide added flexibility and help structure a more efficient capital stack for complex or riskier ventures.

-

Combining senior debt with mezzanine debt can be an effective way to finance commercial real estate projects that need substantial funding. Senior debt typically serves as the primary, lower-cost financing option, while mezzanine debt bridges the gap between senior debt and equity, allowing property owners to raise additional capital without giving up ownership stakes.

This financing structure is especially beneficial for projects with significant capital demands, like large-scale developments or major renovations. Although mezzanine debt comes with higher interest rates due to its subordinate position to senior debt, it offers flexibility and access to funds that senior debt alone might not cover. By using this approach, property owners can strike a balance between risk and return, creating a more efficient financial setup for their projects.