Top 7 DCF Applications in CRE Investment Analysis

Discounted Cash Flow (DCF) analysis is a financial modeling method that helps commercial real estate (CRE) investors evaluate the present value of future cash flows. It’s a powerful tool for making informed decisions across various aspects of CRE investment. Here’s a quick overview of its top applications:

Acquisition Analysis: Determine a property’s long-term income potential, calculate maximum purchase price, compare investment opportunities, and stress-test scenarios.

Sale and Exit Timing: Evaluate whether to hold or sell a property by analyzing opportunity costs, market conditions, and terminal value.

Loan Refinancing: Assess refinancing options by comparing cash flows under existing and new loan terms to optimize returns.

Portfolio Management: Compare risk-adjusted returns, identify underperforming assets, and guide portfolio rebalancing strategies.

Lease Negotiations: Analyze lease terms, rent escalations, and tenant improvement allowances to maximize cash flow.

Development Planning: Model construction costs, timelines, and future income to evaluate project feasibility and secure financing.

Investment Reporting: Use DCF metrics like IRR and NPV to communicate performance, support loan applications, and guide decisions.

DCF stands out for its ability to project long-term cash flows and incorporate risk, making it indispensable for CRE professionals managing complex investments or fluctuating market conditions.

Discounted Cash Flow Analysis (DCF) in Real Estate Explained

1. Property Acquisition Analysis

In commercial real estate investing, deciding which property to acquire is a big deal, and Discounted Cash Flow (DCF) modeling often serves as the backbone of these decisions. Instead of just looking at the current market conditions, a solid DCF model helps investors estimate a property's long-term income potential by projecting future cash flows throughout the holding period.

A DCF model breaks down key factors like projected rental income (based on lease agreements, market rents, and occupancy rates), operating expenses (including property taxes, insurance, utilities, and management fees, adjusted for inflation), and capital expenditures (such as repairs, upgrades, and leasing costs). These elements come together to give a clear picture of the property's financial future.

Determining Maximum Purchase Price

One of the most practical uses of DCF modeling is figuring out the maximum amount an investor should pay for a property to hit a target equity internal rate of return (IRR). For instance, in one scenario aiming for a 15% equity IRR, the maximum purchase price was calculated to be $1,029,760. With 70% loan-to-value financing, this breaks down to a loan of $720,832 and an equity investment of $308,928.

Comparing Investment Opportunities

DCF analysis also makes it easier to compare different types of properties and strategies. Take this example: an apartment building and a hotel both generate $100 in annual income. Because of their differing risk levels, they end up with different valuations. Using a 7.50% discount rate, the apartment building might be valued at $1,333.33, while the hotel, with an 11.00% discount rate, could be valued at about $909.09. This highlights how risk and complexity impact valuations.

Stress-Testing and Scenario Analysis

Another critical feature of DCF modeling is stress-testing. Investors examine various scenarios - base, optimistic, and pessimistic - while tweaking variables like exit cap rates, vacancy rates, rental growth, and inflation. This process helps investors understand a range of possible outcomes and choose properties that align with their risk tolerance.

Accurate assumptions, backed by strong market research, are essential. For example, discount rates typically fall between 5% and 13%. However, chasing a higher IRR may not always justify taking on significantly more risk.

At The Fractional Analyst, we specialize in advanced DCF modeling to guide investors through acquisition decisions. By blending precise financial analysis with the latest market data, we aim to provide actionable insights that help investors make confident choices in today’s competitive real estate market. Up next, we’ll dive into how DCF analysis plays a role in determining the best timing for property sales and exits.

2. Property Sale and Exit Timing

The timing of selling a commercial property can significantly influence the overall investment outcome. Discounted cash flow (DCF) analysis helps compare the immediate proceeds from a sale to the potential long-term benefits of holding the property.

One of the most critical considerations here is the opportunity cost. When you hold onto a property, your capital remains tied up. DCF modeling helps evaluate this trade-off by projecting future cash flows and comparing them to the property's current market value. This approach provides a structured way to decide whether to hold or sell.

The Hold vs. Sell Framework

To determine the best course of action, asset managers often model two scenarios. The first considers an alternative investment opportunity, measured by metrics like internal rate of return (IRR) and equity multiple. The second evaluates the current property, factoring in its market value after accounting for selling costs.

Real-World Application

Take Bayview Capital Group as an example. They analyzed Skyline Office Center, a 150,000-square-foot office building purchased for $45 million. Their DCF analysis showed that holding the property would yield an IRR of 9.5%, while selling it and reallocating the capital could achieve a higher IRR of 14.0%. Based on this data, the asset manager recommended selling the property and reinvesting in a Dallas industrial project.

Key Variables in Exit Timing

Several factors play a role in determining the optimal time to sell:

Terminal value: This can account for 60–80% of a property's total value in a DCF analysis, making assumptions about the exit cap rate particularly important.

Market conditions: Trends in the broader market can heavily influence the decision.

Tenant lease expirations: The timing of lease renewals or terminations can impact cash flow projections.

Capital expenditure needs: Anticipated costs for maintenance or upgrades can affect profitability.

DCF analysis is especially helpful when cash flows are subject to change, such as during major renovations, lease-up periods, or market shifts. It provides a long-term view, typically covering a holding period of 5–15 years in commercial real estate.

Stress-Testing Exit Scenarios

Experienced investors often stress-test variables like exit cap rates, vacancy rates, rental growth, and inflation. This process helps assess how sensitive the hold-versus-sell decision is to changes in market conditions and highlights the range of possible outcomes.

While quantitative data is the backbone of these decisions, qualitative factors also matter. These include tenant credit quality, market trends, and how well the property fits within a broader portfolio strategy. The DCF framework helps integrate these considerations, making decisions more informed and defensible.

At The Fractional Analyst, our advanced DCF modeling tools are designed to guide precise exit timing decisions, aligning seamlessly with our broader focus on thorough investment analysis.

3. Loan Refinancing Decisions

After analyzing the timing for exit strategies, refinancing becomes another crucial way to optimize investment cash flows using DCF (Discounted Cash Flow) modeling. Refinancing decisions can directly influence the profitability of an investment. DCF modeling offers a structured approach to determine whether replacing current debt with new loan terms will improve returns. The process involves comparing the net present value (NPV) of cash flows under your existing loan against those under potential new financing options.

The Refinancing Analysis Framework

To evaluate refinancing, DCF analysis typically involves projecting your property's net operating income (NOI) over a set period - often 10 years - while modeling different debt scenarios. This requires factoring in both the terms of your current loan and the conditions of potential new financing to assess their respective impacts on cash flows and terminal value.

The goal is to calculate and compare the NPVs of the current and new loan scenarios. If the new financing yields a higher NPV, it signals that refinancing could add value to your investment. This approach extends DCF modeling from acquisition decisions to financing strategies. As Harvard Business School Professor Suraj Srinivasan explains:

"A DCF analysis is useful when investing money now and expecting some rewards in the future. A DCF analysis finds the intrinsic value of a business, which is the present value of the free cash flow the company is expected to pay its shareholders in the future. If the intrinsic value is higher than the current price, it could be a good investment opportunity." – Suraj Srinivasan, Harvard Business School Professor

Real-World Impact on Returns

Refinancing can have a significant financial impact, especially in high-leverage situations. For example, consider an investor who purchased a $10 million property with $600,000 in NOI during Year 1, financed with 70% leverage ($7 million in debt). By Year 3, the NOI increased to $650,000, valuing the property at $10.8 million with a 6% cap rate. Refinancing at a 70% loan-to-value ratio would generate $7.6 million in new debt, providing equity investors with an additional $600,000 in cash.

"Refinancing boosts returns for the equity investors by reducing the interest expense." - Breaking Into Wall Street

Key Variables in DCF Refinancing Analysis

Several factors play a pivotal role in refinancing decisions when using DCF modeling:

Interest Rates: Changes in interest rates have an immediate impact on cash flows. For instance, refinancing a $1 million loan from 8% to 5% can save $30,000 annually.

Loan Term Extensions: Extending the loan term reduces monthly payments, improving cash flow even if the interest rate remains unchanged.

Cash-Out Refinancing: This option allows investors to pull equity from the property while retaining ownership, providing capital for additional investments or property upgrades.

Measuring the Financial Impact

The financial benefits of refinancing can be quantifiable. For instance, one investment achieved a 5-year internal rate of return (IRR) of 17.9% without refinancing. With refinancing, the IRR rose to 19.1%. While the 1.2 percentage point increase may seem small, on larger deals, this improvement can translate into hundreds of thousands of dollars in additional returns.

Lower interest rates achieved through refinancing often lead to a noticeable boost in cash flow, which is particularly valuable in high-leverage commercial property deals where debt ratios range from 50% to 70%.

Strategic Timing Considerations

DCF modeling is also instrumental in identifying the best time to refinance by considering market cycles and property performance trends. Ed Ely, President and Head of Commercial Term Lending, highlights the benefits:

"Refinancing can be enormously helpful in increasing cashflow, enhancing portfolio growth and take advantage of commercial real estate's cyclical nature." – Ed Ely, President and Head of Commercial Term Lending

Incorporating sensitivity analysis into your DCF model is crucial. This allows you to evaluate how changes in interest rates, property values, or rental income affect the refinancing decision. By identifying break-even points and assessing the risk-reward profile of different financing options, you can make more informed decisions.

At The Fractional Analyst, we use DCF models to help investors choose debt structures that maximize long-term returns and improve cash flow efficiency.

4. Real Estate Portfolio Management

Overseeing multiple commercial properties demands a structured approach to maximize returns. Discounted Cash Flow (DCF) analysis plays a central role here, offering a consistent method to evaluate property performance and potential. Beyond comparing risk-adjusted returns, DCF analysis helps pinpoint underperforming assets and informs decisions about rebalancing portfolios.

Comparing Risk-Adjusted Returns Across Properties

DCF modeling simplifies the comparison of various real estate investments by converting future cash flows into present values, considering both the time value of money and associated risks. To assess risk-adjusted returns, calculate metrics like Net Present Value (NPV) and Internal Rate of Return (IRR).

The discount rate is a critical factor in this process, as it reflects the risk level of each property. Higher-risk investments require higher discount rates, which reduce the present value of their future cash flows. For example, real estate equity investors typically expect annualized returns between 7% and 20%, with lower-risk properties at the lower end of this range and higher-risk ones at the upper end.

"The discount rate is simply the required return one would need to achieve for the level of risk assumed, so it's important to understand that lower discount rates are applied to investments with lower risk characteristics and higher discount rates are applied to projects that exhibit higher risk characteristics." – Dave Welk, Managing Director of Acquisitions

Both asset-specific and strategy-level risks influence the choice of discount rates. For instance, hotels often carry more risk than apartment buildings due to higher operating leverage and shorter lease durations. Similarly, a ground-up construction project is riskier than a value-add renovation of an existing property.

Identifying Underperforming Assets

DCF-derived intrinsic values are a powerful tool for spotting underperformance. By comparing a property's intrinsic value - based on its cash flow potential - to its current market value, portfolio managers can identify red flags. Common indicators include declining Net Operating Income (NOI), lagging cap rates compared to similar properties, and weak Debt-Service Coverage Ratios (DSCR).

"DCF reveals your company's true value based on its ability to generate cash in the future." - Jack Nicholaisen, Founder, Businessinitiative.org

The process involves forecasting unlevered free cash flows, calculating terminal value, and discounting cash flows using the Weighted Average Cost of Capital (WACC). Warning signs such as falling rental income, extended vacancies, and rising operating expenses often indicate deeper issues. However, it’s vital to distinguish between short-term challenges and long-term declines to determine the right course of action.

Strategic Portfolio Rebalancing

Once underperforming properties are identified, DCF analysis helps guide decisions on whether to hold, improve, or sell those assets. This involves running scenarios - such as base case, optimistic, and pessimistic - and conducting sensitivity analyses on key variables like exit cap rates, vacancy levels, rental growth, and inflation.

Diversification plays a crucial role in portfolio optimization. Geographic diversification spreads risks tied to specific markets, while property type diversification reduces exposure to sector-specific challenges. Additionally, a diverse tenant mix (based on credit quality and business type) and staggered lease maturities can help minimize operational risks.

"Risk-adjusted returns are a way of evaluating the performance of an investment by considering the level of risk that was taken to generate those returns." - Brandon Jenkins

The institutional investment community has long recognized the advantages of real estate in portfolio strategies. Between 2001 and 2020, institutional real estate allocations doubled from 4.4% to 8.8%. The 2024 Real Estate Allocations Monitor, which surveyed 186 institutions managing approximately $1.4 trillion in real estate assets, reported steady target allocations at 10.8% for the second year in a row.

Practical Implementation

DCF analysis is especially effective for properties with fluctuating cash flows, such as those undergoing renovations, lease-ups, or repositioning. Regular audits of financial records, tenant feedback, and property conditions can uncover the root causes of underperformance. Monitoring key financial and operational metrics allows portfolio managers to address issues early, before they escalate.

For sustained success in commercial real estate, portfolio managers must integrate DCF analysis into regular evaluations and decision-making. At The Fractional Analyst, we specialize in helping portfolio managers apply DCF modeling across their holdings. By combining detailed financial analysis with actionable market insights, we provide a framework to optimize capital allocation and make informed strategic decisions.

5. Lease Terms and Tenant Negotiations

Lease negotiations play a key role in commercial real estate, and this is where DCF (Discounted Cash Flow) modeling proves invaluable. When comparing multiple lease proposals - each with different rent structures, escalation clauses, or tenant improvement allowances - DCF analysis simplifies the process by translating all future cash flows into present value. This makes it easier to make direct comparisons between lease terms. Let’s explore how DCF modeling helps evaluate key variations in lease structures.

Evaluating Lease Structure Variations

DCF modeling provides a clear way to assess how different lease structures impact cash flows. Gross leases, for example, often come with higher base rents but also expose landlords to the uncertainty of operating expenses. On the other hand, triple-net leases shift those expenses to tenants, typically resulting in lower base rents. By forecasting and comparing net cash flows, DCF modeling reveals the long-term income potential of each lease structure.

Analyzing Rent Escalations and Improvement Allowances

Rent escalation clauses can significantly alter cash flow over the life of a lease. For instance, a lease with a steady 3% annual increase will produce a different financial profile compared to one with flat rent followed by step-up increases. DCF modeling captures these differences by projecting cash flows year by year.

Tenant improvement allowances also play a big part in lease valuations. These allowances, which often range from $10 to $20 per square foot for basic upgrades, directly influence net present value calculations. By factoring in the time value of money, DCF models provide a precise way to evaluate these lease terms.

Comparing Multiple Negotiation Scenarios and Quantifying Cash Flow Risks

DCF analysis shines when comparing multiple lease proposals, especially those with complex terms like free rent periods, renewal options, or tenant improvement incentives. By calculating the present value of each proposal, landlords can objectively evaluate long-term profitability while identifying potential cash flow risks. For example, tenant rollover risk is far greater in a five-year lease with no renewal options compared to a ten-year lease with multiple extensions.

As Brian Mascis, Chief Operating Officer at Rockport VAL, explains:

"DCFs allow users to highlight and quantify short- and long-term cash flow risks such as tenant rollover and consider those factors either pre or post investment". – Brian Mascis, Chief Operating Officer at Rockport VAL

Additionally, DCF models can account for vacancy periods between leases, factoring in lost rent and ongoing expenses during tenant transitions. These insights help landlords weigh the risks and rewards of different lease agreements.

Practical Implementation Strategies

To ensure accurate lease analysis, landlords must integrate data from various sources. Information such as market rental rates, typical vacancy periods, and standard tenant improvement costs helps refine the model's assumptions. A bottom-up approach, which considers the unique characteristics of each tenant, is critical. As Shiv Sha, Finance Manager, advises:

"Project lease revenues by modeling existing contracts. Apply vacancy rates to account for downtime between leases and non-leased space, reducing effective gross income". – LinkedIn Discussion

Scenario analysis further strengthens lease strategies by testing how they hold up under different market conditions. This makes DCF modeling an essential tool for optimizing commercial real estate decisions.

The expertise provided by The Fractional Analyst in DCF modeling equips landlords with the tools to approach lease negotiations with confidence. By leveraging these insights, landlords can make informed decisions that support long-term investment success.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

6. Development Project Planning

Development projects in commercial real estate are intricate and often come with hefty price tags. That's why Discounted Cash Flow (DCF) analysis plays a vital role in evaluating whether the potential returns justify the upfront costs and associated risks. By carefully modeling factors like construction expenses, project timelines, and anticipated rental income after completion, developers can make well-informed decisions and gain the confidence of lenders. This section dives into how DCF analysis is tailored for projects with major construction phases, building on its use in acquisitions and financing.

Building a Comprehensive Development DCF Model

Unlike traditional property acquisition models, a development DCF model must account for two distinct phases: the construction phase, where cash outflows dominate, and the operational phase, where income starts to flow. To create an accurate model, developers need to include several key inputs:

Acquisition costs

Construction expenses

Landholding costs

Professional fees

Marketing expenses

Tax considerations

Among these, construction costs are typically the largest line item. To prepare for unexpected challenges, developers should allocate a contingency fund of 5–10% of the construction budget. Additionally, keeping project timelines on track is crucial to avoid costly delays. Just as with property acquisitions and refinancing, development projects thrive on scenario-based DCF models that clearly outline risks and potential returns.

Three Levels of Development Feasibility

Development feasibility studies usually unfold in three stages, each building on the last:

High-level feasibility: A preliminary evaluation of the site's potential and initial concepts.

Static feasibility: A more detailed analysis to determine the highest and best use of the site using reliable data.

Cash flow feasibility: A deep dive into the financial and funding requirements needed for project execution.

Each phase incorporates DCF analysis to sharpen return projections and guide key decisions.

Securing Financing Through DCF Analysis

Investors and lenders heavily rely on DCF analysis to gauge whether a project can generate enough cash flow to cover debt obligations and deliver attractive returns. A positive Net Present Value (NPV) signals that the project may yield returns above the initial investment, making it appealing to stakeholders. For instance, a mixed-use development requiring an $11 million investment and using a 5% Weighted Average Cost of Capital (WACC) could generate discounted cash flows of $13.3 million, resulting in a positive NPV of $2.3 million. Lenders also use DCF models to evaluate the borrower's ability to service debt, ensuring the project's financial soundness.

Critical Assumptions and Risk Management

The accuracy of a development DCF model depends on several key assumptions, including:

Revenue growth

Operating margins

WACC

Terminal value

Demand forecasts

Sales prices and rental rates

Additionally, site-specific considerations, such as zoning laws and environmental regulations, can significantly influence costs and timelines .

Ongoing Model Refinement and Scenario Analysis

Development feasibility isn’t static - it evolves as the project progresses. Regular updates and sensitivity analysis help developers understand how changes in key inputs, like construction costs or sales prices, might impact overall outcomes. Scenario modeling further refines these projections, offering a clearer picture of potential risks and opportunities. This iterative approach ensures that financial modeling remains aligned with broader strategic decisions in commercial real estate.

With The Fractional Analyst’s expertise in development DCF modeling, developers gain the tools they need to handle these complex financial projections. By leveraging advanced DCF models, they can confidently balance risks and rewards while securing the necessary funding for their projects.

7. Investment Reporting and Communication

Strong communication with investors and lenders is essential for successful financial management. DCF models serve as a cornerstone in investment reporting, offering reliable metrics that stakeholders can use to evaluate and compare performance.

Creating Standardized Performance Metrics

DCF models help establish consistent benchmarks like Internal Rate of Return (IRR), Net Present Value (NPV), and Equity Multiple. These metrics simplify performance reporting, making it easier for stakeholders to determine if a property aligns with predefined return targets. Whether it’s deciding to acquire, hold, or sell, these benchmarks provide clarity for informed decision-making across various assets.

Supporting Loan Applications and Lender Relations

When it comes to financing, DCF models are invaluable. They provide lenders with detailed cash flow projections, helping them assess loan applications more effectively. By incorporating different market scenarios, borrowers can address potential risks upfront, strengthening their case and improving their chances of securing favorable terms.

Enhancing Investor Updates and Asset Management

For ongoing updates, DCF models act as a tool for tracking a property’s performance against initial projections. Asset managers can compare forecasted and actual figures, such as Net Operating Income (NOI) and capital expenditures, to explain discrepancies. This approach keeps investors informed and aligns future expectations with current realities.

Revealing Hidden Value Drivers

Beyond surface-level metrics, DCF models can highlight less obvious factors that contribute to a property’s value. For instance, cash flow analysis might uncover opportunities tied to lease rollover timing or planned capital expenditures. Identifying these drivers allows asset managers to focus on strategies that could improve overall property performance.

Establishing Clear Decision Frameworks

Investment decisions benefit from clear, objective criteria. DCF models help investors set thresholds for metrics like NPV or IRR, which can then guide decisions to "buy", "hold", or "sell." This systematic approach ensures accountability and provides a solid foundation for evaluating future performance.

The Fractional Analyst's reporting services take DCF modeling to the next level, combining expert analysis with straightforward communication. These services help real estate professionals maintain strong relationships with their capital partners and make well-informed, data-driven decisions.

With these insights in place, the next step is to explore how DCF compares to other valuation methods.

DCF vs Other Valuation Methods

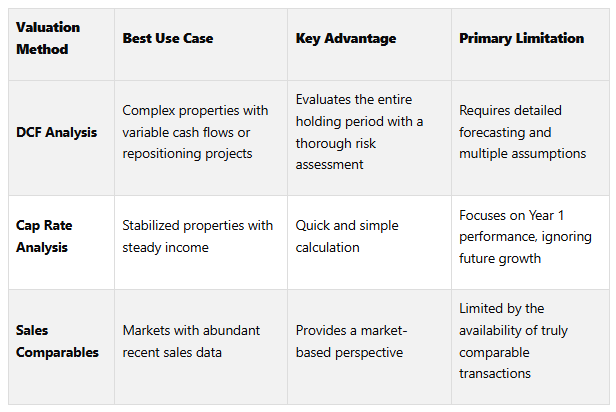

Discounted Cash Flow (DCF) modeling provides a detailed look at a property's future cash flows, but it's just one of several tools available for evaluating commercial real estate investments. Knowing when to apply DCF versus other valuation methods can lead to smarter decisions and a more efficient evaluation process. Here's a closer look at how these methods compare and when they shine.

Cap rate analysis offers a quick way to estimate a property's value by dividing its net operating income (NOI) by its market value. A cap rate between 5% and 10% is generally favorable for stabilized properties with steady income streams. However, this method has its limits - it primarily focuses on the first year's NOI and doesn't account for future growth or potential changes in cash flow.

Sales comparables, on the other hand, estimate property values by comparing them to recent sales of similar properties. This approach works best in markets with plenty of recent transaction data. When a large number of comparables are available, this method can provide reasonable value estimates. But its effectiveness diminishes in markets with scarce data or when a property has unique features that make finding true comparables difficult.

DCF modeling, however, takes a broader approach by analyzing the entire investment timeline and incorporating risk into the equation. As Dave Welk, Managing Director of Acquisitions, puts it:

"The value of an asset is simply the sum of all future cash flows that are discounted for risk". – Dave Welk, Managing Director of Acquisitions

Unlike other methods, DCF accounts for NOI growth over the entire holding period and includes sale proceeds. In fact, the terminal value - representing the property's value at the end of the holding period - typically makes up 60–80% of the total valuation.

These differences highlight why DCF is often the go-to method for long-term, complex evaluations. For properties with intricate lease structures, planned renovations, or repositioning needs, DCF's detailed forecasting becomes essential. Meanwhile, cap rate analysis is useful for quickly screening stabilized assets, and sales comparables help validate assumptions against market trends.

DCF stands out for long-term investments, especially those with high growth potential or fluctuating cash flows. In contrast, traditional methods like cap rate analysis or sales comparables may be better suited for mature markets with predictable performance. The flexibility of DCF also allows for modeling various scenarios, such as major capital improvements or shifting market conditions, in ways other methods cannot.

"DCF offers a valuable advantage in the flexibility and accuracy it provides for property valuations". – The Altus Group

Savvy investors combine DCF with cap rate analysis and sales comparables to cross-check intrinsic value against market data. The Fractional Analyst's services embrace this multi-method approach, ensuring a balance between detailed analysis and practical decision-making for commercial real estate investments.

Conclusion

Discounted Cash Flow (DCF) modeling forms the foundation of decision-making in commercial real estate (CRE) investment. It serves as a critical tool for analyzing opportunities, whether it's property acquisition, determining the best time to sell or refinance, managing portfolios, negotiating leases, planning development projects, or preparing investment reports. By focusing on risk-adjusted return analysis, DCF helps investors evaluate potential deals on a level playing field, factoring in more than just internal rate of return (IRR).

One of DCF's standout features is its ability to stress-test various scenarios, equipping investors to adapt to shifting market conditions. This is particularly important in a market where equity investors generally expect annualized, time-weighted returns ranging from 7% to 20%, depending on the risk level of the deal.

Michael Belasco describes the method succinctly:

"The Discounted Cash Flow Method is a method to value a project by taking all future projected cash flows of the project and discounting them back to time zero (date of purchase) using a predetermined discount rate (the discount rate when used in a DCF to look at an investment can be looked at as synonymous to an investor's targeted IRR)." – The A.CRE Group

By integrating data-driven comparative analysis, DCF models align closely with actual market conditions, using historical data and benchmarks to ensure accuracy. When paired with waterfall distribution modeling, DCF also clarifies profit-sharing structures among stakeholders, ensuring transparency and precision in financial projections.

For CRE professionals looking to implement advanced DCF analysis, The Fractional Analyst offers expert financial services and tools. Through direct support from top-tier analysts and the CoreCast platform, users gain access to underwriting, asset management resources, and tailored financial models. These insights make DCF an essential part of strategic decision-making.

FAQs

-

Discounted Cash Flow (DCF) Analysis: Timing Your Sale

Discounted Cash Flow (DCF) analysis is a reliable method for determining the best time to sell a commercial property. It works by calculating the property's current value based on expected future cash flows. This approach takes into account factors like income potential, operating expenses, and market conditions to gauge how the property's value evolves over time.

By examining the holding period - typically ranging from 5 to 15 years - DCF modeling can pinpoint when the property's value is likely to reach its peak. This insight helps investors align their sale timing with their financial goals and prevailing market dynamics, ensuring they make decisions that maximize their returns.

-

The precision of a Discounted Cash Flow (DCF) model in commercial real estate hinges on several critical factors and assumptions. These include the discount rate (often tied to the weighted average cost of capital), the terminal value (calculated using either an exit multiple or a growth rate), and the cash flow projections, which account for elements like rent growth, operating expenses, and net operating income.

Getting these assumptions right is crucial. Even minor inaccuracies in projected cash flows or the discount rate can lead to major shifts in valuation results. To address this, sensitivity analyses can be a powerful tool, helping to uncover potential risks and enhance the model's reliability. Additionally, a solid grasp of market trends and property-specific details is vital for crafting DCF models that are both precise and practical.

-

Discounted Cash Flow (DCF) modeling is an effective way to analyze lease structures by calculating the present value of future lease payments and their effect on long-term cash flow. It takes into account elements like variable rent terms, indexed rent increases, and other lease conditions, giving investors a clearer picture of how these factors shape property performance over time.

By factoring in lease-related cash flows, DCF modeling also helps evaluate how lease structures influence a property's overall value. This insight supports better decision-making, whether you're comparing lease agreements or negotiating terms to achieve improved financial results.