When to Capitalize Real Estate Development Costs

In real estate development, knowing when to capitalize costs is key for accurate financial reporting and compliance with GAAP. Capitalizing means recording costs as assets, spreading them over time, while expensing means immediately deducting them from profits. Here's what you need to know:

Predevelopment Costs: Most are expensed until project feasibility is confirmed.

Development Costs: Costs directly tied to construction (e.g., materials, labor, permits) are capitalized.

Post-Development Costs: Maintenance and general operating costs are expensed, but improvements that add value can be capitalized.

Capitalization starts when activities to prepare the property begin and ends when the asset is ready for use. Proper documentation and adherence to GAAP guidelines, like ASC 970, are critical to avoid penalties and ensure transparency. Missteps can lead to financial restatements or penalties, so tracking costs carefully and seeking professional advice is essential.

Real Estate Development Capitalization Basics

What is Capitalization?

In real estate development, capitalization refers to recording certain costs as assets on the balance sheet instead of immediately counting them as expenses on the income statement. By capitalizing a cost, you're treating it as an investment that will deliver future economic benefits, typically through depreciation or amortization over time.

This approach has a direct impact on financial reporting. Costs that are expensed immediately reduce profits for the current period, as they appear on the income statement right away. In contrast, capitalized costs strengthen the asset side of the balance sheet and delay expense recognition, spreading it out over future periods. For example, if you’re working on a $2 million development project, capitalizing the costs means they will show up as a $2 million asset on your balance sheet. On the other hand, expensing those costs would leave no asset reflected in your financials.

“The historical cost of acquiring an asset includes the costs necessarily incurred to bring it to the condition and location necessary for its intended use.”

This distinction is especially critical when following GAAP (Generally Accepted Accounting Principles). Understanding how costs translate into future revenue is the first step toward applying GAAP rules to determine when capitalization is appropriate.

GAAP Rules for Capitalization

GAAP provides specific guidelines for when and how costs should be capitalized, ensuring that financial statements accurately reflect the future benefits of an asset. For the real estate industry, ASC 970 serves as the primary reference, covering everything from acquiring property to its eventual sale or use as a rental asset. Additional standards, such as ASC 970-360 and ASC 970-340, focus on assets constructed for sale or rental, while ASC 360-10 offers guidance on capitalizing costs related to the acquisition of property, plant, and equipment.

Under GAAP, capitalization begins when activities to prepare the property for sale or rental start and continues until the property is substantially complete. ASC 835-20-25-3(b) explains that these activities include not only physical construction but also all necessary steps to prepare the asset for its intended use.

“Activities: The term activities is to be construed broadly. It encompasses physical construction of the asset. In addition, it includes all the steps required to prepare the asset for its intended use.”

GAAP also distinguishes between properties intended for sale, rental, or internal use. Generally, broader capitalization is allowed for sale and rental properties.

The financial stakes for compliance are high. Non-compliance can result in hefty costs, averaging between $9.4 million and $14.8 million, while the cost of maintaining compliance typically falls between $3.5 million and $5.5 million. In Fiscal Year 2023, the IRS imposed over $25.6 billion in additional taxes due to late filings, with penalties for accuracy-related issues reaching 20% of underpayments.

Adhering to GAAP not only avoids these financial pitfalls but also provides a competitive edge. Lenders and investors value the transparency and consistency of GAAP-compliant financial statements, which can lead to better financing terms and quicker funding approvals. For entities constructing properties for sale or rental, it’s essential to establish clear policies for tracking and capitalizing indirect costs. These policies should include reviewing cost estimates and allocations at the end of each reporting period until the project is substantially complete. The timing and method of recording these costs have a significant impact on financial reporting, a topic we’ll explore further in upcoming sections.

Capitalizing vs. Expensing Costs [CPA Prep]

Development Stages and Cost Treatment

Real estate development unfolds in three key stages, each governed by specific accounting rules that determine whether costs are capitalized or expensed. These rules are essential for maintaining compliance with GAAP and ensuring accurate financial reporting.

Predevelopment Stage

The predevelopment stage begins with the initial concept and continues until construction starts. During this phase, most costs - such as feasibility studies, market research, site surveys, zoning applications, and initial legal fees - are expensed as incurred because the project's viability is still uncertain. However, once feasibility is confirmed and the development becomes likely to proceed, costs shift to capitalization. This transition marks a critical point and must be well-documented to ensure accurate accounting.

Development Stage

Once the project moves into the development stage, active construction begins, and costs directly tied to creating the asset are capitalized. Activities in this phase include land clearing, grading, excavation, demolition, infrastructure work, and structural, mechanical, or electrical installations. Both hard costs (e.g., materials and labor) and soft costs (e.g., permits, professional fees, and project management) are capitalized. Soft costs typically account for 20%-30% of the budget, while hard costs make up 70%-80%. These expenditures are tracked until the property reaches substantial completion, signaling the end of this stage.

Post-Development Stage

The post-development stage begins when the asset is substantially complete, at which point the capitalization period ends. Routine expenses like maintenance, marketing, and general operating costs are now expensed. However, improvements that increase the property's value, extend its useful life, or adapt it for new purposes may still be capitalized. For properties held for sale, marketing costs (e.g., advertising and sales commissions) are expensed, and the asset is carried at the lower of cost or market value. In contrast, rental properties begin to depreciate over their useful lives. Properly handling costs during this stage provides stakeholders with a clear picture of project performance and asset valuation.

When to Capitalize Costs

Knowing when to capitalize real estate development costs involves meeting specific GAAP criteria to ensure accurate financial reporting. These rules determine whether expenses should be added to an asset's cost basis or recorded as expenses when incurred.

Direct Property Connection

For costs to be capitalized, there must be a clear and traceable link to a specific property. This connection must be well-documented.

“The historical cost of acquiring an asset includes the costs necessarily incurred to bring it to the condition and location necessary for its intended use.”

Direct costs, such as those resulting from transactions with independent third parties during pre-acquisition, qualify for capitalization. For example, hiring an environmental consultant to conduct soil testing for a particular development site is considered a direct cost.

Employee payroll and benefits related to property-specific activities can also be capitalized, but only in proportion to the time spent on the project. For instance, if a project manager dedicates 60% of their time to a single project, 60% of their compensation can be capitalized to that development.

Similarly, inventory costs for materials, spare parts, and supplies used directly in construction meet the direct connection requirement. However, general and administrative expenses - such as corporate office rent, salaries for administrative staff, and general legal counsel - should be expensed immediately since they lack a direct link to any specific property.

While establishing a direct connection is crucial, understanding when to begin and end capitalization is equally important.

Capitalization Start Points

In addition to having a direct cost link, timing plays a key role in capitalization. GAAP provides clear guidelines on when the capitalization period starts and ends. Capitalization begins when activities to prepare the asset for its intended use are underway.

“Activities: The term activities is to be construed broadly. It encompasses physical construction of the asset. In addition, it includes all the steps required to prepare the asset for its intended use.”

For property taxes and insurance, the same criteria used for capitalizing interest costs apply. This includes construction efforts and necessary pre-construction activities, such as site preparation and utility connections.

Capitalization ends when the asset is ready for its intended use, regardless of whether it is occupied or generating income. For example, an office building that is fully constructed and prepared for tenants is considered ready, even if no leases have been signed. Similarly, property taxes and insurance capitalization ceases at the same time as interest capitalization. For income-producing properties, the asset is deemed ready when it can produce a saleable or usable unit. Adhering to these timing requirements ensures compliance with GAAP and supports accurate asset valuation.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Cost Types: Capitalize or Expense?

Understanding how to treat costs - whether to capitalize or expense them - is a key part of accurate project accounting. According to GAAP principles, costs that are directly tied to getting an asset ready for its intended use should be capitalized. Meanwhile, costs that don’t contribute to this readiness or are avoidable must be expensed.

In real estate development, costs fall into various categories. Expenses that directly prepare the asset for use, like construction materials and labor, are typically capitalized. On the other hand, indirect costs, such as general corporate overhead or expenses incurred before a project’s viability is confirmed, are expensed.

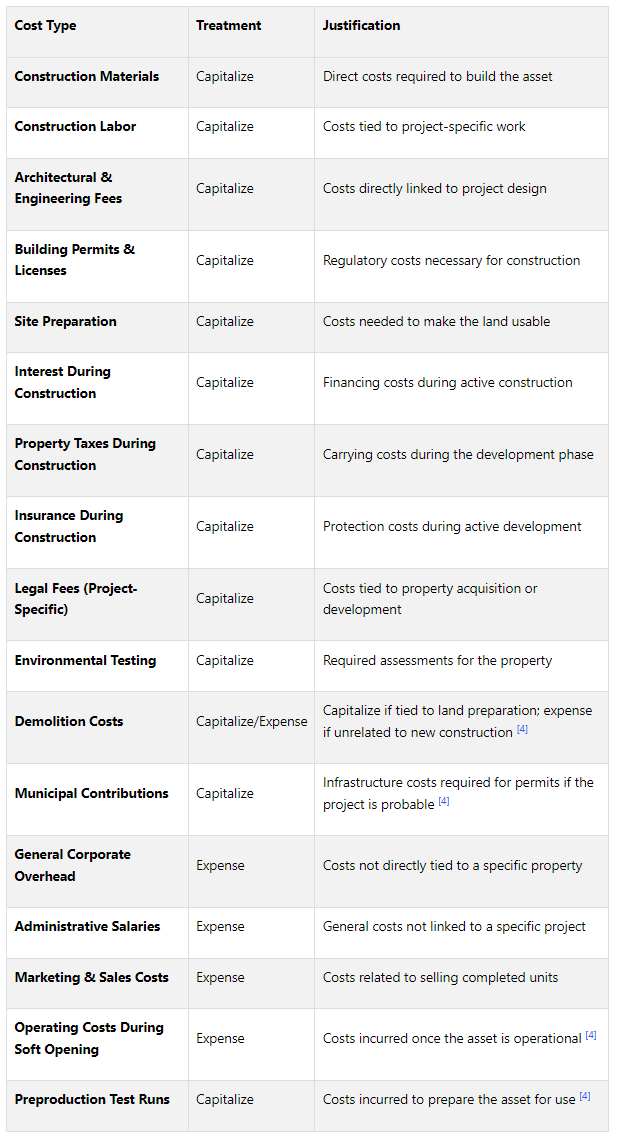

Cost Treatment Table

The table provides a straightforward guide for handling common cost categories. Below, a few categories that require careful judgment are explained further.

Demolition Costs: These are capitalized if they are directly related to preparing land for new construction. If they are unrelated to the new development, they are expensed.

Municipal Contributions: These are capitalized when they involve infrastructure improvements needed to secure permits, provided the project is deemed probable.

For costs related to employees, only the portion of compensation directly tied to project work should be capitalized. For example, if an employee spends 40% of their time on a specific project, only that portion of their compensation should be capitalized.

Compliance and Record Keeping

Keeping accurate records is a cornerstone of ensuring GAAP compliance when it comes to cost capitalization. From the very beginning of a project, it's essential to have systems in place to track and document all project-specific costs.

Documentation Requirements

Start by creating a real estate–specific chart of accounts and assigning a dedicated cost center for each property. This setup allows you to categorize expenses in line with GAAP requirements and simplifies tracking.

Make sure to document every cost thoroughly. Each entry should include key details such as the date, amount, vendor, a description of the expense, and the rationale for its treatment under GAAP.

To prevent errors and fraud, implement strong internal controls. This can include segregating duties and conducting regular audits. Technology can play a big role here by automating expense categorization and flagging unusual transactions. Monthly reviews of financial statements are another critical step, helping you catch and address discrepancies early.

Once you have a solid documentation process in place, seeking expert advice can further enhance your compliance efforts.

Getting Professional Help

Staying on top of GAAP compliance often requires professional expertise, especially given the ever-changing rules and the specific tax considerations tied to real estate.

“In real estate, every dollar tells a story - and if that story isn’t clear, accurate, and compliant, it could cost you.”

Experienced real estate accountants can help you establish clear capitalization thresholds and ensure that costs are treated consistently and in line with current GAAP standards .

For commercial real estate professionals, The Fractional Analyst offers tailored financial analysis and expert support. Their services include underwriting, asset management assistance, and investor reporting, all designed to align cost capitalization practices with GAAP. Their team of financial analysts specializes in navigating the complexities of real estate development accounting.

Additionally, their real estate intelligence platform, CoreCast, provides both direct support through a team of elite analysts and self-service tools for real estate professionals. This hybrid approach lets you access expert guidance when needed while retaining control over your daily accounting processes.

Keeping up with changes in real estate accounting standards is critical. As GAAP evolves, practices that were once acceptable may no longer meet current requirements. Professional advisors can help you stay compliant by adjusting your methods to reflect the latest standards.

Conclusion

Accurate capitalization under GAAP plays a vital role in maintaining financial transparency and earning stakeholder trust.

As discussed earlier, costs incurred during uncertain early stages are typically expensed, whereas construction-related costs that directly contribute to preparing an asset for use are capitalized. It's crucial to differentiate between costs that are "necessarily incurred" and those that could have been avoided.

For businesses with simpler operations, the Section 263A exception provides a more straightforward approach to capitalization. This option, available to eligible small businesses, can be accessed by filing Form 3115 and may lead to notable tax advantages [6, 9].

Given the intricate nature of these rules, seeking professional advice is highly recommended. For example, ASC 970 offers specific guidance for real estate projects developed for sale or rental, as well as for construction intended for personal use. Regularly reviewing capitalization policies ensures they remain consistent with GAAP standards and the company’s operational needs.

FAQs

-

Misclassifying real estate development costs under GAAP can seriously impact a company’s financial reporting and compliance. Capitalizing costs incorrectly can inflate both assets and net income, giving investors and stakeholders a misleading view of the company’s financial health. On the flip side, expensing costs that should be capitalized can understate assets and profitability, potentially distorting key financial metrics and even affecting tax obligations.

These mistakes can attract regulatory scrutiny, lead to audit adjustments, and result in penalties - damaging both the company’s financial standing and its reputation. Properly classifying costs not only ensures compliance with GAAP but also helps maintain a transparent and dependable financial record, which is essential for sound decision-making.

-

When it comes to real estate development, certain costs should be capitalized - but only if they meet specific criteria. These costs must be directly tied to the project, necessary for its completion, and likely to bring future financial benefits. Common examples include interest payments, real estate taxes, and expenses for engineering, design, or storage that are directly related to the development.

On the other hand, general administrative expenses or costs that don’t directly connect to the project should be recorded as expenses when they occur. It’s also crucial for developers to confirm that the project is both viable and technically feasible before capitalizing these costs. This approach ensures compliance with GAAP standards and supports accurate financial reporting.

-

When it comes to handling real estate development costs, seeking advice from professionals is crucial for staying aligned with GAAP standards. This guidance ensures you can correctly identify which costs should be capitalized versus those that need to be expensed. The result? More accurate financial reporting and a lower chance of costly mistakes or regulatory troubles.

Getting capitalization right doesn’t just keep you compliant - it also improves the clarity and reliability of your financial statements. This level of transparency can build trust with investors, foster stronger relationships with lenders, and enhance a company’s financial reputation and long-term stability.