Cash Flow Timing in DCF Models: Why It Matters

Cash flow timing in Discounted Cash Flow (DCF) models is critical for accurate investment valuations, especially in commercial real estate. Even small errors in timing can distort property valuations, misguide decisions, and reduce returns. Here's what you need to know:

DCF Basics: DCF calculates the present value of future cash flows, adjusted for the time value of money (TVM).

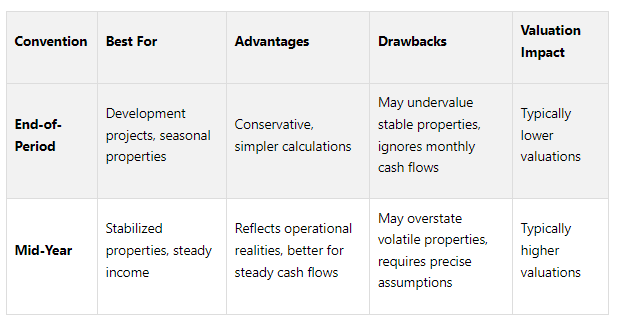

Timing Conventions: End-of-period assumes cash flows occur at year-end, while mid-year reflects income received throughout the year, often leading to higher valuations.

Key Adjustments: Partial-year adjustments and accurate discounting ensure projections align with real-world property operations.

Common Errors: Mistakes like mismatched cash flows and discount rates or short forecast horizons can skew results.

Best Practices: Align cash flow timing with property realities, use sensitivity analysis, and integrate market data for precise modeling.

Precise cash flow timing ensures reliable DCF valuations, helping investors make smarter decisions and manage risks effectively.

Session 13: Time-weighting cash flows and dealing with uncertainty

Cash Flow Timing Conventions in DCF Models

Understanding how cash flow timing impacts Discounted Cash Flow (DCF) models is crucial, especially when it comes to property valuations. While the topic can get technical, these conventions play a key role in ensuring accurate and realistic projections.

End-of-Period vs. Mid-Year Conventions

The end-of-period convention assumes that all cash flows are received at the end of each period, typically at year-end. While this simplifies calculations, it doesn’t reflect how commercial properties actually operate - these properties generate income throughout the year, not in one lump sum.

On the other hand, the mid-year convention assumes cash flows are received halfway through each period. This better mirrors real-world operations, where rental income is collected monthly or quarterly. The difference between these conventions lies in the discount factor formulas:

End-of-Period: 1 / (1 + Discount Rate)^Period Number

Mid-Year: 1 / (1 + Discount Rate)^(Period Number – 0.5)

Because the mid-year convention assumes earlier cash flow receipt, it usually results in slightly higher present values - though the difference is often just a few percentage points.

For properties with steady rental income, the mid-year convention is typically more appropriate. However, for properties with highly seasonal cash flows, like resorts that earn most of their income during specific months, the end-of-period approach might better reflect reality.

Partial-Year Adjustments and Valuation Dates

DCF models often require adjustments for partial years, as valuation dates rarely align perfectly with the start or end of a forecast period. These adjustments are critical for maintaining the credibility of the analysis.

“One of the errors we often encounter when reviewing DCF models concerns valuation date and cashflow timing adjustments. Although the effect may not always be that material, getting these adjustments wrong undermines the credibility of DCF valuations.”

For example, if the valuation date is March 15, 2025, and the first forecast year ends on December 31, 2025, the model must account for the partial year using a fraction like 74/365.

There are two main ways to handle these adjustments. One method calculates partial-year cash flows for the initial period and discounts them directly to the valuation date. A more common approach, however, discounts full-year cash flows to year zero and then rolls forward to the valuation date using this formula:

Target EV (valuation date) = Target EV (Year 0) × (1 + WACC)^f – FCF × f

This method reduces the risk of errors, such as double-counting partial-year cash flows, and ensures consistency. When using mid-year discounting, remember to adjust the discount period for terminal value calculations. For instance, in a 10-year projection, the terminal value is discounted to Year 9.5 instead of Year 10.

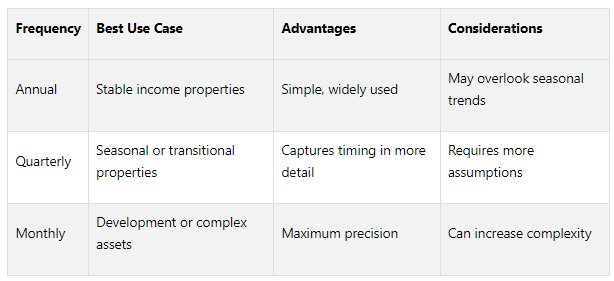

Cash Flow Interval Frequency

The frequency of cash flow intervals - whether annual, quarterly, or monthly - also affects the accuracy and complexity of DCF models. Most commercial real estate models use annual intervals, which balance practicality with sufficient accuracy.

Annual intervals work well for stable income properties, smoothing out seasonal variations and highlighting overall trends.

Quarterly intervals provide more detail, especially for properties with seasonal income patterns or those undergoing transitions, like lease-ups or renovations.

Monthly intervals offer the highest precision, making them ideal for development projects or properties with intricate lease structures. However, they can add unnecessary complexity in many cases.

The choice of interval frequency should align with your investment goals. For long-term strategies involving stable assets, annual intervals are often sufficient. For more active management or assets with intricate cash flow patterns, shorter intervals may be worth the added complexity.

In DCF modeling, the challenge is to balance detail with simplicity. The goal is to include enough detail to reflect realistic cash flow timing while avoiding unnecessary complexity that doesn’t materially impact decision-making. These conventions are essential for accurate valuations and effective commercial real estate investment analysis.

How Timing Assumptions Affect Investment Decisions

Timing assumptions in Discounted Cash Flow (DCF) models play a key role in shaping investment choices, pricing strategies, and returns. Grasping their impact is essential for making informed decisions in commercial real estate.

How Timing Conventions Influence Valuations

The choice of timing conventions in DCF models can lead to notable differences in property valuations. These differences become even more pronounced with larger investments or longer holding periods. For instance, deciding between an end-of-period or mid-year convention is critical when future cash flow timing significantly impacts the price an investor is willing to pay.

Discount rates are a major factor here. In commercial real estate, these typically range from 6% to 12%, reflecting both the property's risk and the business plan's risk. When applied using different timing conventions, the effect on valuation is stark. For example, moving from a 12% to a 10% discount rate can shift valuations by as much as 27%. If timing assumptions are off - say, using an end-of-period convention instead of a mid-year approach - it can lead to undervaluing a property and missing lucrative opportunities.

The relationship between timing and risk is also key. Timing assumptions should match the risk profile of the asset. For example, a stable office building with long-term leases has a very different risk profile compared to a hotel, where revenue fluctuates daily. Hotels generally carry more risk than apartments due to higher operating leverage and shorter lease durations. Misjudging these timing assumptions can lead to flawed valuations and missed opportunities.

Common Errors in Cash Flow Timing

DCF models rely heavily on projections and assumptions, which makes them prone to errors. Timing-related mistakes are among the most common and impactful, often skewing investment analysis and leading to poor decisions.

One frequent error is including historical cash flows in the initial forecast period. This often happens when the valuation date doesn’t align with the start of the forecast, causing past performance data to distort present value calculations.

Another common issue is mismatching cash flows with discount rates. For instance, using a weighted average cost of capital (WACC) to discount cash flows already adjusted for debt service, or applying equity discount rates to unlevered cash flows, can result in significant over- or under-valuations.

Short forecast horizons can also be problematic, particularly in commercial real estate. Many properties, such as those undergoing development or major renovations, take years to stabilize. Ground-up construction projects, for example, are riskier than existing assets and require longer forecast periods to accurately reflect their cash flow potential.

Terminal value errors are another major pitfall. Since terminal values often make up the largest portion of a DCF's total value, mistakes here can be costly. If a terminal value accounts for more than 85% of the total DCF value, it’s a warning sign that the forecast period is too short or other assumptions need revisiting. Coupled with timing errors, these missteps can completely derail an investment analysis.

Lastly, unrealistic reinvestment assumptions and terminal growth rates are common problems. Analysts often overlook the timing of capital expenditures or use growth rates that don’t align with the property’s long-term outlook. Addressing these issues ensures more accurate timing assumptions.

Comparing Timing Conventions

A side-by-side look at timing conventions highlights their impact on valuations:

Choosing the right convention depends on the cash flow characteristics of the investment. As Tim Schultz, CTP, FPAC, notes:

“Property owners continue to see the effects of ‘Higher For Longer’ rates impact cash flow. Cash forecasting is vital for fund managers to effectively execute their strategy and deliver the best possible return for investors.”

Aligning timing conventions with operational realities ensures accurate valuations and better decision-making in commercial real estate.

Ultimately, "the value of an asset is simply the sum of all future cash flows that are discounted for risk". Accurate timing assumptions allow discount factors to reflect when cash flows will actually be received, leading to smarter investments and stronger portfolio outcomes.

Tim Schultz further emphasizes:

“Lenders greatly appreciate proactive borrowers. Having visibility into a portfolio’s future debt servicing allows management to address any liquidity concerns with its debt partners in advance.”

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Best Practices for Cash Flow Timing in CRE DCF Models

Nailing the timing of cash flows in commercial real estate (CRE) discounted cash flow (DCF) models is crucial. It’s about aligning your assumptions with the realities of property operations to create models that reflect actual market dynamics and support smart investment decisions.

Aligning Cash Flow Timing with CRE Operations

Accurate DCF modeling starts with syncing your timing assumptions to how cash flows in and out of a property. For example, consider monthly rent payments, seasonal percentage rents, and irregular capital expenditures like HVAC replacements, roof repairs, or tenant improvements. These factors vary based on the property type and class.

Class A properties, which attract top-tier tenants and have longer lease terms, tend to offer more predictable cash flows. These properties often carry lower risk but also come with lower cap rates. On the other hand, Class B and C properties may experience more cash flow volatility, requiring models to account for fluctuating income streams.

Financing also plays a big role. Commercial loans are typically shorter in term, carry higher interest rates, and require larger down payments compared to residential mortgages. With loan-to-value ratios generally between 65% and 80%, frequent debt service payments and refinancing events must be carefully timed in your model.

Vacancy assumptions are another critical element. Temporary gaps between tenants differ from long-term structural vacancies. For stress testing, a AAA scenario might apply a 30% rental value haircut (RVH) to account for rental stress during a prolonged downturn, while residential properties - being less volatile - might use a 15% RVH.

Adjusting for Partial Years and Rolling Forward Values

When your valuation date doesn’t align with the base year of your forecast, partial-year adjustments are essential. Start by discounting full-year cash flows to Year 0, then roll them forward to the valuation date. For instance, if the valuation date is March 15, 2025, calculate the fraction of the year remaining (e.g., 74/365) and adjust accordingly.

For leveraged properties, net debt requires precise adjustments. The formula typically looks like this: Net debt (valuation date) = Net debt (Year 0) * (1 + COD)^f – FCF_f ± adjustments for changes in investments. This ensures that accrued interest, free cash flow, and any investment changes are properly accounted for.

One key rule here: don’t oversimplify. Always discount to Year 0 before rolling forward to maintain the integrity of your model.

Market Data and Sensitivity Analysis

Once your cash flow timing aligns with property operations and partial-year adjustments are complete, it’s time to integrate current market data. This step is critical because terminal value often accounts for 60–80% of a property’s total value in a DCF model. Using real-time data ensures your cash flow forecasts and discount rates reflect actual market conditions.

Sensitivity analysis is a must in CRE, where market conditions and operational factors can shift rapidly. Testing scenarios - like delays in lease renewals or postponed capital improvements - helps reveal how these changes impact metrics like the internal rate of return. Focus on timing-sensitive variables such as lease expiration dates, capital expenditure schedules, and refinancing timelines.

Updating projections regularly to mirror market trends is equally important. Using tiered confidence levels - ranging from base to optimistic to pessimistic scenarios - can make your forecasts more reliable. Qualitative factors like tenant quality and property location also influence discount rates and cash flow timing, adding another layer of refinement.

Technology has made these analyses easier. For example, ModelTree 2.9.4 (released June 25, 2025) by Exquance Software offers advanced scenario modeling and asset mapping, allowing professionals to test multiple valuation approaches on a single platform.

Finally, it’s vital to compare actual cash flows against your projections. Analyzing variances provides insights to improve future models. During periods of low cash flow, strategies like controlling expenses and negotiating better payment terms can help manage volatility.

The aim isn’t perfection - it’s building resilient models that guide informed decisions, even when the market throws curveballs.

How The Fractional Analyst Supports CRE Professionals

When it comes to accurate cash flow timing, having the right tools and expertise is non-negotiable. The Fractional Analyst bridges this gap by offering two key solutions: direct support from a team of top-tier financial analysts and self-service tools through its CoreCast platform, designed specifically for the complexities of commercial real estate (CRE) modeling.

Tools for Accurate DCF Modeling

The Fractional Analyst offers free financial models tailored to address common cash flow timing challenges in CRE. These models are built with the nuances of the industry in mind. For example, the multifamily acquisition model accounts for staggered lease renewals and seasonal rent changes, while the mixed-use development model handles the intricate timing of construction draws and phased tenant occupancy.

For properties with more unique needs, The Fractional Analyst develops custom financial models. This is particularly useful for assets with irregular cash flow patterns, like hotels with seasonal revenue or office buildings with performance-based rent structures. These customized models ensure that even the most complex scenarios are accurately represented.

Another standout feature is the IRR matrix tool, which allows professionals to test different timing assumptions and their impact on investment returns. This is especially helpful for acquisitions where closing dates may shift, enabling users to refine their cash flow projections with confidence. Together, these tools equip CRE professionals to tackle even the most intricate scenarios with precision.

Expert Support for Complex CRE Scenarios

For more complicated models - think ground leases with escalating payments or value-add projects with heavy capital improvements - The Fractional Analyst provides on-demand access to seasoned analysts. These experts specialize in crafting cash flow projections that reflect the detailed timing of CRE operations, addressing challenges like lease delays, refinancing shifts, and capital expenditures.

The team doesn’t stop at projections. They conduct sensitivity analyses, helping clients understand how timing variables could impact their bottom line. This is especially critical for institutional investors who need to assess potential risks thoroughly.

Relying on high-quality market data, the analysts ensure that discount rates and terminal value assumptions align with current trends. To further streamline the process, the platform automates workflows and reporting, minimizing manual errors. The result? Clear, data-backed reports that professionals can confidently present to investors and lenders.

Using CoreCast for Self-Service Modeling

CoreCast, The Fractional Analyst's real estate intelligence platform, takes self-service modeling to the next level. It offers automated underwriting for various asset classes and risk profiles, making it a powerful tool for CRE professionals. During its beta phase, CoreCast is priced at $50 per user per month, with full deployment pricing expected to reach $105 per user per month.

The platform connects seamlessly with multiple data sources, organizing market data into actionable insights. This ensures that critical inputs like lease rates, cap rates, and financing terms stay up-to-date, directly enhancing the accuracy of cash flow timing in discounted cash flow (DCF) models.

One of CoreCast’s standout features is its ability to consolidate individual underwriting results into a dynamic portfolio dashboard. This provides a complete view of how timing-sensitive variables, such as lease expirations or capital expenditures, impact the overall portfolio. For portfolio managers juggling multiple properties, this feature is a game-changer.

By applying proven best practices gathered from various portfolios, CoreCast sharpens decision-making while keeping the process straightforward. It helps users spot potential blind spots in their analysis, ensuring that no detail is overlooked.

The Fractional Analyst’s mission is clear: to combine expert human insights with advanced technology, giving CRE professionals the tools they need to master cash flow timing. Whether through direct analyst support or the self-service precision of CoreCast, the platform ensures that this critical aspect of DCF modeling is handled with care, setting professionals up for success in their investment decisions.

Conclusion

As explored earlier, precise cash flow timing is a cornerstone of successful commercial real estate (CRE) investments. In discounted cash flow (DCF) models, the timing of cash flows plays a critical role in shaping valuations and, ultimately, investment outcomes. Small errors, like improper partial-year adjustments or inconsistent timing conventions, can lead to miscalculations that skew acquisition decisions and reduce returns.

Key Takeaways

Accurate cash flow timing enhances valuation accuracy and supports better decision-making. Models that reflect real-world cash flow patterns - such as staggered lease renewals, seasonal revenue fluctuations, or phased construction - are better equipped to handle the complexities of CRE operations. On the other hand, poorly modeled cash flows can expose vulnerabilities, especially in a rising interest rate environment.

Understanding timing conventions, whether they follow end-of-period, mid-year, or custom intervals, provides a sharper lens for navigating these challenges. Complementing these models with sensitivity analyses ensures a more comprehensive understanding of how variables like rents, vacancy rates, and cap rates influence key metrics like IRR and equity multiples.

Industry experts emphasize the importance of proactive financial management. For instance, lenders value borrowers who maintain clear visibility into their portfolio’s debt servicing needs, as this transparency allows for early identification of liquidity concerns and fosters stronger relationships with both lenders and investors.

Practical Steps for CRE Professionals

To refine your DCF models and improve investment outcomes, consider the following:

Run stress tests and sensitivity analyses: Test how varying assumptions - market rents, vacancy rates, cap rates - impact key performance metrics. This approach helps you prepare for best-, base-, and worst-case scenarios.

Utilize advanced tools and expert resources: Platforms like The Fractional Analyst and CoreCast offer free financial models, automated tools, and custom analysis to enhance your modeling precision. Whether you prefer hands-on support or self-service solutions, the right tools can make a significant difference.

FAQs

-

The decision between end-of-period and mid-year cash flow timing plays a crucial role in determining the value of commercial real estate.

With end-of-period timing, cash flows are assumed to occur at the end of each period. This typically results in higher valuations because the discounting period is shorter, meaning the present value of future cash flows is higher.

In contrast, mid-year timing assumes cash flows are received midway through the year. This approach often leads to slightly lower valuations since the cash flows are discounted over a longer time. While mid-year timing tends to reflect the actual cash flow patterns of commercial properties more accurately, the choice between these methods depends on the specific property's characteristics and the assumptions used in the financial model.

-

When working with discounted cash flow (DCF) models, errors in cash flow timing often arise from incorrect assumptions. For instance, cash flows are sometimes treated as if they occur at the end of a period, rather than in the middle or earlier. Another frequent issue is the inconsistent application of discount periods, which can throw off calculations related to the time value of money.

These kinds of errors can significantly distort valuations, either inflating or undervaluing an investment. This misrepresentation can lead to poor financial decisions - like overpaying for an asset or overlooking profitable opportunities. To avoid such pitfalls, it's essential to ensure cash flow timing is accurate, as this forms the backbone of dependable projections and informed investment strategies.

-

Adjusting for partial-year cash flows in discounted cash flow (DCF) models is crucial for getting accurate valuations. This adjustment ensures you account for when cash flows are actually received during the year. Skipping this step could lead to overestimating or underestimating an investment's true value.

One popular method to handle this is the mid-year convention. This approach assumes cash flows are distributed evenly throughout the year. To apply it, you adjust the discount factor by incorporating a fractional period - like raising the discount rate to the power of 0.5 to reflect mid-year timing. This adjustment aligns cash flow timing with reality, offering better precision for return calculations and investment decisions.