Short-Term Trends vs Long-Term Cycles in CRE

Understanding commercial real estate (CRE) requires knowing two key concepts: short-term trends and long-term cycles. Here's the difference:

Short-term trends last 1–5 years and are shaped by factors like interest rates, economic conditions, and investor sentiment. They’re volatile and demand quick decision-making.

Long-term cycles span 10–20 years, driven by demographic shifts, technological changes, and macroeconomic patterns. They’re more stable and guide strategic planning.

Key Takeaways:

Short-term trends impact immediate decisions like buying, selling, or repositioning properties.

Long-term cycles help with big-picture strategies like portfolio diversification and development timing.

Understanding both is essential to avoid costly mistakes, like buying at market peaks or missing undervalued opportunities.

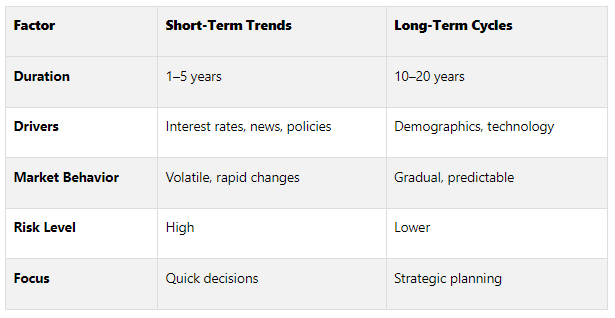

Quick Comparison:

Short-Term Trends in CRE

What Are Short-Term Trends?

Short-term trends in commercial real estate (CRE) refer to market movements that typically last between 1 and 5 years. These trends reflect rapid shifts in property values, rental rates, and overall market activity, often influenced by immediate economic and policy changes [1].

Unlike long-term cycles, short-term trends are marked by significant volatility [1]. They tend to respond quickly to economic data, policy announcements, and market speculation. For instance, investors may make quick decisions based on perceived opportunities or risks, creating noticeable fluctuations in the market [1].

These trends are also highly reactive to news and events. A good example comes from 2024, when nearly 560,000 new multifamily units entered the market. This sudden influx caused rent growth to slow dramatically, with annual growth dropping to just 0.3% [3]. Such shifts illustrate how supply changes can lead to immediate market adjustments.

The multifamily sector offers another example of short-term volatility. In the first nine months of 2024, multifamily permits and starts fell by 20% and 28%, respectively, compared to the previous year [3]. This sharp decline highlights how quickly economic factors can reshape market conditions.

Understanding these short-term movements provides a foundation for analyzing the factors that drive them.

What Drives Short-Term Trends

Several factors play a role in shaping short-term trends in CRE, with interest rate changes leading the way. When the Federal Reserve adjusts rates, borrowing costs shift instantly, influencing investor demand and property valuations across all sectors.

Local policy changes also have a noticeable impact. Updates to zoning laws, tax policies, or regulations can quickly alter investment patterns in specific areas.

Economic uncertainty is another major driver. Fluctuations in employment data, inflation reports, or geopolitical events can lead to rapid changes in market sentiment. This uncertainty often results in heightened volatility as investors reassess their strategies and risk tolerance.

Sector-specific developments can trigger immediate market shifts as well. For example, the industrial sector continues to thrive due to demand from e-commerce and logistics, while grocery-anchored retail centers are performing well. On the other hand, the office sector shows mixed signals, with conditions varying significantly across different cities [6].

Recent data illustrates these dynamics. In Q3 2024, industrial vacancy rates held steady at 6.8%, while the office sector saw its vacancy rate drop to 20.0% after record highs for three consecutive quarters [6]. These shifts show how different factors affect various property types.

These drivers actively shape how investors approach their strategies in real time.

How Short-Term Trends Affect Investment Decisions

Short-term trends push investors to adapt quickly, influencing decisions around acquisitions, asset repositioning, and risk management.

Acquisition timing becomes crucial in navigating these trends. Investors often adjust their buying strategies based on market conditions and sector performance. Victor Calanog, Global Head of Research and Strategy at Manulife Investment Management, explains:

“The industry is poised to be in a better place compared to the last few years. It appears that the landing will be relatively soft, so that should mean continued positive momentum for economic activity, benefiting leasing and income drivers, including rents and occupancies.”

Repositioning strategies are another way investors respond to short-term market shifts. For instance, markets like Austin, Raleigh-Durham, and Nashville are experiencing multifamily overbuilding [6]. In such cases, investors may need to adjust their timelines or reposition assets to stay competitive.

Sector rotation is a common tactic during these shifts. Calanog notes:

“Good retail in prime locations is likely to do well, despite continued growth of the e-commerce segment.”

This insight helps investors decide which sectors to prioritize based on current conditions.

The office sector presents a particularly nuanced case. While some areas show improvement, Calanog points out:

“There are some suburban office markets that are showing signs of cap rate flatness or even declines.”

This variability requires investors to make location-specific decisions.

Risk management also evolves in response to short-term trends. For example, with 80% of organizations reporting attempted or actual payments fraud in 2023 - a 15-percentage-point increase from 2022 - investors are revising their security and operational practices to address new threats [6].

Emerging trends, such as eco-friendly designs and green buildings, are also gaining traction [7]. These shifts create opportunities for investors who can adapt quickly to meet changing tenant preferences and regulatory demands.

Long-Term Cycles in CRE

What Are Long-Term Cycles?

Long-term cycles in commercial real estate (CRE) are market patterns that unfold over extended periods, typically lasting 10 to 20 years [1]. On average, these cycles span about 18 years [4], showcasing steady and predictable trends. Unlike the sharp ups and downs of short-term market shifts, long-term cycles reflect deeper structural changes driven by factors like demographics and macroeconomic trends. For example, ongoing urbanization significantly impacts how commercial properties are utilized and valued. As Matt Felsot of JPMorgan Chase explains:

“Understanding the real estate cycle can help multifamily investors not only project the income and capital appreciation of their properties, but also use the best investment strategy to maximize returns.”

This insight highlights the importance of grasping these extended cycles to navigate the complexities of the CRE market.

What Drives Long-Term Cycles

Several key drivers influence long-term cycles in CRE. One of the most significant is demographic change. Urban population growth and the expansion of urban land are closely linked, with research showing that a one-unit increase in population growth rate correlates with a 23% rise in urban land expansion [8]. Economic development is another critical factor. For instance, in 2018, high-income nations reported an urbanization level of 81%, compared to just 32% in low-income countries [8]. As Matt Felsot notes:

“The population and shifts within the population can drive a market significantly.”

In addition to demographic and economic factors, technological advancements and government policies play a lasting role. The rise of e-commerce, for example, has driven sustained demand for industrial and logistics properties while reshaping the retail landscape. Meanwhile, tax incentives, zoning laws, and infrastructure projects further shape the trajectory of CRE markets over time.

These factors collectively influence how properties are developed, managed, and valued, making them essential considerations for long-term planning.

How Long-Term Cycles Affect Planning

Long-term cycles serve as a roadmap for sustainable strategies in CRE. While short-term trends often guide immediate decisions, understanding these extended cycles provides a broader perspective for managing portfolios. For instance, investors can align development projects, refinancing efforts, or renovations with specific phases of the cycle. Diversifying holdings across different markets can help mitigate localized downturns, while securing long-term leases during market saturation ensures stability.

Multifamily properties, in particular, tend to perform well over long-term cycles. The consistent demand for housing helps buffer these investments against economic fluctuations. By analyzing long-term cycles, investors can better anticipate market shifts, refine property management strategies, and make more informed decisions about when to buy, sell, or hold assets. This kind of foresight is invaluable for optimizing both short-term performance and long-term success.

Short-Term Trends vs Long-Term Cycles: Side-by-Side Comparison

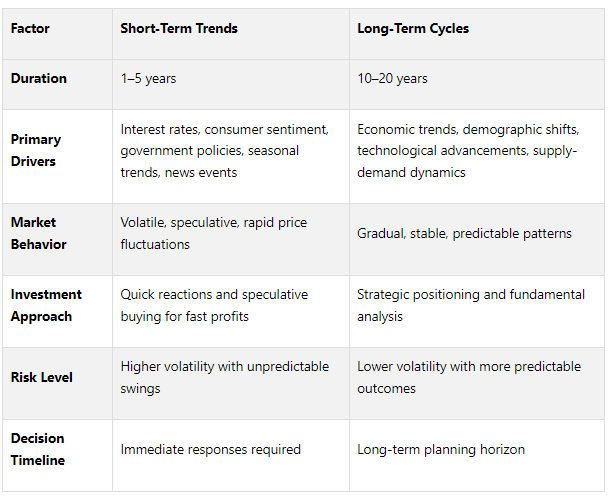

Comparison Table: Main Differences

Grasping the differences between short-term trends and long-term cycles is essential for making sound CRE (Commercial Real Estate) decisions. Here's a breakdown of how these two concepts differ across key factors:

This comparison lays the groundwork for understanding how each affects investment strategies.

How Each Type Affects Decision-Making

The differences between short-term trends and long-term cycles directly shape how CRE professionals approach decision-making. Short-term trends demand quick, reactive strategies. For example, when multifamily permits dropped by 20% and starts fell by 28% in early 2024 [3], investors had to adapt acquisition strategies rapidly, taking advantage of immediate pricing shifts while staying alert to ongoing market changes.

On the other hand, long-term cycles are the backbone of strategic planning and portfolio development. For instance, the $1.8 trillion in commercial loans set to mature in 2026 [9] highlights the importance of understanding where we are in the long-term cycle. This knowledge can guide decisions on refinancing or initiating new development projects.

Timing acquisitions often requires balancing both perspectives. Short-term trends can offer tactical entry points, but long-term cycles provide insight into whether a market's growth trajectory is sustainable. Consider the growing emphasis on sustainability and resilience in building codes [5], a long-term shift poised to impact property values for years to come.

Portfolio diversification also benefits from this dual perspective. Short-term trends might highlight opportunities to shift focus temporarily - such as targeting specific geographic areas or property types - while long-term cycles determine the overall structure of a portfolio. For example, the rise of e-commerce has reshaped retail real estate and driven demand for industrial space [5], illustrating how societal and technological changes influence long-term strategies.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Real Estate Market Cycle Monitor by Dr. Glenn Mueller

How to Use Trends and Cycles in CRE Work

Once you've identified short-term trends and long-term cycles in commercial real estate (CRE), the next step is to apply these insights to financial analysis and asset management strategies effectively.

Using Trends and Cycles in Financial Analysis

Incorporating trend and cycle analysis into underwriting, market research, and forecasting can provide a clearer picture of market dynamics. Key metrics like vacancy rates, rent growth, and cap rates are essential indicators of where a market stands within its current cycle [4].

When evaluating deals, it's important to examine these metrics over both short-term (one to six months) and long-term (six months to five years) periods. This approach not only helps in making quick, informed decisions but also strengthens long-term portfolio planning [10].

Leveraging tools like automated cash forecasting can further refine your financial analysis. For instance, HighRadius' Automated Cash Forecasting Software claims an impressive accuracy rate of up to 95%, which minimizes manual effort and ensures more reliable projections [10]. Accurate long-term forecasting is crucial for positioning assets strategically and avoiding last-minute financial challenges.

Your strategy should align with the market cycle. For example:

During recovery phases, focus on acquiring distressed properties.

In periods of expansion, prioritize development and refinancing opportunities.

At market peaks, consider selling to capitalize on higher valuations.

In recessions, seek discounted assets while carefully managing risks [4].

Improving Asset Management and Reporting

Understanding market trends and cycles can significantly enhance asset management, especially when it comes to stakeholder communication and reporting. Investor reports should include a comprehensive view of past performance, current conditions, and future projections [12]. Trend and cycle analysis provides a structured basis for these insights.

Data visualization tools, such as charts and graphs, can simplify complex market dynamics. These visuals help investors easily understand where assets stand within the market cycle and the reasons behind any shifts [12].

Moreover, these insights are not just for underwriting. They can refine operational strategies and reporting practices. For example:

During expansion phases, focus on improving operational efficiency and reducing costs to maximize returns.

In recessions, implement cost-saving measures and streamline operations [4].

Additionally, prioritizing high-quality assets and managing debt prudently - like reducing leverage or refinancing under favorable terms - can help build a more resilient portfolio [5].

The five pillars of asset management - Planning, People, Process, Portfolio, and Performance - benefit greatly from an understanding of market cycles [11]. Automating investor reporting can also save time and ensure consistency, making it easier to deliver clear and actionable insights [12].

Using The Fractional Analyst and CoreCast

To put these strategies into action, tools like The Fractional Analyst and CoreCast can be game-changers.

The Fractional Analyst offers customizable financial models and expert analyst support tailored to trend and cycle analysis. These models, once priced between $1,000 and $3,000 each, are now freely available for multifamily acquisitions, mixed-use developments, and IRR analysis [13]. This platform recognizes that no single model fits every deal, making its flexibility a valuable asset.

CoreCast, launched in 2024, is an analytics platform designed for real-time insights. It combines financial and operational data to automate quarterly reporting and track performance metrics. Currently in its beta phase, CoreCast is available for $50 per user per month, with pricing expected to rise to about $105 per user per month after full development [14].

Together, these tools address different but complementary needs. While The Fractional Analyst provides the foundational models and customizations required for detailed underwriting and research, CoreCast focuses on ongoing monitoring and automated reporting. This combination allows you to respond swiftly to short-term trends and plan strategically for long-term cycles, creating a balanced and effective approach to CRE management.

Conclusion: Using Both Trends and Cycles for CRE Success

Navigating the commercial real estate (CRE) market effectively means mastering both short-term trends and long-term cycles. Each plays a unique role in shaping a strategy that not only withstands market fluctuations but also seizes opportunities as they arise. Recent market data underscores the importance of blending these two approaches.

For example, commercial real estate values have dropped 24.1% from their 2022 peaks, yet transaction volumes have surged over 35% since hitting their lowest point in the fourth quarter of 2023 [16]. This recovery highlights how understanding cycles can help investors pinpoint when markets are shifting from distress to opportunity.

The secret lies in balancing immediate actions with long-term goals. Short-term trends allow for quick responses to market changes - like the recent growth in healthcare and education jobs, which added 87,000 positions in May 2025 compared to just 52,000 in all other sectors combined [15]. On the other hand, long-term cycles, which typically span about 18 years, provide a broader framework for sustainable growth [4]. Together, these perspectives form the backbone of strategic decision-making.

What sets successful investors apart is recognizing that different markets can be in varying phases of the cycle simultaneously. For instance, while one region might be expanding, another could be entering a downturn. This insight enables strategic diversification and better timing of investments for maximum returns.

The current market conditions further illustrate this dual approach. Net operating income is now 6.1% higher than its Q2 2022 peak, even as construction starts have plummeted by 66–80% [16]. For investors who can interpret both short-term signals and long-term trends, these shifts present unique opportunities.

The most accomplished CRE professionals don’t choose between trends and cycles - they integrate both into their strategies. They use short-term data to act on immediate opportunities while staying committed to long-term fundamentals. By combining solid financial analysis with a deep understanding of market psychology, they position themselves to make well-informed decisions, no matter the market environment. This balanced approach, supported by reliable market intelligence, lays the groundwork for enduring success in commercial real estate.

FAQs

-

To navigate the balance between short-term trends and long-term cycles in commercial real estate (CRE), it’s crucial to first grasp the market's natural rhythm. Typically, this cycle moves through four phases: recovery, expansion, oversupply, and recession. Understanding where the market currently stands in this cycle can provide valuable insights for shaping both immediate actions and future strategies.

In the short term, recovery and expansion phases often present attractive opportunities. This might mean purchasing undervalued properties or focusing on increasing rental income. On the other hand, long-term success relies on sticking to the basics - things like choosing prime locations, ensuring high asset quality, and securing stable tenants. These fundamentals act as a buffer during downturns and help investors capitalize when the market improves. By blending short-term agility with a solid long-term focus, investors can build a strategy that’s flexible yet prepared for the bigger economic picture.

-

Understanding short-term trends and long-term cycles in commercial real estate plays a crucial role in making smarter investment decisions. Recognizing where the market sits in the real estate cycle - be it recovery, expansion, hypersupply, or recession - can help you better time your moves, reduce risks, and strategically decide when to enter or exit the market.

By analyzing these trends and cycles, you can also refine your asset allocation strategy and stay ahead of market changes. This not only strengthens your portfolio against uncertainties but also boosts profitability over time by aligning your decisions with both current market dynamics and broader economic patterns.

-

Demographic trends, including an aging population, urban migration, and shifting household structures, play a significant role in shaping the long-term landscape of commercial real estate. These shifts influence the demand for various property types. For instance, as urban populations grow, the need for multifamily housing tends to rise. Meanwhile, an aging population often sparks increased demand for healthcare facilities and senior living communities.

At the same time, technological advancements are reshaping how properties are marketed and managed. Tools like AI-powered analytics, virtual property tours, and smart building systems are becoming more common. These technologies streamline operations, improve tenant experiences, and help businesses quickly respond to market changes. Together, demographic changes and tech innovations are driving new trends in development, reshaping investment strategies, and influencing the overall dynamics of the commercial real estate market.