Understanding NPV in Real Estate Underwriting

Net Present Value (NPV) is a key financial tool in real estate that helps you decide if an investment is worth it. It compares the present value of future cash flows (like rental income) to the initial investment. Here’s why it’s important:

Positive NPV: The property is undervalued and likely profitable.

Zero NPV: The investment is fairly priced.

Negative NPV: The property is overpriced and may not meet return expectations.

Why NPV Matters:

Accounts for the time value of money (a dollar today is worth more than in the future).

Helps evaluate if returns meet your required rate of return.

Used in acquisitions, developments, refinancing, and portfolio management.

How NPV is Calculated:

Formula: NPV = Σ (CFt / (1 + r)^t) – Initial Investment

CFt = Cash flow in a specific period

r = Discount rate (reflects risk and return expectations)

t = Time period (e.g., years)

Build a cash flow model: Forecast income, expenses, and sale value.

Apply a discount rate: Typically 4%-12% in U.S. real estate.

Quick Example:

Investment: $5,000,000

Annual Cash Flows: $1,200,000 for 5 years

Discount Rate: 5%

NPV: $195,372 (profitable opportunity).

Key Takeaways:

Use NPV to decide whether to buy, hold, or sell properties.

Combine NPV with other metrics like IRR or cash-on-cash return for better insights.

Regularly update assumptions to reflect market changes.

NPV is essential for making smart, data-driven real estate decisions.

Investment Analysis for Commercial Real Estate (an Introduction to NPV & IRR)

Core Components of NPV: Time Value of Money and Discount Rate

Net Present Value (NPV) revolves around two key principles: the time value of money and the discount rate. Together, these concepts help convert future cash flows into their equivalent value in today’s dollars.

Understanding the Time Value of Money

The time value of money (TVM) is a fundamental concept in NPV calculations, especially in real estate underwriting. Simply put, a dollar today holds more value than a dollar received in the future. Why? Because money available now can be invested to generate returns. Add to that the effects of compound interest and inflation, and the picture becomes even clearer. For instance, $100 invested today at a 2% annual return grows to roughly $110.41 in five years. On the flip side, inflation eats away at the purchasing power of money, reinforcing the idea that funds in hand today are more valuable than those promised later.

When assessing a real estate investment, future cash flows - like rental income or eventual sale proceeds - must be discounted back to their present value. This is where the discount rate comes into play, forming the backbone of NPV analysis.

Defining and Selecting the Discount Rate

The discount rate represents the minimum rate of return an investor expects, considering the risks tied to a particular property. It’s a critical part of real estate underwriting because it directly influences the valuation of future cash flows. Choosing the right discount rate involves analyzing several factors, including current market conditions, property-specific risks (like tenant reliability and location), and overall economic trends. For most commercial real estate deals, discount rates typically fall between 5% and 12%.

Tatchada Supakornpichan, Head of Valuation & Advisory at Cushman & Wakefield, explains:

“The discount rate is the rate of return that an investor expects to receive from investing in a particular asset, taking into account the risk and opportunity of the investment.”

Investors often rely on models like the Capital Asset Pricing Model (CAPM) or the Weighted Average Cost of Capital (WACC) to calculate the discount rate. These methods incorporate the costs of both debt and equity, providing a comprehensive view of expected returns.

How Discount Rate Affects NPV Calculations

The discount rate plays a pivotal role in NPV calculations by determining the present value of future cash flows. There’s an inverse relationship: as the discount rate increases, the present value of those cash flows decreases, which lowers the NPV - and vice versa.

A higher discount rate signals greater risk, which reduces the present value of expected cash flows. This rate essentially sets the minimum return threshold for an investment. A positive NPV means the returns exceed this baseline, making the investment worthwhile, while a negative NPV indicates the returns fall short.

Understanding this dynamic helps investors determine the maximum price they can justify paying for a property. It also allows them to evaluate whether an investment aligns with their financial goals. By adjusting the discount rate to reflect their risk tolerance and return expectations, investors can make smarter decisions about acquisitions, development projects, and portfolio strategies in the competitive U.S. commercial real estate market.

Step-by-Step NPV Calculation for Real Estate Projects

To calculate Net Present Value (NPV) for real estate projects, you'll need to focus on three key steps: understanding the formula, building a cash flow model, and running scenario analyses. Let’s break it down.

Breaking Down the NPV Formula

The formula for NPV is: NPV = Σ (CFt / (1 + r)^t) – Initial Investment. Here’s what each term means:

CFt: Cash flow during a specific time period.

r: Discount rate, representing the investment's risk and return expectations.

t: The number of periods (e.g., years).

Cash inflows might include rental income, parking fees, storage income, and other revenue sources. For commercial properties, this could also involve percentage rents from retail tenants or income from rooftop leases for cell towers.

Cash outflows represent expenses like property taxes, insurance, maintenance, management fees, and capital expenditures. These reduce your net cash flow, so estimating them accurately based on market trends and property conditions is critical.

The holding period is the length of time you plan to keep the investment, typically measured in years. It directly impacts your cash flow forecasts and terminal value calculations.

The discount rate, as discussed earlier, helps account for the investment's risk and the time value of money.

Building a Discounted Cash Flow (DCF) Model

A solid DCF model starts with clear assumptions and projections. Begin with a real estate proforma, which outlines expected cash inflows and outflows over the investment period. This proforma acts as the backbone of your NPV calculation.

Forecast operating cash flows: Estimate rental income growth, potential vacancy rates, and changes in operating expenses.

Calculate terminal value: This is the property's estimated sale price at the end of the holding period. You can determine this by applying a capitalization rate to the final year’s net operating income or using market data to project future value.

Discount future cash flows: Convert future cash flows into present value by applying the formula (1 + r)^t for each year.

Subtract the initial investment: Include costs like the purchase price, closing fees, immediate capital improvements, and working capital needs. The result gives you the NPV.

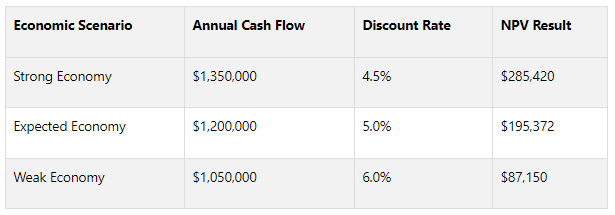

For example, ABC Corporation analyzed a 50-unit apartment building priced at $5,000,000. They projected annual cash flows of $1,200,000 over five years and applied a 5% discount rate. Their NPV calculation showed $195,372, signaling a profitable opportunity.

Scenario Analysis: Comparing NPV Outcomes

Once your cash flow model is ready, you can evaluate investment risks using scenario analysis. This involves testing how different market conditions and assumptions impact your returns.

Create three scenarios: Best-case, most likely, and worst-case outcomes. Each scenario should use different assumptions for rental growth, vacancy rates, operating costs, and terminal values. This helps you understand the range of possible results and assess your risk tolerance.

Identify key variables: Systematically adjust critical assumptions to see which factors have the biggest influence on NPV. For instance, a $1 change in net revenue per unit could significantly affect your overall returns.

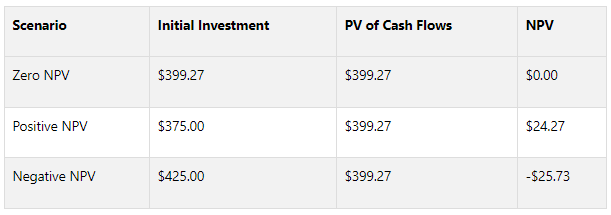

Use comparison tables: They make it easier to visualize how different scenarios affect NPV. Here’s an example:

Stress test extreme conditions: Model scenarios with higher vacancy rates, lower rents, or increased capital expenditures to see how your investment performs during downturns.

Finally, document your assumptions for each scenario, explaining the reasoning behind your projections. This is especially important when presenting your analysis to stakeholders like investors or lenders. Scenario analysis ensures you’re prepared for a range of market conditions and helps confirm whether the investment aligns with your goals.

Using NPV to Make Real Estate Investment Decisions

Once you've calculated the Net Present Value (NPV) for a real estate project, the next step is figuring out how to use it to guide your investment decisions. NPV does more than just show potential profit - it helps you determine whether an investment genuinely adds value.

The NPV Decision Rule

The NPV decision rule is simple:

Positive NPV means potential profit, as the discounted future cash flows exceed the property's cost.

Zero NPV indicates you're paying a fair price, with the acquisition cost matching the property's intrinsic value.

Negative NPV suggests overpaying, as the expected cash flows don't justify the investment.

For example, a property with a positive NPV signals that the investment is likely to generate returns above its cost. On the other hand, a negative NPV means the property may not deliver sufficient returns to make it worthwhile. Properties with long-term, stable leases might justify lower discount rates, while those requiring significant renovations or facing market risks typically demand higher rates to offset the uncertainty.

To get a clearer picture, it's often helpful to combine NPV with other metrics.

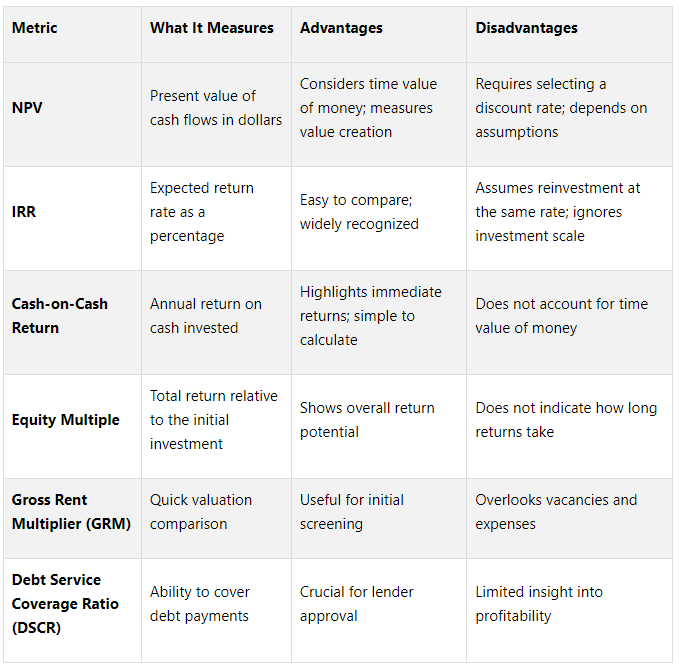

Combining NPV with Other Metrics

While NPV is a powerful tool, it works best when used alongside other performance measures. Metrics like Internal Rate of Return (IRR), cash-on-cash return, and equity multiple give additional perspectives on both short-term and long-term performance.

For instance, a property boasting an NPV of $200,000 and an IRR of 15% represents strong returns. By looking at NPV together with IRR and equity multiple, you can evaluate both the immediate financial benefits and the property's future potential. This comprehensive approach ensures you're making well-rounded investment decisions.

Real Estate NPV Applications and Examples

Here’s how NPV plays a role in various real estate scenarios:

Acquisition Analysis:

When assessing a potential purchase, NPV helps you determine if the acquisition price aligns with expected future cash flows. For example, a stabilized office building with an NPV of $600,000 offers more value than one with an NPV of $400,000. By discounting future cash flows to their present value, NPV shows whether the purchase cost is justified.Development Projects:

Development projects often require significant upfront costs with limited cash flow during construction. NPV helps you decide if the future returns will sufficiently compensate for these early expenses and associated carrying costs.Refinancing Decisions:

In refinancing, NPV can compare refinancing costs to the present value of expected interest savings. For instance, if refinancing costs $75,000 but results in $200,000 in NPV interest savings, the refinancing option is clearly a sound financial choice.Exit Strategy Planning:

NPV is a valuable tool for planning when to sell a property. By comparing the NPV of holding onto the property for a few more years versus selling it now, you can identify the most profitable timing. Factors like projected rent growth, future capital expenditures, and market trends all influence this decision.Value-Add Opportunities and Portfolio Optimization:

For properties needing renovations, NPV helps determine if the improvement costs will be outweighed by increased rental income or property value. When managing a portfolio, NPV analysis allows you to compare properties and allocate capital to those with the highest potential for value creation.

Regularly updating your assumptions and reevaluating return metrics is essential, especially as market conditions shift. Staying on top of these changes ensures you're making informed decisions in a constantly evolving real estate landscape.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Common Challenges and Best Practices in NPV Analysis

NPV is a powerful tool, but it comes with its own set of challenges that can influence investment decisions. Understanding these hurdles and following practical approaches can lead to more dependable analyses.

Challenges in Estimating Future Cash Flows

One of the biggest obstacles in NPV analysis is accurately estimating future cash flows. Market fluctuations, unexpected economic changes, and limited data can all make long-term projections shaky. For instance, if local market conditions shift unexpectedly, vacancy rates might climb higher than anticipated, cutting into rental income. Such forecasting errors can result in returns that fall short of expectations. Additionally, a lack of reliable historical data often forces analysts to rely on educated guesses instead of solid benchmarks.

To address these issues, it’s important to identify potential risks early, adjust the discount rate to account for uncertainties, and factor in both current and projected vacancy rates. Incorporating these considerations into your analysis and conducting robust sensitivity testing can help improve accuracy [28,29].

Enhancing NPV Accuracy Through Sensitivity Analysis

Sensitivity analysis is an essential method for managing the inherent uncertainties in NPV calculations. It allows you to see how changes in key variables can influence a project's financial outcomes. Even small shifts in factors like rental income, interest rates, or operating expenses can have a significant impact on cash flows.

Here are a few examples:

A 5% increase in rental rates could boost annual cash flow by around 10%, assuming stable occupancy.

A 10% drop in property value might reduce the equity portion of an investment.

A 1% rise in interest rates could increase monthly mortgage payments by roughly 10% on a typical 30-year fixed mortgage.

To get the most out of sensitivity analysis, it’s wise to focus on critical variables, use conservative estimates, and update your calculations regularly as market conditions change [33,36]. This approach helps refine your understanding of potential outcomes and leads us to explore how NPV compares with other metrics.

NPV vs Other Underwriting Metrics

In addition to addressing forecasting challenges and incorporating sensitivity analysis, comparing NPV with other key metrics can improve the depth of your investment analysis. Each metric offers a different perspective:

While NPV calculates the present value of expected cash flows in dollar terms, IRR identifies the discount rate at which the present value of all cash flows equals the initial investment. However, IRR assumes that cash flows can always be reinvested at the same rate, which may not be realistic. Additionally, IRR doesn’t account for the scale of the investment, making complementary metrics like cash-on-cash return and equity multiple valuable tools for a more complete analysis [38,39]. By combining these metrics, investors can gain a clearer picture of an investment’s potential performance and associated risks.

Using The Fractional Analyst for NPV-Based Underwriting

NPV analysis can be daunting, but having the right support makes it much more manageable. By tackling the challenges of estimation and sensitivity analysis, The Fractional Analyst simplifies decision-making. Combining advanced financial modeling with practical tools, their CoreCast platform offers both expert services and self-service solutions to streamline your underwriting process.

How The Fractional Analyst Improves NPV Analysis

The Fractional Analyst provides tailored, on-demand expertise to address common hurdles in NPV analysis, such as creating accurate cash flow projections and conducting sensitivity analysis.

Their team customizes financial models to fit unique property types and complex financing structures that standard templates often fail to capture. Whether you're dealing with a mixed-use project with varied revenue streams or a multifamily property undergoing phased renovations, their analysts build models that account for all the details of your deal.

The platform also automates workflows and reporting, eliminating time-consuming manual processes. By applying best practices gathered across various portfolios, they deliver solutions that sharpen decision-making without adding unnecessary layers of complexity. This broad experience helps uncover blind spots in your analysis that might go unnoticed when working independently.

For continuous support, fractional analysts can integrate into your regular operations, such as weekly meetings or monthly financial reporting. This ensures your NPV models remain accurate as market conditions evolve, keeping key assumptions like discount rates and cash flow projections up-to-date.

The Fractional Analyst also offers flexible pricing options, including hourly rates, project-based fees, and monthly retainers. This makes professional-grade NPV analysis accessible to firms of all sizes, allowing real estate professionals to request help with financial modeling, portfolio analytics, or due diligence - without committing to long-term hires.

Free Financial Models and Expert Support

Beyond their direct services, The Fractional Analyst provides practical tools to enhance your analysis. Their free, downloadable models are built on industry standards, giving you a solid starting point for creating detailed DCF models tailored to your specific deals.

Their expertise extends to precision underwriting for commercial real estate. By leveraging top-tier data sources, they conduct thorough market research to identify trends and opportunities, ensuring your NPV assumptions align with current market conditions rather than outdated figures.

The platform integrates seamlessly with various data sources, helping you manage and organize data into clear, actionable formats. This streamlined data management is crucial for building accurate cash flow projections, which are the backbone of reliable NPV calculations.

When it comes to presenting your findings, The Fractional Analyst offers data-driven reports for investors and lenders, as well as professionally designed pitch decks. These tools help translate complex analyses into straightforward insights that support investment decisions and financing efforts.

Their CoreCast platform takes things further by offering automated underwriting across major asset classes and risk profiles. Features like advanced pipeline tracking, portfolio management, and branded, one-click reports make it easier than ever to manage your underwriting process.

The Fractional Analyst’s mission is to empower real estate professionals by combining expert human insights with cutting-edge technology. Their tools not only simplify operations but also enhance collaboration and decision-making. With capabilities like integrating individual underwriting results into a dynamic portfolio dashboard, they provide a comprehensive view of how each NPV outcome contributes to overall portfolio performance.

Key Takeaways on NPV in Real Estate Underwriting

Net Present Value (NPV) acts as a guiding tool for commercial real estate professionals, offering a way to measure the present value of future cash flows against the initial investment. This metric provides a straightforward indication of whether a project adds value or results in a loss.

A positive NPV signals a value-adding investment.

A zero NPV means the investment is fairly priced.

A negative NPV suggests the investment may lead to overpayment.

What sets NPV apart is its focus on the time value of money. Unlike basic return-on-investment calculations, NPV accounts for the timing of cash flows, making it especially useful for long-term projects where income and expenses stretch across many years.

NPV consolidates all expected cash flows - construction costs, rental income, operating expenses, and property appreciation - into a single, easy-to-compare figure. Whether you're assessing a mixed-use development or purchasing an office building, this comprehensive approach ensures all financial aspects are considered.

Another strength of NPV lies in its ability to support risk management through scenario analysis. By adjusting assumptions around rental income, operating costs, or property appreciation, investors can explore how different market conditions might impact profitability. This helps to pinpoint risks before they become problems.

To refine decision-making, NPV is often paired with other tools like sensitivity testing and complementary financial metrics. Together, these methods strengthen the investment process. The rule remains simple: move forward only if the projected cash flows result in a zero or positive NPV. When combined with qualitative factors - such as location, market trends, and management expertise - NPV becomes part of a well-rounded investment strategy.

Using NPV consistently across various projects also helps optimize portfolios. It reveals the most financially sound opportunities and ensures capital is allocated efficiently.

Performing accurate NPV analysis depends on realistic cash flow projections and selecting an appropriate discount rate. Creating multiple projections, from conservative to optimistic, offers a better understanding of potential outcomes than relying on a single estimate.

FAQs

-

The discount rate is a key factor in calculating the Net Present Value (NPV) for real estate investments. When the discount rate is higher, the present value of future cash flows decreases, which lowers the NPV. On the other hand, a lower discount rate boosts the present value of those cash flows, leading to a higher NPV.

Selecting the appropriate discount rate involves considering several elements, including the investment's risk level, anticipated returns, and current market conditions. Getting this calculation right is critical for making sound underwriting decisions and accurately assessing a property's potential profitability.

-

Forecasting future cash flows for NPV analysis in real estate is no walk in the park. Market uncertainties - like shifts in property values, fluctuations in rental income, and unpredictable operating costs - can make it tough to pin down accurate projections. On top of that, choosing the right discount rate to account for the investment's risk adds another layer of complexity.

To tackle these hurdles, you can use sensitivity analyses to see how changes in key assumptions might affect the NPV. Combining this with reliable market data, well-built financial models, and expert opinions can significantly refine your cash flow estimates. Platforms like The Fractional Analyst also come in handy, offering tailored financial tools and insights to streamline decision-making and assess risks more effectively.

-

Scenario analysis sharpens the precision of Net Present Value (NPV) calculations by examining how shifts in market conditions and assumptions could impact a real estate project’s profitability. It involves testing different scenarios - like best-case, worst-case, and most likely outcomes - while tweaking key factors such as estimated cash flows, discount rates, and market growth rates.

This method helps uncover potential risks and uncertainties, providing a more comprehensive view of how a project could perform in various situations. By applying scenario analysis, investors gain valuable insights, anticipate possible hurdles, and improve the dependability of their NPV evaluations.