Operating Costs vs. Capital Expenses in CRE

Understanding the Difference: Operating Costs vs. Capital Expenses

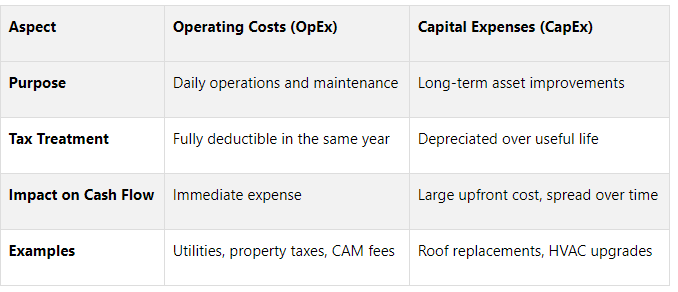

Managing commercial real estate (CRE) finances effectively starts with knowing the difference between Operating Costs (OpEx) and Capital Expenses (CapEx). Here’s a quick breakdown:

Operating Costs (OpEx): Day-to-day expenses to keep the property running. Examples: property taxes, utilities, insurance, and maintenance. These impact Net Operating Income (NOI) directly and are fully tax-deductible in the year incurred.

Capital Expenses (CapEx): Long-term investments to improve or maintain the property’s value. Examples: roof replacements, HVAC upgrades, or building expansions. These are capitalized and depreciated over time, spreading tax benefits across years.

Key Differences:

Why It Matters:

Properly classifying OpEx and CapEx is crucial for accurate financial modeling, property valuation, and tax planning. Misclassifications can distort NOI, cap rate, and investment decisions.

For CRE professionals, tools like financial modeling platforms can simplify this process, ensuring better cash flow management and investor returns.

1. Operating Costs

Definition

Operating expenses (OpEx) refer to the ongoing costs required to keep a property running smoothly and generating income. For multi-tenant properties, these costs are typically divided among tenants based on their share of the space. In contrast, single-tenant properties usually pass the full expense on to the tenant.

“Operating expenses are the costs associated with operating and maintaining a commercial property such as an office building or retail center.”

To understand how these costs work in real life, let’s explore some key examples.

Examples

Operating expenses in commercial real estate often include:

Property Taxes: These have seen a sharp rise, nearly doubling over the last decade [3].

Insurance Premiums: Covering risks like liability and property damage.

Utilities and Maintenance Costs: Such as electricity, water, and HVAC maintenance.

Common Area Maintenance (CAM) Fees: Covering expenses like management salaries, building repairs, property lighting, parking lot upkeep, janitorial services, landscaping, and snow removal.

Administrative and Professional Services: Including management, accounting, legal services, advertising, security, and pest control.

On average, commercial property owners spend about $6.79 per square foot on operating expenses [2].

Accounting Treatment

Operating expenses are recorded on the income statement and deducted from gross rental income to calculate the Net Operating Income (NOI). These costs are generally recognized when incurred. For instance, property taxes might be accrued monthly even if they’re paid annually, while utilities are recorded based on actual usage.

The way leases are structured also affects how these expenses are handled. For example:

Triple Net (NNN) Leases: Common in industrial and retail properties, where tenants pay for taxes, insurance, and CAM fees in addition to base rent.

Full-Service Leases: Often used for office properties, where landlords cover all operating expenses.

Modified Gross Leases: A middle ground where tenants take on specific costs like utilities, while landlords handle the rest.

Impact on Financial Modeling

Accurate accounting of operating expenses plays a crucial role in financial modeling. Mistakes in expense forecasts can disrupt NOI calculations and lead to inaccurate property valuations. Typically, the Operating Expense Ratio (OER) for commercial properties ranges between 30% and 50% of gross rental income [3]. Falling outside this range could indicate either exceptional efficiency or potential operational problems.

Getting OpEx right is essential for reliable NOI and capitalization rate analyses, which are key to making sound investment decisions. Detailed financial models not only improve the chances of securing financing by 50% but can also boost returns by up to 30% [4]. Including scenario analyses - like accounting for potential increases in controllable costs such as CAM fees - and regularly comparing actual costs to projections helps keep financial models accurate and actionable.

2. Capital Expenses

Definition

Capital expenditures (CapEx) refer to the money spent on acquiring, upgrading, or maintaining long-term assets like property, buildings, technology, and equipment. While operating expenses (OpEx) cover the costs of daily operations, CapEx focuses on extending the life or capacity of assets [6].

“Capital expenditures are payments that are made for goods or services that are recorded or capitalized on a company’s balance sheet rather than expensed on the income statement”

To qualify as CapEx, an expense must involve a newly acquired capital asset, represent an investment lasting more than a year, or enhance the useful life of an existing asset [6]. In commercial real estate, this distinction is critical for both financial planning and tax strategies. It also highlights how CapEx affects balance sheets and cash flow projections differently compared to OpEx.

CapEx typically falls into two categories: maintenance CapEx, which supports current operations, and growth CapEx, which aims to expand future potential [7]. Understanding these categories helps property owners make informed investment decisions and improve cash flow forecasting.

Examples

Capital expenses often involve significant investments that protect or improve the long-term value of a property. Common examples include:

HVAC System Replacements: Full system upgrades that prolong a building's lifespan.

Roof Replacements: Structural improvements designed to last 15–20 years.

Elevator Modernization: Upgrades for better efficiency and safety.

Parking Lot Resurfacing: Major pavement work beyond routine fixes.

Building Expansions: Adding new structures or increasing square footage.

Technology Infrastructure: Installing fiber optic networks or advanced automation systems.

For instance, in 2022, Amazon reported $63.645 billion in capital expenditures related to "purchases of property and equipment" [7]. This showcases the scale of CapEx investments for companies with large real estate portfolios.

Accounting Treatment

CapEx is recorded as a capitalized asset and depreciated over its useful life. For example, a $100,000 HVAC system with a lifespan of 15 years would incur an annual depreciation expense of about $6,667. However, land is an exception - it does not depreciate over time [8].

Unlike OpEx, CapEx cannot be fully deducted from taxes in the year it occurs [6]. Instead, depreciation spreads the tax benefits over the asset's useful life. This creates timing differences in cash flow, which are essential to consider during financial planning.

On financial statements, CapEx is listed under the "cash flow from investing activities" section, keeping it separate from operational cash flows [6].

Impact on Financial Modeling

CapEx decisions play a key role in shaping cash flow and overall financial performance. Since capital expenses directly reduce free cash flow, they are a critical factor in financial modeling and investment analysis for commercial real estate [6]. Effective planning involves forecasting future capital needs, prioritizing projects, and evaluating their potential returns [5]. Property owners must weigh immediate cash flow requirements against long-term asset value. Strategic capital improvements can boost property appeal, leading to higher rents and better occupancy rates.

Tracking CapEx levels can provide insights into financial stability and management strategies [10]. When creating financial models, it’s helpful to use historical CapEx ratios and industry benchmarks to set realistic projections. Additionally, reviewing property management reports and market data can help identify upcoming capital needs and their timing [9]. Striking the right balance between CapEx and OpEx is essential for maintaining and enhancing property value.

Capital Expenditures vs Operating Costs

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

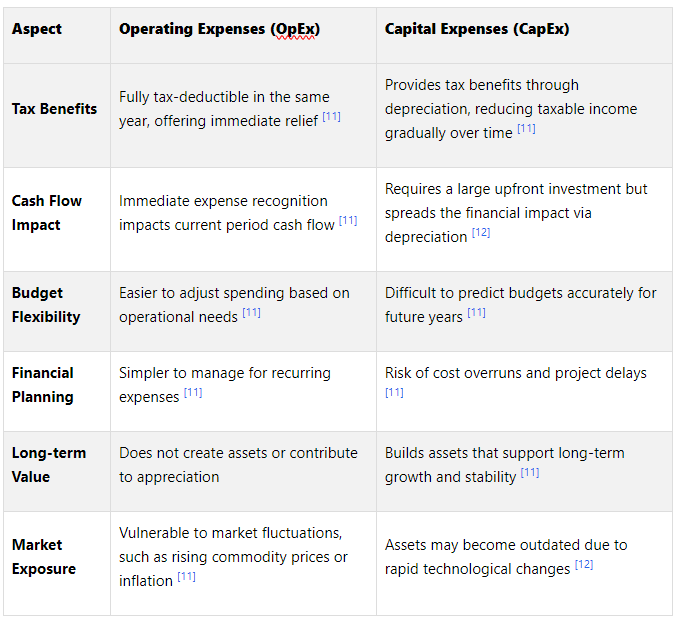

Advantages and Disadvantages

Understanding the trade-offs between operating expenses (OpEx) and capital expenses (CapEx) is crucial for managing cash flow, tax planning, and long-term asset performance. Each approach comes with its own set of benefits and challenges that can significantly influence a property’s financial health.

Operating Expenses: Flexibility and Immediate Impact

Operating expenses offer adaptability and short-term benefits. For example, property managers can adjust maintenance contracts, utilities, or staffing levels based on current market conditions and occupancy rates. This flexibility proves invaluable during periods of economic uncertainty. However, rising costs - like energy prices, insurance premiums, or inflated service contracts - can quickly erode profit margins, making constant cost management essential [12].

Capital Expenses: Building for the Future

Capital expenditures focus on long-term growth and efficiency. Investments in technology and equipment can lower future operating costs while improving tenant satisfaction. These expenditures are particularly appealing in markets where property values are appreciating. For instance, a strategic improvement that increases a property's net operating income by $100,000 could, at a 5% cap rate, boost the property’s value by $2 million [13]. However, CapEx projects often require significant upfront capital and carry risks like cost overruns or obsolescence due to technological advancements [12].

Cash Flow Considerations

Choosing between OpEx and CapEx often boils down to cash flow management. Operating expenses generally align with predictable monthly outflows, making them easier to incorporate into rental income planning. In contrast, capital expenditures can strain liquidity, particularly if not carefully planned [12].

Balancing OpEx and CapEx for CRE Success

Both OpEx and CapEx come with inherent risks - OpEx faces market volatility, while CapEx involves execution and obsolescence challenges. A balanced approach is key to effective commercial real estate (CRE) strategy. Properties that manage cash flow efficiently are better equipped to navigate economic downturns and interest rate hikes [13]. Combining operational flexibility with well-planned capital investments ensures financial stability. Conservative budgeting and maintaining operating buffers can support strategic improvements without jeopardizing liquidity.

Conclusion

Grasping the difference between operating expenses (OpEx) and capital expenditures (CapEx) is a cornerstone of effective financial management in commercial real estate (CRE). While OpEx covers the costs of daily operations, CapEx focuses on long-term investments in asset improvements. Understanding these categories is crucial for building reliable financial models, creating accurate budgets, and making informed decisions about investments, loan underwriting, and property valuation.

Accurate financial modeling plays a key role in identifying market opportunities and maximizing returns. For CRE professionals looking to refine their financial analysis, tools like the Fractional Analyst can be a game-changer. This platform provides tailored financial models, expert insights, and free downloadable templates - all available through a subscription starting at $300 per user [14].

As the CRE landscape continues to shift, managing OpEx and CapEx effectively, combined with precise financial modeling, equips properties to weather market fluctuations, secure competitive financing, and achieve strong financial performance.

FAQs

-

Misclassifying operating expenses (OpEx) and capital expenses (CapEx) can create major financial issues for a commercial real estate property. For instance, treating CapEx as OpEx can make current expenses look higher than they really are. This, in turn, reduces net income and cash flow, potentially giving investors and lenders a skewed view of the property's profitability.

On the flip side, if OpEx is incorrectly classified as CapEx, costs are spread out over future periods. While this might make current profits appear higher, it understates actual expenses. The result? Inaccurate property valuations and flawed financial analyses. Getting these classifications right is crucial - not just for accurate financial reporting, but also for managing cash flow effectively, staying compliant with tax laws, and ensuring smart investment decisions and dependable property performance evaluations.

-

Balancing operating expenses (OpEx) and capital expenditures (CapEx) in commercial real estate (CRE) calls for a thoughtful, data-focused strategy. A good starting point is to evaluate financial ratios like the Cash Flow to Capital Expenditures Ratio. This will give you a clear picture of whether your operational cash flow can comfortably support planned investments, ensuring your spending aligns with long-term objectives.

Keep a close eye on market trends and economic shifts to prioritize projects that are truly necessary, helping you avoid stretching your budget too thin. Streamlining recurring costs and timing major upgrades during periods of strong cash flow can ease financial pressure. By staying prepared and adaptable, CRE professionals can safeguard financial health while improving overall portfolio performance.

-

Managing the finances of a commercial property requires understanding two key categories of expenses: operating expenses (OpEx) and capital expenditures (CapEx). Each plays a distinct role in maintaining the property and influencing its financial health.

OpEx covers the regular, day-to-day costs of running the property. Think of expenses like maintenance, utilities, and property management fees. These are recurring costs that are deducted immediately, which might impact short-term cash flow but can also deliver tax advantages within the same year.

CapEx, on the other hand, involves more substantial, long-term investments. This includes things like major renovations, system overhauls, or structural upgrades. Unlike OpEx, these costs are capitalized and depreciated over time. While they can initially put pressure on cash flow, they often enhance the property’s value, increase its income potential, or make it more appealing for resale in the future.

Striking the right balance between OpEx and CapEx is crucial. It ensures steady cash flow while keeping the property competitive and profitable in the long term. Careful financial planning, backed by expert insights, can guide you in making smart decisions for your commercial real estate investments.