Step-by-Step Guide to Adjusting Comparable Sales

Adjusting comparable sales is essential for accurate property valuation in commercial real estate (CRE). It ensures fair comparisons by accounting for differences in location, size, condition, and market trends. Here’s what you need to know:

Why It Matters: Adjustments help align comparable properties with the subject property, avoiding overvaluation or undervaluation.

Key Factors: Market timing, location, property features (like size, age, and condition), and transaction details (e.g., concessions or financing terms).

How It’s Done:

Select Comparables: Use recent, similar sales in the same area.

Calculate Adjustments: Adjust for market conditions, location, and physical differences.

Validate Results: Ensure adjusted prices are accurate and consistent.

Document Everything: Record methods, data sources, and calculations for transparency.

Pro Tip: Use tools like CoreCast for real-time market insights and structured adjustment tables to streamline your analysis.

Accurate adjustments lead to reliable valuations, helping investors and appraisers make smarter decisions.

Determine Property Value: Sales Method Made Easy #commercialrealestate #realestateinvesting

Main Factors That Require Comparable Sales Adjustments

When it comes to accurate commercial real estate (CRE) valuations, adjustments for market conditions, location, physical features, and transaction specifics are key. These adjustments help account for differences in comparable sales that affect property values.

Market Conditions and Sale Timing

The timing of a sale can significantly impact its value, especially when market conditions change. As Fannie Mae guidelines highlight:

“Market condition adjustments must be based on observable market changes and supported with empirical evidence.”

Adjustments should align with the market's phase. For example:

During growth periods, focus on recent transactions.

In stable markets, consider a broader range of sales.

During market corrections, use conservative adjustments [1].

To ensure accuracy, tools like paired sales, market indices, and graphs can be used to validate adjustments [5]. For instance, an appraiser in Dallas, Texas, observed a 5% increase in the S&P CoreLogic Case-Shiller Dallas Home Price Index over six months. Based on this, they applied a 5% upward adjustment to a sale from six months earlier [5]. Broader economic indicators - such as interest rates, employment levels, and consumer confidence - along with pending sales and active listings, also guide these adjustments [5].

But timing isn’t the only factor; where a property is located matters just as much.

Location and Submarket Differences

Geographic differences can lead to significant variations in property values, making location-based adjustments essential. Even within a single metro area, submarkets often have distinct investment profiles and pricing. Take the Orlando-Kissimmee-Sanford MSA, for example, which includes over 30 submarkets [7]. In this region, the Airport/Lake Nona area is known for office and industrial properties, while Winter Park/Maitland leans toward residential real estate [7].

Key factors like accessibility, visibility, and nearby amenities also play a role in property values. Properties in high-traffic areas with excellent access often command higher prices, while those in less desirable locations may see lower values [6]. Additionally, zoning laws and regulations can heavily influence property value, so reviewing local zoning details is critical when making adjustments [6].

Physical Property Features

Physical differences between properties often require adjustments to ensure fair comparisons. One common example is size - appraisers typically calculate cost per square foot for comparable properties and adjust based on square footage differences [8]. Other factors include:

Age and condition: Older properties or those in poor condition may require downward adjustments.

Construction quality: Materials, finishes, and systems like HVAC can impact value.

Special features: Parking, loading docks, or upgraded equipment often warrant specific cash value adjustments [8].

The National Association of Realtors notes that proximity to work, transportation links, and schools are major factors in property selection, with larger outdoor spaces also being a popular consideration [8]. Layout and functionality, which affect how well a property serves its purpose, further influence market value.

Sales Concessions and Financing Terms

Sales concessions and financing terms can skew the effective sale price of a property. For example, seller financing or buyer incentives might push prices outside typical market ranges. Adjustments should reflect how the market reacts to these differences rather than relying solely on nominal figures. As Fannie Mae guidance explains:

“The number and/or amount of the dollar adjustments must not be the sole determinant in the acceptability of a comparable... The appraiser’s adjustments must reflect the market’s reaction (that is, market based adjustments) to the difference in the properties.”

Step-by-Step Process for Adjusting Comparable Sales

Now that we've covered the key factors that require adjustments, let’s dive into how this process actually works. According to a CoreLogic study, adjustments are made in 99.8% of all appraisals [4], highlighting their importance in accurate commercial real estate valuations.

Step 1: Verify Property Data and Select Comparables

The first step in this process is data verification, which lays the groundwork for a reliable comparable sales analysis. Confirm sale prices, terms, and conditions by consulting trusted sources like buyers, sellers, or brokers [11]. Industry guidelines stress the importance of verifying data with independent parties who have no financial stake in the transaction [13].

When choosing comparables, look for properties that closely match your subject property in terms of location, size, layout, amenities, age, and condition [10][12]. Proximity is key - prioritize properties located near the subject property [12]. However, don’t immediately dismiss more distant sales if they offer better alignment on critical factors.

To gather data, use resources like multiple listing services (MLS), public records, real estate agents, and online databases [12]. Be mindful that sales data often lags by about six months, so account for any market changes during that time [15].

Also, consider any unique circumstances that may have influenced sale prices, such as properties sold below market value due to urgent relocations or price negotiations caused by structural issues [14]. For competing neighborhoods, evaluate factors like style, age, construction quality, price trends, amenities, traffic, land use, and accessibility [14].

Step 2: Calculate and Apply Adjustments

Once you’ve verified your data and selected comparables, it’s time to calculate the necessary adjustments. The aim here is to estimate what the subject property would have sold for if it had been available on the same day as the comparable property [17].

For market condition adjustments, paired sales analysis can help quantify shifts in market conditions by comparing similar properties sold at different times [5]. Use local property price indexes, like the CoreLogic HPI or S&P CoreLogic Case-Shiller Index, to guide these adjustments [5]. Comparing pending sale prices with recent closed sales can also indicate whether the market is appreciating, stable, or declining [5].

Location adjustments can be addressed using comparative market analysis (CMA) to identify differences based on factors such as proximity to urban centers, schools, or public transportation [2].

Here are some practical starting points for adjustments:

1% of the sale price for view and location differences (positive or negative) [16].

5% to 10% adjustments for varying property conditions [16].

2.5% to 5% adjustments for differences in quality levels [16].

To calculate adjustments, multiply the adjustment factor by the difference in quantity between the comparable and the subject property [4]. For instance, if the subject property has 1,000 more square feet than a comparable that sold for $500,000, and the value difference is $50 per square foot, you’d add $50,000 to the comparable’s sale price.

Step 3: Check and Confirm Adjusted Results

After applying adjustments, evaluate the results for accuracy. Your adjusted sales price range should be narrower than the original range. As AmeriMac explains:

“If the adjustments are accurate, then the range of possible values is narrow, and the report is more accurate. So, this is the main reason professional appraisers place a lot of emphasis on collecting relevant and substantial market data in order to make the most accurate adjustments.”

Review each adjustment to ensure it aligns with market data and buyer preferences. Cross-reference your results with other valuation methods. If one adjusted value stands out as an outlier, revisit your calculations or the weight assigned to that comparable.

A mix of quantitative and qualitative analysis is essential. The numbers should make sense within the context of the local market and align with broader market trends [11].

Step 4: Record Your Methods and Calculations

Finally, document your methods and calculations for transparency and future reference. This step ensures your analysis is clear, professional, and easy to follow. Record your adjustment methods, data sources, and reasoning for each comparable property [11]. This not only supports your conclusions but also provides a reference for future valuations.

Be sure to explain why certain sales were excluded [14]. If you’ve used more distant sales or properties with noticeable differences, detail your reasoning and how you accounted for neighborhood disparities [14].

Include specifics like adjustment factors, supporting market data, and calculation methods. Note the dates of data sources and any relevant communications with market participants.

Experienced appraisers are key to setting accurate adjustments [3]. Your documentation should clearly justify each decision, helping both current analyses and future valuation reviews in commercial real estate underwriting.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Best Practices and Common Mistakes

Nailing comparable sales adjustments means sticking to tried-and-true methods while steering clear of errors that can derail your analysis. The difference between getting it right and missing the mark often boils down to attention to detail and following established guidelines.

Proven Methods for Adjusting Comparable Sales

Use the most up-to-date data available. Focus on comparables from the last 90 days to reflect current market trends [18]. If older sales are necessary, make sure to document your reasoning and apply proper market condition adjustments using reliable data.

Verify property details across multiple sources. Cross-check property information using public records, MLS data, and other independent sources. Keep your adjustments well-documented, using clear tables to outline your factors, data sources, and methods.

Base adjustments on actual market data. Adjustments should reflect how the market values differences between properties [9]. Use tools like paired sales analysis, market surveys, or input from local real estate experts to justify your adjustments. Avoid making arbitrary changes that lack market evidence.

Get a second opinion when needed. For complex adjustments, consult experienced appraisers or real estate professionals. Their insights can help validate your approach and reveal any blind spots [18].

Acknowledge and address data gaps. When no perfect comparables exist, choose the best available alternatives and make well-supported adjustments [9]. Be transparent about these limitations and explain how you accounted for them in your analysis.

These best practices will help you build a solid foundation for your analysis while avoiding the pitfalls outlined below.

Common Mistakes to Avoid

Just as important as following best practices is steering clear of common errors that can compromise your work.

Don’t use outdated or irrelevant comparables. Including properties that don’t align with the subject property can skew your analysis [18]. Avoid forcing a sale into your study just because it’s recent or convenient.

Avoid basing adjustments on opinion or guesswork. Use empirical market data to support your decisions [20]. Personal opinions or vague assumptions weaken your analysis and make it harder to defend.

Factor in recent upgrades and unique features. Conduct thorough property inspections to account for renovations, special amenities, or standout characteristics [18]. Missing these details can lead to inaccurate valuations.

Double-check your math. Errors in calculating square footage or applying adjustments can undermine your entire analysis [18]. Make sure your numbers align with market data.

Rely only on verified data. Use information from independent, unbiased sources. Avoid relying on data from buyers, sellers, or agents, as it may not be impartial [20].

Consider local factors and trends. Pay close attention to location-specific details like zoning, economic conditions, and market trends that could impact property values [19].

The goal is to ensure every adjustment is well-supported, grounded in evidence, and ready to stand up to scrutiny from all stakeholders [5]. By combining these proven methods with an awareness of common mistakes, you’ll produce accurate and defensible comparable sales analyses that reflect true market conditions.

Tools and Resources for CRE Analysts

Once you've established your adjustment process, leveraging advanced tools can make your work more accurate and efficient. Many commercial real estate professionals turn to platforms that merge property data, market insights, and analytics to refine valuations.

The Fractional Analyst and CoreCast: A Closer Look

The Fractional Analyst offers a dual approach to comparable sales adjustments: expert analyst services and self-service technology. Their skilled analysts provide tailored underwriting and market research starting at $95 per hour, giving users access to high-level expertise.

On the tech side, CoreCast serves as their real estate intelligence platform. Designed to tackle the challenges of comparable sales analysis, CoreCast automates data collection and provides real-time market monitoring. Currently in beta at $50 per user per month, pricing is expected to increase to $105 per user per month upon final release.

CoreCast stands out for its ability to streamline quarterly reporting and track key performance metrics. For instance, when market conditions shift quickly, its real-time dashboards allow analysts to spot trends that might require timing adjustments in their comparable sales evaluations. This tool seamlessly integrates with earlier-discussed processes, ensuring adjustments remain consistent and transparent.

AI-powered tools like CoreCast are transforming the industry. Research shows that AI could add between $110 billion and $180 billion in value to the real estate market by enhancing accuracy and consistency through large-scale data analysis [21].

In addition to these platforms, The Fractional Analyst provides free downloadable financial models, such as multifamily acquisition templates, mixed-use development models, and IRR matrices. These templates act as a solid foundation for comparable sales analysis, though they may need to be tailored for more complex scenarios.

Structuring Adjustment Tables for Clearer Analysis

Enhance your analysis by incorporating structured adjustment tables. These tables not only help organize property comparisons but also document the reasoning behind your adjustments, making calculations far more efficient than relying on scattered notes or mental math.

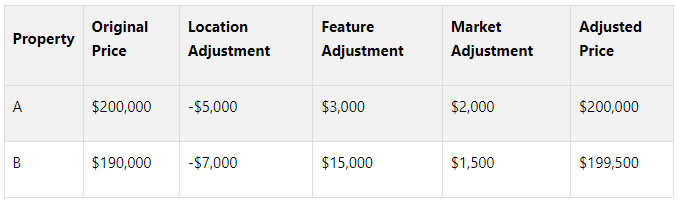

A well-constructed adjustment table should include the original sale price, specific adjustment categories, and the final adjusted value for each comparable property. Here's an example of how such a table might look:

These tables should also clearly document your data sources and explain the rationale behind each adjustment. This level of detail not only supports your conclusions but also ensures your analysis is defensible during stakeholder reviews. For example, noting how market evidence justifies a location adjustment can strengthen your credibility.

To avoid manual errors and improve consistency, many tools allow you to integrate adjustment tables directly with financial software. This enables you to export them into appraisal reports, investment memos, and client presentations effortlessly.

The secret to effective adjustment tables lies in balancing detail with simplicity. Provide enough information to back up your decisions while keeping the format easy to read and verify. This approach not only streamlines your workflow but also ensures your analysis can withstand professional scrutiny.

Key Points for Adjusting Comparable Sales

Getting comparable sales adjustments right is a cornerstone of accurate commercial real estate valuation. Even small errors in this process can lead to big valuation mistakes[22].

The sales comparison approach stands out because it’s based on real transactions[10]. When you have access to a robust set of comparable property data, this method becomes a powerful tool for accurately reflecting current market trends. That’s why making precise adjustments is so essential.

Timing is critical. Market conditions can change quickly, and relying on outdated sales without proper adjustments can throw off your analysis. Adjustments should reflect actual economic shifts and must be backed by clear, observable data.

The goal of adjustments is straightforward: to make the comparable properties more closely resemble the subject property. This allows you to estimate what the subject would have sold for on the same day as the comparable property[17]. To achieve this, adjustments should be calibrated using both market data and professional judgment[23].

When dealing with multiple comparables, prioritization is key. Give more weight to properties that closely match your subject property, and be cautious with those requiring significant adjustments[8]. Adjustments can be expressed in either percentages or dollar amounts and may be qualitative (based on property characteristics) or quantitative (based on measurable differences)[17].

Every adjustment should be documented in detail to hold up under scrutiny from stakeholders[5]. As Fannie Mae highlights, adjustments should reflect actual market behavior rather than being purely mathematical[9].

Beyond quantitative methods, involving third-party experts can add credibility to your analysis. Local real estate agents, market specialists, or other professionals can provide insights to ensure your adjustments align with real market trends[8].

FAQs

-

When accounting for unique features or upgrades in comparable properties, it's essential to evaluate how these differences influence market value. If the comparable property boasts superior features, you'll need to make a negative adjustment to offset its higher value. On the flip side, if the subject property has advantages, a positive adjustment should be applied to reflect those benefits.

Key factors to assess include location, property size, condition, and prevailing market trends. To determine the adjustment amounts, rely on trustworthy sources like recent sales data or market reports. This method ensures your comparisons are balanced and leads to a more accurate property valuation.

-

Adjusting comparable sales becomes much more manageable when you leverage specialized tools and platforms. For example, property valuation software like LightBox or PropStream offers detailed data and insights to help make precise adjustments. Similarly, real estate databases such as Reonomy and CoStar provide extensive market information, making it easier to identify and compare similar properties. On top of that, appraisal tools like the Solomon Adjustment Calculator or Spark simplify calculations, ensuring accuracy and consistency.

By incorporating these tools, commercial real estate professionals can save valuable time and enhance the accuracy of their adjustments, streamlining the entire process.

-

To make sure your comparable sales adjustments reflect current market conditions, it's crucial to stay informed about the latest real estate trends, economic shifts, and local market activity. Pay attention to factors like property value fluctuations, interest rate changes, and the area's supply-and-demand balance.

When making adjustments, consider differences specific to each property - such as size, location, amenities, and overall condition. Always aim to use recent sales data, preferably from the past 3 to 6 months, to capture the most up-to-date market dynamics. Regularly reviewing market reports and seeking advice from industry professionals can further refine your adjustments and improve their accuracy.