Terminal Cap Rate: Real Estate-Specific Factors

The terminal cap rate, also known as the exit rate, is a critical metric in commercial real estate (CRE). It helps estimate a property’s resale value by dividing the final-year net operating income (NOI) by the terminal cap rate. For example, if the NOI is $5.5 million and the cap rate is 4.0%, the estimated sale price would be $137.5 million.

Key points to know:

Why it matters: The terminal cap rate often determines 60–75% of a property’s total valuation, directly influencing metrics like IRR, equity multiple, and NPV.

Market trends: Factors like interest rates, GDP growth, and inflation impact cap rates. For instance, rising interest rates typically increase cap rates, reducing property values.

Property-specific risks: Asset class, location, tenant quality, and lease terms influence cap rate assumptions. Multifamily and industrial properties tend to have lower cap rates due to stable cash flows, while office properties often have higher cap rates.

Calculation formula: Terminal Value = Final-Year NOI ÷ Terminal Cap Rate.

Sensitivity analysis: Small changes in the cap rate can significantly impact valuations. For example, a 0.5% increase in the cap rate can reduce a property’s value by millions.

Best practices: Use thorough market data, create scenarios with varying cap rates, and benchmark against comparable sales to refine assumptions.

Understanding how terminal cap rates work and their impact on valuations is essential for making informed CRE investment decisions.

Formula and Calculation Methods

Basic Terminal Value Formula

At its core, calculating terminal value hinges on a simple formula that brings together three key elements: terminal value, net operating income (NOI), and terminal cap rate.

Here’s the standard formula:

Terminal Value = NOI (Year of Sale) ÷ Terminal Cap Rate

You can also rearrange this formula to solve for other variables depending on what you’re analyzing:

Anticipated Sale Price = Expected Net Operating Income (NOI) ÷ Terminal Cap Rate

Terminal Cap Rate (%) = Expected Net Operating Income (NOI) ÷ Anticipated Sale Price

In this equation, NOI represents the projected income at the time of sale, while the terminal cap rate reflects the return investors expect.

Let’s look at a practical example: A commercial real estate firm purchases a property for $4 million at the end of 2022, generating $460,000 in NOI. By Year 5 (fiscal year ending 2027), the NOI is expected to grow to $656,000. Assuming a terminal cap rate of 8.0%, the projected sale price would be calculated as $656,000 ÷ 0.08, which equals $8.2 million.

While the formula itself is straightforward, predicting future NOI and terminal cap rates is far from easy. These calculations don’t just determine the sale price - they also play a critical role in assessing overall return sensitivity.

How Terminal Cap Rate Affects Investment Returns

Even minor shifts in the terminal cap rate can lead to major changes in valuation, especially since terminal value often accounts for about 75% of the total implied valuation in a discounted cash flow (DCF) model. Small adjustments in the cap rate can significantly impact metrics like IRR, NPV, and equity multiples.

Here’s an example: If a property generates $6 million in final-year NOI, a terminal cap rate of 4.2% would result in a sale price of $142.9 million. But if the terminal cap rate rises to 4.7%, the same property would be worth only $127.7 million - a difference of $15.2 million, or 11% less value.

Higher terminal cap rates reduce projected sale prices, which can turn a profitable investment into a borderline one. This is why experienced investors dedicate substantial time to analyzing market trends and comparable sales to validate their terminal cap rate assumptions.

The relationship between the going-in cap rate and the terminal cap rate is also a key indicator of potential returns. When the terminal cap rate is lower than the going-in cap rate, it suggests potential capital appreciation, assuming the NOI remains stable or grows over the holding period. Investors often target markets and property types where cap rates are expected to decline, offering opportunities for capital gains. To manage these risks, careful analysis and precise calculations are crucial.

Best Practices for Accurate Calculations

Accurate terminal cap rate estimates require up-to-date market data combined with a prudent safety margin. Real estate professionals should gather and analyze as much data as possible to pinpoint a reliable terminal cap rate for their projects.

The most effective strategy is to align the terminal cap rate with current market conditions while incorporating a safety buffer. Many professionals recommend slightly increasing the terminal cap rate beyond the prevailing market rate as a conservative test for the investment.

Sensitivity analysis and thorough documentation are vital tools for strengthening your calculations. Instead of relying on a single terminal cap rate, create scenarios with varying rates - typically adjusting by 25 to 50 basis points above and below your base case. This approach highlights how sensitive your investment returns are to cap rate fluctuations and helps you identify break-even points for your investment strategy.

Another critical step is conducting a comparable sales analysis. Focus on recent transactions involving similar properties in comparable locations and market conditions. Pay close attention to cap rates achieved across different market cycles, as these can provide valuable insights into potential shifts in cap rates over your holding period.

Finally, remember that conservative assumptions often lead to better outcomes in real estate investing. While it’s tempting to use lower terminal cap rates to justify higher purchase prices, sustainable strategies rely on realistic market expectations rather than overly optimistic scenarios.

How To Set The Exit Cap Rate On A Real Estate Deal

Real Estate Factors That Affect Terminal Cap Rate

Making accurate terminal cap rate assumptions can mean the difference between a profitable investment and a costly error. These assumptions hinge on both broader economic conditions and specific property details.

Market Conditions and Economic Trends

Interest rates play a crucial role in shaping terminal cap rates due to their strong correlation. When the Federal Reserve raises rates, borrowing becomes pricier, which typically drives cap rates higher. Investors demand greater returns to balance out the higher financing costs.

For example, between Q2 2023 and Q3 2024, cap rates for multifamily, industrial, and office properties increased by more than 0.4% as interest rates climbed. This demonstrates how quickly market shifts can influence terminal cap rate expectations.

Economic growth also affects cap rates. A growing GDP usually lowers cap rates by increasing demand for real estate. On the other hand, inflation can complicate this dynamic. Rapid rent increases, especially for short-term lease properties like apartments, can boost net operating income (NOI), helping to offset the impact of higher interest rates.

Looking ahead, there are signs of potential cap rate compression. Market forecasts suggest that interest rates could drop in 2025, reducing borrowing costs and likely lowering cap rates. CBRE anticipates gradual cap rate compression starting in Q4 2024, with more noticeable declines by 2025. Their projections include industrial cap rates falling by 40 basis points, retail by 35 basis points, multifamily by 25 basis points, and office by 20 basis points by the end of 2025.

Supply and demand dynamics also shape cap rates. Markets with tight supply and strong demand often have lower cap rates, while oversupplied markets see the opposite. These trends can vary widely across asset classes, depending on performance and future outlook.

Property-Specific Risk Factors

In addition to regional trends, property-specific characteristics heavily influence cap rate assumptions. Asset class, for one, is a key factor. Multifamily and industrial properties generally have lower cap rates due to their perceived stability and reliable cash flows. In contrast, office properties - facing challenges like higher vacancy rates - have seen cap rates rise above 8% on average by 2024.

Location quality also matters. Properties in high-demand, stable areas tend to command lower cap rates. For instance, markets like New York often have lower cap rates compared to smaller, less competitive markets.

Other factors, such as tenant quality, lease terms, and property condition, also play a role. Properties with high-quality tenants and long-term leases typically secure lower cap rates. Similarly, a newly built Class A office building will generally trade at a lower cap rate than an older Class B property that requires significant upgrades.

Different property types bring varying levels of risk. Multifamily properties are often seen as less risky, leading to lower cap rates. Meanwhile, assets like hotels or restaurants, which are considered higher risk, tend to have higher cap rates. These risk assessments directly shape terminal cap rate assumptions in financial models.

Using Comparable Sales for Benchmarking

To refine terminal cap rate assumptions, comparable sales provide a practical benchmark. Historical transaction data offers insight into what investors have paid for similar properties under similar market conditions. As the FNRP Editor at First National Realty Partners puts it:

“As such, the closest a real estate investor can get to a ‘good’ terminal cap rate is one that is close to those obtained in historical sales of comparative properties, adjusted for expected market conditions at the time of sale.”

The key is adjusting historical cap rates to reflect future market conditions. Cap rates from past transactions need to account for changes in interest rates, supply levels, and economic trends to remain relevant for a future sale.

Rather than relying solely on broad industry surveys, market-specific analysis provides more actionable insights. National averages may not accurately reflect the dynamics of a specific submarket. By comparing a property to similar historical transactions, investors can validate their assumptions and identify any outliers. Additionally, tracking exit cap rates over time creates valuable benchmarks for future use. Since cap rates are inherently forward-looking, it’s critical to consider where the market is likely headed at the time of the projected sale.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Using Terminal Cap Rate in DCF Models

This section dives into how to effectively integrate the terminal cap rate into discounted cash flow (DCF) models. The terminal cap rate plays a key role in estimating a property's resale value, which is a critical component of DCF calculations. Given that terminal value can account for 60-80% of a property's total value in a DCF model, ensuring precise calculations is essential for reliable investment analysis.

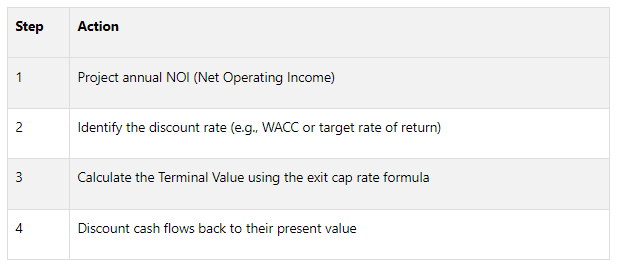

Step-by-Step DCF Integration

Incorporating the terminal cap rate into a DCF model involves a structured process. The terminal cap rate is used to estimate the property's resale value at the end of the holding period.

Start by projecting the property's future NOI for the year immediately after the planned sale date. This projected NOI becomes the numerator in the terminal value formula. Then, estimate the terminal cap rate based on anticipated market conditions at the time of sale. The formula is straightforward: divide the exit year NOI by the estimated terminal cap rate.

To ensure a margin of safety, choose a terminal cap rate that reflects current market trends while adding a conservative buffer for potential changes.

Once this is done, it's important to evaluate how changes in the cap rate might impact your investment. This is where sensitivity analysis comes into play.

Sensitivity Analysis for Terminal Cap Rate

After determining the terminal cap rate, the next step is to assess how variations in this rate could influence your investment outcomes. Sensitivity analysis is a powerful tool for understanding how different assumptions about the terminal cap rate impact key metrics like net present value (NPV) and internal rate of return (IRR).

For example, if your base case assumes a terminal cap rate of 5.0%, you can test scenarios at 4.5%, 5.5%, and 6.0%. This approach helps you identify the range of possible outcomes and assess the stability of your investment under different market conditions.

Insist on sensitivity analysis from sponsors that includes multiple cap rate scenarios. Pay close attention to historical trends for cap rates in your asset class and market. This analysis can reveal whether the investment remains attractive, even if cap rates shift unfavorably.

Additionally, sensitivity analysis can pinpoint the break-even cap rate - the point where the investment no longer meets your return targets. Knowing this threshold allows you to better understand the risks involved and make more informed decisions about pricing and risk tolerance.

Common Mistakes and How to Avoid Them

There are several common errors that can undermine your terminal cap rate analysis:

Overly optimistic NOI projections: Inflated rental income estimates or underestimated operating costs can distort the NOI used in the terminal value calculation, leading to unrealistic valuations.

Errors in terminal value calculations: Missteps like using the wrong exit multiple or failing to align growth assumptions with the terminal cap rate can throw off your analysis.

Ignoring changing market conditions: Economic shifts, interest rate changes, and evolving market fundamentals can quickly render your model outdated if not accounted for.

To avoid these pitfalls, validate your terminal value by comparing it to historical data and industry benchmarks. Use both the perpetuity growth method and the exit multiple method to cross-check your calculations for consistency.

Also, remember that unleveraged discount rates in real estate typically fall between 6% and 12%. If your calculations deviate significantly from this range, revisit your inputs to ensure they align with realistic market conditions.

Using The Fractional Analyst's Tools and Services

When it comes to accurate terminal cap rate analysis, having the right tools and access to reliable market data is essential. The Fractional Analyst combines expert services with advanced technology to meet the needs of commercial real estate (CRE) professionals.

Custom Financial Analysis for CRE

The Fractional Analyst's team brings years of experience in financial modeling and strategic planning. Whether you need a custom-built model or adjustments to an existing framework, their analysts work to align their solutions with your specific investment strategy. This tailored approach helps refine terminal cap rate inputs, improving the accuracy of your Discounted Cash Flow (DCF) model.

They gather data from multiple sources and integrate it with comprehensive market research. By doing so, they ensure that your terminal cap rate assumptions are based on up-to-date market conditions and relevant comparable sales data. Their research taps into top-tier data sources to identify trends and opportunities that could influence your exit strategies.

For those managing assets over time, The Fractional Analyst offers ongoing portfolio analysis. This service helps you adjust terminal cap rate projections as market dynamics shift, which is especially valuable for multi-year hold strategies where initial assumptions need periodic updates.

Using CoreCast for Market Data

CoreCast, The Fractional Analyst's real estate intelligence platform, acts as the backbone for precise terminal cap rate projections. This tool provides a clear view of portfolio performance while benchmarking cap rates against market comparables.

One standout feature of CoreCast is its ability to detect cap rate anomalies when compared to market averages.

“CoreCast transformed how we communicate portfolio performance to stakeholders. We now spend more time analyzing data, and less time assembling it.”

CoreCast also offers robust forecasting tools that combine historical data, market benchmarks, and user-defined assumptions. These tools simulate future cap rate scenarios, helping assess their impact on returns. The platform’s machine learning models can even suggest cap rate adjustments based on emerging trends in specific regions.

With its ability to analyze data across monthly, quarterly, and annual timelines, CoreCast helps uncover cyclical patterns that might influence your terminal cap rate decisions.

“The forecasting approach we honed at The Fractional Analyst now powers the decision logic behind CoreCast. It’s built from real-world use.”

CoreCast's Underwriter modeling engine supports all major asset classes and investment strategies. Its dynamic, live-linked portfolios ensure that terminal cap rate assumptions flow seamlessly into portfolio-level analysis and reporting. Additionally, this platform integrates with free financial models offered by The Fractional Analyst, simplifying your DCF analysis process.

Free Financial Models and Templates

To further support CRE professionals, The Fractional Analyst provides a library of free financial models designed to streamline terminal cap rate and DCF analysis. These templates cover a range of scenarios, including multifamily acquisitions, mixed-use developments, and IRR matrices. Each one is designed to incorporate exit cap rate and perpetuity growth methods.

Every model comes with a detailed instructional guide, helping users understand not just how to input data, but also why certain approaches are better suited for specific property types and market conditions. These templates eliminate the need to build complex formulas from scratch, making it easier to present investment opportunities to stakeholders.

The instructional materials also highlight industry best practices, reducing the risk of errors that could affect your investment decisions. By offering these resources, The Fractional Analyst lowers the barriers to sophisticated DCF modeling, making high-level analysis accessible to a wider audience. These tools ensure that your terminal cap rate assumptions translate into actionable and reliable DCF outcomes.

Conclusion

Terminal cap rates play a critical role in shaping commercial real estate (CRE) investment decisions. From market trends and economic conditions to property-specific risks and comparable sales data, these factors collectively influence returns and exit strategies.

As JPMorgan Chase highlights:

“Cap rates are just one unit of comparison used for evaluating commercial real estate; both macroeconomic and property specific characteristics should be considered when determining an appropriate cap rate for any specific property.”

This underscores the importance of a thorough and balanced approach when analyzing terminal cap rates for successful CRE investments.

Key Takeaways

Getting terminal cap rate analysis right requires a mix of solid market research and realistic assumptions. Current market dynamics make careful analysis even more important.

When setting terminal cap rate assumptions, focus on comparable properties that align with your asset's location, type, income and expense profile, quality, and overall condition. Properties in sought-after, stable areas typically have lower cap rates, while assets in secondary markets often demand higher cap rates due to increased risk [7, 9].

Macroeconomic factors also come into play. GDP growth, unemployment rates, and the economic cycle stage should all be factored into your projections. With interest rate cuts anticipated in 2025, borrowing costs may decline, potentially reducing cap rates across asset categories.

Ultimately, terminal cap rates serve as a forward-looking measure, linking a property’s projected net operating income to its expected sale price.

How The Fractional Analyst Supports CRE Professionals

Recognizing the need for accuracy in cap rate analysis, The Fractional Analyst provides tools and expertise to simplify this complex process. Their team of financial analysts delivers tailored underwriting, in-depth market research using top-tier data, and investor reports grounded in reliable cap rate assumptions.

Their CoreCast platform enhances decision-making with advanced market data and forecasting tools. By identifying cap rate anomalies and simulating future scenarios, CoreCast helps investors refine their exit strategies and investment timing.

For those looking to sharpen their discounted cash flow (DCF) modeling skills, The Fractional Analyst offers free financial models and templates. These resources integrate industry best practices, helping to minimize errors and improve investment outcomes. Whether you’re navigating market uncertainties or refining your analysis, these tools provide a practical and reliable foundation.

FAQs

-

Interest rate changes play a key role in shaping terminal cap rates and property valuations. When interest rates go up, borrowing costs increase, and investors often seek higher cap rates to offset these added expenses. This usually leads to a drop in property values.

Conversely, when interest rates decrease, borrowing becomes cheaper, and cap rates tend to shrink. This makes properties more appealing, pushing their values higher. Grasping this connection is crucial for assessing how shifts in monetary policy impact the U.S. real estate market.

-

Sensitivity analysis is a powerful tool for investors to assess how shifts in the terminal cap rate can influence property values and overall investment performance. Take this example: if the cap rate rises from 6% to 7%, the property's value could drop sharply - from $1,166,667 to $1,000,000. This highlights just how much valuations can hinge on market changes.

By exploring various scenarios, investors gain a clearer picture of potential risks and can better prepare for uncertain market conditions. This kind of analysis equips them to make smarter decisions and craft strategies aimed at safeguarding their returns, even when cap rates fluctuate.

-

To estimate a terminal cap rate in a market that's all over the place, start by looking at recent market data and comparable sales. These will give you a clearer picture of current trends and where the market might be heading.

Don't stop there - zoom out and consider the bigger economic picture. Factors like interest rates, inflation, and economic growth play a huge role in shaping property values, so keeping an eye on them is essential.

For an extra layer of caution, add a margin of safety by slightly increasing the cap rate. This conservative tweak can help you stay on the safe side, especially when the market feels unpredictable.