Ultimate Guide to CRE Presentation Technology

Commercial real estate (CRE) presentations have evolved significantly, thanks to advanced technology. Here's why it matters:

Efficiency: AI tools save time by automating tasks like data analysis and report generation.

Engagement: Interactive visuals, virtual tours, and real-time dashboards keep investors interested.

Accuracy: AI improves property valuation accuracy by up to 40%, ensuring reliable projections.

Collaboration: Cloud-based platforms enable teams to work together seamlessly, even remotely.

Security: Advanced encryption and access controls protect sensitive investor data.

Key Features of Modern CRE Presentations

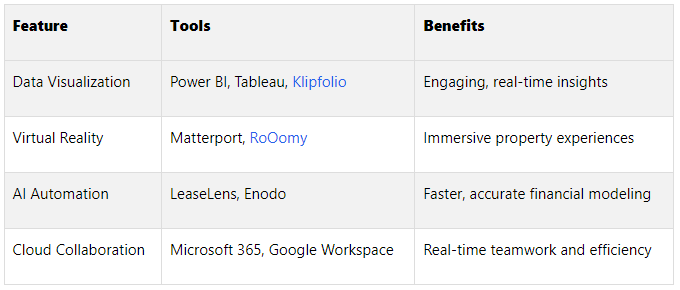

Interactive Data Visualization: Tools like Power BI and Tableau simplify complex data with real-time visuals.

Virtual and Augmented Reality: Platforms like Matterport offer immersive property tours, reducing the need for site visits.

AI and Automation: Tools like LeaseLens and Enodo streamline financial analysis and reporting.

Cloud Collaboration: Platforms like Microsoft 365 and Google Workspace improve teamwork and presentation quality.

Quick Comparison of Presentation Tools

Modern CRE presentations are no longer static slideshows. They're dynamic, tech-driven, and designed to win investor trust. Let’s dive into the tools and strategies transforming this space.

Pulse CRE’s Avi Solomon on the utilization on AI tools in the institutional real estate space

Key Technologies for CRE Presentations

The commercial real estate (CRE) industry has embraced cutting-edge technologies that are redefining how property presentations are crafted and delivered. These tools not only make presentations more visually compelling but also transform how investors engage with property data. With projections showing that over 70% of businesses will adopt data visualization tools by 2025[3], leveraging technology is no longer optional - it’s a game-changer.

This shift toward tech-driven presentations plays a crucial role in boosting investor confidence. Companies prioritizing data-driven approaches are 23 times more likely to attract customers[2]. By bridging the gap between raw data and meaningful insights, these tools help close deals while keeping investors engaged.

Interactive Data Visualization Tools

Gone are the days when static spreadsheets and charts were enough to convey financial insights. Today, interactive data visualization platforms bring data to life, allowing investors to explore complex information in real time. Since visuals are processed 60,000 times faster than text[1], these tools make it easier for investors to grasp intricate data quickly.

Leading platforms like Microsoft Power BI, Tableau, and Klipfolio stand out for their dynamic dashboards and user-friendly interfaces. Each offers unique features tailored to specific needs, from cash flow projections to market comparisons. These tools cater to various budgets and team sizes, making them accessible to a wide range of CRE professionals.

When designing visualizations, simplicity is your best friend. Use bar charts to compare properties or markets and line graphs to highlight trends like rental rate fluctuations over time[1]. Thoughtfully applied color schemes can emphasize key data points while reinforcing your brand identity. Most importantly, focus each visual on a single insight to avoid overwhelming your audience[1].

Virtual and Augmented Reality for Property Tours

Taking presentations a step further, virtual and augmented reality (VR and AR) technologies provide immersive experiences that bring properties to life for investors. Virtual tours, in particular, are a hit - properties with these features often receive more views and higher sale prices compared to those without[4].

One standout in this space is Matterport, widely regarded as the gold standard for 3D virtual tours in CRE. Properties showcased with Matterport tours are 49% more likely to sell than those without[4]. These detailed, interactive experiences allow investors to explore every corner of a property, from individual office spaces to entire floor plans.

Major CRE firms are already leveraging VR to great effect. For instance, CBRE Group uses virtual reality to showcase office layouts and potential modifications, reducing the need for multiple site visits[4]. Similarly, Sotheby’s International Realty employs immersive virtual tours to attract out-of-state and international buyers - a strategy that has proven highly effective for luxury properties[4].

Augmented reality takes things further by overlaying real-time data onto property views. With AR, investors can point their devices at a building to instantly access details like occupancy rates, energy efficiency metrics, or historical revenue figures[5]. Companies like RoOomy also specialize in virtual staging, allowing CRE professionals to present multiple layout options without the costs of physical staging[4].

Cloud-Based Presentation and Collaboration Platforms

Cloud-based platforms have revolutionized how CRE teams create and share presentations. Today, over 80% of U.S. businesses use cloud collaboration tools, with many reporting a 20% boost in productivity and efficiency[9].

Popular choices like Microsoft 365 and Google Workspace offer robust tools for document creation, real-time collaboration, and storage - all starting at $6 per user per month[6]. Microsoft’s seamless integration with Power BI and Google’s superior simultaneous editing features make them invaluable for CRE teams.

For teams managing complex projects, ClickUp is a standout option. Priced at $7 per user per month[6], it combines task tracking, deadline management, and team communication with presentation collaboration. Similarly, Notion provides a flexible workspace for creating outlines, managing client communications, and tracking deal progress. Both platforms consistently earn high ratings, with 4.7/5 on G2 and Capterra[7].

Security is a critical consideration when working with cloud-based tools. Look for platforms offering end-to-end encryption and customizable access controls[8], especially when handling sensitive financial data. Tools like Slack and Microsoft Teams complement these platforms by enabling seamless team communication and file sharing. Slack, for example, boasts a 4.5/5 rating from over 32,500 reviews on G2[7].

When choosing cloud-based solutions, prioritize those that integrate well with your existing software and offer mobile accessibility. These features ensure streamlined workflows and allow for real-time collaboration, making it easier to deliver polished, investor-ready presentations. Together, these technologies underline the growing importance of tech in modern CRE practices.

Using AI and Automation in CRE Presentations

AI and automation are transforming how commercial real estate (CRE) presentations are created and delivered, offering a blend of precision and personalization. The global AI presentation software market is projected to grow from $1.25 billion in 2024 to $5.6 billion by 2033, with an annual growth rate of 18.5% [15]. This technology is cutting down the 3.6 hours professionals typically spend each week preparing presentations [15], seamlessly integrating with interactive tools to make CRE presentations more impactful.

“Artificial intelligence… is rapidly becoming an integral part of how work gets done in commercial real estate.”

By automating repetitive tasks and improving data analysis, AI allows CRE professionals to focus on crafting strategic messages rather than worrying about calculations or formatting.

AI-Powered Financial Analysis and Reporting

AI is a game-changer when it comes to analyzing financial data, market trends, and historical performance. It can quickly and accurately evaluate property risks and borrower profiles [10]. For example, AI tools can calculate key metrics like Debt-to-Income (DTI), Loan-to-Value (LTV), and Debt Service Coverage Ratio (DSCR) with minimal error, speeding up the underwriting process [10].

Platforms like LeaseLens offer AI-powered lease abstraction services at about $25 per lease abstract export, making it a cost-effective solution for firms managing multiple properties [11]. Meanwhile, Prophia provides an asset and portfolio management platform that combines lease abstraction with actionable insights to enhance investment strategies and operational performance [11].

Another standout tool, Enodo, uses machine learning to assess investment risks through predictive analytics [11]. These platforms can generate cash flow projections based on historical data, helping lenders and investors estimate a property's future income potential [10]. Unlike static spreadsheets, AI tools continuously update financial models with real-time data, ensuring presentations always reflect the latest market conditions [10].

Natural Language Processing for Investor Communication

Natural Language Processing (NLP) is reshaping how CRE professionals engage with investors. Just like interactive data visualizations, NLP brings a dynamic element to investor communication. These tools can craft engaging presentation narratives, answer investor questions, and tailor content to specific audience preferences [15]. By analyzing investor behavior and market trends, NLP ensures that communication is personalized in real-time [15].

Despite its potential, adoption of AI for investor communication remains low. A recent survey found that 90% of respondents have never used AI tools to analyze their investor materials, and 96.8% have not reviewed their presentations or calls for tone or body language [16]. This presents a unique opportunity for early adopters to stand out.

AI tools are enabling a shift from static slides to adaptive presentations that combine intelligent content creation with visuals, videos, and interactive elements [15].

“The future of investor communications lies in smart automation. With AI handling the tasks of design and data formatting, companies can focus more on strategic messaging and less on the mechanics of slide creation.”

These tools also integrate real-time data updates into charts, KPIs, and market news, ensuring that presentations remain accurate and relevant, even for professionals juggling multiple deals [15].

Data Quality and Security Requirements

While AI enhances the quality of CRE presentations, safeguarding data integrity and security is critical. The 2023 IBM Cost of a Data Breach report reveals that the average breach costs $4.45 million, with misconfigured automation workflows contributing significantly [12].

To ensure security, a layered approach is essential. This includes implementing AES-256 encryption for stored data, TLS 1.3 for data transmission, Role-Based Access Control (RBAC), OAuth 2.0 authentication, and Security Information and Event Management (SIEM) monitoring [12]. Identity and Access Management (IAM) frameworks should incorporate least privilege access, multi-factor authentication (MFA), and segmented service accounts [12].

A major challenge is "shadow data" - untracked information that can create blind spots in AI workflows. Nearly one in three organizations face issues with this ungoverned data [12].

“The first rule of any technology used in a business is that automation applied to an efficient operation will magnify the efficiency. The second is that automation applied to an inefficient operation will magnify the inefficiency.”

Continuous monitoring and anomaly detection through SIEM integration, behavioral analytics, and audit trails are vital. For firms handling sensitive investor data, compliance with regulations like GDPR and CCPA is non-negotiable. This includes logging user consent, enabling "right to forget" requests, and restricting access to personally identifiable information based on region and purpose [12].

A phased approach to AI implementation is recommended, starting with automating repetitive, error-prone tasks [13]. Forming a cross-functional task force that includes IT, data science, security, operations, and legal teams can help identify vulnerabilities and ensure a smooth rollout [12]. This collaborative strategy minimizes risks and helps avoid costly mistakes.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Best Practices for Effective CRE Presentations

Combining storytelling with technology can help you deliver presentations that are clear, engaging, and focused on what investors care about most. While AI tools can handle data analysis and create polished visuals, the strategic design and human touch are what truly make a presentation stand out.

How to Structure Presentations for Clarity

A strong presentation structure helps simplify complex information and guide your audience toward informed decisions [17]. Start by defining your conclusion. This approach ensures that every piece of content supports your main goal. Ask yourself: What is the key takeaway? What action do I want the audience to take? How will my conclusion drive that action?

Tailor your introduction to your audience. For investors who need quick answers, lead with your main point. If you're aiming to persuade and build consensus, consider a gradual approach that unfolds your argument step by step [17].

The body of your presentation can follow a five-part framework: context, approach, findings, implications, and sensitivities. Here's how it works:

Context: Set the stage with market conditions and property details.

Approach: Explain your analysis methods.

Findings: Present key data and metrics.

Implications: Turn those findings into actionable insights.

Sensitivities: Address risks and alternative scenarios.

Your introduction should establish credibility and preview the key points, while your conclusion should reinforce those points and include a clear call-to-action [18]. To make your presentation even more compelling, integrate real-time data and dynamic visuals.

Including Real-Time Data and Visuals

Using dynamic visuals and up-to-date data can make your arguments more persuasive and easier to understand. Real-time data visualizations allow you to present information as it’s generated, helping investors analyze trends and make decisions faster [20].

Picking the right type of chart is key:

Bar charts work well for comparing categories, like rental rates across property types.

Line charts are great for showing trends over time, such as occupancy rates or market appreciation [19].

Keep your visuals simple and consistent by using uniform color schemes, fonts, and formatting. Add interactive features to let investors explore data on their own. For instance, Visual Craft revamped Redatum, a real estate analytics tool, by replacing static PDF reports with interactive ones that allowed advanced filtering and real-time updates. This change improved performance by about 92% [22]. Similarly, their work on a zoning analytics platform showcased how real-time updates can create a more responsive user experience [22].

To ensure your visuals are effective, include clear labels, legends, and titles. Use accessible design elements like high-contrast colors and alternative text for visual descriptions [19][21]. Real-time dashboards can also help you quickly spot unusual transaction patterns or market shifts that could impact your investment strategy [20].

Once your visuals are in place, focus on customizing your presentation to fit your audience.

Customizing Presentations for Different Investors

Tailor your presentation to match the preferences and expectations of your investors. Understanding their experience level, investment goals, timing, and risk tolerance is critical to creating a connection [23].

With most investors spending less than four minutes on a pitch deck [25], it’s important to highlight your achievements early. Use key performance indicators (KPIs), financial metrics, and relevant company stats to grab their attention [24].

“For us it has to be very clear what exactly you do to create value. What’s the return driver? What is your ‘trick’ that you can do repeatedly? What’s your competitive advantage? We’re looking for groups that can explain to us what they are very good at, and go into case studies.”

Storytelling can make your presentation memorable and relatable [23]. However, tailor your narrative to your audience. Institutional investors might prefer in-depth market analysis and risk mitigation strategies, while individual investors often respond better to straightforward explanations and clear return projections.

Be transparent about risks and offer realistic, data-backed financial projections. Use simple, clear language to avoid overwhelming less experienced investors, while including more detailed technical analysis for institutional audiences. Be ready to adapt your presentation based on real-time feedback during discussions [23].

Good communication builds trust. Personalize follow-ups and use effective channels like SMS, which has a 98% read rate [27]. Set clear expectations and goals from the start to establish a strong foundation for ongoing communication and reporting tailored to each investor’s preferences [27].

Using The Fractional Analyst and CoreCast

The Fractional Analyst offers a range of tools and services to elevate your commercial real estate (CRE) presentations. Whether you need a team of experts to handle intricate financial analyses or prefer to take the reins with user-friendly tools, this platform provides solutions tailored to your needs.

Direct Services: Expert Financial Analysts

For those navigating complex deals or tight deadlines, The Fractional Analyst’s team of financial experts is ready to assist. Their services cover a wide array of needs, including custom underwriting, asset management support, market research, lender and investor reporting, and creating polished pitch decks. From the initial property analysis to the final investor presentation, the team ensures every detail is managed with precision.

Self-Service: The CoreCast Platform

CoreCast, the platform’s real estate intelligence tool, is designed for those who prefer a hands-on approach. It features advanced financial modeling tools, real-time market data, and automated capabilities to simplify the creation of professional presentations. During its beta phase, CoreCast is priced at $50 per user per month, with the cost set to increase to $105 upon full release. With CoreCast, users can craft in-depth investment analyses, build interactive dashboards, and present real-time visuals that address investor questions on the spot.

Free Financial Models for CRE Professionals

To further support CRE professionals, The Fractional Analyst provides free downloadable financial models. These include templates for multifamily acquisitions, mixed-use developments, and IRR matrices, offering a strong starting point for creating compelling investment presentations. These models are highly customizable, allowing users to tailor them to specific deals.

Real estate financial modeling is essential for evaluating investment opportunities and profitability. These models delve into critical factors like cash flows, costs, capital expenditures, debt structures, and projected returns. They also help assess risks, explore various scenarios, and secure funding. Available formats include models for development, acquisitions, value-add projects, funds, and portfolios. To ensure accuracy, it’s crucial to regularly update inputs, perform sensitivity analyses, and collaborate with stakeholders [28].

These free models integrate seamlessly with the tools and strategies discussed in this guide, providing a reliable analytical foundation for your investor presentations. Whether you’re relying on expert services, self-service tools, or a combination of both, The Fractional Analyst equips you with the resources needed to deliver impactful and data-driven communications.

Conclusion

The commercial real estate (CRE) industry stands at a pivotal moment, where embracing advanced technology is no longer optional but essential for staying competitive. These tools are reshaping how professionals engage investors, streamline workflows, and close deals.

Data underscores this shift: organizations leveraging generative AI are seeing an average return of $3.70 for every $1 invested[31]. Tasks that once required 45–50 minutes can now be completed in just 3–4 minutes[30]. This efficiency allows professionals to dedicate more time to strategic decisions and building meaningful relationships.

Key Points to Remember

The integration of technology has fundamentally transformed CRE presentations. Here's how:

AI-Driven Automation: By automating repetitive tasks, professionals can focus on strategy and creativity.

Cloud-Based Collaboration: Real-time data sharing and collaborative platforms enable faster responses to investor inquiries.

Dynamic Presentations: Tools that incorporate live market data and interactive financial models create a level of engagement that static slides simply can't match.

Data Security: Advanced encryption, access controls, and compliance with privacy regulations ensure sensitive information stays protected[32][33].

Next Steps for CRE Professionals

To successfully integrate these technologies, a thoughtful and phased approach is key. Begin by engaging stakeholders, providing comprehensive training, and running pilot programs to test performance before scaling up[33]. Choose tools that align with your business needs, whether it's AI-powered financial modeling, virtual property tours, or automated reporting systems.

Platforms like The Fractional Analyst and CoreCast offer a blend of expert financial analysis and self-service tools, making them ideal for early adopters looking to stay ahead.

Automation isn’t about replacing jobs; it’s about creating opportunities. The World Economic Forum predicts a net gain of 58 million jobs through automation[29]. As Jamilah Caballero, Customer Success Manager at Altus Group, puts it:

“AI will help us to save time and focus on what really matters, which is our judgment, our insights, and our relationships with our clients. And honestly, no machine could do or replace that.”

FAQs

-

AI is transforming property valuations in commercial real estate by processing vast amounts of data with speed and precision. Using automated valuation models (AVMs), it evaluates market trends, property specifics, and financial metrics to provide well-informed, data-backed insights.

This approach not only accelerates the valuation process but also minimizes the risk of human error, leading to more dependable outcomes. By integrating real-time data and predictive analytics, AI elevates the quality and effectiveness of CRE presentations, making them more impactful and accurate.

-

Virtual and augmented reality (VR/AR) are changing the game for property tours in commercial real estate. With immersive, remote experiences, clients can explore properties in incredible detail without ever stepping foot on-site. This not only saves time and cuts costs but also makes property viewing accessible from virtually anywhere.

Beyond convenience, VR/AR takes client engagement to a new level. These tools provide a realistic feel for a property’s space and layout, helping clients make more informed decisions. By simplifying the exploration process, VR/AR offers a modern, efficient way to navigate today’s competitive real estate market.

-

When leveraging cloud-based platforms for CRE presentations, keeping data security at the forefront is non-negotiable. Start by employing strong encryption to safeguard your data - whether it's being transmitted or stored. Pair this with multi-factor authentication to add an extra layer of protection for user access.

It’s also crucial to implement strict access controls, ensuring that only authorized personnel can view or handle sensitive information. Conduct regular security audits and align with industry standards like SOC 2 or ISO 27001 to maintain a secure environment. Tools such as cloud security posture management (CSPM) can help identify and address potential risks, while maintaining robust authentication protocols will further reduce vulnerabilities.