3 Steps to Review Underwriting Assumptions

Want to make smarter real estate investment decisions? Start by mastering your underwriting assumptions.

Here’s how to ensure your financial projections are accurate and reliable:

Verify Your Data: Collect property-specific details (rent rolls, operating statements) and market benchmarks. Cross-check and validate everything.

Benchmark and Stress-Test: Compare assumptions (like rent growth and vacancy rates) to market norms. Simulate worst-case scenarios to identify risks.

Conduct Due Diligence: Inspect the property, review financial records, and check for legal or regulatory issues. Update your model as needed.

Accurate underwriting isn’t just about numbers - it’s about reducing risk and boosting confidence for lenders and investors. By following these steps, you’ll avoid costly mistakes and set your investments up for success.

Key Assumptions in Real Estate Modeling

What Are Underwriting Assumptions

Underwriting assumptions are the financial estimates and projections used to evaluate commercial real estate investments. These assumptions take raw property data and turn it into forecasts for rental income, operating costs, market dynamics, and tenant behavior. By relying on these calculated projections, investors can avoid overly optimistic expectations and make more grounded decisions.

These assumptions play a big role in securing financing and attracting investors. For example, most lenders require a Debt Service Coverage Ratio (DSCR) of at least 1.25. This means a property's Net Operating Income (NOI) must be at least 25% higher than its annual debt payments to qualify for financing [1]. Below, you’ll find the primary categories of assumptions commonly used when analyzing real estate investments.

Main Underwriting Assumptions

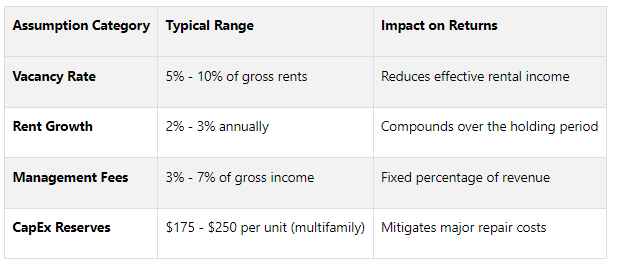

Key underwriting assumptions work together to paint a full financial picture of a real estate investment. Here’s a breakdown of the main factors:

Vacancy Rates: These account for periods when units sit empty due to tenant turnover or changing market conditions. A realistic vacancy rate is critical for accurate income projections.

Rent Growth Projections: Typically, annual rent increases are estimated at 2% to 3% [4]. Operating expense growth is often pegged at around 2% annually and should stay below the rate of income growth [4].

Cap Rates: These are used to evaluate purchase and sale values. The entry cap rate helps determine the initial property value, while the exit cap rate projects potential sale proceeds. Investors often assume the exit cap rate will rise by 2% to 3% annually over the holding period [4].

Management and Operating Costs: Property management fees typically range from 3% to 7% of gross rental income [2]. Additional costs include maintenance, insurance, utilities, and taxes. Property taxes, in particular, can account for 15% to 45% of total operating expenses [3].

Capital Expenditure (CapEx) Reserves: These are funds set aside for major repairs or upgrades. Common benchmarks include $175 to $250 per unit for multifamily properties or $0.15 to $0.25 per square foot for office, retail, and industrial spaces [2].

Why Assumptions Matter

These assumptions don’t just shape financial models - they also play a critical role in managing risk. They influence everything from financing options to exit strategies. For example, using a higher-than-average vacancy rate in your projections can act as a buffer during unexpected market downturns.

Lenders rely on these assumptions to ensure that projected income will comfortably cover debt payments, even in challenging conditions. At the same time, investors use them to determine whether the expected returns align with the risks. Striking a balance between cautious estimates and forward-thinking projections is essential for building trust and ensuring investment plans can withstand market ups and downs.

Step 1: Gather and Verify Source Data

Every reliable underwriting analysis begins with a solid foundation of accurate, well-verified data. This combination of thorough data collection and strict validation ensures that your assumptions are grounded in reality, allowing for effective benchmarking and stress-testing.

Data to Collect

Start by focusing on two key areas: property-specific details and market context. For property-specific data, gather at least three years of historical operating statements. These documents provide insight into income patterns, expense trends, and any seasonal fluctuations that generic market assumptions might miss.

Rent rolls are equally critical. They offer tenant-level details, such as lease terms, expiration dates, rental rates, and tenant creditworthiness. Pay close attention to lease escalation clauses and renewal options, as these directly affect future income. Expense reports should be broken down by category - maintenance, utilities, insurance, property taxes, and management fees - to give a clear picture of operating costs.

Market comparables are another essential piece. Look for properties similar in age, size, tenant mix, and location. Additionally, demographic data for the surrounding area can help validate demand assumptions, especially for retail and multifamily properties.

Finally, consult financial benchmarks from trusted industry sources. These might include cap rate surveys, vacancy rates by property type and market, or standard operating expense ratios. Once you’ve gathered this data, verify it immediately to ensure your financial model is built on dependable numbers.

Data Validation Methods

Collecting data is just the first step - verification is what ensures its reliability. Cross-referencing multiple sources can help identify inconsistencies and flag potential issues.

“Validating data accuracy helps avoid costly errors, supports compliance, improves risk assessment, and provides a solid foundation for investments and strategic planning.”

Physical verification is a must. Inspect the property in person to confirm square footage, unit counts, and its overall condition. Tools like satellite imagery can help verify property boundaries and visible conditions [5].

Compare your data with historical appraisals to identify value trends and fluctuations [5]. This historical perspective helps you determine whether the property’s current performance is typical or an outlier.

Third-party validation adds another layer of reliability. Evaluate the credibility of your sources by examining their methodology, sample size, and how frequently they update their data [6].

Be especially cautious with market data. Outdated or poorly matched comparables can distort your analysis, so double-check that the information reflects current market conditions and aligns with the property you’re evaluating.

Real-time verification is also crucial. Set up protocols to address discrepancies as they arise and perform regular audits of your data sources. This proactive approach helps prevent errors from affecting your analysis [7]. With these steps in place, you’ll create a robust foundation for benchmarking and testing your underwriting assumptions.

Step 2: Benchmark and Stress-Test Assumptions

Now that you've outlined your investment strategy, it's time to test those assumptions against market realities and see how they hold up under pressure. This step ensures your projections are grounded in real-world data and helps uncover weaknesses before making any commitments.

How to Benchmark Assumptions

Start by comparing key assumptions - like vacancy rates, rent growth, and operating expenses - against current market data. This step ensures your expectations align with actual market conditions.

For example, recent surveys like CBRE's Q4 2024 Multifamily Underwriting Survey showed annual rent growth improving slightly from 2.5% to 2.7%. If your rent growth projections are significantly higher without strong justification, it might indicate overly optimistic assumptions.

Cap rates are another useful benchmark. According to the same CBRE survey, the average core multifamily going-in cap rate stayed steady at 4.90% in Q4 2024, while the average exit cap rate remained at 5.05%[8]. Additionally, core unlevered IRR targets rose by 12 basis points to 7.76% during the same period[8]. Using these figures as a reference helps you evaluate whether your return expectations are realistic.

When it comes to expenses, compare your estimates with industry reports that outline expenses as a percentage of gross income for similar properties. If your expense assumptions are noticeably lower than market averages, you could be underestimating costs, which might lead to unpleasant surprises later.

It's also a good idea to cross-check data from multiple sources, including industry reports, local market studies, and recent comparable transactions. CBRE notes that as the market gains clarity on policy changes, underwriting assumptions are becoming more consistent[8], making current benchmarks more reliable than in uncertain periods.

Once you've set benchmarks, the next step is to test how well these assumptions perform under stressful conditions.

Stress-Testing Your Assumptions

Stress testing is all about tweaking key variables to see how they affect your returns. This process helps you pinpoint the limits of your assumptions and identify where your investment might be most vulnerable.

Focus on the factors that have the biggest impact. Common stress scenarios include economic slowdowns, rising interest rates, market fluctuations, and increasing vacancy rates[11]. Adjust these variables one at a time to see how they influence cash flow and overall returns.

Vacancy rate stress testing is particularly insightful. For instance, commercial real estate proformas often assume a 5%–7% vacancy rate[10]. But what happens if vacancies spike? In one example, an investor stress-tested a retail shopping center to see how high the vacancy rate could climb before the Net Operating Income (NOI) could no longer cover the property’s debt service. They found that vacancy rates could rise to 11.16% in year one before the NOI fell short[10].

You can also test other variables by lowering rent growth, increasing expense ratios, or raising exit cap rates. Track how these changes affect key metrics like cash-on-cash returns, IRR, and DSCR. This process helps you understand which assumptions have the greatest influence on your investment’s performance.

Instead of relying on single-point estimates, aim to create a range of possible outcomes. The goal is to understand the spectrum of potential results, which allows you to make more informed decisions about risk and develop strategies to address vulnerabilities. This approach strengthens your financial position and prepares you to navigate uncertainty[9][11].

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Step 3: Validate Through Due Diligence

Once you've validated your data and stress-tested your assumptions, it's time for the final step: due diligence. This process ensures your underwriting assumptions hold up under scrutiny. It involves targeted inspections and detailed document reviews to confirm everything aligns with real-world conditions.

Physical and Financial Inspections

Start with a physical inspection to verify the property meets your expectations. The goal here is to ensure the property is safe, identify any unexpected repair needs, and confirm there are no environmental hazards[13].

Begin by hiring a structural engineer or building inspector to examine critical elements like the roof and support systems[13]. As Brian Hennessey, author and real estate expert, explains:

“Each property type has its unique qualities and issues that should be investigated or addressed.”

Walk through every unit to assess its condition and determine if repairs are needed. Check key systems - like plumbing, electrical, and HVAC - to ensure they’re safe and functional[13]. Pay special attention to the roof and mechanical systems since these can lead to expensive repairs if overlooked[14][16]. For more complex issues, bring in specialists who can provide detailed assessments and cost estimates[12]. A Property Condition Report (PCR) is often helpful, summarizing the property's overall condition and highlighting any significant capital improvements that may be required[16].

Equally important is a financial inspection. Review income-related documents to confirm that rent and expense assumptions are accurate. Keep an eye out for discrepancies between the provided paperwork and actual records. Assess tenant creditworthiness to ensure your assumptions about vacancy rates and rent growth are realistic.

Once you've confirmed the physical and financial aspects, shift your focus to legal compliance.

Legal and Regulatory Review

Legal due diligence is critical for identifying potential regulatory risks and protecting your investment. Real estate issues often arise from market conditions, legal entanglements, or property-specific challenges[17]. Overlooking even minor legal details can lead to costly consequences.

Start with a title search, secure title insurance, and verify that the property complies with zoning regulations[18]. Collaborate with local officials to ensure the property aligns with long-term development plans[18].

Carefully review all relevant property documents, including financial statements, tax records, and maintenance logs, to confirm compliance with federal, state, and local regulations. Look for red flags like pending lawsuits, code violations, or outstanding financial obligations that could lead to unexpected costs or legal challenges[18].

Finally, scrutinize contracts. Ensure they are reviewed by experienced legal professionals. Key terms - such as closing timelines, financing contingencies, and due diligence periods - should be clearly defined. Include dispute resolution clauses to address potential conflicts down the road.

Update Your Model Based on Due Diligence

Once inspections and legal reviews are complete, update your financial model to reflect the findings. Unexpected repair costs, revised lease terms, or regulatory challenges should all be factored into your projections[19].

Financial due diligence ensures your valuation assumptions align with historical performance and current realities. Adjust for unforeseen expenses, lower-than-expected rents, or higher operational costs.

Legal findings should also be incorporated. For example, if you discover code violations requiring costly remediation or zoning restrictions that limit planned improvements, revise your value-add assumptions accordingly.

These updates help you identify potential risks and create strategies to manage them. For instance, if inspections reveal aging HVAC systems, you might negotiate a credit at closing or set up a reserve fund for future replacements. By addressing these issues proactively, you can safeguard your investment and avoid surprises down the line[19].

Using Technology and Expert Support

Once you've verified your data and refined your assumptions, the next step is to leverage modern tools and expert insights to strengthen your underwriting process. By combining the precision of technology with the strategic judgment of professionals, you can streamline workflows, reduce errors, and ensure your assumptions are as accurate as possible.

Using Advanced Platforms

Technology is reshaping how commercial real estate professionals approach underwriting. With AI-driven solutions, the process becomes faster, more consistent, and better equipped to handle complex data. These tools automate repetitive tasks, deliver real-time analytics, and simplify decision-making. In fact, the global underwriting software market is expected to hit $15.9 billion by 2032[22].

Take CoreCast, for example - The Fractional Analyst's real estate intelligence platform. It offers features to benchmark and stress-test assumptions, automate data collection, assess risks, and generate actionable insights. By automating these processes, CoreCast reduces errors and enhances predictive analytics[20].

When choosing a platform, look for tools that provide flexibility in adjusting key metrics like revenue, expenses, cap rates, vacancy rates, and interest rates. This allows you to evaluate critical financial indicators such as DSCR, Debt Yield, and LTV[25]. Cloud-based platforms offer additional benefits like scalability, accessibility, and cost efficiency, making them an attractive option for modern underwriting workflows[23].

Automation doesn't just save time - it saves money, too. Lending services that automate underwriting can cut administrative expenses by 20–30% while delivering faster, data-driven decisions[22]. As Shannon Kelly, SVP and Director of Model Risk Management at Zions Bancorporation, explains:

“In the current competitive environment, future business strategies will depend both on thoughtful data and analytical strategies.”

Industry leaders have already embraced AI and digital integration to streamline their processes, significantly reducing the need for manual intervention[20]. However, while technology enhances efficiency, it doesn’t replace the need for expert judgment.

Expert Help from The Fractional Analyst

While technology excels at processing data, it’s the human touch that adds strategic depth. The Fractional Analyst's team of financial analysts brings years of experience to underwriting, market research, and financial modeling. Their expertise ensures that your assumptions are thoroughly vetted and aligned with market realities.

Underwriters are integral to the investment process. They assess financial risks tied to insurance policies, securities, or loans, ensuring proper pricing for those risks[24]. This expertise becomes especially critical when dealing with complex properties or unique market conditions. Analysts can spot red flags that automation might overlook, provide valuable context to market data, and clarify the broader implications of your assumptions. With their guidance, investors can make more informed decisions and navigate risks more effectively[24].

Conclusion

Reviewing underwriting assumptions isn't just another checkbox in the commercial real estate process - it's the backbone of making informed, strategic investment decisions. By carefully gathering and verifying data, benchmarking and stress-testing assumptions, and conducting diligent validation, you’re not just protecting your investments - you’re setting them up for maximum returns.

Each step plays a critical role. Gathering data uncovers the real financial health of a property. Benchmarking and stress-testing ensure your assumptions align with market conditions. And due diligence digs deep to expose risks that might otherwise go unnoticed.

In today’s challenging market, the stakes are higher than ever. With commercial real estate loan delinquency rates at their highest in a decade [28], thorough underwriting has become a non-negotiable. As the FDIC points out:

“In this respect, a systematic approach to developing common-sense assumptions for use in IRR measurement systems is an important part of a bank’s strategic planning. Conversely, using unrealistic or overly optimistic assumptions in IRR systems can result in an inaccurate picture of a bank’s risk exposure, potentially resulting in flawed asset-liability management strategies.”

This kind of methodical approach doesn’t just mitigate risks - it can also boost profitability. Identifying opportunities early and avoiding costly errors improves your bottom line. Plus, well-underwritten properties are more likely to secure better financing terms, as lenders value the reduced risk [27].

Consistency is the cornerstone of effective underwriting. Cross-check borrower information to spot discrepancies, compare financial performance to industry benchmarks, and run sensitivity analyses to see how variable changes might affect debt service. Rely on qualified professionals for property evaluations and use multiple valuation methods to confirm your findings.

Thorough underwriting isn’t just about avoiding pitfalls - it’s about creating a roadmap for success. In today’s market, combining systematic processes with advanced tools and expert insights is key to staying ahead and achieving long-term growth.

FAQs

-

When assessing the realism of your underwriting assumptions, it's a good idea to stack them up against industry benchmarks and test them under various scenarios. Conservative assumptions often factor in modest rent growth, stable or even declining occupancy rates, and increasing expenses. If your projections can withstand these conditions, there's a good chance they're grounded in reality.

On the flip side, assumptions might lean too optimistic if they depend on aggressive revenue growth, steep expense cuts, or overly favorable market trends. To keep things balanced, make it a habit to review your financial models regularly and stress-test them with worst-case scenarios. This approach can help ensure your assumptions stay realistic and in line with solid underwriting principles.

-

When evaluating commercial real estate, it's crucial to steer clear of common pitfalls during property due diligence. Here are three key areas where investors often go wrong:

Overestimating property value or returns: Skipping the step of validating underwriting assumptions can lead to overly optimistic projections, which might result in unexpected financial setbacks.

Overlooking legal and regulatory factors: Ignoring issues like title defects, zoning restrictions, encumbrances, or building code violations can cause significant delays, disputes, and added expenses.

Relying too much on third-party reports: While reports such as appraisals, environmental assessments, and inspections are essential, it's important to cross-check their accuracy to ensure they align with your investment strategy.

Paying close attention to these areas can help reduce risks and support smarter investment decisions.

-

Technology has transformed underwriting by using AI and machine learning to handle vast amounts of data with speed and precision. These tools allow for more accurate risk evaluations, automate time-consuming tasks, and simplify workflows. The result? Faster decisions and shorter underwriting timelines.

Advanced analytics also play a key role in reducing mistakes and improving the overall quality of underwriting for commercial real estate investments. This not only ensures more dependable results but also empowers smarter, data-driven choices in a highly competitive market.