Ultimate Guide to Sublease and Assignment Analysis

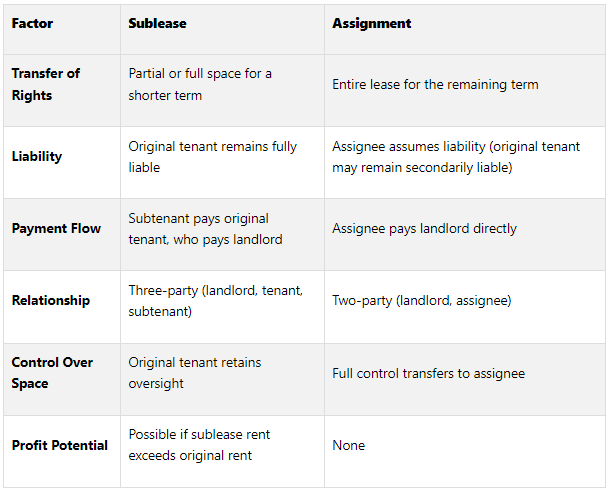

Subleases and assignments are ways to transfer lease rights, but they differ in terms of control, liability, and financial responsibility. Here’s the key breakdown:

Sublease: You (the original tenant) lease part or all of the space to a new tenant (subtenant) while remaining responsible for the lease. It’s ideal for temporary adjustments but requires you to manage the subtenant and maintain liability.

Assignment: You transfer the entire lease to a new tenant (assignee), exiting the lease entirely (unless you agree to remain as a guarantor). It’s great for a clean break but involves transferring full control to the assignee.

Why It Matters

Landlords need to assess the financial stability of subtenants or assignees.

Tenants must understand risks, costs, and legal obligations before transferring leases.

Investors evaluate how these arrangements impact property value and cash flow.

Key Considerations

Legal: Review lease terms for landlord consent, liabilities, and recapture clauses.

Financial: Compare cash flows, calculate net present value (NPV), and assess tenant creditworthiness.

Operational: Subleasing involves managing subtenants, while assignments simplify operations but relinquish control.

Quick Comparison Table

Key Takeaways

Subleasing is flexible but involves ongoing management and liability.

Assignments provide a clean break but require careful financial and legal evaluation.

Always conduct due diligence, including tenant credit checks and legal reviews, to avoid costly mistakes.

Use tools like financial models to assess scenarios and make informed decisions.

How a Sublet is Different from an Assignment of Lease - Surge Business Law

Legal Framework and Key Lease Provisions

Understanding the legal framework surrounding subleases and assignments is crucial for navigating the rights, responsibilities, and risks tied to these arrangements. The legal distinctions between the two can significantly influence your approach to commercial real estate.

Legal Differences Between Sublease and Assignment

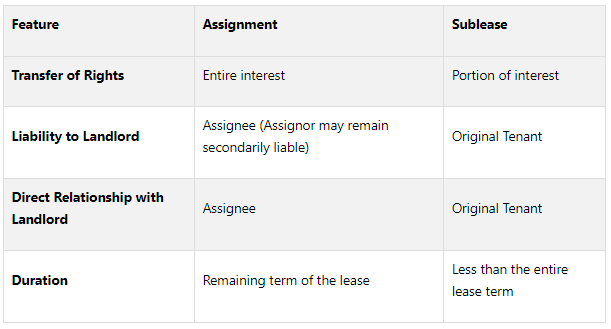

The legal structure of a sublease differs fundamentally from that of an assignment, shaping the relationships between landlords, tenants, and third parties. These differences impact liability, payment flows, and overall responsibilities.

In an assignment, the tenant transfers their entire lease interest to an assignee, establishing a direct relationship (known as "privity of estate") between the assignee and the landlord. The assignee takes on all the rights and obligations of the original lease. However, unless the landlord explicitly releases the original tenant (the assignor), they may remain secondarily liable for lease obligations.

A sublease, on the other hand, involves the original tenant (now acting as a sublandlord) transferring only part of their lease rights to a subtenant, typically for a shorter period than the full lease term. In this arrangement, the original tenant remains directly liable to the landlord and oversees the subtenant relationship.

Important Lease Provisions to Review

When reviewing lease agreements, specific clauses related to assignment and subletting demand close attention. These provisions aim to balance landlords' interests with tenants' flexibility.

Landlord Consent Requirements: Most leases require landlord approval for subleases or assignments, often specifying that consent cannot be unreasonably withheld. Understanding these terms is vital to avoid disputes.

Information Requirements: Leases typically outline what details tenants must provide about proposed subtenants or assignees. This includes documentation for credit and reference checks, with deadlines for landlord responses clearly stated.

Right of Recapture: Some leases allow landlords to reclaim the space instead of approving a sublease or assignment request. This clause can significantly affect your exit strategy, so it’s essential to understand its terms.

Release Provisions: These clauses determine whether the original tenant or guarantor remains liable after an assignment. Stronger tenants often negotiate automatic releases under specific conditions.

Associated Costs: Landlords often charge fees, typically between $1,500 and $5,000, to cover the review and approval process. These should be factored into your financial planning.

Pre-Approved Transfers: Tenants can negotiate scenarios where landlord consent isn’t required, such as transfers to affiliated entities or during mergers and acquisitions. Planning for these situations upfront can save time and money.

Common Legal Pitfalls to Avoid

Avoiding legal missteps is key to a smooth sublease or assignment process.

Skipping Landlord Approval: Failing to secure landlord consent can lead to penalties and lease violations. Always review lease terms and communicate with the landlord before proceeding.

Poor Documentation: Ambiguity in agreements can lead to disputes. Clearly define all terms in writing, including responsibilities, payment details, and termination conditions.

Inadequate Tenant Screening: Conduct thorough vetting of potential subtenants, including credit checks and reference verification, to minimize financial and operational risks.

Misaligned Lease Terms: Ensure that sublease durations align with the original lease term and account for non-renewal scenarios.

Poor Communication: Open and consistent communication with landlords can prevent minor issues from escalating. Document all interactions to safeguard your interests.

Lack of Legal Counsel: Navigating these agreements without an experienced real estate attorney can lead to costly mistakes. As White and Bright, LLP advises:

“Commercial lease negotiations are complicated and it’s essential to have an experienced real estate attorney by your side. By attempting negotiations without counsel, you may inadvertently make costly mistakes that could impact your business for years to come.”

Finally, keep in mind that laws governing subleases and assignments vary by state. Consulting local legal expertise ensures compliance and protects your interests throughout the process.

These legal considerations provide the groundwork for evaluating the financial risks and advantages of sublease and assignment arrangements. A thorough understanding of these provisions is essential for informed decision-making and effective strategy development.

Financial Analysis and Risk Assessment

To make smart decisions about subleasing or assigning a lease, you need a thorough financial analysis. This step helps you understand the monetary impacts and risks involved, ensuring your investments are protected and returns are maximized.

Steps for Financial Analysis of Sublease and Assignment

Taking a structured approach to financial analysis helps you capture all the critical costs, benefits, and risks tied to your decision. Start by defining your baseline financial metrics, then dive into detailed scenario modeling.

Cash Flow Impact Assessment should be your starting point. Calculate how subleasing or assigning a lease affects your monthly and annual cash flow. For subleases, compare your rent payments to the income you’ll receive. For instance, if your rent is $15,000 per month but you can only sublease for $12,000, you’ll face a $3,000 monthly gap. For assignments, factor in assignment fees, ongoing liabilities, and the financial relief from transferring your lease obligations.

Present Value Calculations help you see the bigger picture. Use your company’s cost of capital to calculate the net present value (NPV) of each option. Comparing NPVs can show which lease scenario is more favorable long-term. Similarly, analyzing the internal rate of return (IRR) provides insight into which option offers better potential returns.

Cost-Benefit Analysis should include all related expenses, such as landlord review fees, legal costs, broker commissions, and even indirect costs like management time and potential vacancy periods. Don’t forget to consider the opportunity cost of capital tied up in security deposits or guarantees.

Market Rate Validation ensures your assumptions about sublease pricing are realistic. Research comparable lease rates in your building or area to confirm your financial expectations align with market conditions. This also strengthens your negotiating position.

Look at all these metrics together to get a full picture of the financial implications of your lease decision. Keep in mind that what works for one business might not work for another, depending on factors like industry trends, growth stage, and overall financial health.

Once you’ve analyzed the financial metrics, it’s time to assess tenant creditworthiness to fully understand the risks.

Evaluating Creditworthiness and Risk Exposure

Assessing the financial health of potential subtenants or assignees is critical to ensuring stability and reducing risks. A thorough evaluation can help protect your investment and avoid tenant defaults. This is especially important considering that, as of April last year, about 43% of small business renters in the U.S. struggled to pay rent in full and on time.

Financial Statement Analysis is the foundation of any creditworthiness check. Request and review the candidate’s financial statements. Audited or reviewed statements provide more reliability than internally prepared ones. Focus on income statements, balance sheets, and cash flow statements to evaluate financial stability, profitability, and debt levels.

Business History and Operational Assessment offers insight into performance. A long and stable track record often signals reliability. Look at their revenue streams - diverse and sustainable income sources suggest a stronger financial position. Consider the tenant’s industry as well; for instance, essential businesses like grocery stores or pharmacies tend to remain stable even in tough economic times.

Credit and Reference Verification adds another layer of security. Request credit reports to check the tenant’s payment history and outstanding debts. References from banks or financial institutions can also provide valuable insights into their financial reliability. Reviewing past rent payment records is another way to gauge their commitment to meeting financial obligations.

Legal and Management Review can uncover potential red flags. Check for any legal issues, such as bankruptcies or ongoing litigation, that could pose risks. Also, evaluate the tenant’s management team - strong leadership is a key indicator of business stability. Additionally, look into where the tenant is incorporated, as this can affect their legal and financial obligations under the lease.

Risk Mitigation Strategies can help protect your interests. Consider requiring tenant guarantees, such as corporate or parent company guarantees, to reduce risk. For tenants with weaker financial profiles, ask for larger security deposits, personal guarantees, or letters of credit.

Once you’ve assessed both financial metrics and tenant stability, use financial modeling tools to explore potential scenarios.

Using Financial Modeling Tools

Financial modeling tools are invaluable for turning raw data into actionable insights. They help you evaluate complex scenarios and make informed decisions about subleasing or assigning a lease.

Scenario Analysis and Sensitivity Testing allow you to prepare for different outcomes. Use these tools to forecast revenues, expenses, and capital costs, and compare these forecasts to your actual budgets. By modeling best-case, worst-case, and most-likely scenarios, you can better understand the potential impacts of changes in sublease income, vacancy periods, or market rent trends over time.

Advanced Risk Assessment Techniques provide a deeper understanding of potential outcomes. Monte Carlo simulations, for example, can generate a range of possible results to assess risks. Stress testing your model against extreme market conditions can also reveal its resilience.

Building a Financial Modeling Framework ensures your analysis covers all the bases. A good model should include revenue projections, cost structures, cash flow forecasts, and debt schedules. For subleases, consider factors like lease escalations, operating expense pass-throughs, and renewal scenarios. For assignments, account for remaining liabilities and ongoing obligations.

Specialized Tools and Platforms can take your analysis to the next level. While Excel offers flexibility, dedicated software provides advanced capabilities. For example, the Fractional Analyst platform is tailored for commercial real estate, offering customizable templates for sublease and assignment evaluations. It includes scenario modeling, risk assessment features, and detailed reporting tools. Similarly, the CoreCast intelligence system provides market data and benchmarks to ensure your models reflect current conditions.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Operational and Business Considerations

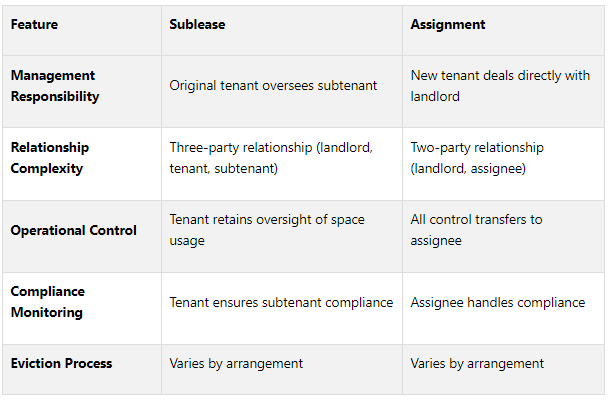

Subleasing and assignments can significantly alter daily operations by redistributing management responsibilities and redefining tenant relationships. Beyond the financial aspects, these operational factors are key to effectively implementing sublease or assignment strategies.

Operational Impacts of Subleasing or Assigning

The decision to sublease or assign a lease changes the nature of your daily operations and management duties. Each option requires distinct workflows and introduces unique relationships that must be carefully managed.

Property Management Complexity varies depending on the approach. Subleasing essentially turns you into a middleman, requiring you to screen subtenants, collect rent, handle maintenance issues, and ensure compliance with the master lease terms.

“Subleasing offers flexibility while imposing subtenant management duties.”

On the other hand, assigning a lease transfers all responsibilities to the new tenant, who deals directly with the landlord. While this reduces your operational role, you may still need to handle the transition, transfer deposits, or address any lingering obligations tied to the original lease.

Tenant Relationship Management is more intricate with subleasing. You must maintain ties with both the landlord and the subtenant, and any problems with the subtenant could strain your relationship with the property owner. In an assignment, the new tenant directly interacts with the landlord, simplifying daily interactions. However, you might still bear secondary liability if the assignee defaults on their obligations.

Occupancy and Space Management also depend on your choice. Subleasing allows you to retain some oversight of how the space is used and maintained, provided the subtenant complies with the master lease. With an assignment, all control over the space is handed over to the new tenant.

Compliance and Monitoring responsibilities shift as well. As a sublessor, you are accountable for ensuring the subtenant adheres to original lease terms and local regulations. In contrast, an assignee assumes full compliance responsibilities, though it’s wise to confirm they understand these obligations.

Business Reasons for Sublease and Assignment

Operational challenges often influence whether businesses choose to sublease or assign their lease. These options allow companies to adjust their lease commitments to better align with changing business needs.

Downsizing and Cost Reduction are common reasons for subleasing. If a business needs to cut costs quickly, subleasing unused space can provide immediate financial relief while maintaining flexibility for future changes. This is especially beneficial for companies navigating temporary economic setbacks or transitioning to remote work setups.

Business Expansion and Relocation often lead to lease assignments. When a company outgrows its current space or relocates for strategic purposes, assigning the lease provides a clean exit. This eliminates the burden of managing multiple locations and allows the business to focus on its new operational priorities.

Success in these scenarios depends on aligning operational capabilities with business goals. Subleasing requires ongoing management efforts, whereas assignment demands careful transition planning but ultimately simplifies operations.

Best Practices for Documentation and Negotiation

Given the complexities involved, thorough documentation and clear negotiations are essential for a smooth lease transfer process.

Comprehensive Legal Review is the cornerstone of a successful transfer. Legal counsel can identify potential issues and ensure compliance with all lease terms. As Brett Prikker, BDC Business Centre Manager, advises:

“Always, always, always get a lawyer’s opinion.”

Securing landlord consent and reviewing the sublease clause in your lease are critical steps. Your attorney should confirm that you understand all requirements for landlord approval and tenant obligations.

Due Diligence Documentation is vital for protecting all parties. Whether you're dealing with a subtenant or an assignee, review financial statements, credit reports, and business references to ensure their reliability. If you're the subtenant, it’s equally important to verify the financial stability of the sublandlord to safeguard your occupancy rights.

Strategic Negotiation Approaches can improve your terms. Use market data to support your proposals, whether for sublease rates or assignment conditions.

“You should always ask what inducements they can provide.”

Consider mutually beneficial concessions, such as rent-free periods, tenant improvement allowances, or flexible lease terms.

Critical Clauses and Protections should not be overlooked. For subleases, negotiate provisions like restoration clauses to avoid unexpected costs and ensure your right to the space if the sublandlord defaults. For assignments, ensure a clear transfer of obligations and watch for landlord recapture clauses that could allow the property owner to reclaim the space.

Timeline and Process Management is essential to avoid delays. Set clear deadlines for each stage of the process, from negotiations to final documentation. Ensure all required documents are submitted to the landlord promptly, and allow extra time for legal reviews and approvals.

Using detailed checklists for documentation, approvals, and transition tasks can help streamline the process and prevent oversights. Investing time in proper documentation and negotiation not only protects your interests but also ensures a smoother operational transition.

Sublease vs. Assignment Comparison

Understanding the differences between subleasing and assignment is essential when navigating commercial real estate decisions. While both provide ways to transfer lease responsibilities, they come with distinct legal and financial implications that can impact your business operations in significant ways.

Key Factor Comparison

Building on the legal distinctions covered earlier, let's dive deeper into how these two approaches differ across several important categories.

Transfer of Rights and Control

When you assign a lease, the assignee steps into your shoes, taking over all rights and obligations for the remainder of the lease term. Subleasing, however, keeps you (the sublessor) tied to the original lease while allowing the subtenant (sublessee) to occupy and use the space. This arrangement means you retain some control over how the space is utilized.

Liability and Financial Responsibility

In an assignment, the assignee becomes primarily responsible for the lease, but you may still hold secondary liability. With a sublease, you remain fully liable under both privity of contract and privity of estate. As King Law Offices explains:

“In a sublease, the tenant is always liable under the privity of contract and privity of estate.”

Payment Structure and Cash Flow

Assignments simplify the payment process - rent is paid directly from the assignee to the landlord, removing you from the equation. Subleasing, however, involves a more layered approach: the subtenant pays rent to you, and you, in turn, pay the landlord. This setup can create an opportunity to earn extra income if the subtenant’s rent exceeds your original lease cost.

Relationship Complexity

Assignments simplify the arrangement to a two-party relationship between the landlord and the assignee. Subleasing, on the other hand, introduces a three-party dynamic, which can add complexity. As LawDepot.com notes:

“Keep in mind that a sublease arrangement requires more work on your part because you are essentially keeping your existing arrangement and adding another one on top of it. This means you take on some responsibility.”

Choosing the Right Option

The decision between subleasing and assignment depends on your specific needs and goals.

Assignment is the better choice if you’re looking for a clean break from your lease obligations. This is especially useful for businesses permanently relocating, downsizing, or dealing with financial challenges. If your landlord agrees to release you from secondary liability and you have a creditworthy assignee lined up, this option allows you to focus entirely on your core operations without lingering lease responsibilities.

Subleasing, on the other hand, is ideal for businesses that want to keep their options open while potentially earning additional income. It’s a good fit for temporary adjustments, such as transitioning to a hybrid work model or scaling back during slower periods. If market rents have risen since you signed your lease, subleasing might even allow you to charge a higher rate and pocket the difference.

Your choice should align with your business strategy, risk tolerance, and the specifics of your lease agreement. Balancing flexibility, financial goals, and current market conditions will help you make the best decision for your situation.

Conclusion and Key Takeaways

Summary of Key Points

Reflecting on the earlier discussions, several important considerations emerge when analyzing subleases and assignments in commercial real estate. Both options require a solid grasp of legal, financial, and operational factors, with landlord consent being a pivotal element in either scenario.

When it comes to financial evaluation, it's not just about calculating rent. A thorough review of creditworthiness and financial stability is critical to understanding potential risks. Payment structures also differ: assignments establish a direct financial relationship between the landlord and the new tenant, while subleases involve a three-party payment flow.

Risk exposure varies significantly between the two approaches. In assignments, the new tenant (assignee) takes on primary liability, though you may still have secondary liability if they default. In subleases, however, you remain fully liable to the landlord if the subtenant fails to meet their obligations.

Siegfried Rivera from Siegfried Rivera highlights the importance of these provisions:

“Assignment and subletting provisions are vital for both landlords and tenants in commercial leases and commercial real estate. For landlords, these clauses help protect their properties’ financial and operational integrity. For tenants, they provide the flexibility to adapt to changing business needs. Negotiating these terms with clear guidelines and mutual understanding is essential for a successful leasing relationship.”

Operationally, the choice should align with your long-term business goals. Assignments allow for a clean break from lease responsibilities, whereas subleases provide flexibility by retaining some control over the space while adapting to changing needs.

Proper due diligence is non-negotiable. This includes reviewing lease agreements for restrictions, conducting background checks on potential assignees or subtenants, and understanding the tax implications of sublease income or potential capital gains. Contingency planning is equally important - whether dealing with rejected proposals, withdrawn assignees, or shifting market conditions. These steps lay the groundwork for leveraging expert tools and resources effectively.

How The Fractional Analyst Can Help

Informed decision-making in sublease and assignment scenarios hinges on precise financial modeling and market insights. The Fractional Analyst's team of financial specialists excels in commercial real estate underwriting, providing tailored analyses to evaluate potential assignees, assess market dynamics, and model scenarios specific to your needs.

Our direct services include custom financial evaluations that address key factors like creditworthiness, risk assessment, and cash flow projections. These tools are invaluable for understanding the financial impacts of subleasing or managing liability in assignments, as discussed throughout this guide.

For real estate professionals juggling multiple evaluations, our CoreCast platform offers self-service tools designed to streamline the process. With templates tailored to lease transfer scenarios, you can conduct initial assessments quickly and efficiently before diving into detailed negotiations.

Whether you're a tenant looking to transfer lease responsibilities or a real estate professional advising clients, our free models provide an excellent starting point. For more complex transactions, our custom analyses offer the depth required to navigate intricate details.

Success in these decisions depends on thorough preparation and expert insights. With the right tools and financial expertise, you can confidently approach sublease and assignment opportunities, aligning outcomes with your business objectives.

FAQs

-

When choosing between a sublease and an assignment, start by carefully examining your lease agreement. This document will clarify if these options are allowed and whether written approval from your landlord is necessary. Many leases include specific terms that govern subleasing or assigning the lease, so understanding these details is key.

It's also important to consider local laws, as some may prohibit landlords from unreasonably denying consent. Take the time to thoroughly evaluate potential subtenants or assignees to ensure they meet both financial and operational requirements. This step can go a long way in preventing future conflicts or liabilities.

-

When choosing between subleasing and assigning a lease, it's essential to consider the financial risks and potential benefits tied to each option.

With subleasing, you can earn rental income by leasing the space to a subtenant. However, you’ll still be on the hook for the original lease terms. If the subtenant fails to pay rent or violates the agreement, you could end up dealing with financial or legal fallout.

Assigning a lease, on the other hand, shifts all lease responsibilities to another party. Once the agreement is finalized, you're no longer liable, which means no ongoing risks. The trade-off? You give up any chance to earn income from the property.

Take a close look at your financial situation, your comfort level with risk, and your long-term plans to decide which path works best for you.

-

Managing a sublease comes with its fair share of challenges. One major issue is that the original tenant usually remains responsible if the subtenant fails to meet their obligations. On top of that, the original tenant has limited control over what the subtenant does, which can lead to problems like poor property upkeep or non-compliance with lease terms. Keeping a sublease running smoothly often requires consistent oversight to ensure the subtenant fulfills their responsibilities.

On the other hand, a lease assignment shifts all rights and responsibilities to the new tenant. But there’s a catch - unless the landlord formally releases the original tenant from liability, they could still be held accountable for any problems that arise down the line. This is why it’s crucial to structure the agreement carefully to reduce potential risks.

In short, subleases call for hands-on management of the subtenant, while lease assignments focus on addressing lingering liabilities through well-drafted agreements.