ALTA Leasehold Endorsements Explained

ALTA leasehold endorsements protect tenants and lenders in commercial real estate transactions by addressing risks standard title insurance doesn’t cover. These endorsements are critical for long-term leases or when tenants invest heavily in property improvements. They ensure financial protection against title defects, eviction, and loss of leasehold value.

ALTA 13 Endorsement: Protects tenants by covering leasehold interests and improvements.

ALTA 13.1 Endorsement: Protects lenders by safeguarding their collateral in leasehold transactions.

Coverage includes tenant improvements, relocation costs, and replacement leases in case of eviction.

Endorsements require detailed lease documentation, underwriting, and state-specific compliance.

Both endorsements are often used together to provide full protection for tenants and lenders in complex leasehold arrangements.

Leasehold Title Coverage

Types of ALTA Leasehold Endorsements

When dealing with leasehold transactions, two primary ALTA leasehold endorsements come into play, each serving a distinct purpose. These endorsements are designed to protect either the tenant or the lender, depending on the specifics of the deal. Knowing which one applies to your situation is key to ensuring the right coverage.

ALTA 13 Endorsement for Owner's Policies

The ALTA 13 Endorsement for Owner's Policies is tailored for tenants who hold leasehold estates. It works in conjunction with the ALTA Owner's Policy 2006, focusing specifically on safeguarding the tenant's interest in the leased property - not the property itself.

Adding the ALTA 13 endorsement to an owner's policy alters the way damages are calculated in the event of a covered loss. It introduces provisions for valuing the leasehold estate and accounts for additional types of losses that standard policies typically overlook. Essentially, if your leasehold interest is compromised due to title defects, the endorsement ensures that the insurance company calculates damages in a way that reflects the actual value of your leasehold position.

This endorsement is particularly useful for tenants who’ve made significant investments in tenant improvements or hold long-term leases with substantial remaining value. It applies to policies that cover either the leasehold estate alone or both the estate and any improvements made by the tenant.

ALTA 13.1 Endorsement for Loan Policies

The ALTA 13.1 Endorsement for Loan Policies (ALTA 13.1-06) is designed to protect lenders who provide financing for leasehold transactions. When a tenant uses their leasehold interest as collateral for a loan, lenders face unique risks that standard loan policies don’t adequately cover.

This endorsement attaches to loan policies and safeguards the lender’s collateral by recalculating the leasehold’s value in the event of title issues. It modifies damage calculations and establishes valuation methods from the lender’s perspective, ensuring their financial interest is protected.

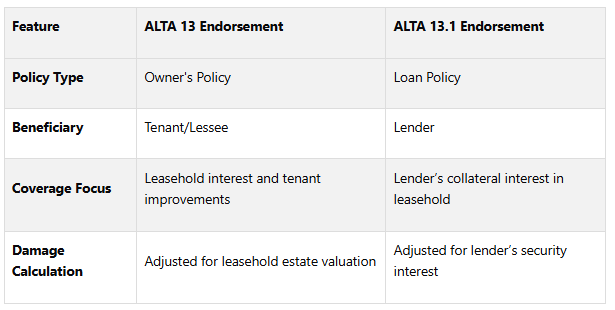

Differences Between ALTA 13 and ALTA 13.1

The key difference between these endorsements lies in who they are designed to protect and the type of policy they modify. The ALTA 13 endorsement is for lessees, enhancing owner’s policies to protect the tenant’s leasehold interest. On the other hand, the ALTA 13.1 endorsement is for lenders, modifying loan policies to secure their collateral in leasehold transactions.

In many commercial leasehold transactions, both endorsements are often used together. This dual approach ensures that the tenant’s interests are protected through the ALTA 13 endorsement, while the lender’s position is secured with the ALTA 13.1 endorsement. Together, they provide comprehensive coverage for all parties involved in these complex arrangements.

Coverage and Protections

ALTA leasehold endorsements address the specific challenges faced by lessees, offering targeted safeguards against title defects and related risks. Here's a closer look at how these endorsements shield lessees from financial losses.

Protection Against Loss of Leasehold Value

One of the key benefits of an ALTA leasehold endorsement is its ability to secure the full value of your leasehold interest in the event of eviction. This protection recalculates losses by factoring in the remaining lease term and the value of tenant improvements.

"Evicted" or "Eviction": (a) the lawful deprivation, in whole or in part, of the right of possession insured by this policy, contrary to the terms of the Lease or (b) the lawful prevention of the use of the Land or the Tenant Leasehold Improvements for the purposes permitted by the Lease, in either case as a result of a matter covered by this policy. – Virtual Underwriter

Even if you're not entirely evicted but are unable to use the property as intended, the endorsement provides coverage to mitigate such disruptions.

Coverage for Tenant Improvements

Unlike standard policies, which generally exclude tenant improvements, ALTA leasehold endorsements define "Tenant Leasehold Improvements" broadly. This includes improvements like landscaping that are either required or permitted by the lease, constructed at your expense, or represent an investment beyond simply obtaining possession.

If eviction occurs after improvements are completed, their full value is covered. For projects still under construction, the endorsement compensates for actual costs incurred, including permits, professional fees, and construction management - minus salvage value.

Eviction and Replacement Leasehold Costs

These endorsements also address the financial strain caused by relocation. They cover relocation expenses, removal costs, ongoing rent or damages, and even losses related to tenant relationships.

Additionally, they provide support for obtaining a replacement leasehold. This includes reasonable costs for securing land use, zoning, building, and occupancy permits, as well as expenses tied to acquiring a leasehold equivalent to the original one.

Requirements for Obtaining ALTA Leasehold Endorsements

To secure an ALTA leasehold endorsement, you’ll need to meet specific documentation and underwriting criteria. These steps are essential to ensure the protections discussed earlier remain intact and effective.

Documentation and Lease Recording

To start the process, you’ll need a complete and finalized lease agreement, along with any amendments. This full lease package allows the title company to thoroughly review your leasehold rights and obligations.

Next, you’ll need to record the lease. This can be done by filing either the entire lease agreement or a recordable memorandum, which serves to confirm the lease’s existence.

An estoppel certificate from the lessor is also required. This document verifies key lease details, including the term, compliance status, and any defaults or modifications.

Additionally, it’s critical to examine the fee title to confirm that the lessor had the legal authority to grant the leasehold interest at the time of execution. This step ensures there are no surprises regarding ownership or authority.

Underwriting Considerations

Underwriting for leasehold endorsements involves a more detailed review compared to standard title policies. Title companies carefully analyze the lease agreement, focusing on elements like renewal options, assignment rights, and any restrictions that could impact the leasehold’s value.

It’s important to allow sufficient lead time for this underwriting process, especially for complex commercial leases. The review process is thorough, and rushing it could lead to oversights.

Underwriters will include lease terms as exceptions on Schedule B of the policy. Any existing exceptions to the fee title - such as easements, liens, or other encumbrances - will also be listed here, as they impact the underlying property.

The type of lease significantly influences the level of scrutiny during underwriting. For instance, ground leases tied to development projects typically undergo a more rigorous review than standard office leases. Underwriters assess factors like the lease’s stability, the financial strength of the lessor, and the intended use of the property.

Once the standard underwriting review is complete, adjustments may be needed to address state-specific requirements, which are outlined below.

State-Specific Considerations

The process for obtaining ALTA leasehold endorsements varies across states due to differences in insurance regulations and real estate laws. These variations can have a significant impact on the requirements and structure of the endorsements.

For example, New York only permits TIRSA 2006 ALTA policies and endorsements, as mandated by the New York State Department of Financial Services. Pennsylvania employs modified versions of the 2006 ALTA policies, where survey coverage requires a separate endorsement. In Ohio, state-specific forms from the Ohio Title Insurance Rating Bureau are used, offering optional coverages through a "check the box" system.

Arbitration rules also differ by state. In Florida, arbitration is only allowed if both parties agree, while Louisiana prohibits enforceable arbitration clauses in insurance policies. In Texas, arbitration is not mandatory if the insured is a natural person.

Some states impose additional recording requirements beyond the standard lease documentation. These requirements, driven by variations in real estate recording laws, can influence both the timing and cost of obtaining endorsements.

The availability of certain endorsement forms also depends on the state. This makes it crucial to work with local underwriting professionals who understand the specific rules and options in your area.

Navigating these regional differences is key to ensuring effective leasehold insurance and managing risks effectively.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Leasehold Endorsements vs Standard Title Insurance

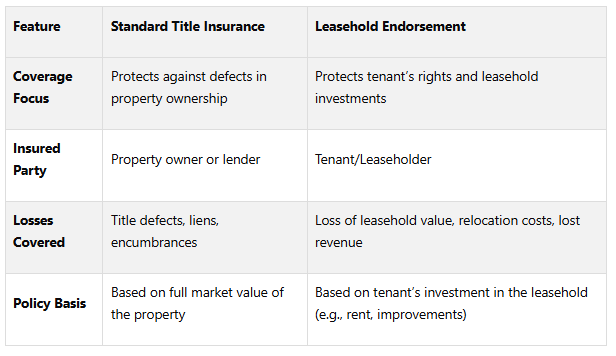

Let’s dive into the key differences between leasehold endorsements and standard title insurance. While both aim to provide financial protection in commercial real estate transactions, they cater to distinct parties and serve unique purposes.

Coverage Differences

Standard title insurance focuses on safeguarding the property owner’s ownership rights. On the other hand, leasehold endorsements are designed to protect tenants and their lenders, ensuring their financial interests are secure in the event of title issues that impact a leased property’s usability or value.

"Title endorsements enhance coverage of a standard homeowner's title insurance policy, usually either by removing exceptions to the standard policy or by adding coverage specific to the property's situation." – Elizabeth Whitman, attorney-at-law with Whitman Legal Solutions

For property owners, standard title insurance offers protection by covering the full market value of the property. For tenants, leasehold endorsements step in to cover losses tied to their leasehold investments. These could include decreased revenue, relocation expenses, or other financial setbacks caused by title defects affecting the landlord’s property. Additionally, leasehold endorsements adjust how damages are calculated, factoring in the tenant’s financial commitment, such as rent payments and property improvements, and defining the leasehold estate as the tenant's right to possession under the lease.

These differences highlight the specific scenarios where leasehold endorsements become a must-have.

When Leasehold Endorsements Are Necessary

The need for leasehold endorsements hinges on factors like the tenant’s financial investment and the lease’s duration. They become critical when tenants face financial risks that standard title insurance doesn’t address.

For example, tenants with long-term leases - say, 20 years - often secure leasehold endorsements because moving after such a significant commitment can be incredibly costly and disruptive. In contrast, tenants with short-term leases (three years or less) may decide that a title policy isn’t worth the added expense. Major investments in the property, such as extensive renovations or custom buildouts, also make leasehold endorsements a smart choice, as they provide coverage for these significant expenditures.

If the insurance is solely for the landlord’s interest, leasehold endorsements aren’t necessary. In such cases, the landlord’s policy simply needs to include an exception on Schedule B for the lease’s terms and conditions.

Leasehold endorsements also offer extra protection for properties with unique challenges, like zoning restrictions, easements, or encroachments. These issues could interfere with a tenant’s ability to use the space, and standard title insurance may not fully address these risks. By securing a leasehold endorsement, tenants gain a financial safety net in case their right to the premises is contested or compromised by a covered claim. This added layer of security becomes even more essential as tenants increase their financial stake in a property through long-term leases or costly improvements.

Role in Commercial Real Estate Financial Analysis

ALTA leasehold endorsements play a key role in addressing risks tied to leasehold interests - risks that standard fee-simple policies don’t cover. These endorsements help quantify potential issues, which in turn makes financial models more accurate by accounting for possible disruptions in cash flow.

Impact on Financial Modeling

By converting these protections into measurable factors, financial models become better equipped to reflect real-world risks. For example, if title defects lead to eviction, endorsements can cover losses such as rental income, tenant improvements, relocation expenses, and business interruptions. This standardized approach allows analysts to reliably simulate worst-case scenarios.

When it comes to financial modeling, these endorsements help adjust for risk and account for tenant investments. Key areas of focus include:

Cash Flow Protection: Endorsements safeguard cash flow by covering disruptions caused by title defects, ensuring recovery of major investments.

Capital Investment Recovery: Significant tenant expenditures - like construction costs, design fees, permits, testing, professional services, landscaping, and loan interest - are factored into risk assessments. By protecting these outlays, endorsements reduce the overall risk level of a project.

Valuation Adjustments: Properties with leasehold endorsements often achieve higher market valuations. The additional coverage reduces perceived investment risks, which can result in more favorable risk-adjusted returns.

These protections are especially critical when lessors are single-purpose entities with limited financial resources. In such cases, analysts are encouraged to estimate potential damages realistically and secure suitable insurance coverage to enhance financial model accuracy.

Using The Fractional Analyst

The Fractional Analyst incorporates leasehold endorsement analysis into financial models through its CoreCast platform. Leveraging AI and machine learning, CoreCast simulates lease-specific risk scenarios, enhancing the precision of financial assessments.

Additionally, The Fractional Analyst offers custom financial modeling services tailored to complex leasehold transactions. Their team ensures that endorsement protections are seamlessly included in risk evaluations, resulting in cash flow projections that reflect true risk-adjusted returns. To cater to various project needs, they provide flexible service options:

Associate Analyst services at $115 per hour

Director Analyst services at $145 per hour

Executive Analyst services at $195 per hour

Fixed pricing possible for Associate & Director access at $12,000 per month for the first analyst, each additional is $8,000/analyst/mo.

Conclusion

Expanding on the underwriting analysis and detailed coverage, ALTA leasehold endorsements play a critical role in completing the risk management puzzle. These endorsements are specifically designed to protect leasehold interests in intricate commercial transactions, addressing risks that standard title insurance often overlooks.

The ALTA 13 and 13.1 endorsements offer protection against eviction, safeguard tenant improvements, and even reimburse construction costs. They also cover seven additional loss scenarios typically excluded from standard policies, making them an essential layer of protection for leasehold interests.

For commercial real estate professionals, these endorsements are more than just insurance - they're strategic assets. By integrating leasehold endorsement analysis into financial models, professionals can achieve more precise cash flow forecasts and prepare for realistic worst-case scenarios, resulting in stronger risk assessments and better investment decisions.

Incorporating ALTA leasehold endorsements into due diligence is essential for investors. By addressing leasehold risks head-on and reinforcing financial models, these endorsements support smarter investment choices and strategic planning in the commercial real estate sector. This approach not only strengthens financial projections but also lays the groundwork for sound, strategic decision-making.

FAQs

-

ALTA leasehold endorsements play an important role in protecting tenants and lenders in commercial real estate deals. These endorsements are designed to shield against financial setbacks that can arise from eviction. They often cover costs like lost rent, damages for use and occupancy before eviction, and the value of any leasehold improvements.

This extra layer of protection helps tenants and lenders manage the risks tied to unexpected lease disruptions, offering greater peace of mind in their transactions.

-

The ALTA 13 endorsement is specifically crafted to protect leasehold owners, including coverage for any tenant improvements. On the flip side, the ALTA 13.1 endorsement is designed for lenders, providing protection for the leasehold estate tied to leasehold loan policies.

Although both endorsements offer crucial protections, their purposes differ. ALTA 13 addresses the needs of tenants, ensuring their leasehold rights and any improvements they’ve made are safeguarded. Meanwhile, ALTA 13.1 focuses on lenders, insuring their financial stake in the leasehold estate. These endorsements play a vital role in commercial real estate deals, offering tailored protections to address the unique concerns of both parties.

-

To secure an ALTA leasehold endorsement, you'll need several essential documents. These include the signed lease agreement, any amendments, and either a recordable lease or a memorandum of lease. Make sure to list the lease terms as exceptions in Schedule B, obtain an estoppel certificate from the lessor, and confirm approval for any lease assignments, if applicable. Additionally, it's critical to thoroughly review the fee title to confirm that the lessor owned the property at the time the lease was signed.

Keep in mind that state-specific regulations can influence this process, as they determine which forms and endorsements are permitted. Working with local underwriting professionals can help ensure compliance with these rules and address any regional nuances. Having the right documentation and following local laws are key to completing the endorsement process smoothly.