How Scenario Projections Improve CRE Investment Decisions

Scenario projections are a game-changer for commercial real estate (CRE) investors. Instead of relying on rigid forecasts, this approach models multiple potential outcomes, helping investors prepare for uncertainties like interest rate hikes, tenant turnover, or market shifts. Here’s why they matter:

Better Risk Management: Spot risks early, like interest rate sensitivity or tenant default, and create contingency plans.

Clearer Decision-Making: Compare best, base, and worst-case scenarios to evaluate returns and align with your goals.

Improved Credibility: Lenders and stakeholders value proactive forecasting that accounts for market volatility.

For example, a 1% interest rate increase can reduce property values by up to 10%. Scenario projections help investors navigate such challenges, ensuring smarter, data-backed decisions in a complex market.

Key Tools: Excel, Argus Enterprise, and platforms like CoreCast simplify modeling and scenario testing. Fractional analyst services further enhance accuracy and scalability.

CRE investors who adopt scenario-based planning are better equipped to handle market uncertainties, optimize cash flow, and achieve long-term success.

Building Sensitivity Analysis into Your Real Estate Proforma

Core Components of CRE Scenario Analysis

When it comes to commercial real estate (CRE), scenario analysis hinges on three key components that together provide a clearer picture of potential investment outcomes. Each addresses a unique layer of uncertainty, helping investors make more informed decisions about their returns.

Modeling Revenue Under Different Conditions

Revenue modeling is the backbone of scenario analysis. It involves testing assumptions about market rents, rent growth, and vacancy rates to gauge profitability.

"Scenario analysis is the process of testing different assumptions in real estate transactions to determine potential outcomes." - Corey Philip, Owner of Wisdify

A practical way to approach this is by creating three scenarios: best-case, base-case, and worst-case. For instance, tweaking occupancy rates can drastically influence revenue. Research highlights that a property with a 90% occupancy rate generates significantly more income than one at 50%.

Take an example: an apartment building earning $100,000 annually. Under base-case conditions, it might achieve a 14% profit margin. In a best-case scenario, that jumps to 20%, while a worst-case scenario might see it drop to 8%.

Revenue modeling should also factor in rent escalations, lease renewals, and tenant turnover. Local economic shifts can affect market rent levels, so it's crucial to use realistic rent growth assumptions to identify which variables have the biggest impact on performance.

These revenue insights are essential for refining cost estimates under different scenarios.

Adjusting Cost Estimates for Different Scenarios

Costs in CRE investments are far from static. Fixed and variable expenses, financing terms, and capital expenditures all fluctuate based on economic conditions.

"Cost estimation is not a static process. As the project progresses, there will be changes in scope, unforeseen issues, or market conditions that can affect the budget. Continuously monitoring and updating your cost estimates ensures that the project stays financially viable." – Birdview

Interest rates, for example, can greatly influence financing costs. In the Wisdify apartment example, a $600,000 loan at a 6% interest rate (base-case) results in $36,000 in annual interest. In a best-case scenario with a 5% rate, the expense drops to $30,000, while a worst-case 7% rate pushes it to $42,000.

Operational expenses also shift with market demand. High-demand markets may drive up costs for maintenance, utilities, and property management, while low-demand markets might offer savings but require different spending strategies to remain competitive.

Key cost factors to consider include labor, raw materials for maintenance, regulatory compliance, and supplier dynamics. Additionally, technology upgrades and energy-efficient improvements can reshape expense structures, especially in response to evolving regulations.

Once costs are modeled, the next step is to assess how these scenarios influence property valuations.

Property Valuation Changes Across Market Conditions

Property values are highly sensitive to factors like location, market demand, comparable sales, and interest rates. Scenario analysis must explore how these variables affect valuations over time.

Location remains a dominant factor in determining value. Interest rate shifts, for instance, can significantly impact valuations, influencing decisions around refinancing and exit strategies.

Market conditions also play a role. In strong markets, comparable properties may sell at premium prices, boosting valuations. On the flip side, downturns can lead to lower appraised values.

Neighborhood trends and infrastructure improvements can further sway property values. Gentrification or new safety measures often lead to faster value appreciation, while economic decline or aging infrastructure can slow growth or even cause depreciation.

Property-specific details, such as age, condition, and potential for upgrades, also matter. For example, energy-efficient improvements can both increase property value and lower operating costs. Modeling the timing and cost of major capital improvements helps clarify their impact on cash flow and eventual sale price.

Finally, government policies and tax changes add another layer of complexity. Tax credits or subsidies can temporarily boost demand and valuations, while new regulations might impose costs or restrictions that affect long-term growth.

How Scenario Projections Improve Investment Decisions

Scenario projections play a crucial role in refining investment decisions. Instead of relying on single-point estimates, which can often mislead, scenario-based approaches provide a broader perspective on potential outcomes. This method uncovers critical risk exposures and offers a way to better understand and prepare for uncertainties.

Finding and Understanding Risk Exposures

Scenario projections help identify risks that single-point forecasts often miss. By exploring various assumptions about market trends, economic shifts, and operational challenges, investors gain a deeper understanding of where vulnerabilities might lie.

This process involves assessing how different variables impact property performance under best-case, base-case, worst-case, and stress test scenarios. For instance, interest rate sensitivity often emerges as a major risk factor to monitor.

Key variables examined through scenario analysis include:

Market demand and supply

Economic indicators

Interest rates

Regulatory environment

Operational factors

By simulating stress scenarios, investors can pinpoint areas of concern before they escalate into costly problems. Additionally, scenario projections highlight sensitivity to changes in key variables, offering insights into which assumptions have the most significant impact on returns. This clarity allows for more precise risk management and better preparation for market fluctuations.

Comparing Return Potential Across Scenarios

Scenario projections also enable side-by-side comparisons of return potential under different market conditions, providing a data-driven foundation for decision-making.

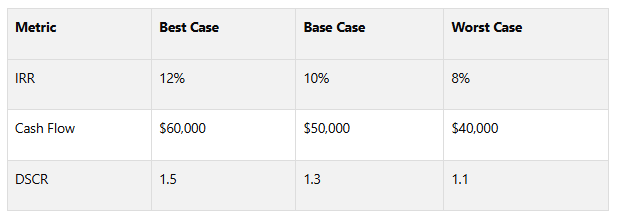

By modeling various hypothetical situations, investors can see how changes in variables affect cash flow and overall performance. For example, comparing metrics like IRR (Internal Rate of Return) and Equity Multiple across scenarios helps clarify the range of possible outcomes:

This comparison not only reveals expected returns but also highlights the spread of potential outcomes. Understanding this range helps investors align their choices with their risk tolerance and financial goals.

Moreover, scenario analysis equips investors to adjust strategies as conditions evolve, turning static financial data into actionable insights. By anticipating both challenges and opportunities, investors can make proactive decisions, laying the groundwork for effective contingency planning.

Creating Backup Plans and Risk Strategies

Scenario projections are instrumental in developing contingency plans by identifying potential cash flow challenges early.

For each scenario, investors can design targeted strategies. In best-case scenarios, the focus might be on reinvesting surplus cash or expanding operations. In worst-case scenarios, strategies may involve cutting costs or renegotiating payment terms. For base-case scenarios, maintaining steady operations while staying flexible for potential pivots becomes the priority.

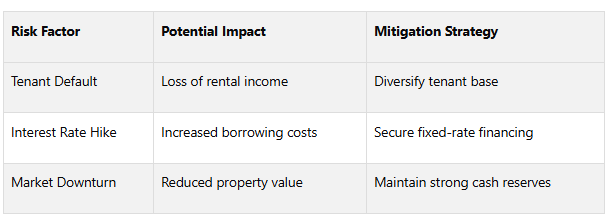

Risk mitigation strategies also become more focused when guided by scenario analysis:

Investors can reduce exposure to unfavorable outcomes by diversifying their portfolios or securing insurance. Preparing for worst-case scenarios with backup plans and alternative strategies ensures readiness for potential challenges.

Ongoing monitoring is essential. Investors should establish processes to regularly update scenarios as market conditions and information evolve. This continuous reassessment ensures risk strategies remain effective over time.

With the global real estate market projected to grow from $3.69 trillion in 2021 to $5.85 trillion by 2030, at an annual growth rate of 5.2%, scenario-based planning becomes even more critical for navigating this expanding and complex market landscape.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Scenario Projections vs Single-Point Forecasting

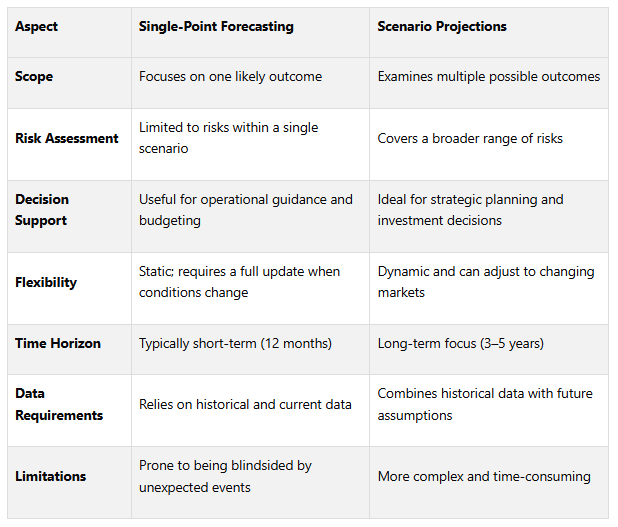

Grasping the differences between scenario projections and single-point forecasting is key to making better CRE investment decisions. While both methods provide valuable insights, they take very different approaches to dealing with future uncertainties.

The main distinction lies in how each handles unpredictability. Scenario analysis explores a variety of potential outcomes and their impact on a company's financial standing, whereas single-point forecasting focuses on predicting the most likely scenario based on past and present data.

Here’s a breakdown of how these two methods differ:

These differences highlight the broader perspective scenario projections offer compared to static forecasts. For example, while single-point forecasting might predict a specific return based on historical data, scenario analysis provides a range of outcomes, accounting for market fluctuations. Combining scenario analysis with traditional forecasting can deliver a more dynamic view, enabling investors to balance immediate needs with long-term goals.

When to Use Scenario-Based Methods

So, when should you lean on scenario projections? The answer lies in situations marked by uncertainty and complexity. Market volatility, for instance, often calls for scenario-based analysis. With interest rates and economic conditions shifting rapidly, single-point forecasts can miss critical risks. For example, even a 1% increase in interest rates can significantly lower property values, making scenario analysis essential for long-term planning.

Scenario projections shine in high-stakes decisions, such as acquisitions, development projects, or major capital investments. These decisions demand a clear understanding of how different market conditions might affect returns over several years. With the global real estate market expected to grow from $3.69 trillion in 2021 to $5.85 trillion by 2030 at a 5.2% annual growth rate, scenario analysis can help navigate both opportunities and risks.

For transactions involving large capital commitments, the added complexity of scenario modeling is worth it. The cost of this deeper analysis pales in comparison to potential losses from unforeseen market changes. This approach complements earlier discussions on managing risk and creating contingency plans, making it a vital tool for strategic CRE decision-making.

That said, scenario analysis isn’t always necessary. For routine, short-term decisions - like daily budgeting or managing cash flow - single-point forecasts are often sufficient. The trick is to align the method with the complexity and stakes of the decision. As markets grow more unpredictable, scenario analysis provides a broader view, helping investors handle risks more effectively.

Interestingly, 55% of companies don’t currently use scenario analysis when making forecasting adjustments. This gap presents a major opportunity for improvement. Businesses that embrace scenario planning can gain an edge through better risk management and greater strategic adaptability.

Tools and Resources for Scenario Analysis

Navigating scenario analysis in commercial real estate (CRE) requires the right tools. With the US CRE market valued at over $1 trillion, investors and analysts need reliable resources to make informed decisions.

Financial Modeling Tools for Scenario Analysis

At the heart of effective scenario analysis is choosing tools capable of handling complex variables and calculations. Microsoft Excel remains a go-to option due to its flexibility, robust functionality, and compatibility with various data sources. Its widespread use and reliability make it a staple for financial modeling.

For more specialized needs, Argus Enterprise is widely regarded as the industry benchmark for CRE valuation and cash flow analysis. Its precision and ability to manage intricate property types and scenarios make it indispensable for advanced users.

RealData caters to real estate investment and development projects, offering a straightforward interface ideal for specialized analysis. Meanwhile, CoStar provides a comprehensive suite of data and analytics tools, making it a leading choice for CRE professionals. For those seeking simplicity, ProCalc offers a user-friendly experience, even for those just starting out.

When evaluating tools, prioritize features that simplify scenario adjustments and sensitivity analysis. Look for options that allow you to build detailed pro formas, test variables, and visualize metrics with dashboards and charts. Integrated services that combine software with expert insights can further enhance the reliability of your analysis.

The Fractional Analyst Services and Platform

Beyond software, The Fractional Analyst offers a unique blend of expert services and a self-service platform tailored to CRE professionals. This approach combines the expertise of financial analysts - who have underwritten over $20 billion in deal volume - with technology designed for the industry.

Direct Expert Services: Starting at $115 per hour, these services include underwriting, asset management support, market research, investor reporting, and pitch deck creation. This is ideal for complex deals requiring detailed and customized analysis.

CoreCast Platform: For $50 per user per month during beta testing, this self-service platform integrates tools and data, helping users streamline investment strategies and improve operational efficiency.

Additionally, Free Financial Models offer a cost-effective way to explore scenario analysis. These downloadable Excel models, previously sold for $1,000 to $3,000, include built-in assumptions, error-checking features, and sensitivity tables. Covering a variety of property types and investment scenarios, they are valuable for both learning and practical use.

Getting Expert Support for Better Results

Scenario analysis often demands expertise that goes beyond the capabilities of in-house teams. With studies showing that up to 90% of spreadsheets contain errors, professional support can make a significant difference in accuracy and confidence.

Cost efficiency is a key advantage of outsourcing. Fractional services, costing $5,000–$10,000 per month, provide access to high-level expertise without the expense of a full-time CFO, which can exceed $400,000 annually.

Specialized expertise brings fresh perspectives, improving scenario modeling and expanding the scope of analysis. These professionals also leverage advanced tools to enhance financial predictions and stay current with regulatory changes, reducing compliance risks.

Scalability is another major benefit. Fractional services allow businesses to adjust their financial leadership needs based on growth phases or specific projects, such as acquisitions or entering new markets.

The results of expert-driven planning are clear: firms with strong financial planning grow up to 30% faster than those without. This highlights the measurable impact of professional support in making smarter, more strategic investment decisions in the CRE sector.

Conclusion

Expanding on the earlier discussion about revenue modeling and cost adjustments, scenario projections have become a critical tool for bridging gaps left by traditional forecasting. In today’s unpredictable markets, these projections are reshaping how commercial real estate (CRE) investors make decisions. By leveraging multiple scenarios, investors can stress-test their assumptions and handle risks with greater precision.

Key Takeaways

Using scenario-based cash flow projections provides distinct advantages over conventional forecasting. This method uncovers hidden risks and enables a more detailed comparison of investment options. It also helps investors plan ahead by visualizing a range of potential outcomes. As Tim Schultz, CTP, FPAC, highlights, the prolonged impact of "Higher For Longer" interest rates on cash flow makes scenario analysis indispensable. Schultz emphasizes that modeling various business scenarios equips fund managers with the tools needed to execute their strategies effectively.

By embracing diverse scenarios, investors can shift from merely reacting to market changes to planning proactively. These insights pave the way for immediate, impactful action.

Steps for CRE Investors to Take

To get started, begin with a manual cash flow forecast to identify your specific needs. Once you’re comfortable with the basics, transition to a rolling forecast that you update regularly based on actual performance and changing market conditions.

Additionally, focus on gaining leadership support and encouraging collaboration across your organization to ensure accurate and comprehensive data sharing. You may also want to partner with experts to develop and implement tailored technology solutions that meet your unique requirements. These steps can help investors face challenges head-on and capitalize on opportunities.

The commercial real estate market continues to evolve, requiring strategies that look ahead rather than lag behind. Mastering scenario-based projections is a powerful way to manage uncertainty and strive for consistent, long-term success.

FAQs

-

Scenario projections are a valuable tool for commercial real estate (CRE) investors, offering a way to navigate the challenges of changing interest rates and uncertain markets. By simulating various economic scenarios, these models help investors understand how factors like rising interest rates or economic slowdowns might affect property values, cash flows, and overall investment outcomes.

With this insight, investors can pinpoint potential risks and weak spots ahead of time. This allows them to take strategic steps, such as restructuring debt or diversifying their portfolios, to protect their investments. Taking these measures early helps investors stay prepared and make smarter decisions, even when market conditions are unpredictable.

-

When it comes to commercial real estate (CRE), scenario projections offer a way to explore multiple outcomes by tweaking various assumptions. This method allows investors to weigh risks and opportunities across different conditions, offering a more comprehensive view of potential performance - especially in unpredictable market environments.

On the other hand, single-point forecasts aim to predict one specific, most likely outcome based on current data and assumptions. While helpful for straightforward planning, they fall short in accounting for variability or unexpected shifts. In contrast, scenario projections shine by considering a broader range of possibilities, making them a powerful tool for risk management and smarter investment choices.

-

Commercial real estate (CRE) investors often rely on Excel for scenario analysis, using it to create financial models that explore different outcomes - like best-case, worst-case, and base-case scenarios. This flexibility allows for quick adjustments to key assumptions and sensitivity testing, making it easier to see how changes in variables such as rent growth or vacancy rates could impact cash flows.

For a more advanced approach, Argus Enterprise offers built-in 'what-if' tools that streamline scenario modeling. These features let users explore various property and portfolio scenarios, evaluate risks, and forecast cash flows with greater precision. By using both tools together, CRE investors can better analyze market conditions and make smarter, data-backed investment decisions.