Title Insurance Endorsements: Cost Breakdown

Title insurance endorsements help protect against specific risks that standard policies may not cover. They are particularly important for commercial properties with unique challenges like zoning issues, environmental liens, or mineral rights disputes. Here's a quick breakdown:

ALTA 3 Zoning Endorsement: Covers zoning classification and permitted uses. Costs $0.50–$1.00 per $1,000 of coverage (e.g., $2,500–$5,000 for a $5M loan).

ALTA 8.1 Environmental Lien Endorsement: Protects against recorded environmental liens. Typically costs around $75.

ALTA 9 Restrictions, Encroachments, Minerals Endorsement: Covers covenant violations, encroachments, and mineral rights risks. Costs 10% of the base premium (e.g., $50,000 on a $500K policy) or 25% in Florida.

Key Takeaway: Endorsements add 5–10% to the base premium but offer targeted protection for commercial real estate risks. Choose endorsements based on property specifics and lender requirements.

1. ALTA 3 Zoning Endorsement

Purpose and Coverage

The ALTA 3 series endorsements are designed to address zoning-related risks that standard title insurance policies typically overlook. They provide coverage for a property's zoning classification and permitted uses, offering protection for both loan and owner policies [1]. Depending on the property's development stage, there are three variations of this endorsement:

ALTA 3-06 (Zoning Unimproved Land): This applies to both vacant and improved land, insuring the property's zoning classification and permitted uses. It also covers losses if a court invalidates the zoning ordinance, preventing any of the insured uses.

ALTA 3.1 (Zoning‑Completed Structure): Specifically for improved land, this endorsement provides coverage similar to ALTA 3-06 but focuses on risks tied to existing structures. It protects against court orders requiring removal or alteration of a building due to zoning issues like setbacks, height limitations, floor space, or parking requirements.

ALTA 3.2 (Zoning – Land Under Development): This extends the ALTA 3.1 coverage to land with planned improvements, provided the construction adheres to the plans and specifications submitted to the underwriter.

These endorsements are tailored to meet the needs of various stages of commercial property development. However, they exclude coverage for losses resulting from land becoming unsellable or unmortgageable due to zoning issues or non-compliance with zoning restrictions [1].

Cost Range

The cost of an ALTA 3 zoning endorsement is calculated as a percentage of the insured amount. Typically, the additional premium falls between $0.50 and $1.00 per $1,000 of coverage [6]. For instance, on a $5 million commercial property loan, the endorsement might cost anywhere from $2,500 to $5,000. Larger policies often benefit from lower rates within this range, making the endorsement more economical for high-value transactions.

“The additional premium charged for a zoning endorsement is based on a percentage of the overall insured loan amount and typically ranges from $0.50 to $1.00 per $1,000 of coverage depending upon the size of the policy.”

Impact on Total Premiums

Adding an ALTA 3 endorsement results in a slight increase to the overall title insurance premium. However, it offers a practical and often more affordable alternative to traditional zoning opinions obtained through legal counsel. Borrowers find zoning endorsements simpler to present to lenders, as they allow direct claims to the title insurer in the event of zoning-related losses, bypassing the need for litigation against legal counsel [6].

This endorsement provides a cost-effective layer of protection against zoning disputes, particularly in areas with intricate regulations or for properties with specific use requirements. While the added cost is modest, the peace of mind it delivers can be invaluable in navigating complex zoning challenges.

2. ALTA 8.1 Environmental Protection Lien Endorsement

Purpose and Coverage

The ALTA 8.1 Environmental Protection Lien Endorsement offers protection against financial losses caused by recorded environmental liens that aren't already listed as exceptions in the title policy. It also extends to environmental protection liens established by state statutes effective as of the policy date, unless explicitly excluded [1][7][8].

Important: This endorsement applies only to residential loan policies. For commercial, industrial, or mixed-use properties, the ALTA 8.2-06 endorsement should be used instead [1][9].

By addressing these liens, the endorsement shields property owners from unexpected financial burdens tied to past environmental issues. It also aligns with exclusions approved by FNMA, making it a standard inclusion in most FNMA residential transactions [7]. This targeted protection provides peace of mind at a relatively low cost, helping to manage environmental financial risks effectively.

Cost Range

The ALTA 8.1 endorsement is an affordable option. Compared to other title insurance endorsements, it is typically inexpensive [5]. On average, title endorsements cost around $75, though prices can vary based on the type of coverage and property details [4]. State-specific regulations may also influence costs [4]. For example, New Castle Title charges $175 for a Gap Endorsement on residential properties [10]. In comparison, the ALTA 8.1 endorsement tends to fall on the lower end of the price spectrum, making it an accessible choice for most residential transactions.

Impact on Total Premiums

Adding the ALTA 8.1 endorsement has a negligible effect on the overall title insurance premium for FNMA residential transactions. It delivers essential protection against undisclosed environmental liens without significantly increasing the total cost of the policy, offering a cost-effective way to manage potential risks.

3. ALTA 9 Restrictions, Encroachments, Minerals Endorsement

Purpose and Coverage

The ALTA 9 endorsement combines protections related to restrictive covenants, easements, and issues involving mineral rights, often requested by institutional lenders [1]. It provides coverage for losses tied to covenant violations that impact property value or usage [12]. Additionally, it safeguards against existing encroachments, damages caused by the exercise of mineral rights, and court-ordered removal of encroachments due to setback violations [1][11].

This endorsement offers a comprehensive approach to addressing potential risks, making it a key consideration for those evaluating title insurance options.

Cost Range

The cost of the ALTA 9 endorsement is generally calculated as 10% of the original title insurance premium, with a minimum charge of $150 [12]. While most states adhere to this 10% rate, Florida typically applies a higher rate of 25% [11][12][13].

Impact on Total Premiums

Adding the ALTA 9 endorsement increases the total title insurance premium proportionally. For instance, on a $500,000 commercial title insurance premium, the endorsement would add $50,000 in most states (10%), while in Florida, the additional cost would be $125,000 (25%). Even for smaller transactions, the $150 minimum ensures meaningful coverage costs are applied.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Common Endorsements in Commercial Transactions

Advantages and Disadvantages

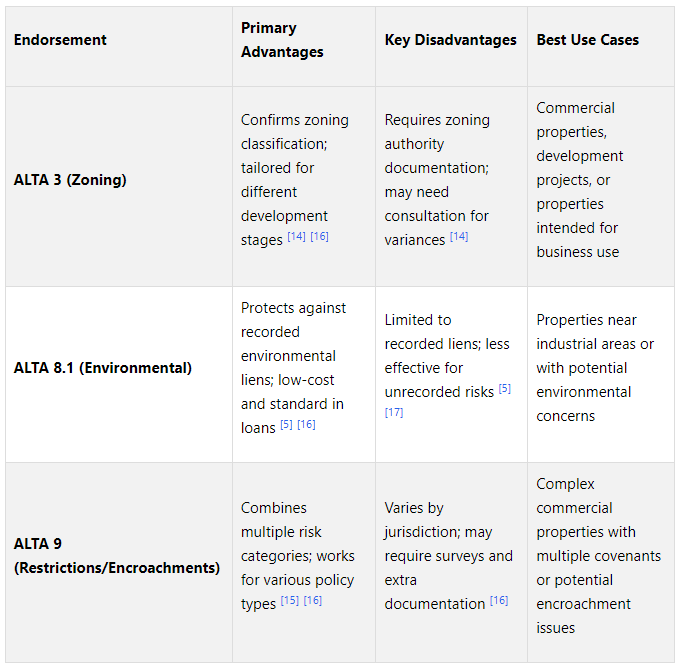

Let’s dive into the pros and cons of different title insurance endorsements. By weighing the costs against the coverage, you can make informed decisions about which endorsements best address specific property risks.

Comparative Analysis

Each title insurance endorsement is designed to address unique risks tied to the type of property and the complexity of the transaction. For instance, ALTA 3 confirms zoning classifications and permitted uses, but it requires documentation from zoning authorities and may involve consultations for exceptions or variances [14].

The ALTA 8.1 endorsement protects against recorded environmental liens. It’s a relatively low-cost option and is commonly included in loan transactions [5] [16]. However, its scope is limited to liens that are recorded or specified by state statutes, meaning it may not cover all potential environmental risks [17].

Meanwhile, ALTA 9 consolidates several risk categories into one endorsement. While it offers broad protection, its issuance requirements can vary depending on the jurisdiction, often requiring additional surveys and documentation [16].

Cost-Benefit Considerations

When evaluating endorsements, it’s essential to balance their costs with the risks they mitigate. For instance, commercial properties with intricate zoning requirements greatly benefit from ALTA 3, as zoning non-compliance can negatively impact property values and permitted uses [2] [3].

Environmental endorsements like ALTA 8.1 are especially useful for properties near industrial zones or those with a history of industrial use. For a relatively small fee, they provide peace of mind against recorded environmental liens [2] [3]. On the other hand, properties with no environmental concerns or a straightforward history might not require this additional protection.

For properties with clear boundaries and simple restrictions, ALTA 9 may not be a high priority. However, in cases involving complex developments with multiple covenants or potential encroachment issues, the additional coverage it provides can be worth the cost [1] [3].

Strategic Selection Approach

The complexity of the property often dictates the number of endorsements needed. For intricate commercial properties, a comprehensive endorsement package might be necessary. In contrast, straightforward transactions in well-established neighborhoods may only require minimal additional coverage [2].

Lender requirements also play a significant role in deciding which endorsements to include. Early consultation with title experts is crucial for identifying potential issues in preliminary title reports and selecting endorsements that provide adequate coverage without unnecessary expense [4]. This proactive approach ensures smoother transactions and better protection for all parties involved [2].

Conclusion

As outlined earlier, endorsements play a key role in tailoring title insurance to address the specific risks associated with commercial properties. They modify a standard title policy to provide targeted protection, ensuring your commercial real estate investment is better safeguarded. With around 80 ALTA-approved endorsement forms available, the challenge lies in selecting the right ones to address your property's unique risks while avoiding unnecessary expenses [1]. This approach allows for informed and strategic choices when it comes to endorsements.

When considering costs, a thoughtful analysis is crucial. Endorsements typically add about 5–10% to the base premium [2]. To make the most of this investment, it’s important to evaluate property-specific risks, relevant laws, and lender requirements early in the process. Given the complexities of commercial transactions, which often involve multiple regulations, having comprehensive coverage is even more critical than in residential deals [3]. Consulting experienced commercial real estate attorneys and title companies early on can help identify the most suitable endorsements for your situation [3] [4].

For properties with multiple risk factors, financial analysis tools can be incredibly useful. These tools help quantify potential exposures and weigh them against the cost of endorsements. For example, tools like the Fractional Analyst's financial modeling capabilities can evaluate cost-effectiveness by simulating scenarios where specific risks might arise. This is particularly valuable for complex commercial properties where endorsement decisions can significantly impact the overall transaction's financial outcome.

A careful and thorough approach is essential. Reviewing preliminary title reports, consulting with lenders about their requirements, and obtaining quotes from title companies for specific endorsements are all critical steps [4]. If disagreements arise with your lender over necessary endorsements, seeking a second opinion from a title expert can provide clarity [4].

FAQs

-

When selecting title insurance endorsements for your commercial property, it's essential to consider the unique risks tied to your transaction. Some commonly used endorsements include zoning and land use coverage (like the ALTA 3 series), survey accuracy (such as ALTA 25-06), and environmental lien protection (e.g., ALTA 8.2). These options can help safeguard against issues like zoning violations, boundary disagreements, or environmental liabilities.

To determine which endorsements make sense, take a close look at your property’s title, survey, zoning rules, and any environmental factors. Partnering with your title company or a real estate professional can provide the insight you need to secure the right coverage and protect your investment.

-

Without certain title insurance endorsements like ALTA 3, ALTA 8.1, or ALTA 9, property owners and lenders could face serious financial risks. Take ALTA 8.1, for instance - it offers protection against environmental protection liens. Without this endorsement, you might find yourself responsible for unexpected expenses tied to environmental violations.

Similarly, skipping the ALTA 9 endorsement could leave you vulnerable to claims related to covenants, conditions, or restrictions (CC&Rs). These issues can lead to costly legal disputes or even jeopardize your property rights. These endorsements are crafted to safeguard against hidden encumbrances or legal challenges that could harm the property's value or the mortgage's security. Without them, the chances of financial setbacks and legal complications grow significantly.

-

When managing the cost of title insurance endorsements, it’s important to focus on the specific risks associated with the property and transaction. Pay close attention to endorsements that address key concerns like liens, zoning compliance, or restrictive covenants - issues that could result in serious financial consequences if left unaddressed.

Take the time to weigh the cost-benefit ratio of each endorsement. Some can offer extensive protection for little to no extra cost, making them a smart choice. By aligning your selections with the particular complexities of the transaction, you can strike a balance between thorough coverage and managing expenses. This approach ensures you’re protected where it matters most, without overspending.