How to Budget CapEx for CRE Renovations

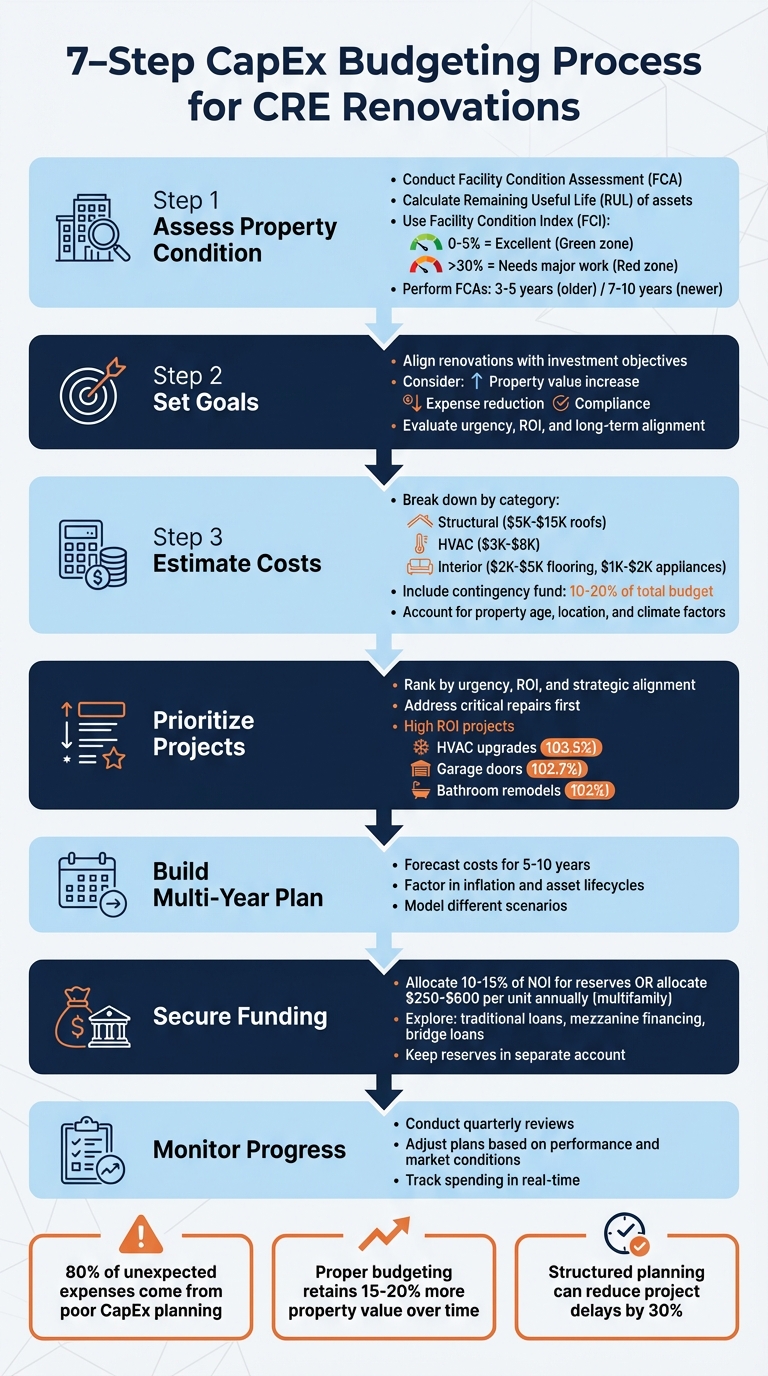

To effectively budget for capital expenditures (CapEx) in commercial real estate (CRE), start by focusing on long-term planning and prioritizing essential upgrades. Poor CapEx planning causes 80% of unexpected property expenses, while proper budgeting can help retain 15–20% more property value over time. Here’s a summary of the steps to get it right:

- Assess Property Condition: Conduct thorough inspections, calculate the remaining useful life (RUL) of key assets, and use tools like the Facility Condition Index (FCI) to evaluate repair needs.

- Set Goals: Align renovations with investment objectives, such as increasing property value, reducing expenses, or meeting compliance standards.

- Estimate Costs: Break down expenses into categories (e.g., structural improvements, HVAC systems, interior upgrades) and include a contingency fund (10–20% of the total budget).

- Prioritize Projects: Rank tasks based on urgency, return on investment (ROI), and alignment with long-term goals. Address critical repairs first.

- Build a Multi-Year Plan: Forecast costs and timelines for 5–10 years, accounting for inflation and property-specific factors like age and location.

- Secure Funding: Allocate 10–15% of Net Operating Income (NOI) for reserves or explore financing options like loans, mezzanine financing, or bridge loans.

- Monitor Progress: Conduct regular reviews and adjust plans as needed to stay on track.

7-Step Process for Budgeting CapEx in Commercial Real Estate Renovations

Capital Expenditures (CapEx) in Real Estate Explained

Assess Property Condition and Identify Renovation Needs

Start by conducting a thorough property assessment to pinpoint renovation needs and accurately plan for capital expenditures (CapEx). This approach removes guesswork, replacing it with informed, data-backed decisions. Detailed inspections are essential to evaluate the condition of your assets.

Conduct Property Inspections

Begin with a Facility Condition Assessment (FCA) to thoroughly inspect all critical systems. This includes structural elements, mechanical systems (like HVAC, plumbing, and elevators), electrical systems, and life safety features [9][10]. Modern inspections often extend to evaluating technology infrastructure, such as building automation systems, security setups, and IoT sensors [1][7].

A key focus is determining the Remaining Useful Life (RUL) of each asset. For instance, if a roof with a 20-year lifespan was installed a decade ago, you can anticipate needing a replacement in about 10 years [4][10]. This foresight allows for better financial planning rather than reacting to unexpected system failures. Reviewing maintenance records from your CMMS (Computerized Maintenance Management System) can also highlight patterns. For example, repeated failures of an air handler within a year might indicate it's time for a replacement instead of another repair [10].

To objectively measure your property's condition, use the Facility Condition Index (FCI). This is calculated by dividing the total repair costs by the property's total replacement value. An FCI score of 0–5% suggests the property is in excellent shape with only minor maintenance needed, while a score above 30% indicates significant refurbishment or replacement is required [10]. For older properties, FCAs should be performed every 3 to 5 years, whereas newer buildings can go 7 to 10 years between assessments [10].

Set Clear Renovation Goals

Once the assessment is complete, align renovation plans with your broader investment strategy. Are you aiming to increase the property's value, raise rental income, extend its lifespan, or meet regulatory requirements? Your goals will shape your renovation priorities.

Assess potential projects by considering three factors: the urgency of the need, the expected return on investment, and how well they align with long-term property objectives [1][7]. Address critical issues immediately, schedule medium-priority deficiencies for the next 2–5 years, and tackle minor concerns over the long term [11]. This structured approach ensures you're not just reacting to problems but making strategic improvements that support your property's overall goals.

Estimate CapEx Costs

After identifying the necessary renovations, the next step is to put numbers to those needs. Accurate estimates are crucial to avoid budget surprises and to have a clear understanding of the capital required. To stay organized, break down your costs into specific categories while factoring in unique property variables.

Break Down Expenditures by Category

To map out your CapEx budget effectively, divide expenses into clear categories. For instance:

- Structural Improvements: Think about roof replacements ($5,000–$15,000), foundation repairs, and framing work [1][8].

- Major Building Systems: This includes HVAC replacements ($3,000–$8,000), electrical upgrades, and plumbing overhauls [1][5].

- Exterior and Land Enhancements: Items like parking lot repaving, landscaping, and outdoor lighting fall under this category [3][5].

- Interior Upgrades: Consider kitchen and bathroom remodels, new flooring ($2,000–$5,000), appliance replacements ($1,000–$2,000), and technology updates like automation or IoT sensors, which can cut costs by up to 25% [3][2][4].

- Compliance and Safety Projects: This includes fire sprinkler systems, ADA compliance upgrades, and low-flow plumbing fixtures [5][13].

Don’t forget to set aside contingency funds, typically 10–20% of your total project cost, to cover unexpected issues. Older buildings, especially those built before 1985, often come with hidden costs like asbestos removal ($1,200–$3,100) or lead paint remediation [6]. For simpler projects, a lower contingency (10–12%) might suffice, but for older properties or those requiring structural changes, aim closer to 20% [6].

These categories serve as the foundation for a well-structured CapEx budget.

Account for Property-Specific Variables

Factors like the property’s age, location, and type play a big role in shaping your cost estimates. Older buildings generally need more immediate reserves since systems like plumbing, roofing, and HVAC are often nearing the end of their usable life [3][4]. For example, a 30-year-old building is likely to require HVAC replacement sooner than a 5-year-old property.

Location also matters. Labor costs and material availability vary by region, directly impacting quotes. Climate conditions, such as extreme heat, cold, or moisture, can speed up wear and tear on exterior materials like paint and roofing, leading to more frequent replacements. It’s also worth noting that CapEx costs don’t scale with property value. A roof replacement or water heater costs roughly the same for a $100,000 property as it does for a $500,000 property, making CapEx a larger percentage of the budget for lower-priced assets [8].

For benchmarks, multifamily properties typically allocate $250–$600 per unit annually, while commercial properties often reserve 10–15% of Net Operating Income (NOI) for CapEx [4]. When planning for the next 5, 10, or 15 years, factor in inflation for materials and labor [12]. Lastly, keep CapEx reserves in a separate account from operating funds to maintain liquidity when major projects arise [13].

Prioritize Projects by Urgency and ROI

Once you've estimated costs, the next step is prioritizing your projects. To do this effectively, consider urgency, return on investment (ROI), and how well each project aligns with your long-term goals [1].

Start by addressing projects that protect your property's structural integrity and ensure compliance with regulations. Think of it as focusing on the "bones" of your property - key systems like roofing, foundation, electrical wiring, and water management. These are the foundational components that, if neglected, can lead to much larger expenses. For instance, ignoring a $1,500 roof repair could snowball into a $20,000 issue involving mold remediation and structural damage [15].

For projects driven by ROI, the numbers speak for themselves. Some upgrades provide excellent returns: HVAC conversions or electrification projects boast an average ROI of 103.5%, while garage door replacements recover 102.7% of their cost [16]. Minor bathroom remodels return about 102%, and minor kitchen remodels yield around 98.5% [16]. As Kermit Baker, Director of the Remodeling Futures Program at Harvard University, explains:

"People buying a house look first at kitchens and baths" [17].

These high-use spaces are not only practical but also play a major role in attracting tenants and retaining them.

Use a Prioritization Framework

To objectively rank your projects, consider using a straightforward scoring system. Identify 5–6 criteria that reflect your property's specific needs, such as safety, compliance, tenant usability, cost to address, and expected ROI. Assign scores to each project based on these criteria to determine their priority [18]. This method ensures that critical, high-priority projects rise to the top, regardless of who proposed them.

Incorporate the "Needs, Wants, and Wishes" framework to further refine your priorities [14].

- Needs include essential repairs and compliance measures, such as ADA modifications (e.g., ramps, widened doorways) or energy-efficient upgrades that qualify for federal tax credits [15].

- Wants focus on improvements that enhance tenant experience or cut operating costs, like installing building automation systems that can reduce expenses by 25% [4].

- Wishes are non-essential, luxury upgrades that enhance aesthetics but don't address immediate concerns.

Allocate your budget to "Needs" first, then turn to "Wants" that offer the best ROI. "Wishes" can wait until core priorities are addressed.

Balance Immediate Needs with Long-Term Plans

Once you've ranked your projects, create a timeline that balances urgent repairs with strategic upgrades. Use "Cost to Remedy" reports to address immediate fixes - issues that could disrupt operations or lead to non-compliance - while developing a "Capital Reserve Forecast" to plan for long-term replacements over 5, 10, or 15 years based on asset lifecycles [12]. This approach avoids the common "hockey stick" problem where spending is delayed early in the year, only to result in rushed, more expensive projects later [18].

Regular reviews are key. Conduct quarterly assessments to ensure your capital improvement plans stay aligned with changing market conditions and property goals [1]. Properties that follow a structured capital expenditure timeline tend to retain 15–20% more value over time [1]. To save on costs, bundle similar projects - like plumbing upgrades and bathroom renovations or siding and window replacements - to streamline labor and coordination [14]. And always consider the neighborhood's value ceiling to ensure your renovations maximize returns [17].

sbb-itb-df8a938

Build a Multi-Year CapEx Budget

After prioritizing your projects, the next step is to create a multi-year budget that accounts for both planned replacements and unexpected costs. A solid CapEx budget should include a detailed inventory of major components - such as roofs, HVAC systems, elevators, and plumbing - along with their current age and estimated remaining lifespan [7][3]. By conducting a lifecycle analysis, you can anticipate when replacements will be needed and estimate their costs. This process transforms immediate cost estimates into a long-term financial strategy.

Start by identifying the key components of your property and their replacement timelines. For instance, roofs typically last 15–25 years and may cost between $5,000 and $15,000 or more to replace, while HVAC systems generally have a lifespan of 15–20 years with replacement costs ranging from $3,000 to $8,000 [3][8]. To ensure adequate funding, calculate monthly savings by dividing the replacement cost of each component by its remaining useful life.

Don’t forget to account for inflation. Use a "CapEx Appreciation Rate" to adjust for increasing material and labor costs over your 5–10 year planning horizon [2]. It’s also helpful to model different scenarios - like postponing upgrades or choosing energy-efficient systems - to see how these decisions impact your long-term finances [7][19].

Set Aside Reserves and Contingencies

To avoid financial strain, industry experts recommend setting aside 10–15% of your Net Operating Income (NOI) annually for CapEx reserves in commercial properties. Alternatively, you can allocate 1–2% of the property’s purchase price each year. For multifamily properties, the typical range is $250 to $600 per unit annually [4][1][20].

In addition to regular reserves, maintain a contingency fund equal to 5–10% of your total project budget [4][7]. It’s also wise to keep 2–6 months of operating expenses in reserve to provide flexibility during major projects [4][1]. As the Primior Team explains:

"Strategic CapEx planning helps maintain competitive properties and maximize returns. Our clients avoid unexpected major expenses by setting aside operational funds regularly" [1].

To safeguard your budget, keep CapEx reserves separate from operating funds by placing them in a dedicated account [13]. If you own older properties with significant deferred maintenance, establish an initial balance to cover these costs, especially if current cash flow is insufficient. Use "no deficit" modeling to ensure your projected balance never falls below zero by adjusting your starting reserves and monthly contributions over the forecast period [2].

Use CoreCast for Budget Modeling

Once you have a multi-year plan, advanced tools can simplify the budgeting process. Managing a CapEx budget across multiple properties or components with different replacement schedules can be challenging. CoreCast, a real estate intelligence platform from The Fractional Analyst, helps streamline this process. It centralizes your budget modeling, reducing data silos and manual errors, while offering real-time monitoring and scenario testing [7].

CoreCast allows you to create detailed capital reserve forecasts that automatically adjust for inflation, track spending in real time, and generate reports for stakeholders. You can also model different funding scenarios and assess how changes in interest rates or construction costs might affect your returns. Plus, it ensures you can maintain separate accounts for reserves and contingencies [19][13].

Plan Funding and Reserve Strategies

Once you’ve mapped out your multi-year CapEx budget, it’s time to figure out how to fund your projects and manage spending effectively.

Review Financing Options

Start by building internal cash reserves. A good rule of thumb is to allocate 10–15% of your NOI or 1–2% of the property’s purchase price. This gives you quick access to funds for smaller upgrades or routine maintenance without needing to take on debt [4][1].

For bigger projects, traditional bank loans are a solid option. They typically come with 5–10 year terms and 25–30 year amortization schedules, offering fixed rates that are ideal for large-scale structural improvements [1]. If you’re looking for higher leverage, life insurance company financing could be a fit, often providing 70–80% loan-to-value (LTV) ratios with competitive rates for stabilized properties [1]. For even more leverage, consider mezzanine financing, which can push your borrowing power to 85–90% of the property value by using your existing equity [1].

For short-term needs, bridge loans are worth exploring. These loans, which typically cover 6–36 months, are great for urgent renovations that need to be done before securing permanent financing [1]. However, lenders often require you to hold 3–10% of the loan amount in escrow as a CapEx reserve, which is only released after you submit invoices or bids for approved work [21].

Once you’ve reviewed your financing options, it’s crucial to establish a formal CapEx policy to ensure spending stays on track.

Create a CapEx Policy

A written CapEx policy helps standardize decision-making and avoids unnecessary delays. Start by setting clear approval thresholds. For example, property managers might have the authority to approve projects under $2,000, while larger expenses require approval from senior leadership. This ensures a streamlined process.

Make sure to clearly define what counts as CapEx versus routine maintenance to stay compliant with tax rules and to manage expenses wisely [1][5]. For discretionary projects, set ROI benchmarks to guide spending decisions, and maintain a 5–10% contingency fund for unexpected costs [4][1]. Regular quarterly reviews are also essential. These reviews allow you to adjust your budget based on property performance, market conditions, and how projects are progressing [1]. By doing so, you’ll keep your funding strategy adaptable to both immediate priorities and long-term objectives.

Conclusion

Getting your CapEx budgeting right isn’t just about managing expenses - it’s about safeguarding your investment and increasing your property’s long-term value. Start by assessing your property to separate immediate needs from future projects. Break down costs, set clear priorities, and, as mentioned earlier, include a multi-year plan with a 5–10% contingency reserve for those inevitable surprises [4]. This step-by-step approach ensures you’re prepared for both the present and the future, while paving the way for incorporating technology into your strategy.

Here’s a key takeaway: 80% of unexpected expenses stem from poor planning, while structured timelines can enhance long-term property value by 15–20% [1]. Shifting from reactive decision-making to proactive planning allows you to focus on upgrades that cut operational costs and drive efficiency.

"Limiting investments to end-of-life asset replacement or deferred maintenance traps organizations in a reactive cycle - chasing funding, shelving growth initiatives and falling behind competitors." - Ali Helland, Director of Capital Planning, JLL [18]

To make this process smoother, tools like CoreCast can be game-changers. They centralize budget modeling, provide real-time tracking, and streamline forecasting. By doing so, they not only reduce project delays by up to 30% but also cut communication efforts in half [4]. This kind of integrated solution keeps your projects on track and your team focused on what matters most.

FAQs

How can I prioritize capital expenditures (CapEx) for my commercial property effectively?

Prioritizing capital expenditures (CapEx) for your commercial property is key to keeping operations running smoothly, ensuring tenant satisfaction, and achieving strong returns. Start by creating a detailed inventory of your property’s assets - things like the roof, HVAC systems, and electrical infrastructure. Evaluate their age, current condition, and estimated replacement costs. Pinpoint critical issues, such as safety concerns or compliance requirements, and tackle those first.

From there, align your projects with your business objectives. For example, consider investing in tenant-focused amenities to justify higher rents, energy-efficient upgrades to lower operating costs, or improvements needed to meet building codes. Calculate the financial impact of each project by weighing the costs against potential benefits, like increased rental income or savings on utilities. To prioritize effectively, use a scoring system to rank projects based on factors like urgency, strategic importance, and return on investment (ROI). Allocate your budget accordingly, and set aside a contingency fund - around 5-10% - to handle unexpected costs.

Lastly, take advantage of technology to monitor project progress and expenses in real time. This not only simplifies decision-making but also ensures your budget remains focused on improvements that deliver the most value.

What should I focus on when estimating CapEx for commercial real estate renovations?

When planning capital expenditure (CapEx) for commercial real estate renovations, start by examining the scope of the project and the type of property - these two factors will play a major role in determining costs. Other key considerations include the quality of materials and finishes, the building's age and current condition, and local labor and material costs. It's also crucial to factor in regulatory requirements, such as obtaining permits and ensuring compliance with building codes.

To safeguard your budget from unexpected expenses, include a contingency buffer, typically around 5–10% of the total budget. This helps cover any hidden issues or unplanned costs that might come up during the renovation. By addressing these elements upfront, you can develop a more precise and dependable budget for your project.

How can CoreCast improve CapEx budgeting for commercial real estate renovations?

CoreCast makes CapEx budgeting easier by bringing all your project data into one place, automating cost forecasts, and offering tools to monitor renovation expenses in real time. This leads to more precise budgets and helps you steer clear of surprise costs.

With a smoother budgeting process, CoreCast lets you concentrate on strategic decisions while keeping your renovation projects aligned with both timelines and budgets.