New York vs. Federal 1031 Exchange Tax Rules

When selling investment property, a 1031 exchange lets you defer taxes by reinvesting proceeds into similar real estate. Federal rules set the foundation: reinvest all proceeds, stick to strict deadlines (45 days to identify replacement property, 180 days to close), and use a Qualified Intermediary. However, New York adds extra hurdles, including 7.7% withholding for nonresidents, mandatory state filings, and non-deferrable transfer taxes.

Key differences include:

- Federal rules focus on property eligibility and timelines.

- New York rules add state-specific taxes (e.g., transfer tax, mansion tax) and filing requirements like Form IT-2663 for nonresidents.

Quick tips:

- Work with a Qualified Intermediary to ensure compliance.

- File required forms (e.g., TP-584) at closing.

- Budget for costs like transfer taxes and mansion taxes, which can’t be deferred.

Knowing these rules is crucial to avoid unexpected taxes and audits.

How to Do a 1031 Exchange in NYC | What is a 1031 Exchange in NYC?

Federal 1031 Exchange Rules

Federal regulations provide specific guidelines for property eligibility, strict deadlines, and the mechanics of tax deferral under 1031 exchanges.

Property and Eligibility Requirements

Federal law restricts 1031 exchanges to real property. This means both the property you’re selling (known as the relinquished property) and the property you’re acquiring (the replacement property) must be held for investment purposes or used in a trade or business. Properties held primarily for resale, such as inventory, don’t qualify.

The "like-kind" requirement is less about the property's quality and more about its nature. For instance, you can exchange improved real estate, like a commercial building, for unimproved land, or swap urban property for a rural farm. However, U.S. real estate and foreign real estate are not considered like-kind. Additionally, assets like stocks, bonds, partnership interests, and securities are excluded from 1031 exchange eligibility.

Required Timelines

Federal rules impose two key deadlines that must be followed closely:

- 45-Day Identification Period: Within 45 days of transferring your relinquished property, you must identify potential replacement properties in writing. This list, typically submitted to your Qualified Intermediary or escrow agent, can include up to three properties. Alternatively, you can identify more than three properties if their combined market value doesn’t exceed 200% of the value of the relinquished property.

- 180-Day Closing Period: You’re required to close on the replacement property within 180 days of the relinquished property’s transfer date. Missing either of these deadlines results in disqualification, and you’ll face immediate taxation on the transaction.

These deadlines are critical to ensuring the tax-deferral benefits of a 1031 exchange.

How Tax Deferral Works

A 1031 exchange doesn’t eliminate taxes - it postpones them. The tax basis of the property you sell carries over to the property you acquire. To fully defer taxes, you must reinvest all net proceeds and ensure the replacement property’s debt matches or exceeds the debt on the relinquished property. Any cash received, commonly called "boot", is taxable. Similarly, if the buyer assumes any liabilities, such as a mortgage, the IRS treats it as money received. If not properly offset, this may also count as boot and become taxable.

New York 1031 Exchange Rules

New York adheres to the federal 1031 exchange guidelines, including the familiar 45-day identification window and 180-day closing deadline. However, the state adds its own layers of complexity with extra filing requirements and taxes that investors need to navigate carefully.

Nonresident Withholding Requirements

New York imposes specific rules for nonresidents selling property within the state. If you're a nonresident, expect a 7.7% withholding on the gain unless you file the appropriate forms to claim a 1031 exchange exemption. To sidestep this withholding, submit Form IT-2663 (for residential properties) or Form IT-2664 (for non-residential properties) at the time of closing. These forms confirm that you're conducting a like-kind exchange.

It's essential to file these forms at closing, even if withholding taxes don’t apply, to ensure the deed is recorded properly. Keep in mind, this withholding requirement is separate from the federal FIRPTA rule, which applies to foreign sellers and calculates withholding at 15% of the total sale amount - not just the gain. New York’s rule, however, applies to U.S. citizens and residents who live outside the state.

State Filing Requirements

To certify your 1031 exchange and claim a tax deferral, New York requires the filing of Form TP-584 (or TP-584-NYC for properties in New York City). This form must be submitted at the time of the sale to notify the state of your intent to defer the gain.

Additionally, you’ll need to report the deferred exchange on your annual state income tax return - using Form IT-201 if you're a resident or Form IT-203 if you're a nonresident. New York tracks deferred gains separately, and should a taxable event occur in the future, the state will impose income tax at rates ranging from 4% to 10.9%.

New York City and Local Tax Rules

Beyond state-level requirements, New York City has its own tax obligations to consider. While capital gains can be deferred at both the state and city levels through a 1031 exchange, transfer taxes and the mansion tax are non-deferrable and must be paid separately to avoid creating taxable boot.

Here’s a breakdown of these taxes:

- New York State Transfer Tax: 0.4% of the sale price ($2 per $500 of consideration).

- New York City Transfer Tax: Ranges from 1% to 2.625%, depending on the property type and sale price.

- Mansion Tax: Applies to residential properties sold for $1M or more, with rates from 1% to 3.9%. Properties exceeding $3M also face an additional base tax of $1.25 per $500 of consideration.

For high-income NYC residents, the combined federal, state, and city tax burdens can climb above 40%. This makes the tax-deferral benefits of a 1031 exchange particularly valuable. Additionally, New York City requires full disclosure of beneficial ownership for LLCs involved in deed transfers of buildings with up to four family units, adding another layer of compliance to the process.

sbb-itb-df8a938

Federal vs. New York Rules: Main Differences

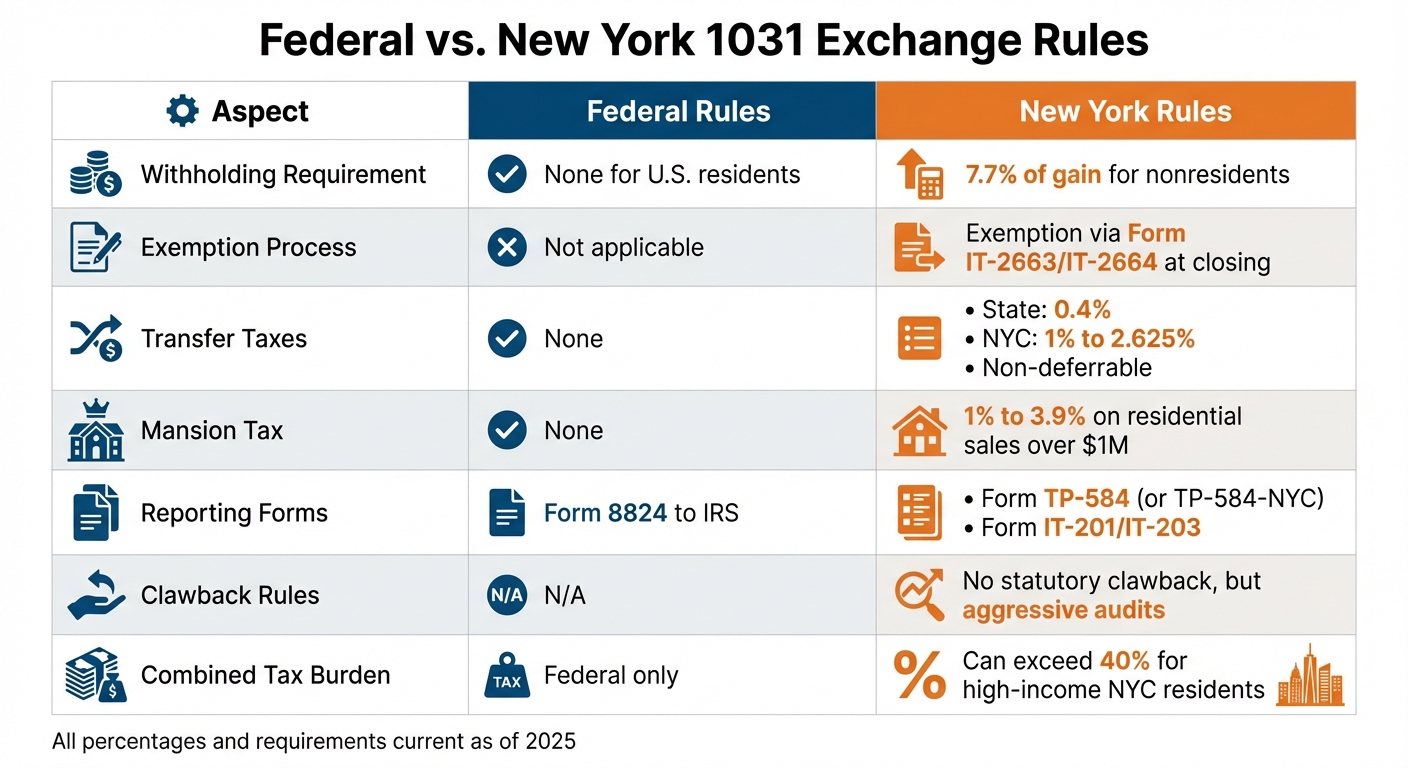

Federal vs New York 1031 Exchange Rules Comparison Chart

When comparing federal and New York rules for 1031 exchanges, some clear distinctions emerge. While New York aligns with the federal framework for timelines and property eligibility, the state introduces additional compliance hurdles. The biggest differences lie in withholding rules, mandatory state filings, and non-deferrable taxes, which are absent at the federal level.

Withholding and Compliance Comparison

At the federal level, there’s no withholding requirement for U.S. residents conducting a 1031 exchange. New York, on the other hand, requires nonresidents to withhold 7.7% of the gain unless they file specific exemption forms at the time of closing. This creates an extra layer of compliance that federal rules simply don’t impose.

| Aspect | Federal Rules | New York Rules |

|---|---|---|

| Withholding Requirement | None for U.S. residents | 7.7% of gain for nonresidents |

| Exemption Process | Not applicable | Exemption via proper closing forms |

| Transfer Taxes | None | 0.4% state + up to 2.625% NYC (non-deferrable) |

| Mansion Tax | None | 1% to 3.9% on residential sales over $1M |

| Reporting Forms | Form 8824 to IRS | Form TP-584 (or TP-584-NYC) plus IT-201/IT-203 |

In addition to withholding, New York imposes state and city transfer taxes as well as the mansion tax, all of which must be paid with funds outside the exchange. These costs can quickly add up, particularly in New York City, where combined transfer taxes can exceed 2.5% on high-value properties. Federal rules, in contrast, do not include any comparable transaction taxes. This highlights the added complexity for investors navigating New York’s requirements.

Clawback Rules and Audit Risks

Unlike states such as California or Oregon, New York doesn’t have a statutory clawback provision to track deferred gains when an investor exchanges in-state property for out-of-state replacements. Once a valid 1031 exchange is completed and the investment moves to another state, New York generally doesn’t attempt to reclaim the deferred gain upon a future sale.

However, this doesn’t mean New York is lenient. The state compensates for the lack of clawback rules with aggressive audit practices. As noted by Deferred.com:

New York State has taken an aggressive approach to auditing like-kind exchanges and applying federal guidance and case law to those audits [1].

Auditors often examine closing statements for discrepancies, particularly in cases involving pre- or post-exchange refinances. If an investor refinances to pull out cash during the exchange, New York may treat the excess loan proceeds as taxable "boot", regardless of the business purpose behind the refinance [1].

Another area of focus is "drop-and-swap" transactions. While these are scrutinized, a June 2025 ruling in the Hadar case clarified that New York doesn’t require a minimum holding period. The Division of Tax Appeals stated:

There is no authority for the proposition that title to the property must be held for more than one day [1].

Despite this ruling, investors should ensure they document their investment intent thoroughly to minimize the risk of audit challenges. New York’s approach underscores the importance of careful planning and compliance when conducting 1031 exchanges within the state.

What This Means for New York Investors

Federal timelines may stay consistent, but New York adds its own layer of complexity. The state's additional withholding rules and nondeferrable transfer taxes can climb as high as 33.82% for high-income investors [1]. Navigating these rules effectively is crucial to maintaining the tax deferral benefits of a 1031 exchange. Here’s how investors can stay compliant and manage costs.

Planning for Compliance

Start by working with a Qualified Intermediary (QI) before closing any deals. The QI is responsible for holding all exchange funds [2][3]. Make sure to select one who is well-versed in New York’s specific requirements, including forms like IT-2663 and IT-2664 for nonresident withholding exemptions, and Form TP-584 for the combined real estate transfer tax return [2].

Budgeting for nondeferrable costs is also key. These include state, NYC, and mansion taxes, which must be paid with funds outside of the exchange [2]. For high-value properties, these costs can add up quickly [2]. To avoid pitfalls, consult a CPA familiar with New York audits. They can help ensure your closing statements are accurate and that your documentation aligns with your investment intent. This is especially important to avoid triggering boot and to meet New York’s stringent timing and paperwork standards [1].

If your investment involves multifamily properties in New York City, it’s essential to check the rent regulation status. Nearly half of the city’s rental units are subject to rent stabilization or control [2]. These regulations, governed by the 2019 Housing Stability and Tenant Protection Act, can significantly affect both cash flow and property valuation.

Using Financial Analysis Tools

Balancing federal and New York-specific compliance demands detailed financial planning. Alongside expert advice, sophisticated financial tools can simplify the process. For example, The Fractional Analyst offers specialized resources for commercial real estate investors navigating complex transactions like 1031 exchanges. Their services include custom underwriting, asset management support, and the CoreCast self-service platform. These tools allow you to model tax liabilities, budget for nondeferrable costs, and assess replacement properties while considering New York’s unique tax rules.

Whether you choose to work with their team of financial analysts or use their free financial models, these resources can help you stay on top of both federal deadlines and New York’s additional requirements, ensuring you're fully prepared before committing to a replacement property.

Conclusion

Federal 1031 exchange rules outline clear guidelines: properties must be like-kind, the identification period is limited to 45 days, and the exchange must be completed within 180 days. While New York follows these federal requirements, it introduces additional complexities that can increase tax liabilities. For example, while federal rules let you defer capital gains taxes, New York mandates upfront payment of certain taxes, such as transfer taxes and mansion taxes, using external funds. Non-resident investors also face a 7.7% withholding requirement unless they secure an exemption during closing [1].

These added expenses highlight the importance of thorough planning when investing in New York. The state’s rigorous audit practices further emphasize this need. New York is known for closely examining refinancing transactions and using Schedule L from tax forms to pinpoint potential taxable boot from excess loan proceeds. This makes detailed and accurate documentation essential [1]. Additionally, a 2025 Division of Tax Appeals ruling affirmed the validity of drop-and-swap transactions, provided investors strictly follow proper procedures and maintain thorough records [1].

FAQs

What are the key differences between New York and federal 1031 exchange rules?

Federal 1031 exchanges, as outlined in IRC §1031, let investors defer capital gains taxes when exchanging real property for another like-kind property. To qualify, strict timelines must be followed: a replacement property must be identified within 45 days, and the entire exchange must be completed within 180 days or by the tax return due date - whichever comes first. Additionally, the property involved must be used for investment or business purposes, not for resale.

New York adheres to the federal framework but adds its own state-specific tax rules. To defer state income taxes, investors must file a New York like-kind exchange election and may need to submit supporting documents. Non-resident sellers face real estate withholding taxes, and all transactions are subject to transfer taxes. These include a base tax of $2 per $500 of property value and a 1% mansion tax on residential properties sold for over $1 million.

The Fractional Analyst provides expert support to help investors navigate these federal and New York-specific regulations, ensuring compliance while optimizing tax benefits.

What is New York's 7.7% withholding rule for nonresidents selling real estate?

In New York, when a nonresident sells real estate, the buyer or closing agent must withhold 7.7% of the seller's gain and send it to the New York State Department of Taxation and Finance as an estimated tax payment. This serves as an advance payment toward the seller’s New York income tax obligation for the sale.

The withheld amount is applied as a credit when the seller files a New York nonresident tax return. If the actual tax owed ends up being less than the amount withheld, the seller is eligible for a refund. Certain exemptions might apply, such as for the sale of a primary residence under specific conditions or if a waiver is approved. However, without an exemption, the 7.7% withholding is mandatory, no matter the final tax liability.

How can I comply with New York’s 1031 exchange rules?

To follow New York's 1031 exchange rules, make sure both the property you're selling and the one you're purchasing qualify as like-kind real estate. This means they must be used for business or investment purposes. It's also essential to work with a qualified intermediary (QI) before the sale to handle the funds and required exchange documents.

Timing is critical. You have 45 calendar days to identify a replacement property and 180 calendar days to finalize the purchase. If you're a non-resident, you'll need to calculate and pay the estimated New York personal income tax on the gain. Additionally, don't overlook real estate transfer taxes, including the 1% mansion tax on residential properties priced at $1,000,000 or more.

Make sure to file all required paperwork, such as the NY withholding form and transfer tax return, and maintain detailed records in case of an audit. For those seeking guidance, the Fractional Analyst provides financial analysis and tools to help investors navigate these complex rules with ease.