What Is Mezzanine Financing in CRE?

Mezzanine financing is a mix of debt and equity used in commercial real estate (CRE) to bridge funding gaps between senior debt and equity. It offers higher returns (12%-20% annually) but comes with greater risk and cost. Positioned below senior debt and above equity in the capital stack, it allows developers to secure additional capital without giving up significant ownership. Mezzanine loans are typically unsecured, carry higher interest rates, and may convert to equity if the borrower defaults.

Key Points:

Purpose: Fills funding gaps when senior loans fall short.

Position in Capital Stack: Subordinate to senior debt, above equity.

Returns: 12%-20% annually; higher risk than senior debt but lower than equity.

Loan Terms: 1-5 years, interest-only payments, no property collateral.

Uses: Acquisitions, developments, and recapitalizations.

While mezzanine financing helps reduce upfront equity requirements and boosts leverage, it increases borrowing costs and risks. Borrowers should carefully assess financial models, repayment capacity, and market conditions before proceeding.

How Mezzanine Financing Fits in the Capital Stack

Capital Stack Components

To understand mezzanine financing's role in commercial real estate (CRE) deals, you first need to grasp the concept of the capital stack. Essentially, the capital stack outlines how repayment is prioritized and how risk and returns are distributed among investors. Here's how the components are typically arranged:

Senior Debt: This is the safest layer, often secured by the property itself, which is why it comes with lower interest rates.

Mezzanine Debt: Positioned above senior debt but below equity, this layer is generally unsecured. It carries more risk than senior debt but offers higher returns.

Preferred Equity: This layer provides more predictable returns than common equity and is repaid before common equity investors.

Common Equity: The riskiest part of the stack, but with the highest potential for returns. It’s repaid last after all other components.

Where Mezzanine Financing Sits in the Stack

Mezzanine financing occupies a middle ground in the capital stack. It’s subordinate to senior debt but takes precedence over both preferred and common equity. This means that in the event of financial trouble or a property sale, senior debt is repaid first, followed by mezzanine debt, then preferred equity, and finally common equity. While mezzanine debt involves more risk than senior loans, it’s still less risky than equity investments. This strategic positioning helps fill funding gaps without heavily diluting equity ownership, making it a valuable tool for developers.

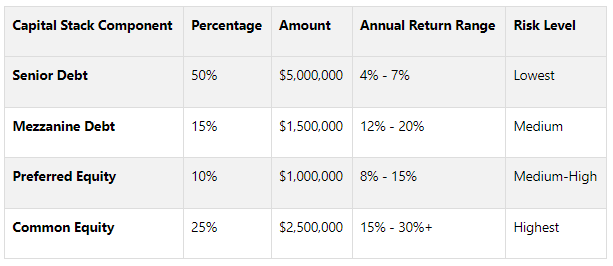

Capital Stack Example Breakdown

Here’s an example to illustrate how mezzanine financing fits into a $10,000,000 CRE acquisition:

In this scenario, mezzanine financing contributes $1,500,000, helping to reduce the equity required for the project. By leveraging mezzanine debt, developers can ease the cash burden tied to common equity while still retaining more ownership control over the property. This balance makes mezzanine financing an attractive option for filling funding gaps in CRE projects.

How Mezzanine Financing Works

Loan Terms and Interest Rates

Mezzanine loans occupy a unique position between senior debt and equity in the capital stack, and their terms reflect this. These loans typically have durations ranging from 1 to 5 years, though some can extend to 10 years for more complex projects. They are often structured as interest-only loans.

Because mezzanine financing carries more risk due to its subordinate position, lenders charge higher interest rates to offset this. Rates generally fall between 9% and 20%, with most agreements landing in the 12% to 16% range. Unlike senior debt, which is secured by collateral like property, mezzanine loans lack such backing, further contributing to their higher cost. Borrowers should also be prepared for upfront expenses, including points (2% to 3% of the loan amount) and fees ranging from 3% to 6%. These terms create a hybrid structure that blends elements of both debt and equity, as explained below.

Debt and Equity Features

One of the defining characteristics of mezzanine financing is its hybrid nature, combining aspects of both debt and equity. While it operates like a loan with regular interest payments, mezzanine lenders often have the option to convert their debt into equity if the borrower defaults. For borrowers, this arrangement allows them to retain control of operations under normal circumstances, though it comes with the risk of losing equity ownership if they fail to meet repayment terms.

In the hierarchy of the capital stack, mezzanine debt is subordinate to senior debt but takes precedence over equity when it comes to repayment. This positioning makes it riskier than senior debt but less risky than an equity investment.

When to Use Mezzanine Financing

Given its structure and cost, mezzanine financing is particularly effective in specific scenarios. It serves as a flexible solution for acquisitions, development projects, and recapitalizations, filling the funding gaps that traditional lenders often leave behind.

This type of financing is especially useful when senior lenders take a conservative stance, leaving borrowers in need of higher loan-to-value ratios than those lenders are willing to provide. For property acquisitions, mezzanine financing can supply the additional equity needed to close a deal. In development projects, it can cover shortfalls in construction funding when senior loans fall short. For recapitalizations, mezzanine loans allow property owners to tap into their asset’s equity without selling, potentially boosting overall equity returns.

Will Howard, VP of Relationship Management at Foro, captures its role succinctly:

“Mezzanine financing is considered a filler in the capital stack.”

Before moving forward, borrowers should create detailed financial models to evaluate how the added leverage might affect returns and cash flow. They should also carefully consider the risks, especially if the property faces operational issues or unfavorable market conditions.

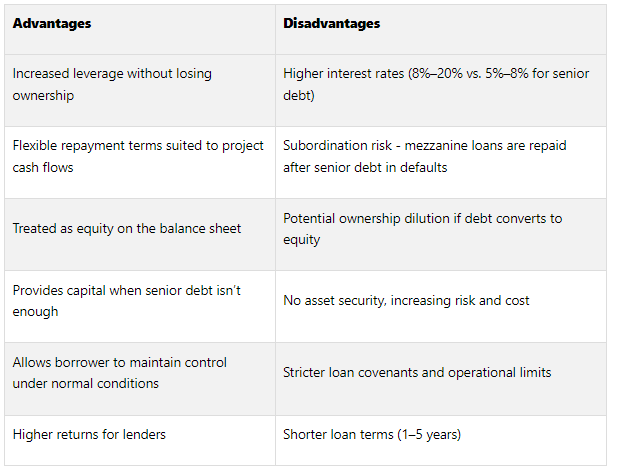

Pros and Cons of Mezzanine Financing

Benefits of Mezzanine Financing

Mezzanine financing sits between debt and equity in the capital stack, offering a mix of benefits and risks. For commercial real estate (CRE) investors, it provides a way to increase leverage without giving up immediate ownership. This means you can take on larger projects while keeping control of your equity stake. Plus, repayment terms are often flexible - options like interest-only payments or payment-in-kind (PIK) terms align well with project cash flows, which is especially helpful during development phases or when rental income is lower.

From a lender's perspective, mezzanine loans are appealing because of their higher returns, thanks to elevated interest rates and the potential for equity participation. Another advantage for borrowers is how these loans are treated on the balance sheet. They’re often recorded as equity, which can improve your leverage position and make it easier to secure additional senior debt for future projects.

Risks and Drawbacks

Of course, mezzanine financing comes with its own set of challenges. The most obvious downside is the cost. While senior debt typically carries interest rates between 5% and 8%, mezzanine loans range from 8% to 20%, significantly increasing your overall cost of capital.

There’s also the issue of subordination. Mezzanine loans are only repaid after senior debt, making them riskier for lenders and borrowers alike. If a project runs into trouble, mezzanine lenders may convert their debt into equity, which could dilute your ownership stake.

Additionally, these loans are unsecured, meaning they aren’t backed by company assets. This lack of security further raises costs and risk. Borrowers may also face stricter loan covenants and operational restrictions, which can limit flexibility.

Pros vs. Cons Comparison

Choosing mezzanine financing requires careful consideration of your project’s cash flow stability, your ability to handle higher borrowing costs, and your overall risk tolerance. Lenders typically look for businesses with proven profitability, a solid reputation, and realistic growth plans before offering this type of financing.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Getting Started with Mezzanine Financing

What to Consider Before Using Mezzanine Financing

Before diving into mezzanine financing for your commercial real estate (CRE) project, it's important to evaluate whether it aligns with your needs. Typically, mezzanine financing covers 5% to 20% of a project’s capital requirements, offering investors annual returns between 10% and 20%.

Start by assessing the borrower's creditworthiness - or your own financial standing if you're the one seeking financing. Lenders will scrutinize your track record, experience, and overall financial stability. Additionally, the quality of the asset and the strength of the local market play a significant role in determining approval and pricing.

Take a close look at your project’s total leverage. This means analyzing how mezzanine financing fits alongside senior debt, bridge loans, or equity components. Keep your loan-to-value (LTV) ratio and debt service coverage ratio conservative. This is especially important since mezzanine financing comes with interest rates ranging from 12% to 20% annually - and in some cases, rates can climb as high as 30%.

Don’t overlook the legal documentation. Understand the lender's rights in case of default, as mezzanine loans generally require a pledge of equity. Also, consider potential risks like operational challenges or market downturns that could impact your investment.

Using Expert Analysis Platforms

Once you’ve evaluated your project’s fundamentals, enhance your strategy with advanced tools. Mezzanine financing involves complex financial structures, and platforms like The Fractional Analyst can simplify the process. They offer specialized financial services for CRE professionals, including underwriting mezzanine deals, building detailed financial models, and providing ongoing asset management. Their team also supports investor and lender reporting, which is essential for managing relationships across multiple stakeholders.

For those who prefer a hands-on approach, CoreCast, The Fractional Analyst’s real estate intelligence platform, provides self-service tools. These tools let you model different financing scenarios, helping you see how various mezzanine terms might impact returns and cash flow. Additionally, their market research features allow you to benchmark mezzanine rates and terms against current market conditions. This ensures you’re negotiating from an informed position, especially since mezzanine debt typically yields returns in the range of 13% to 15%.

Free Financial Models and Tools

To fine-tune your financing strategy, take advantage of free Excel templates designed to simplify mezzanine financing analysis. The Fractional Analyst offers templates for multifamily acquisitions, mixed-use developments, and IRR matrices, all of which can be customized to include mezzanine financing scenarios.

These tools let you experiment with different capital stack configurations before committing to more costly professional services. By using these templates, you can see how mezzanine financing affects your project’s internal rate of return (IRR), cash-on-cash returns, and overall risk exposure. They clearly demonstrate how mezzanine financing bridges the gap between senior debt and available equity.

“A robust development feasibility is the foundation of getting development finance.”

These free resources provide a strong starting point, helping you establish feasibility and create a framework for more detailed analysis. They empower you to optimize your capital structure and highlight mezzanine financing's role in closing funding gaps in CRE projects.

Watch Me Build a Capital Stack with Mezzanine Debt for Real Estate Development

Conclusion

The earlier sections explored how mezzanine financing fits into the commercial real estate (CRE) capital stack and its practical role in bridging senior debt and equity. Positioned strategically, mezzanine financing allows developers to boost leverage while reducing upfront cash needs. With annual returns typically ranging from 12% to 20% - and occasionally climbing as high as 30% - it offers a middle-ground solution. While it's more expensive than senior debt, it's still a less costly option compared to pure equity.

Thanks to its hybrid debt-equity structure, mezzanine financing proves especially useful for projects like expansions, renovations, and acquisitions. Despite higher interest rates, its perks - such as preserving cash flow, avoiding additional collateral, and retaining more control compared to equity partnerships - can make it an attractive choice for developers.

However, success with mezzanine financing requires careful planning. Higher costs, potential equity dilution, and restrictive covenants are challenges that demand thoughtful management. This is where expert financial analysis plays a vital role. Platforms like The Fractional Analyst and CoreCast offer advanced tools to help structure capital stacks effectively and secure favorable terms.

Given the complexity of mezzanine financing, professional expertise is key. Whether you're using free financial models for preliminary planning or working with seasoned analysts for detailed underwriting, having the right resources ensures you can fully leverage the benefits while mitigating risks. Ultimately, mezzanine financing remains a valuable tool for optimizing capital structures in CRE projects.

FAQs

-

How does mezzanine financing compare to other commercial real estate financing options in terms of risk and return?

Mezzanine financing in commercial real estate (CRE) is known for its high potential returns, typically ranging from 12% to 20% annually. However, this comes with increased risk. The reason? Mezzanine debt is subordinate to senior debt, meaning it only gets repaid after senior loans in the event of a default. Since it’s unsecured, the elevated interest rates serve as compensation for the additional risk investors take on.

By contrast, senior debt is a safer option. It’s secured by the property itself and prioritized for repayment, but it offers lower returns. On the other end of the spectrum, equity investments carry the most risk but also the potential for the highest rewards. Mezzanine financing finds a sweet spot between these two, offering a balance of risk and return. This makes it a popular choice for projects needing extra capital without giving up ownership equity.

-

When a borrower defaults on a mezzanine loan, the lender usually gains the right to claim the borrower’s equity interest in the property. This can mean the lender takes ownership or forecloses on that equity stake, effectively stripping the borrower of their ownership rights and control over the property.

Beyond losing control of the property, defaulting on a mezzanine loan can trigger harsh financial and legal repercussions. These might include demands for accelerated repayment or harm to the borrower’s credit profile. Such outcomes can make it tougher to secure financing down the road, potentially hindering future investments and business ventures.

-

Mezzanine financing can be a smart choice for commercial real estate developers looking to bridge funding gaps, lower their equity investment, or enhance leverage on sizable or intricate projects. This type of financing often works alongside senior debt, enabling developers to tackle ambitious ventures without tying up too much of their own capital.

Before opting for mezzanine financing, developers need to weigh several important factors. Start by examining the loan-to-value (LTV) and loan-to-cost (LTC) ratios to ensure they fit within the project's financial framework. Typically, senior debt covers about 50-70% of a property's value, with equity contributions falling between 10-20%. It's also essential to account for the higher interest rates that come with mezzanine loans, their subordinate position in the repayment hierarchy, and potential additional conditions like equity warrants. Carefully evaluating the project's risk level and ensuring the ability to meet repayment obligations are key steps in making a sound financial decision.