Refinancing Trends in CRE: 2025 Update

$957 billion in loans are maturing in 2025, and refinancing is getting tougher. Borrowers face higher interest rates, with new loans averaging 6.2%, up from 4.3% on maturing debt. Office properties are hit hardest, with 30% of loans underwater and 18% delinquency rates. Multifamily properties fare better but still face 10% underwater loans. Here's a quick breakdown:

Office Sector: High vacancy (14.1%), falling values, and lender pullback.

Multifamily Sector: Stable demand but impacted by 2022 overvaluations.

Industrial Sector: Strong fundamentals, low vacancies (6.8%), and rent growth.

Retail Sector: Success hinges on location and tenant stability.

Hospitality Sector: Rising costs and uneven recovery.

Declining property values (down 19% since 2022) and rising construction costs (40% above pre-pandemic levels) add to the challenges. Lenders are extending maturities and restructuring terms, but $1.5 trillion in loans are at risk of default by year-end. Borrowers must adopt tailored strategies, explore alternative financing, and manage risks like inflation and insurance costs to navigate this tough environment.

"Survive Until 25" (CRE Debt Strategies Explained)

Market Overview and Key Refinancing Drivers in 2025

The year 2025 is shaping up to be a pivotal one for property owners as they grapple with shifting economic dynamics and the need to reassess their debt strategies. A staggering 20% of the $4.8 trillion in outstanding commercial mortgages is set to mature this year, reflecting a 3% increase from the $929 billion that came due in 2024.

This isn't just a domestic challenge. Across regions like Asia Pacific and Europe, billions of dollars in maturing debt are creating similar pressures. Meanwhile, the Mortgage Bankers Association (MBA) forecasts $583 billion in new commercial real estate (CRE) loans for 2025, a 16% jump from the $503 billion recorded in 2024.

Amidst these challenges, there's a glimmer of hope: 88% of real estate owners and investors anticipate revenue growth in 2025. However, the combination of global and domestic factors is setting the stage for a tough refinancing environment, particularly with fluctuating interest rates.

Interest Rate Changes and Loan Maturities

The current interest rate climate has added complexity to refinancing decisions. While the Federal Reserve reduced its short-term interest rate target by 100 basis points in 2024, longer-term rates rose by the same amount during that period.

“While the Federal Reserve cut its short-term interest rate target by 100 basis points in 2024, longer-term interest rates increased over the same time by an equivalent amount. Commercial property owners who had sought to take advantage of a drop in rates stemming from Fed cuts were disappointed.”

Many loans that were set to mature in 2024 were pushed into 2025 due to unfavorable refinancing conditions. Adding to the challenge, consumer price inflation saw a 3% year-over-year increase, delaying further Fed rate cuts. As a result, the federal funds rate is expected to hover around 3.9% by late 2025.

The maturity landscape varies based on lender type and loan structure. For 2025, $452 billion (25%) of mortgages are serviced by depositories, $231 billion (29%) are tied to CMBS, CLOs, or other asset-backed securities, and $180 billion (35%) are held by credit companies.

Asset Valuation Challenges by Sector

Adding to the refinancing difficulties, declining asset valuations are making life harder for borrowers. Global property valuations dropped 6.3% year-over-year through the second quarter of 2024. The maturity burden also varies across sectors: 35% of hotel/motel loans, 24% of office, 22% of industrial, 14% of multifamily, and 18% each for retail and healthcare properties.

In the securitized space, $277 billion in commercial mortgages are set to mature in 2025, with another $163 billion due in 2026. Office properties alone account for 24% of all maturing loans over these two years, totaling $64 billion, while multifamily properties make up 23% at $61 billion.

For borrowers with sub-4% cap rates, refinancing could lead to a 75–100% increase in debt service payments. This sharp rise in costs is forcing property owners to rethink their portfolios and explore alternative financing options.

Transaction activity has also slowed, with global property transactions down 31% year-over-year as of June 2024. The office sector remains under particular strain, with vacancy rates still a significant issue. While the overall office vacancy rate has settled at 20.0%, some markets are struggling more than others - New York's Q3 vacancy rate was 13.3%, while San Francisco's hit 22.1%.

Despite these challenges, there is a cautious sense of optimism. Victor Calanog, Global Head of Research and Strategy for Real Estate Private Markets at Manulife Investment Management, commented:

“The industry is poised to be in a better place compared to the last few years. It appears that the landing will be relatively soft, so that should mean continued positive momentum for economic activity, benefiting leasing and income drivers, including rents and occupancies.”

The rise of alternative capital sources, such as private credit and other non-traditional lenders, is also playing a role in addressing financing gaps for properties with near-term loan maturities.

Refinancing Trends by CRE Sector

The commercial real estate (CRE) market in 2025 presents unique challenges for refinancing, with each sector - office, multifamily, retail, industrial, and hospitality - facing its own set of hurdles. These challenges stem from broader market pressures, but the specific dynamics vary significantly across property types.

Office and Multifamily: Underwater Loans and Shifting Lender Attitudes

The office and multifamily sectors are at the forefront of refinancing difficulties. A staggering 30% of maturing office loans - worth $30 billion - are underwater. Multifamily properties, while slightly better off, still face $19 billion in underwater loans, accounting for 10% of those maturing in 2025. These loans, often originated during the low-interest, high-valuation environment of 2022, now struggle with mismatched debt levels in today’s market.

Multifamily delinquency rates remain relatively stable for traditional lenders like banks, life companies, and government-sponsored enterprises (GSEs), hovering at 1.0% or less. However, the CMBS multifamily delinquency rate has climbed to 3.2%, signaling growing stress in this segment.

Office properties face even greater challenges. Lenders are increasingly reluctant to extend maturities, moving away from the "extend-and-pretend" strategies that previously dominated. As one Senior Researcher from the CRE Finance Council explained:

"Owners are grappling with valuations that remain well below acquisition prices, and lenders are no longer willing to wait".

The scale of the issue is immense, with $500 billion in CRE loans set to mature in 2025. Banks, under heightened regulatory scrutiny, are pulling back from CRE lending, leaving borrowers to explore alternative financing options or risk foreclosure. For property owners, navigating these challenges demands tailored strategies that align with the specific market conditions and debt structures of their assets.

Retail and Industrial: Contrasting Refinancing Scenarios

The retail and industrial sectors present a mixed picture when it comes to refinancing. Industrial properties are generally in a stronger position, while retail outcomes depend heavily on location and asset quality.

The industrial sector benefits from solid fundamentals, with national vacancy rates at 6.8% and asking rents rising to $9.50 per square foot, a 5.2% year-over-year increase. These factors provide predictable cash flows and bolster lender confidence, simplifying refinancing negotiations. However, certain submarkets are grappling with oversupply, leading to increased vacancies and slower rent growth. Despite these localized challenges, the sector’s overall stability keeps it attractive to lenders.

Retail, on the other hand, is more fragmented. Prime retail properties, with a national vacancy rate of 4.2% and a 3.1% year-over-year rent increase, are performing well. Suburban centers and high-traffic locations are particularly appealing for refinancing due to strong tenant bases. Conversely, secondary and tertiary retail assets face persistent refinancing struggles as e-commerce continues to reshape consumer behavior. For retail property owners, securing favorable terms often hinges on demonstrating strong market positioning and tenant stability.

Hospitality: Balancing Recovery with Refinancing Challenges

The hospitality sector stands out with its unique set of refinancing obstacles, shaped by ongoing recovery from the pandemic and rising operational pressures. Higher labor costs, evolving guest expectations, and climbing insurance premiums - especially in climate-sensitive regions - are adding to the refinancing complexities.

Hotel construction remains subdued, with supply growth well below historical averages. While this limited supply could benefit existing properties, operational uncertainties make refinancing tricky. Insurance costs, in particular, are becoming a critical factor in underwriting decisions, especially for properties in high-risk areas.

Segment performance varies widely. Luxury hotels are outperforming economy properties, creating distinct refinancing outcomes based on market positioning. Arash Azarbarzin, CEO of Highgate, expressed optimism about the sector’s investment potential:

“The supply has never been so low, [and] new construction has never been so low, so with the interest rate coming into place, I think the investment horizon is going to be very bright for 2025”

To bridge financing gaps, many operators are turning to alternative options like C-PACE loans and mezzanine debt. These structures not only provide financial flexibility but also allow operators to implement technology and sustainability upgrades, enhancing their properties’ appeal. As the sector continues its recovery, creative and property-specific refinancing strategies will be essential for navigating these challenges effectively.

Financial Analysis: Refinancing Costs and Benefits in 2025

Refinancing commercial real estate (CRE) in 2025 presents a tough landscape for borrowers. With interest rates doubling and debt service costs climbing steeply, the financial dynamics of refinancing are forcing a deeper evaluation of its costs and potential benefits.

Debt Service Costs vs. Cash Flow Benefits

The sharp rise in debt service costs is the most pressing issue for borrowers. As of January 2025, the average interest rate for CRE loans from banks with five, seven, or ten-year terms hit approximately 6.7%. For those opting for commercial mortgage-backed securities (CMBS) financing, rates are even higher, ranging from 7.1% to 7.4%. To put this into perspective, refinancing a $10 million loan from a 3.5% rate (annual cost ~$350,000) to 6.7% increases the annual cost to ~$670,000 - an additional $320,000 annually.

Borrowers are also contending with stricter financial covenants and more conservative loan-to-value ratios, as banks face tighter regulatory oversight. Many are left with limited options, such as partial refinancing or injecting additional equity to meet lender requirements.

Adding to the challenge, asset values have dropped significantly. Office buildings, for instance, are now selling for 25% to 50% less than their pre-pandemic prices. Bloomberg data shows that commercial property values in major U.S. metropolitan areas financed through CMBS declined by about 24% by the end of 2024. Office properties experienced an even steeper drop, with values plummeting nearly 50%.

The scale of the refinancing challenge is enormous. By the end of 2025, $1.5 trillion in loans will mature, with about 25% of those loans at risk of default. Furthermore, Savills Investment Management highlights that around $6 trillion in loans are set to mature over the next several years. These financial pressures are shaping a variety of refinancing outcomes.

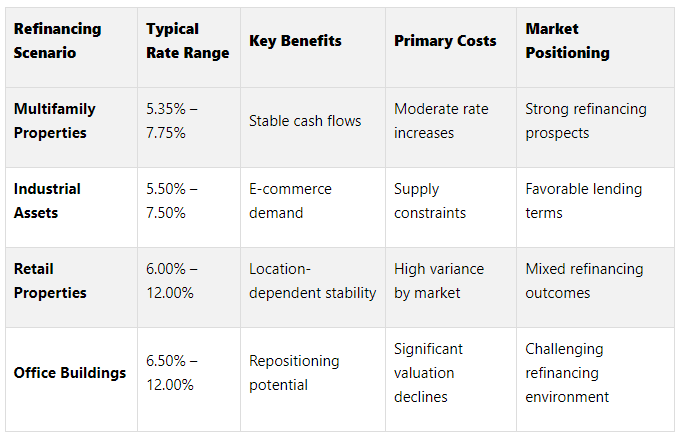

Refinancing Scenarios Comparison

Refinancing outcomes differ widely depending on the type of property and market conditions. Here’s how various asset classes stack up:

Multifamily properties, supported by steady rental demand and reliable cash flows, face relatively manageable refinancing scenarios. Even though their valuations have dropped by nearly 16% from prior levels, lenders still view them as lower-risk investments. Industrial assets are also faring well, buoyed by strong e-commerce and logistics demand, alongside limited supply.

On the other hand, retail and office properties are navigating much rougher waters. Retail outcomes vary widely depending on location and market conditions, while office buildings face the toughest refinancing climate due to high vacancy rates and steep valuation losses.

For borrowers nearing loan maturities, private credit has emerged as a potential lifeline, offering bridge financing to stave off defaults until market conditions improve.

In 2025, property owners must weigh short-term liquidity needs against long-term asset performance. With interest payment-to-GDP ratios reaching 3.3% in two-thirds of OECD countries in 2024, the high-cost environment is likely to persist. Making informed, strategic refinancing decisions will be critical for navigating this challenging period in commercial real estate.

Transform Your Real Estate Strategy

Access expert financial analysis, custom models, and tailored insights to drive your commercial real estate success. Simplify decision-making with our flexible, scalable solutions.

Risk Management and 2025 Refinancing Strategies

This section delves into the less obvious risks and strategic measures that investors need to consider as they prepare for refinancing in 2025. Beyond the well-known hurdles like higher interest rates and declining asset values, there are hidden challenges that could disrupt refinancing plans if not addressed early.

Inflation and Insurance Costs: The Hidden Challenges

Insurance has emerged as a major, often underestimated, expense in refinancing. In 2023 alone, property insurance costs jumped by 20%, and general liability rates have been climbing nearly 5% every quarter. Projections from Deloitte suggest that by 2030, the average monthly insurance cost for a commercial building could hit $4,890 - an increase of almost 80% compared to today.

What’s driving these surges? Climate-related disasters are a significant factor. In 2024, the U.S. faced 27 separate billion-dollar weather events, causing widespread property damage and forcing insurers to reevaluate their risk exposure.

“Recent disasters - whether they be hurricanes, fires, storm surges - are unprecedented, and the losses suffered by the insurance industry are unprecedented.”

Adding to the challenge is social inflation, where rising litigation costs and larger liability settlements are pushing insurers to tighten coverage and, in some cases, exit high-risk markets altogether. This leaves property owners grappling with both steeper premiums and fewer coverage options.

Loyalty in the insurance market is also fading. According to Brooks:

“There’s not a lot of loyalty from insurance companies any longer. They can’t afford it, and neither can you”

Cybersecurity risks are another growing concern. Real estate ransomware attacks now average $353,000 per incident, and insurers are paying closer attention to technology vulnerabilities. Properties with outdated security systems or inadequate cybersecurity measures often face higher premiums or even exclusions from coverage.

Strategies for Managing Risk

To successfully navigate these challenges, property owners need to adopt tailored risk management strategies. A comprehensive, multi-layered approach can address both traditional and emerging threats, ensuring smoother refinancing outcomes.

Start by regularly reviewing and optimizing insurance coverage. Work with a real estate insurance advisor to ensure policies reflect rising property values and rebuilding costs while identifying potential gaps. Customized coverage can make a significant difference in mitigating risk.

Invest in physical property upgrades to lower insurance costs and reduce refinancing risks. Weatherproofing measures like reinforced roofing, flood barriers, and storm-resistant windows can demonstrate proactive risk management to both insurers and lenders. Additionally, enhanced security systems - such as advanced surveillance, access controls, and fire suppression systems - can offer added protection and potentially qualify for premium discounts.

Routine maintenance is another key factor. Keeping detailed maintenance records not only prevents costly claims but also signals reliability to lenders during refinancing discussions.

Interest rate hedging strategies, such as interest rate caps or swaps, can provide a safeguard against further rate hikes. These tools help stabilize borrowing costs, making cash flow projections and debt service coverage more predictable.

Stress testing and scenario planning are essential for identifying vulnerabilities before they become major issues. Running scenarios that account for adverse economic conditions, additional rate increases, or natural disasters can uncover potential liquidity gaps or capital shortfalls.

Diversifying property portfolios across different types and locations can also reduce exposure to localized market downturns. While this requires long-term planning, it can add stability during refinancing cycles.

Lastly, prepare thorough property documentation to streamline the refinancing process. Detailed dossiers that include preventive measures, claims history, and current photos can demonstrate professional management and expedite underwriting.

For particularly challenging refinancing situations, exploring alternative financing structures might be a solution. Options such as captives or parametric insurance can provide more control over coverage terms and costs.

With an estimated $1 trillion in commercial real estate loans set to mature in 2025, these strategies are not just helpful - they’re essential for navigating the road ahead. Proactive measures can make all the difference in overcoming the refinancing challenges on the horizon.

Tools and Expert Support for Refinancing Analysis

Refinancing decisions in 2025 come with their fair share of challenges, especially for commercial real estate (CRE) professionals navigating a tough market. Having access to the right tools and expert advice is crucial - it can mean the difference between a smooth refinancing process and a costly misstep.

Direct Support from Expert Analysts

The Fractional Analyst service provides on-demand access to seasoned CRE analysts without the need for full-time hires. Starting at $95 per hour, this service covers a wide range of needs, including underwriting, market research, asset management, lender reporting, and even creating pitch decks. It’s a cost-effective way for CRE professionals to get top-tier analysis without the overhead of permanent staff.

If you prefer a more hands-on or independent solution, the CoreCast platform might be a better fit.

CoreCast: A Self-Service Intelligence Platform

CoreCast is designed for those who want to take control of their refinancing analysis. Launched in 2024, this platform transforms complex data into user-friendly insights, replacing clunky spreadsheets with real-time dashboards. It’s especially useful for modeling different refinancing scenarios, such as varying interest rates, loan terms, and cash flow projections.

CoreCast integrates smoothly with existing financial and property management systems, ensuring that your refinancing analysis is based on up-to-date property performance. It supports all major CRE asset classes and includes tools like portfolio summaries and a pipeline tracker to help manage properties throughout the refinancing process. Currently in its Alpha phase, CoreCast is available at a beta price of $50 per user per month, which will increase to $105 as new features are added.

Free Financial Models for Planning

In addition to expert services and the CoreCast platform, free financial models are available to support your planning efforts. Provided by The Fractional Analyst, these downloadable templates are tailored for scenarios like multifamily acquisitions, mixed-use developments, and IRR comparisons. They’re a great starting point for feasibility studies. For more advanced or custom analysis, you can always turn to the direct analyst services or the advanced capabilities of CoreCast.

This tiered system ensures that CRE professionals can choose the level of support that aligns with their specific refinancing needs and budgets, whether they’re focusing on a single property or managing a complex portfolio.

Conclusion: Key Points for 2025 Refinancing Decisions

The commercial real estate (CRE) refinancing landscape in 2025 brings both hurdles and opportunities, highlighted by the staggering $957 billion in maturing loans. One of the biggest challenges lies in the gap between interest rates: new CRE loans average 6.2%, while maturing loans sit at 4.3%. This disparity significantly raises debt service costs for borrowers. Office properties are particularly vulnerable, with delinquency rates potentially climbing to 18%. Adding to the strain, up to 15% of maturing loans may not qualify for traditional refinancing. Around 30% of maturing office loans are linked to underwater assets, and even apartment loans face difficulties, with roughly 10% impacted by past overvaluations. These dynamics underscore how outcomes will differ across various CRE sectors.

Technology is becoming a game-changer in this environment. The PropTech AI market is forecasted to grow to $159.9 billion by 2033, and CRE teams leveraging AI tools are seeing tangible benefits - properties are listed 73% faster, and closing prices are 25% higher. Today, success in refinancing goes beyond traditional metrics. Advanced tools and robust analysis are now essential, alongside considerations like climate risks, cybersecurity, and evolving regulations.

Industrial properties remain a bright spot, bolstered by strong e-commerce demand. Meanwhile, retail performance hinges on tenant stability and location quality. For borrowers and lenders alike, proactive strategies are critical. This includes thorough portfolio risk assessments, building capital reserves, and maintaining open communication. As Peter Linneman aptly puts it:

“Money will flow”, but it will flow to those who demonstrate a clear understanding of current market dynamics and future risks.”

Whether you're working with direct analyst support, exploring platforms like CoreCast (currently in beta at $50 per user monthly), or using free financial modeling templates, having the right tools and expertise is essential. By prioritizing detailed analysis and strategic planning, CRE stakeholders can better navigate the refinancing challenges ahead and position themselves for long-term success.

FAQs

-

In 2025, commercial real estate owners are facing tough refinancing conditions due to higher interest rates - hovering between 5% and over 15% - and falling property values. These challenges call for smart strategies to manage the financial strain effectively:

Extend loan maturities to ease immediate financial burdens and create breathing room for cash flow.

Look into alternative lenders, such as non-bank institutions. These lenders are gaining traction in the market and often provide more flexible terms than traditional banks.

Take advantage of market shifts by keeping an eye on declining interest rates. When rates drop, it could be a chance to secure better refinancing terms.

It’s also wise to focus on properties with strong fundamentals and explore investments in resilient asset types, like industrial or mixed-use properties, to offset risks tied to declining values. By planning ahead and consulting with financial experts, you can better navigate these challenges and position yourself for long-term stability.

-

To tackle the challenges of increasing insurance costs and climate-related risks in the commercial real estate sector, investors have a few smart options to consider. One approach is to diversify insurance providers and coverage plans, which reduces reliance on any single insurer. Another is looking into self-insurance or captive insurance arrangements, giving investors more control over their expenses.

On the risk management side, adopting resilient building designs and performing climate risk assessments can help pinpoint vulnerabilities and may even lead to reduced insurance premiums. Some companies are also taking matters into their own hands by developing in-house insurance solutions to better navigate these issues. These strategies not only safeguard assets but also support long-term stability in a market that’s constantly shifting.

-

In 2025, refinancing trends paint a mixed picture across the commercial real estate market. Multifamily and industrial properties are thriving, thanks to strong demand, solid fundamentals, and growing confidence from investors. These factors have led to higher transaction volumes and more favorable refinancing opportunities in these sectors.

Meanwhile, the office sector is grappling with significant challenges. Nearly 30% of maturing office loans are at risk, as high interest rates and tighter lending standards limit refinancing options. This sharp contrast underscores the need for tailored strategies to navigate the refinancing landscape effectively in 2025.